What Is Loan Interest

Interest is the price you pay to borrow money from someone else. If you take out a $20,000 personal loan, you may wind up paying the lender a total of almost $23,000 over the next five years. That extra $3,000 is the interest.

As you repay the loan over time, a portion of each payment goes toward the amount you borrowed and another portion goes toward interest costs. How much loan interest the lender charges is determined by things like your , income, loan amount, loan terms and the current amount of debt you have.

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

Benefits Of Scotia Plan Loan

Flexible terms

- Take up to 5 years to pay it back1

- Pay off your loan at any time without prepayment penalties

Customized payment structure

- Pick a weekly, bi-weekly, or monthly payment plan

- Change how much you pay, how often, or even what days you make a payment

Interest rate options

- Choose between a fixed and variable rate

Postpone a payment

- Postpone one payment each year that you have the loan2

Manage your loan online

- View loan details, including outstanding balance, payment amount, and remaining term

- Make an extra payment at any time if needed

Secure your loan

- Have the option to secure your loan under Scotia Total Equity Plan

- Lower your rate if you use your home equity

Calculate your Scotia Plan Loan payments

Quickly estimate how much your payments would be on a personal loan.

Don’t Miss: Upstart Vs Avant

What Happens If You Cant Pay Back A Payday Loan On Time

There can be serious consequences if you dont repay your loan by the due date.

Depending on the laws in your province, these consequences may include the following:

- the payday lender may charge you a fee if there isnt enough money in your account

- your financial institution may also charge you a fee if there isnt enough money in your account

- the total amount that you owe, including the fees, will continue to increase

- the payday lender could call your friends, relatives or employer in attempts to contact you to collect the money

- the payday lender could deal with a collection agency and this could be included on your credit report

- the payday lender or collection agency could sue you for the debt

- the payday lender or collection agency could seize your property

- the payday lender could go to the courts to take money from your paycheques

If you cant make your payday loan payments on time, it can be easy to get stuck in a debt trap.

Infographic: Payday loans: An expensive way to borrow money!

The infographic Payday loans: An expensive way to borrow money! is illustrating an example of what can happen when you take out a payday loan.

You need $300 for household repairs. You get a $300 payday loan for 2 weeks. Over the 2-week period, youll pay $51 in charges, which is equivalent to a yearly interest rate of 442%. You owe $351.

If you dont make your payment, youre charged a $40 penalty. You now owe $391.

Before you make a decision, explore your options.

How Much Of A Business Loan Can I Get With Different Types Of Lenders

You may be able to qualify for the following amounts based on which lender you choose:

1. Bank loans

Banks tend to offer the largest business loans out of any provider. Many banks offer term loans between $5,000 and $1 million, although you may have to put up collateral such as your business equipment or real estate to qualify.

Providers include BMO, TD Bank, RBC, CIBC, Scotiabank, HSBC, Canadian Western Bank and National Bank.

2. Credit union loans

Providers include Meridian, Servus, Vancity, connectFirst, Conexus, First West, Steinbach, Alterna Savings and Coast Capital Savings.

3. Online loans

Online lenders typically offer financing between $5,000 and $300,000, though you may be able to find providers that offer more. Larger funding amounts typically need to be backed by collateral such as business equipment or real estate.

Providers include Loans Canada, SharpShooter, OnDeck, Company Capital, Thinking Capital and Lending Loop. Compare online business loans.

Promoted for

About our promoted products

Read Also: Auto Loan Calculator Usaa

What To Do If I Have A High Foir

Well, there is not much you can do. One way is to close some of the existing loans. I understand that this may not be an option. The other option is to have a joint applicant with you. With a joint applicant , the EMI burden gets divided and the loan eligibility may increase.

Banks will do what they want to do. However, they do not know as much about you as you do. Moreover, they dont care much. If you dont repay the loan, they will take away the asset. You need to be very clear where you are headed. For instance, if you foresee lack of stability in your job, you should refrain from increasing your loan liability. Now, the bank may not be aware of this uncertainty and be ready to give you the loan but you need to be responsible. I have covered such aspects inthis post.

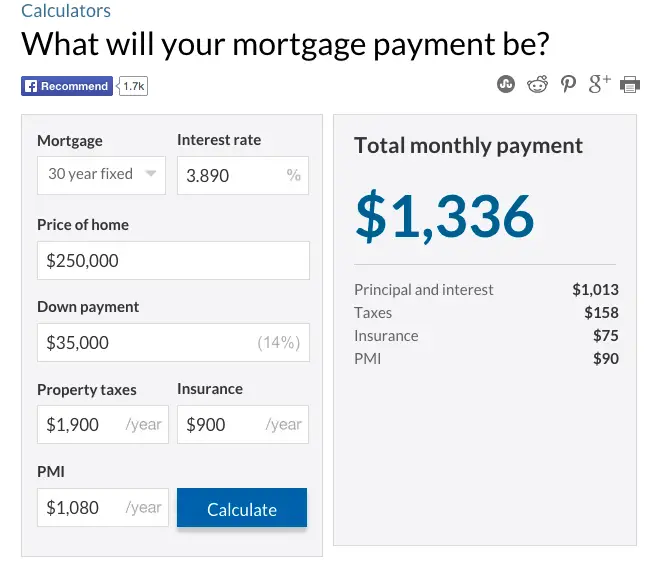

How To Use A Small

To get the most accurate total cost estimate, youll need to gather a little information before you use a business loan calculator:

- Loan amount

- Interest rate

- Loan term

- Extra monthly loan payment amount

You dont need to have the exact numbersafter all, you probably wont know your final interest rate until you get approved for your loanbut more accurate numbers will give you more accurate results .

Once you put in all those numbers, just click the button to have the calculator do the math for you. And there you gothe total cost of your loan.

You can also use a loan calculator to see how different rates, terms, or payments would affect the total cost of your loan. So if youre deciding between a loan with a longer repayment term and a lower rate and a loan with a shorter repayment term and a higher rate, you can use a calculator to find out which one offers the better deal.

But thats not the only thing a loan calculator can show you.

Recommended Reading: Usaa Mortgage Credit Score

Home Loan Borrowing Power Calculator

The results are a guide only. They are not a quote, credit approval or offer of credit. This tool is not necessarily suitable for self-employed persons. The results are not advice on how much you can or should borrow, which product you should choose, the product features or options, or about making extra payments. The calculator does not take into account certain tax considerations e.g. negative gearing, which you should receive your own advice on. You should speak to us or obtain professional advice about a loan that meets your requirements and objectives. The ranges of rates, terms and loan amounts in the calculator may not be available for products offered by us or other credit providers. Credit providers have different credit criteria and there may be other factors which affect whether you qualify for credit and the amount you could borrow. The results assume regular scheduled payments and that the interest rate does not change, and do not include any discount period. Interest rates are subject to change except during a fixed rate period. The rates and repayment amounts do not include any monthly service fees or lenders mortgage insurance if applicable. For the Bendigo Complete Loan the variable interest rates displayed are based on Loan to Value Ratio calculated using your LVR at the date we document your loan contract. Bendigo Express available via online application only. for more information.

Quick links

What Does Borrowing Power Mean

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan, calculated generally as your net income minus your expenses. Your expenses include all your daily living costs and regular financial commitments like bills, groceries and petrol, as well as any other debts you hold such as a credit card, car loan or personal loan.

Once you have a ballpark figure for your borrowing power youll be able to house hunt with a price range in mind. See our tips for what to consider when working out how much to borrow.

Read Also: How Long Does The Sba Loan Take To Process

How Much Personal Loans Cost

Dont take out a personal loan unless you have the ability to pay it back. Borrowing money with a personal loan may cost a lot of money, depending on your interest rate, fees and when you pay it back. Consider your need for the personal loan. Ask yourself if you need the money now, if you can wait, or if you need it at all.

Shop around when considering a personal loan. To get the most competitive interest rate, get loan quotes from multiple lenders. Compare and negotiate fees such as administration fees.

Before you borrow, consider saving money for your purchase. By borrowing a smaller amount, you will save on interest fees.

When you take out a personal loan, your lender will give you a quote for a regular payment amount.

To get to this amount, they calculate the total cost of the loan which includes:

- the amount of the loan to be repaid

- the interest on the loan

- any other applicable fees

This amount is divided into equal payments.

How To Get A Personal Loan

If youre ready to take out a personal loan, follow these four steps:

- Research and compare lenders. Be sure to shop around and compare as many personal loan lenders as possible to find the right loan for you. Consider not only interest rates but also repayment terms, any fees charged by the lender, and eligibilty requirements.

- Pick a loan option. After comparing lenders, choose the personal loan option that best suits your needs.

- Complete the application. Once youve picked a lender, youll need to fill out a full application and submit any required documentation, such as tax returns or pay stubs.

- Get your funds. If youre approved, the lender will have you sign for the loan so the funds can be released to you. The time to fund for a personal loan is usually about one week though some lenders will fund loans as soon as the same or next business day after approval.

Check Out: How to Get a Fast Personal Loan for Quick Cash

Also Check: Used Car Loan Rates Usaa

Which Is Better: A Personal Loan Credit Card Line Of Credit Or Home Equity Loan

While taking out a personal loan could be a good option in some circumstances, it isnt the right move for everyone. Heres how a few other options compare to personal loans so you can decide which is best for your situation:

If you decide to get a personal loan, remember to consider as many lenders as you can to find the right loan for you. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Ready to find your personal loan? Credible makes it easy to find the right loan for you.

- Free to use, no hidden fees

- One simple form, easy to fill out and your info is protected

- More options, pick the loan option that best fits your personal needs

- Here for you. Our team is here to help you reach your financial goals

Keep Reading: How Debt Consolidation Loans Can Help Your Credit Score

Taylor Medine is a Credible authority on personal finance. Her work has been featured on Bankrate, Experian, The Balance, Business Insider, Credit Karma, and more. Shes also the author of The 60-Minute Money Plan, a self-published intro to budgeting guide for people who hate budgeting.

How Much Of A Business Loan Can I Get With Different Types Of Loans

There are a several types of business loans that will let you borrow varying amounts of money:

Canada Small Business Financing Program

You can borrow up to $1 million if you get a CSBFP loan, which is mostly backed by the federal government and administered through banks. Up to $350,000 of this can be used for equipment and leasehold improvements.

Business term loans

Typically, you can borrow between $5,000 and $1 million with business term loans, though many lenders will cap their loans at less than $500,000 . As with other types of business loans, larger amounts are typically only available with collateral.

Lines of credit

Many banks offer business lines of credit starting at $10,000, with the overall limit defined by your business needs and financial position. Private lenders offer lines of credit that can go as high as $500,000 when secured by business assets. or as high as $50,000 when unsecured.

Merchant cash advances

A merchant cash advance gives you an advance on your future sales. Most lenders that offer merchant cash advances will let you borrow between $5,000 and $50,000. Youll pay this money back using a predetermined portion of the credit card sales for your business each month.

Equipment and vehicle financing

Microloans

Microloans run from around $500 to around $10,000 depending on the provider. These are meant to fund small startup costs and are usually available to entrepreneurs and bad credit borrowers.

Invoice factoring

You May Like: Fha Loan Limits Texas

What Information Do I Need To Provide Lenders

When you submit an application, lenders take into account a few different pieces of information in order to determine if you qualify for the loan amount youre requesting. These can include:

- Your loan purpose. Many lenders will ask what you plan to use the loan for. Be honest, as this could impact your loan contract and the interest rate youre offered in addition to your loan amount.

- Your address. You will need to provide your home address.

- Rent or own. You will need to state whether you rent or own you home, plus how long youve lived there.

- Your monthly expenses. You will need to provide information about your monthly costs, such as car payments, credit card payments and house payments.

- While your credit score isnt the only deciding factor, it does carry a lot of weight. The better your credit score, the more likely a lender will be to approve you for the maximum loan amount.

- Your employment information. Lenders will want to know where you work, how long youve been working for that company and how much you earn.

- Your age. In order to qualify for a loan, you will need to be at least 18 .

- Canadian citizen or resident. If you are not a Canadian citizen or resident, your options are limited as most lenders require this.

Start With The Interest Rate

The higher your credit score, the lower the interest rate you will likely qualify for on a personal loan. If you think you might be in the market for a personal loan in the future, its a good idea to get to work building up your credit score. Contest any errors in your credit report, pay your bills on time and keep your credit utilization ratio below 30%.

Once you’re ready to shop for a personal loan, don’t just look at one source. Compare the rates you can get from credit unions, traditional banks, online-only lenders and peer-to-peer lending sites.

When you’ve found the best interest rates, take a look at the other terms of the loans on offer. For example, its generally a good idea to steer clear of installment loans that come with pricey credit life and credit disability insurance policies. These policies should be voluntary but employees of lending companies often pitch them as mandatory for anyone who wants a loan. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can’t pay off.

You May Like: Usaa Auto Loan Process

Employer And Income Verification

A lender wants to see that you have the ability to pay back your current debts as well as the new loan. To do this, lenders typically require prospective borrowers to demonstrate their employment history and current earnings as part of the application process. Common forms of income verification for traditional employment include:

- Paystubs

What Is A Credit Rating

Your credit rating is a ranking that indicates your financial health at a specific point in time. It compares the risk you pose for lenders to that of other Canadians.

Your overall credit rating is an important factor in determining the type and amount of credit you may be eligible to receive at any given time. That’s why it’s so important to establish and maintain the highest rating possible.

Also Check: Usaa Home Loans Credit Score