Shopping Around For A Car Loan Can Help

Perhaps the most important suggestion I can give you, especially if you have so-so credit, is to shop around for your next car loan. You may be surprised at the dramatic difference in offers you get.

Many people make the mistake of accepting the first loan offer they get . It’s also a smart idea to get a pre-approval from your bank as well as from a couple of other lenders. Online lenders and credit unions tend to be excellent sources for low-cost loan options. Not only are you likely to find the cheapest rate this way, but you’ll then have a pre-approval letter to take to the dealership with you.

The best part is that applying for a few auto loans won’t hurt your credit. The FICO credit scoring formula specifically allows for rate shopping. All inquiries for an auto loan or mortgage that occur within a 45-day period are treated as a single inquiry for scoring purposes. In other words, whether you apply for one car loan or 10, it will have the exact same impact on your credit score.

Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Bank Of America : Best Auto Loan Rates For Those Who Prefer A Bank

- New car loan rates start at 2.39%

- Terms range from 1275 months

- Amounts start at $7,500

While the starting APR for a Bank Of America auto loan is higher than the two credit unions above, you dont need to qualify for membership. B of A offers convenience. It could be your one-stop shop with competitive auto loan rates for any type of auto loan youd like: new, used, refinance, lease buyout and private party.

WHAT WE LIKE

Bank of America has a variety of auto loans that you dont always see from one lender; it has no membership requirements and it is the second-largest U.S. bank by assets.

WHERE IT MAY FALL SHORT

Bank of Americas minimum loan amount is relatively high at $7,500; you could easily find a used car from a private seller for less. By comparison, Navy Federal CU minimum loan amount is $250.

HOW TO APPLY

You could apply for a Bank of American auto loan online or by calling 844-892-6002. If you like to do business in-person, you could schedule a visit online. Be sure to follow all COVID-19 safety precautions if you go in-person.

Don’t Miss: How Do I Get My Student Loan Number

What Is The Average Credit Score Needed To Get An Auto Loan

As discussed, the average credit score for new loans is 721 and for used car loans is 641. But keep in mind that this information doesnt even come close to telling the whole picture of whats needed to get an auto loan. Its important to also know that there are other factors that are looked at.

Your credit score is a 3-digit number, but it is anything but arbitrary. Your credit score is a direct reflection of certain information that is found in your credit report, including:

Each of these factors also carries its own weight, or the degree to which it impacts your credit score. Lets take a closer look at this here:

FICO scoring model calculation factors

| 10% |

The most important to your credit score and creditors is your ability to pay your debts on time. Followed by that the amount of money you owe versus how high your maximum spending power is. Another way to look at credit utilization is if you have a balance of $2,500 on a credit card with a limit of $10,000, you have used 25 percent of your available credit.

Now that you know more about your FICO score, what about your FICO auto score?

Auto Loan Rates University Credit Union

University Credit Union in CA offers auto loans at great rates so that you can buy your next car with confidence. Access our rates and apply today!

View our competitive auto loan rates for new and used vehicles. Find out how you can save and explore Get great benefits with our low-rate auto loans.

The average interest rate for a car loan is higher if you have bad credit than if you have a good credit score. This is.

Recommended Reading: Does Applying For Personal Loan Hurt Credit

What Options Do I Have If Im A First

If you have limited or no credit history, and you havent taken out a car loan before, you might qualify for a first-time car buyers program. These programs can enable buyers to purchase a vehicle on a monthly payment plan. They also might decrease the APR and the amount of the down payment you have to make compared to other loan options.

For example, Ford offers a program you can apply to if you meet the following criteria:

- You havent had previous car credit

- There are no issues with your credit report

- Your income is $2,000 a month or more

Note that these programs will typically have an income and/or employment requirement, so youll likely need to demonstrate that you are either currently employed and earning above the required minimum or show a written job offer for a position you will be starting soon.

The Magic Number The Best Credit Score For A Car Loan

If you want a cut-off point, a number that serves as a bare minimum, then the number youll want to remember is 630,;however, if your score is lower, you may still able to get a loan;or simply fill in their information on the right registration form to find out.;If your score sits there or higher, youll more than likely qualify for a loan.

But thats just the short answer. You could get approved for a car loan if your credit score is lower , and of course, you can get a loan with great rates with a high score. Remember too, though, that a healthy credit score doesnt even guarantee you a car loan.

For the sake of this topic, take note of the following ranges and how they can impact your application outcome.

Excellent

Reach 760 or above, and youre among the elite, the credit sweetspot. A number of 760 or more shows that you are a very responsible person when it comes to your finances. A lender seeing such a number will trust you more with a loan of any kind. Assuming other aspects of your finances look good, you will also qualify for the lowest rates possible.

Very Good

Youre still sitting pretty in the very good range. You shouldnt have any problems with getting a car loan if your credit score sits here, and lenders will likely take a risk on you with a loan.

Good

Fair

Poor

You May Like: How To Eliminate Student Loan Debt

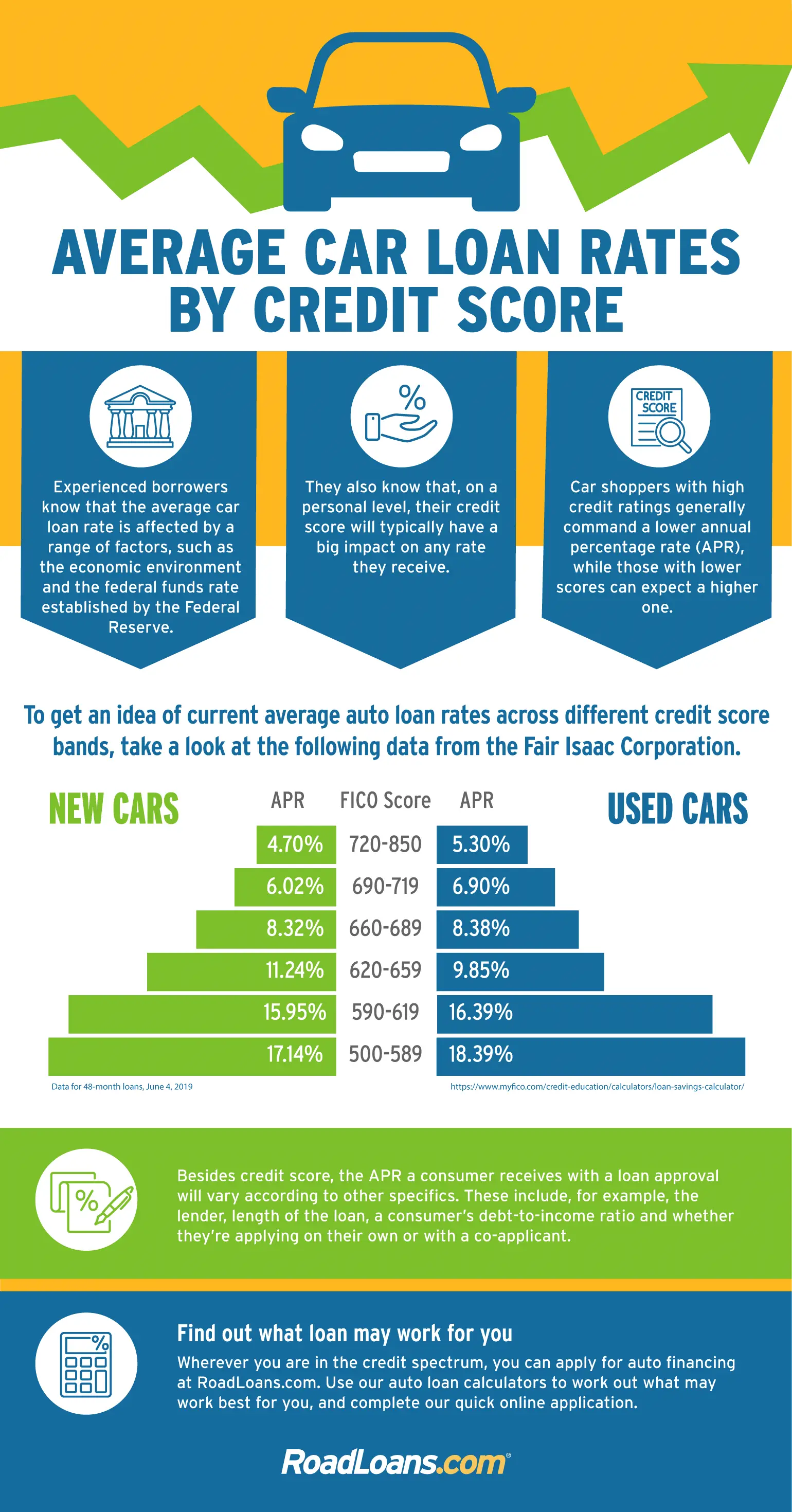

Average Auto Loan Interest Rate By Credit Score

Now that you have a better idea of what credit score you need to qualify for an auto loan, lets see how the average interest rates compare for new and used cars, based on your current credit score.

Average APR for Used and New Cars in 2017

| 3.60% | 2.83% |

It comes as no surprise that the average interest rate for both new and used cars increases sharply as credit scores decline. For instance, with excellent credit you could expect to pay 3.6 percent interest on a new car loan. By contrast, if you have bad credit , you can expect to pay nearly 15.25% in interest charges.

Also not surprisingly, interest rates for used cars were lower than their new car counterparts, across the board. Which is good news if you are trying to save money or if your credit is less than stellar giving you more options for your purchase.

| Related to “Auto Loan Score Requirements” |

|---|

| How Many Points Will a Car Loan Raise My Credit |

A Few Additional Tips About Using The Car Loan Calculator

In addition to;looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the calculator’s total amount paid result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

The car loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates;and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

You May Like: When Do Student Loan Payments Start After Graduation

Utah Auto Loan Financing For Your New Or Used Car

Before you find the perfect car, it helps to have the perfect loan. We can help you get pre-approved for competitively low auto loan rates in Utah, so you can pursue your dream new or used car with more negotiation power at the dealership and greater confidence in your purchase.

We can also help you find the ideal car. When youre approved for a University Federal Credit Union auto loan, we can help you choose from multiple car dealerships, review available vehicles , and estimate the value of your trade-in.

Benefits of Getting a New or Used Auto Loan Pre-Approval from UFCU

- Get pre-approved and know your buying potential before you shop

- Know your negotiation power with dealerships before you show up

- Easy application and competitive auto loan rates

- Exceptional loan servicing throughout the life of your auto loan

Car Loan Rates By Credit Score

Its smart to have some idea what dealers will see when they check your credit profile by checking your;free credit score.;You can also buy your FICO automotive score through that company’s website. That specialty score gives more weight to how you have repaid car loans in the past.;Many lenders use auto-specific credit scores that weigh past car-loan payments more heavily.

Someone with a score in the low 700s might see rates on used cars of about 6.05%, compared with 17.78% or more for a buyer scoring in the mid-500s, according to the data from Experian.

On a $20,000, five-year loan, thats a monthly payment of about $387 for the buyer with better credit versus $505 for the buyer with bad credit. The buyer with better credit would pay about $3,222 in interest over the life of the loan, while the buyer with lesser credit would pay $10,329. Plus, in most states, bad credit can mean higher car insurance rates, too.

Read Also: What Credit Score Is Needed For Conventional Loan

What If I Dont Want To Pay For My Fico Auto Scores

You can monitor your TransUnion;auto insurance score;for free on Credit Karma, along with your;free credit reports;and VantageScore 3.0 scores from TransUnion and Equifax. Just remember that your auto insurance scores are not the same as your credit scores, and a lender may not use your auto insurance scores.

Even if you cant see your exact FICO® Auto Scores, reviewing your credit reports means having access to your auto loan history and can help you determine what you can do to improve your credit.

What Credit Score Do I Need To Refinance My Car Loan

Considering an auto refinance loan but nervous about your credit score? Dont worry, there are other factors that can work in your favor.

Are you in the market for a new auto loan? If so, youve probably wondered, What does my credit score need to be to refinance a car?

Much to the surprise of many vehicle owners, theres no true minimum credit score to qualify for auto loans or refinancing. There are plenty of subprime lenders that offer loans to borrowers with bad credit even if your credit score is well below 600.

However, dont get tunnel vision and solely focus on your credit score; its only one factor that auto lenders consider when deciding whether to issue you a new loan. Lenders also look at your income, debt, existing car loan, and vehicle.

2021 Auto Refinance Rates

Recommended Reading: What Is Interest Rate For Commercial Loan

Aim For A Higher Credit Score

Ultimately, the answer to having the right credit score, is to have the highest number possible. If you can stay in the excellent range , great. Even if you can maintain a score in the very good range , you wont have any problems securing a loan that offers you great rates and discounts. By means of responsible payment habits, youll find it easy to maintain a score that gets you nothing but the best deals on car loans.

What Credit Score Do You Need To Buy A Car In 2020

Rather than asking, “What credit score do you need to buy a car?” it’s a better idea to ask, “What credit score do you need to get a good deal on an auto loan?”

Its always in a dealerships advantage to sell you a car, so the salespeople are going to do everything to secure financing for you, even if your credit isnt stellaralbeit sometimes at ridiculous interest rates.

Typically, a will put you in a good position to find favorable auto loan terms. If your credit score is lower, youll probably be offered a higher interest rate. And the lower it is, the more youre likely to pay. If your credit score is very poorless than 450then you may not be able to get a car loan.

Also Check: How Much Is Va Loan Entitlement

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Which Credit Score Is Used For Car Loans

Credit-scoring models from FICO and VantageScore are most commonly used for auto loans, but lenders may also use the industry-specific FICO® Auto Scores.

With the FICO Auto Scores, FICO first calculates your base scores your traditional FICO scores then adjusts the calculation based on specific auto risks. These scores help lenders determine the likelihood youll make your auto loan payments on time. FICO Auto Scores range from 250 to 900 points.

Read Also: How Long For Sba Loan Approval

How To Check All Versions Of Your Fico Auto Score

If you want to finance a car with an auto loan, signing up for one of the FICO® Basic, Advanced or Premier credit monitoring services can help.

All three FICO Basic, Advanced and Premier plans offer access to 28 versions of your credit score so you can use it when applying for any type of credit, including auto loans, mortgages and credit cards. These three services will also alert you of potential fraud, such as someone opening a new loan in your name or a sharp spike in your credit card balance.

If all you want are the multiple versions of your FICO Score, sign up for Basic, the lowest tier, to save more money each month. Learn more about the differences between each FICO credit monitoring service.

-

$19.95 to $39.95 per month

-

Experian for Basic plan or Experian, Equifax and TransUnion for;Advanced and Premier plans

-

Yes, for;Advanced and Premier plans

-

Identity insurance

Yes, up to $1 million

Terms apply.

What Is A Good Credit Score For An Auto Loan

While lenders can set their own standards when assessing an individual’s FICO score, generally accepted standards across the board for multiple lenders. According to Experian, “higher scores represent better credit decisions and can make creditors more confident that you will repay your future debts as agreed.”

So what’s a “good” credit score? Anything above 700 will at least allow borrowers to be in a good position to obtain auto loans. Once you build your score over 800, you can pretty much be assured of your excellent credit and an ace up your sleeve when negotiating your annual percentage rate and your loan terms. However, if you credit score is higher than 600 and lower than 750, you’re in line with most borrowers. The average credit score in America is 657.

Read Also: What Kind Of Loan Do I Need To Buy Land