Do You Need Pay Stubs For An Auto Loan

- Post category:Loans

Disclosure: We may get commissions for purchases made through links in this post.

Knowing whether you need pay stubs for an auto loan can help you determine if a new car could be in your future. Auto loans can be complicated, and there are often many steps involved in the approval process. Weve done the necessary research so you can feel prepared when you step onto the sales lot.

The short answer is that no, you dont usually need pay stubs for an auto loan. If you have another means of proving your income, thats good news. In that case, auto lenders dont need your latest paycheck to verify your ability to repay what you owe.

Additional financial documentation can help prove your monthly income, such as:

- A signed statement from your employer, confirming your wages

- Last years tax return

- State or federal forms showing disability or social security payments

Gather these documents, and you may be able to bypass the paystub requirement when buying a car.

Its complicated, we know. Fortunately, we can walk you through the different types of documentation you need to make car buying a less stressful experience. Read on for details.

Many People Dream Of Working From Home But Think It’s Simply Not Practical

When taking out a home loan, you may want to request a little extra to pay off any other loans you may have, especially if you qualify for a good interest rate. If you’re looking for a loan to renovate your home or pay down another debt, you might have an opportunity to use the equity you’ve already invested in your home. Buying a house gives you the freedom to do what you want and build a lif. If you are currently paying student loans you are not alone. Consumer debt stood at almost $14 trillion in the second quarter of 2019. Fortunately, there are multiple ways you can purchase things online with relatively little risk. Many of us dream of owning our home, but it’s getting harder to achieve. After you log in to ultipro using the direct link provided by your employer, you will be able to view and print pay stubs, view pay statements, view w2 wage and t. Here’s a look at how to modify your home loan. According to beuro and labor statistics, there are over 1.5 trillion loans that are currently unpaid in the united states. Read on to learn more about home equity loan requirements and answer your hom. Understanding the best ways to modify your home loan requires financial expertise, especially when you’re facing a foreclosure. Rates for tuition have quadrupled in recent years.

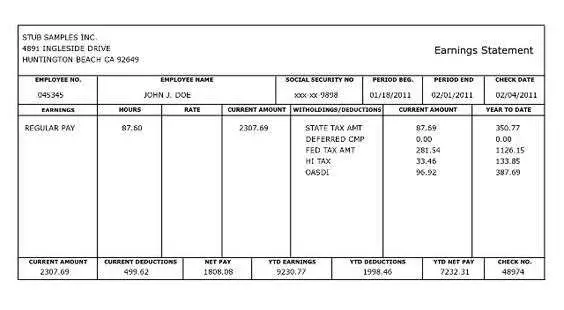

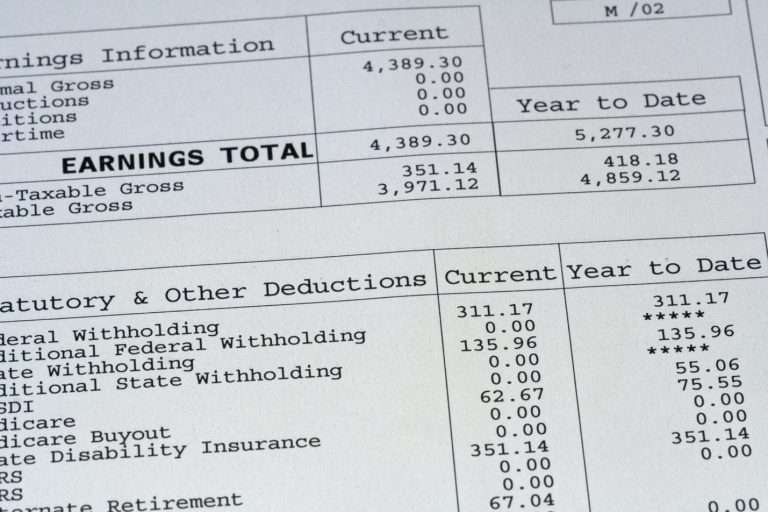

Why You Need A Check Stub For Loans

When you apply for a loan, most lenders will need to see some type of proof of income before they’ll consider lending to you. The best way to prove that you earn a regular, steady income is by providing a check stub.Check stubs show how much you earn, how often you get paid, and how much money you’ve pulled in for the year to date. They give lenders a clear picture of your financial health and whether or not you’ll be able to pay your loan back on time. Presenting that information in an easy-to-understand format, that can speed up the loan process so you can get your money sooner.

The process for securing a check stub may vary depending on where–and how–you work.

Don’t Miss: Capital One Car Note

Choose An Inspector To Give Your Home The Once

When you purchase a home, there are many decisions to make. One of the most important ones is choosing whom you will have to inspect your new home before the purchase is finalized.

You will want an inspection that can give you a good idea about the overall condition of the home and a report on any problems or deficiencies.

The best place to find a good inspector is from your real estate agent. He or she should be able to recommend inspectors in your area whove done work for other people in your neighborhood.

Be sure to get recommendations from several people before you make your final choice.

The inspector should be able to give you references of clients that hes worked within the past and tell you about his fees and services.

There are several types of inspections: electrical, plumbing, septic, termite, and so on.

The size of your house and the type of loan youre taking out will determine which ones you should get.

In addition to inspecting the physical structure of the home, another important part of the home inspection process is meeting with the inspector to review any major issues or concerns that he or she may have with the property.

It is important that you understand any potential risks associated with purchasing this particular house as well as whether there are any specific defects or problems that could affect your stay there.

Investment Account Statements And List Of Debts

Some people keep their funds in places outside savings and checking accounts. Individuals with alternative sources of income, such as investors, need to show proof of their income and assets, too. As a result, your lender may have to review investment account statements from 401s, 403s, IRAs, bonds, mutual funds and stocks, if applicable.

Since lenders want to know your available income and assets, they also need to know how much of that money goes toward debt. So, they review your debt-to-income ratio and see if it fits within their guidelines.

Variable, monthly expenses dont fall under your DTI, such as utilities or groceries. But other recurring, regular costs do, like:

- Car loans

- Personal loans

- Student loans

If you have to provide records of debt payments to your lender, make sure to include pertinent information. Relevant details such as the creditor, creditors contact information, monthly minimum payment and total balance due are important.

Also Check: Credit Score For Usaa Personal Loan

Get Approved For Your Loan

If youre planning on purchasing a home in the near future, then getting approved for a loan is one of the most important steps you can take.

Getting approved for a loan doesnt necessarily mean that youll get the home of your dreams, but it does mean that youre on your way to making your dream a reality.

Getting approved for a home loan isnt easy, but its not impossible, either. To get started, make sure youre prepared financially. Then take these steps:

- Get your credit in order. To qualify for most mortgages, you must have a good credit rating and history. Check your credit scores and report before you apply for a home loan. If there are any errors on your report that could be damaging to your application, get them corrected as soon as possible.

- Save up for a down payment. Most lenders require that you make at least 10 percent of the purchase price of the home upfront. The more money you can bring to closing, the better your chances are of getting approved.

- Calculate how much of a loan you can afford. Most lenders will use one of two methods to determine how much theyre willing to lend you the front-end ratio or the back-end ratio method. The front-end ratio is calculated by dividing your monthly housing expenses by your gross monthly income. For example, if your monthly housing expense is $2,000 and your gross monthly income is $5,000, this would equal 0.4 on the front-end ratio scale .

- Then apply for a loan and secure it in 30 days.

What Is A Bank Statement Mortgage Program

A bank statement mortgage program allows you to verify your income on a mortgage application using documented bank deposits instead of tax forms.

Traditional mortgage loans use tax returns, W2s, and pay stubs to verify monthly income.

The higher your monthly income, the lower your debttoincome ratio , and a lower DTI can justify a higher loan amount.

But providing those traditional employment documents will be impossible for people who dont have fulltime employers. Instead, mortgage applicants may opt for a bank statement loan program.

Using personal bank statements to qualify for a mortgage instead of W2s might be a good loan option if:

- You dont have traditional tax documents to verify your total income

- You have tax documents, but due to writeoffs, your income looks smaller than it really is

Once upon a time, stated income loans were a common mortgage solution for borrowers who couldnt document their full income. But stricter regulations in response to the mortgage crisis of the late 2000s have made stated income loans a thing of the past.

Today, bank statement loans have become more popular because they create less risk for lenders. Borrowers dont simply state their income anymore. With bank statement loans, applicants must document regular monthly deposits in order to qualify for a mortgage loan.

Also Check: Www Upstart Com Myoffer

Read On To Learn More About Home Equity Loan Requirements And Answer Your Hom

When taking out a home loan, you may want to request a little extra to pay off any other loans you may have, especially if you qualify for a good interest rate. Getting it right means understanding the mortgage process, from start to finish. For many people, one of the greatest achievements in life is owning a home. If you’re looking for a loan to renovate your home or pay down another debt, you might have an opportunity to use the equity you’ve already invested in your home. Read on to learn more about home equity loan requirements and answer your hom. According to beuro and labor statistics, there are over 1.5 trillion loans that are currently unpaid in the united states. The thought of purchasing items online using your bank information can seem scary, especially with the rise of security breaches and hacking. To get more specific, mortgages, auto costs, credit cards and student loans are the four main areas of debt that h. According to the new york federal reserve, the u.s. If you are currently paying student loans you are not alone. According to salary.com, ziprecruiter and glassdoor, these are the ave. Rates for tuition have quadrupled in recent years. Buying a house gives you the freedom to do what you want and build a lif.

What Kind Of Personal Questions Can I Expect

Lenders will need to look beyond the paper, especially if theyre trying to grant you a QM. While these questions might seem intrusive, each one of them can substantially affect your financial standing and is something the lender needs to know about.

Here are some questions you can expect:

- Have you been through a divorce? If yes, what were the terms?

- Have you ever been involved in a lawsuiton either side of the bench?

- Have you ever sold a home through a short sale?

- How long have you been employed at your current job?

While shopping around for a mortgage, whether its a QM or otherwise, remember to ask us about our fantastic home loan options. We offer better rates and quicker closings than most banks, along with the personal service and attention youve come to love and expect at Horizon. Call, click or stop by Horizon today to get started!

Recommended Reading: Car Loan With Credit Score Of 600

What Is The Purpose Of A Pay Stub

Also known as payslips, paycheck stubs, or wage statements, a pay stub is a written document that records your earnings for each payment term you work . Although its less common, those who work odd jobs like seasonal workers, contract employees, or consulting positions may receive pay stubs too.

If you work for an employer who gives out physical paychecks, youll find your pay stub attached to the bottom or included on a separate document, while businesses that offer direct deposit will normally make your pay stubs available on some sort of online portal or may send them to you via a personal email address. Pay stubs are important for clarity, accountability and, of course, payroll compliance.

How Do I Qualify For A Self

A lender will likely consider you selfu2013employed if any of the following apply:

Thereof Is it hard for self-employed people to get a mortgage? But getting a mortgage when self-employed is certainly not impossible. There are plenty of ways to prove to a mortgage lender that you have a reliable income, its usually just a case of jumping through a few extra hoops.

What can I use as proof of self employment? Documents that could be used to prove self-employment include, but are not limited to: business licenses, tax returns, business receipts or invoices, signed affidavits verifying self-employment, contracts or agreements, or bank statements from a business account that show self-employment.

Beside this, How much can I borrow self employed? If you are employed of self-employed and meet the mortgage lenders criteria, you can usually borrow 4.5 times your annual income.

Recommended Reading: Va Home Loan Benefits 2020

What Income Is Considered When Applying For A Mortgage

Determining whether your income is sufficient to get a home loan isnt as simple as just looking at your pay stub.

Lenders will assess all of your income sources and monthly debts to figure out what mortgage you can afford and have the likely ability to pay back. Weve put together a list of sources, variables and debts to help you determine if you may be eligible for a loan.

Regular Income Calculations

For salary and wage earners, a lending partner will want to see current pay stubs as well as W-2 tax forms for the past two years. If youve recently had a change in pay, such as a raise, youll also need to get a statement from your boss confirming that the change is permanent.

You may also be able to use special-case income, such as overtime and commissions, as part of the income calculation for your mortgage. To qualify these items, youll need to document that youve received them for at least two years and provide confirmation from your boss that theyre expected to continue.

If this income comes from a source outside of your primary employersuch as part-time work or side jobs that pay only commissionyoull need W2 forms for these as well.

|

Income Type |

|---|

What Happens If You Get A New Job In The Middle Of The Mortgage Process

Getting a job during the mortgage process can also throw a bit of a monkey wrench into things, as your lender was likely underwriting you based on your previous employment situation. In this case, you will most likely be asked to provide updated versions of the documentation mentioned above. If your job change is viewed as stable and continuous, it probably will not derail your mortgage loan application.

But, if your job change comes with some of the red flags we discussed earlier, there may be a problem.

No matter what, its a good idea to discuss your job situation and status with your lender as you work through the mortgage process.

Do you have more questions about starting your mortgage journey? Contact a New American Funding Loan Officer for answers today.

Recommended Reading: Used Car Loan Calculator Usaa

Can I Get A Mortgage With 3 Months Employment

Yes. It is possible to obtain a mortgage if your contract has recently changed with the same employer. However, the issue is that you may not have earnings history for last 3 months as required by many lenders and as a result they may consider your application in the same way that they would consider a change of job.

The Difference Between Your Pay Stub And Your Paycheck

Remember, a pay stub is a written statement you get with your paycheck. Its basically a record of your weekly, bi-weekly, or semi-monthly wage payments for a particular payment term, as well as how those wages are calculated and what deductions are taken from them. If you dont have direct deposit at work, youll probably get your pay stub in paper form.

However, a paycheck or paycheque is a physical cheque that your employer gives you, which youre free to deposit at your financial institution as soon as you receive it. On your check, youll see all this other essential information:

- Your employers name, address and postal code

- PAY TO THE ORDER OF followed by your name

- The amount of pay in numbered and written form

- The name and address of your employers financial institution

- An optional memo section for extra notes or details

- The cheques 8-digit identification number

- Your employers or managers signature of approval

Additional Reading

Read Also: Va Business Loan For Rental Property

What Is An Asset Statement

Asset statements are documentation of your net worth and assets. When you apply for a mortgage, you will need to verify that you own certain types of assets and your sources of personal wealth. Youll submit a collection of statements detailing your asset portfolio to your lender in order to do so.

Its important for a mortgage lender to be able to review your asset statements so they can know for certain that you wont be burdened with a mortgage you cant afford. Asset statements are meant to provide a comprehensive look at your finances, so not only will your prospective lender feel more confident that youll be able to afford your mortgage payments, but theyll also make sure the mortgage youre approved for is the right one for your financial goals.