What Is Repo Rate And How Does It Affect Personal Loans

Repo rate is the rate at which the Reserve Bank of India lends money to commercial banks. A cut in repo rate usually translates to lower borrowing costs such as interest rates and EMIs for individuals and banks.

Repo rate affects the interest rate on personal loans only if you opt for a floating interest rate. Personal loans offered at fixed interest rates don’t get affected by a cut in the repo rate.

Benefits Of Scotia Plan Loan

Flexible terms

- Take up to 5 years to pay it back1

- Pay off your loan at any time without prepayment penalties

Customized payment structure

- Pick a weekly, bi-weekly, or monthly payment plan

- Change how much you pay, how often, or even what days you make a payment

Interest rate options

- Choose between a fixed and variable rate

Postpone a payment

- Postpone one payment each year that you have the loan2

Manage your loan online

- View loan details, including outstanding balance, payment amount, and remaining term

- Make an extra payment at any time if needed

Secure your loan

- Have the option to secure your loan under Scotia Total Equity Plan

- Lower your rate if you use your home equity

Calculate your Scotia Plan Loan payments

Quickly estimate how much your payments would be on a personal loan.

What You Need To Provide A Lender

Generally, lenders will require proof that you have:

- a regular income

- a bank account

- a permanent address

Most lenders will run a credit check when you apply for a personal loan. Your credit report helps lenders evaluate your ability to repay your personal loan. They will likely consider your debts. Your credit report, credit score and debts may affect your loan options, including your interest rate and the type of loan you qualify for.

Don’t Miss: How Long For Sba Loan Approval

Faqs On Personal Loan Interest Rates

The interest rate that applies on your personal loan is an important factor. In this page, weve put together some of the questions borrowers usually ask regarding their personal loan interest rates.

PNB offer personal loans at attractive rates starting from 6.90% p.a. However, the interest rate may vary from customer to customer depending on certain factors, customers including credit profile and relationship with the bank, to name a few.

Your income denotes your capacity to repay a loan. A higher income shows that you have a better financial bandwidth to repay the loan on time. This means that your risk level is low. Lenders prefer individuals with low risk profiles and may hence offer you a lower interest rate.

Working with reputed companies means that you are more likely to have a stable job and income. Your work experience shows work stability as well. This reflects on your loan rate.

A good credit score indicates that you are responsible in handling your finances. This keeps your risk rating low. If your credit score is 750 and above, most likely you will be offered preferential rates.

What Are Coronavirus Hardship Loans

Coronavirus hardship loans are short-term personal loans designed by lenders specifically to help people affected by the coronavirus pandemic. These loans are typically less than $5,000 and may have to be repaid within three years or less. Coronavirus hardship loans are popular among credit unions, in particular if you need short-term relief, ask your local credit union about its offerings.

Recommended Reading: How To Get An Aer Loan

S For Interest Calculation On Personal Loan

Personal loan interest rates are calculated in two waysflat rate and reducing balance interest rate:

Getting Your Loan From A Lender

Your lender will usually give you the money for your loan in one of the following ways:

- in cash

- deposited in your bank account

- sent to you as an e-transfer

- sent to other lenders directly, if you are consolidating other debts

- on a prepaid card

If you decide to take the loan on a prepaid card, there may be a cost to activate and use the card.

Also Check: Does Va Loan Work For Manufactured Homes

Average Personal Loan Interest Rates By Credit Rating

Average personal loan interest rates range from 10.3 percent to 12.5 percent for excellent credit scores of 720 to 850, 13.5 percent to 15.5 percent for “good” credit scores of 690 to 719, 17.8 percent to 19.9 percent for “average” credit scores of 630 to 689 and 28.5 percent to 32.0 percent for poor credit scores of 300 to 629.

| 28.5%32.0% |

Types Of Personal Loans And Their Uses

With the exception of loans from a few niche lenders, like Payoff, most personal loans can be used for any purpose. The most common types of personal loans are:

- Debt consolidation: If you have multiple lines of credit card debt, for instance, you can pay them off with a personal loan and repay the loan over time, often with a better interest rate.

- Emergency expenses: Unexpected expenses like a car repair or hospital bill can throw off your monthly budget, and a small personal loan can alleviate the immediate cost.

- Home renovations: A personal loan is a great way to pay for a large home renovation project and boost the equity in your home.

- Major purchase or event. Personal loans are often used to cover major expenses, such as a wedding or vacation.

To learn more, read our article on the top nine reasons to apply for a personal loan.

You May Like: Does Va Loan Work For Manufactured Homes

Changes To Support You During Covid

As of April 1, 2021, no interest will be charged on Canada Student Loans and Canada Apprentice Loans. This measure is temporary. For more information, please see the proposed changes in this years budget announcement.

Provincial interest rates may still apply. Contact the NSLSC or your province or territory to find out more.

Sections on this page impacted by these temporary changes are flagged as Temporary COVID-19 relief.

Controllable Factors That Determine Interest Rate

While many factors that affect the interest rate are uncontrollable, individuals can, to some degree, affect the interest rates they receive.

Individual Credit Standing

In the U.S., credit scores and credit reports exist to provide information about each borrower so that lenders can assess risk. A credit score is a number between 300 and 850 that represents a borrower’s creditworthiness the higher, the better. Good credit scores are built over time through timely payments, low credit utilization, and many other factors. Credit scores drop when payments are missed or late, credit utilization is high, total debt is high, and bankruptcies are involved. The average credit score in the U.S. is around 700.

The higher a borrower’s credit score, the more favorable the interest rate they may receive. Anything higher than 750 is considered excellent and will receive the best interest rates. From the perspective of a lender, they are more hesitant to lend to borrowers with low credit scores and/or a history of bankruptcy and missed credit card payments than they would be to borrowers with clean histories of timely mortgage and auto payments. As a result, they will either reject the lending application or charge higher rates to protect themselves from the likelihood that higher-risk borrowers default. For example, a credit card issuer can raise the interest rate on an individual’s credit card if they start missing many payments.

How to Receive Better Interest Rates

Don’t Miss: When Can I Apply For Grad Plus Loan 2020-21

Fixed Interest Rates Vs Floating Interest Rates Which Is Better

If you opt for a personal loan with a fixed interest rate, you will be charged the same rate of interest throughout the loan repayment period.

On the other hand, the floating or variable interest rate is linked to the Marginal Cost of Lending Rate or the MCLR, thus causing the interest rate to fluctuate as and when the MCLR changes.

The benefit of opting for a fixed interest rate is that you know exactly how much you will be charged during the loan tenure. Thus, those who wish to plan their finances in advance can opt for a fixed interest rate.

If you, however, dont mind a fluctuating interest rate, you can opt for a floating/variable interest rate. The benefit of opting for a variable interest rate is that your repayment amount will reduce when the interest rate is low.

Personal Loan Interest Rates By Lender

Interest rates on unsecured personal loans typically range between 5% and 36%.

Banks and credit unions will offer competitive personal loan rates, but some of the lowest you can find are from online lenders, especially those that cater to creditworthy borrowers.

If you have a lower credit score, you will also have more luck with online lenders, as some will accept borrowers with scores as low as 580, and sometimes lower. In the table below, we take a look at the rates offered on an unsecured personal loan by a variety of online and traditional lenders.

| Lender/Lending Platform |

|---|

You May Like: How To Find Your Student Loan Number

Current Personal Loan Interest Rate

With a Bajaj Finserv Personal Loan, you can get up to Rs. 25 lakh at an attractive interest rate. The loan comes with no hidden charges and 100% transparency, which make your overall borrowing experience seamless.

The latest personal loan interest rates and charges are listed in the table below:

| Rate of Interest on Personal Loan | |

|---|---|

| Types of Fees | |

| Up to 4% of the loan amount | |

| Bounce charges | Rs.600 – Rs.1,200 per bounce |

| Penal interest | A delay in payment of monthly instalment/EMI shall attract penal interest of 2% to 4% per month on the monthly instalment/EMI outstanding.This penal interest will be chargeable from the date of default until the receipt of the monthly instalment/EMI. |

| Document/statement chargesStatement of Account/Repayment Schedule/Foreclosure Letter/No Dues Certificate/Interest Certificate/other documents | Download your e-statements/letters/certificates at no extra cost by logging into our customer portal Experia.You can get a physical copy of your statements/letters/certificates/other list of documents from any of our branches at a charge of Rs.50 per statement/letter/certificate. |

| Stamp duty | At actuals. |

The table below shows other fees and charges:

What Is The Average Interest Rate On A Personal Loan

The average interest rate on a personal loan is 9.41%, according to Experian data from Q2 2019. Depending on the lender and the borrower’s credit score and financial history, personal loan interest rates can range from 6% to 36%. It’s important to learn how personal loan interest rates work to better understanding how much your monthly payments will be for the loan, and how much you will pay for the lifespan of the loan.

A personal loan is a form of credit that allows consumers to finance large purchases, such as a home renovation, or consolidate high interest debt from other products like credit cards. In most cases, personal loans offer lower interest rates than credit cards, so they can be used to consolidate debts into one lower monthly payment.

The average personal loan interest rate is significantly lower than the average credit card interest rate, which was about 17% as of November 2019, according to the Federal Reserve.

Don’t Miss: Fha Loan Limits Texas

Borrower’s Cost Of Debt

While interest rates represent interest income to the lender, they constitute a cost of debt to the borrower. Companies weigh the cost of borrowing against the cost of equity, such as dividend payments, to determine which source of funding will be the least expensive. Since most companies fund their capital by either taking on debt and/or issuing equity, the cost of the capital is evaluated to achieve an optimal capital structure.

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan. Temporary COVID-19 relief

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

Recommended Reading: Aer Loan Balance

Extend Your Grace Period By Another Six Months If You:

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9 ½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an OSAP loan.

You can make payments on your loan at any time to repay it faster.

Get repayment assistance:

If youre having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you cant attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9 ½ up to 14 ½ years. Log in to your National Student Loans Service Centre account.

What Is The Best Credit Score To Get A Mortgage

Lenders reserve their most competitive rates to borrowers with excellent credit scores usually 740 or higher. However, you dont need spotless credit to qualify for a mortgage. Loans insured by the Federal Housing Administration, or FHA, have a minimum credit score requirement of 580, although youll probably need a score of 620 or higher to qualify.

To score the best deal, work to boost your credit score above 740. While you can get a mortgage with poor or bad credit, your interest rate and terms may not be as favorable.

You May Like: How To Reclassify A Manufactured Home

What Factors Determine My Mortgage Rate

Lenders consider these factors when pricing your interest rate:

- Loan term

- Interest rate type

Your . Lenders have settled on this three-digit score as the most reliable predictor of whether youll make prompt payments. The higher your score, the less risk you pose and the lower rate youll pay.

Lenders also look at the amount of your down payment. For instance, if you put 20 percent down, youre viewed as a lower risk, and you might get a lower rate than someone whos financing nearly all of their home purchase. From the lenders viewpoint, the more skin the borrower has in the game, the more likely the mortgage will be repaid on time and in full.

Rolling additional closing costs into the loan affects your mortgage rate as well. With these costs added to what you owe, youll typically pay a higher interest rate than someone who pays those fees upfront. Borrowers might also pay higher rates for jumbo loans mortgages above the limits for conforming mortgages.

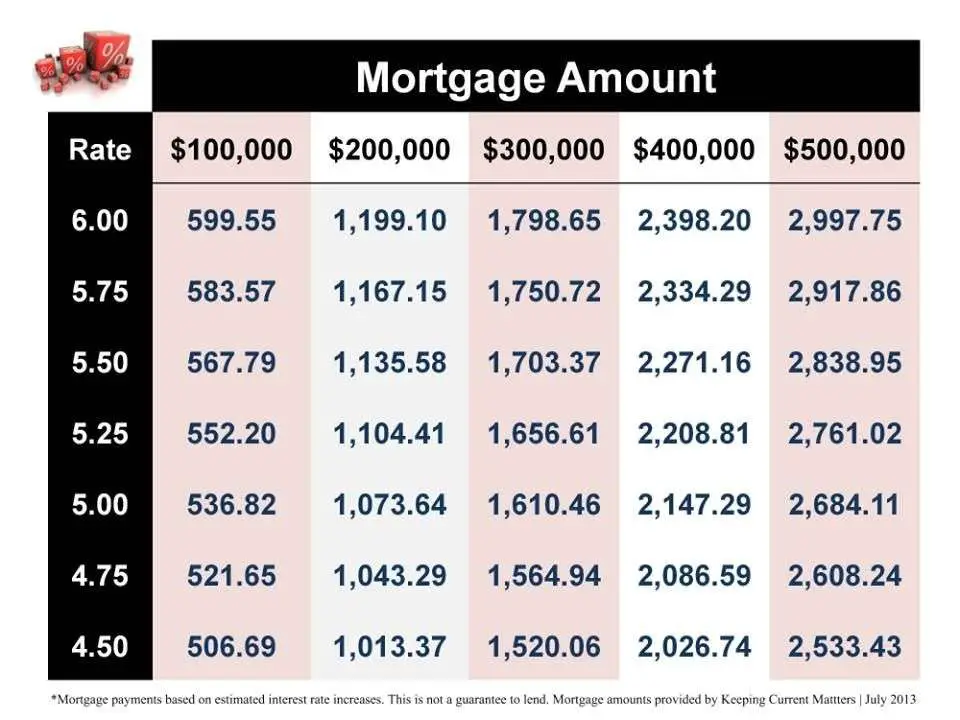

Use our mortgage calculator to see how different interest rates, down payments, loan amounts and loan terms would affect your monthly mortgage payments.

What’s The Difference Between A Secured Loan And An Unsecured Loan

Secured loans are backed by a piece of the borrowers property as collateral, typically a vehicle or house. Because the borrower stands to lose personal property if they default, secured loans tend to have lower interest rates.

Unsecured loans are not backed by collateral, but instead by the borrowers creditworthiness. Because the lender takes on more of a risk with an unsecured loan, interest rates tend to be higher. Lenders also require that borrowers seeking unsecured loans have higher-than-average credit scores.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Where To Find The Best Personal Loans For You

You can apply for personal loans from online lenders, banks and credit unions. The interest rate and fees will vary between lenders, but the lending process can also be quite different for each.

Banks and credit unions have physical branches, offering both an in-person and digital lending options for borrowers. However, there may be a limited number of credit union branches in each state. Online lenders operate strictly online, so borrowers will not meet with anyone face-to-face during the loan process, but there may be customer service available via phone, chat and/or email.

The type of lender is important, but what makes a loan the best personal loan for you? As you search for a personal loan, youll want to consider low interest rate loans, those with few or no fees and flexible repayment terms. These factors will ultimately affect the affordability and cost of the loan.

Depending on your circumstances, you may not qualify for a personal loan that checks all three of these boxes, so your best course of action may be to review the available options and choose a personal loan that will be the least expensive. Student Loan Hero offers a personal loan marketplace that features lenders that may have options suitable for your personal loan needs.