Speedy Cash Reviews And Complaints

| BBB accredited | |

|---|---|

| 4.6 out of 5, based on 8,599 customer reviews | |

| Customer reviews verified as of | 18 March 2021 |

While Speedy Cash earns positive reviews on its Trustpilot page, almost all of the recent reviews on its BBB page are negative. Borrowers frequently complain about the high costs, poor customer service and inability to change payment due dates.

How Do You Value Jewelry Gold & Diamonds

With more than 40 years of jewelry buying & selling experience, we look at each piece on an individual basis. Market value, scrap vs sellable, quality, designer, resale value & trends are what we consider when pricing your gold and jewelry. We pay MORE than scrap price for sellable jewelry! Appraisals, while great for insurance purposes, dont always translate into loan or market value, however we typically loan and buy at a higher rate than the industry standards.

Advantages Of Loans Like Speedy Cash

Fast- Theres no need to deal with a long wait time to receive your short-term loan. All short-term loans are usually ready quickly, such as within one day of applying.

Easy Sometimes, people are hesitant to get loans because they expect it to be complicated. But with short-term loans, there is less hassle as you are not faced with a rigorous screening process like with other loans. Plus, when you apply for a loan online, the process is quick and more convenient.

Also Check: Fha Vs Conventional 97

What If You Cant Wait

Borrowers who are confident that they can pay their debts on time would certainly benefit from an instant online title loan or other types of speedy cash installment loans.

Keep in mind that these programs are popular for a reason. If an urgent situation comes up, you dont have time to wait for a credit card to arrive in the mail or find ways to build up your credit score.

However, when you cant pay back the often sizable payday or title loan, the problem could end up creating more emergencies in the future.

Because of this, if you do borrow money, can you take care of your other bills when your salary is deposited and the lender expects their cash back? If not, then you will likely have to extend that loan and incur heavy interest fees.

Why Do You Need All This Information

We are a responsible loan provider and this means that we need to verify:

- That it is you taking out the loan

- That you are employed full time and are / will be able to repay your loan

- That we electronically deposit the loan funds to your account and no-one elses account

- That you can realistically repay your loan

Recommended Reading: Usaa Car Loan Refinance Rates

What Is The Interest Rate On A Loan Or Cash Advance

Cash advance loans can provide a fast way to pay for an emergency expense or create a little breathing room in your budget until pay day, but getting one is not free. Speedy Cash offers a variety of cash advance loans including short-term payday loans, longer-term installment loans, and flexible lines of credit. The interest you pay on a loan from Speedy Cash will depend on the type of loan you borrow and individual state rates and regulations.

Is Any Merchandise Stolen

While it does happen occasionallyunder 1% of our merchandise actually turns up as stolen merchandise. In the grand picture, that is a SMALL percentage. At, we take certain precautions in order to prevent continuous illegal transactions.

We turn copies of all pawns/purchases in to the Nigerian Police Force as well as Lagos state Police Division EVERY day. State regulations require us to hold pawned items in store for 2 days, and purchased items for 10 days before releasing them for sale or back to owners in order to check for theft. We, as a store, block customers who are found to have stolen items from ANY future transactions so as not to have repeated offenses! What people dont realize is that we lose out on the money paid AND the merchandise when items come up as stolen.

At SPEEDY CASH SHOP, we work closely with all victims and law enforcement in order to assist in any way with suspected stolen merchandise!

Also Check: Do Mortgage Loan Officers Make Commission

Cashnetusa Reviews And Complaints

| 4.6 out of 5, based on 15,117 customer reviews | |

| Customer reviews verified as of | 09 February 2021 |

|---|

CashNetUSA receives mixed reviews on its Better Business Bureau page and on Trustpilot. Those happy with the lender praise its fast, easy application. Negative reviews centered around the high cost of borrowing.

While these are valid complaints, its important to remember that payday loans tend to have high interest rates. Payday and installment loans are repaid over short periods of time usually a few weeks to a few months and you should expect to pay $10 to $30 for every $100 borrowed.

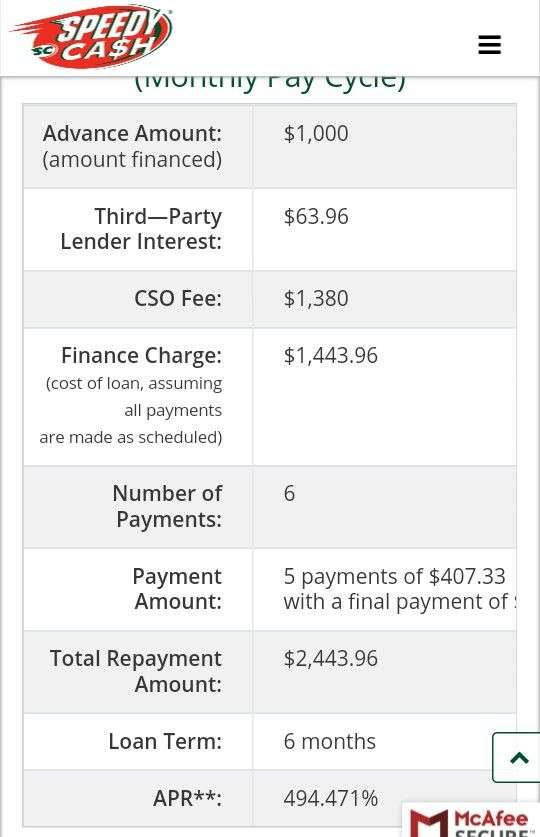

Speedy Cash Rates Fees And Terms

The cost of a payday loan from Speedy Cash depends on your state laws, the amount you borrow and the term of your loan. In most states, you will likely be able to borrow between $100 to $500. Because financing fees are set by state, you may have to pay between $10 to $30 for every $100 borrowed.

This means that the annual percentage rate of your loan will be 150% or more. And because Speedy Cash also offers installment loans, lines of credit and title loans, the amount you pay can vary widely.

To help make the cost more clear, Speedy Cash provides examples of its financing fees and average APR on its website. Visit your states rates and terms page for more specific details.

Don’t Miss: Usaa Used Car Loan Rate

Not Everyone Is Eligible

Speedy Cash requires proof of steady income to apply for a loan, so if you’re unemployed, you may not be eligible. You’ll also need an active bank account in order to apply, so Speedy Loan services aren’t available to the 17 million “unbanked” Americans. And, Speedy Cash is only licensed to operate in certain statesmuch of the East Coast, for example, is out of luck. Before you apply, make sure there’s a Speedy Cash near you.

Who Are Speedy Cash Loans For

Loans like Speedy Cash are intended for borrowers with poor credit scores. If you have a low credit score and youre considering a loan like Speedy Cash, you should know that you do have other options.

Many borrowers with a low credit score arent usually approved for traditional bank or credit union loans. Often, they have to resort to an online payday loan, title loan, or other expensive loan services.

UNFORTUNATELY, SOME PAYDAY LOANS ARE PREDATORY AND END UP COSTING THE BORROWER MORE IN THE LONG RUN.

But because borrowers with low credit scores dont have very many options, they may have no other choice than to choose one of these risky loans.

You May Like: Capitol One Car Loan

Will A Speedy Cash Loan Affect My Credit Score

It depends. Certain locations, and certain loan types, may require a credit check before approval. If that’s the case, the credit inquiry can slightly ding your credit score.

Also, while paying off a Speedy Cash loan on time won’t help you improve your credit score, it can lower your score if you miss a payment. If you’re working to build better credit, ask your local Speedy Cash location if they’ll run a credit check, so you know what to expect.

Speedy Cash And Payday Loans

A payday loan is a short-term, high-cost loan that provides borrowers with a small amount of cash to help them make it to their next payday. Payday lenders, like Speedy Cash, typically offer loans in small amounts, and they are unsecured, so you wont need collateral.

The problem with payday loans is that they tend to come with extremely high interest rates and very short repayment periods. Typically, a payday loan needs to be repaid within two weeks, in one lump-sum payment. But the high interest rates and additional fees make this problematic for borrowers with little income and low credit scores.

If youre trying to get quick cash online, payday loans may seem like a good idea. But many bad credit borrowers end up trapped in a cycle of debt from these dangerous loan products. We always recommend finding an alternative to payday loans if possible.

Recommended Reading: Auto Loan Usaa

A Closer Look At Speedy Cash Loans

Here are a few other features to keep in mind if youre considering an installment loan from Speedy Cash.

- No prepayment penalty If you want to pay off your loan early, Speedy Cash wont charge a prepayment penalty. This could help you save interest costs.

- Multiple ways to get money Along with direct deposit, Speedy Cash lets you pick up your money at a storefront location . You also can get your loan funds on one of three types of prepaid debit cards, called Opt+ cards. But keep in mind that there may be fees depending on how you decide to get funds.

- Automatic payments allowed You can set up automatic payments so that your payments are automatically deducted from your checking account each month.

What Types Of Items Can You Pawn

ALL TYPES! Jewelry , Gold , Silver , Guns, Tools, Electronics, Music Equipment and Instruments, Hunting/Fishing Equipment, Archery, Car Audio Speakers, Antiques, Unique items, etcThe skys the limit If we have room, and can agree on a price, well look at ANYTHING! At SPEEDY CASH SHOP, we strive to think outside the box for ways to loan you money and find value where others may not!

Recommended Reading: Can A Va Loan Be Used For An Investment Property

Is Speedy Cash Safe To Use

Speedy Cash makes the privacy and security of its customers a priority, and they continually update their technology to safeguard your personal data.

However, they warn of a common phone scam in which the caller claims to represent Speedy Cash, and demands payment for a past loan.

While these scammers aren’t affiliated with Speedy Cash, it’s worth noting that former Speedy Cash customers are more susceptible to this scammainly because it’s easier to believe you owe money on a Speedy Cash loan if you’ve actually had a Speedy Cash loan at some point.

If someone contacts you requesting money to pay off a past due loan, and you aren’t aware of any missed payments, be sure to contact the Speedy Cash Fraud Department directly to verify whether it’s a legitimate request.

In addition, there have been occasional complaints of customers being held liable when a fraudulent loan is opened in their name.

One TrustPilot reviewer said:

A few months ago, someone fraudulently accessed my account, changed the customer address and banking info, and requested a $1500 loanI made a police report and a report with the Federal Trade Commission. Out of the blue today, I discovered that Speedy Cash entered my original bank account and deducted the $1500 from me.

Before applying for a loan, ask the Speedy Cash representative how fraudulent transaction are handled and what steps you should take if you notice fraudulent activity on your account.

Is Speedy Cash legit?

How Does Speedy Cash Shop Differ From Other Pawn Shops

We are family owned and operated and our customers are treated like family. We offer the BEST customer service, honest opinions and values and strive to get you the MOST MONEY FOR YOUR MERCHANDISE! We have the largest variety of merchandise for sale and on most items, NO ONE PAYS FULL PRICE!

We work with our customers to make sure they have the best pawn experience, purchase experience, and overall best quality pawn shop experience around by offering grace periods, no prepayment penalties, no hidden fees, principal payments allowed on up-to-date loans, 60 days LAYAWAY on purchases, test all merchandise on sales, and offer 30 day warranty on ALL ELECTRONICS PURCHASES. No other pawn shop offers all of that to their customers. Basically, if you work with us, well work with you.

Read Also: How Long Does It Take Sba To Approve Loan

How Does The Pawn Process Work

A Pawn is basically a collateral loan. You bring in an item of value. We determine the possible loan value of the item and you exchange that for CASH! From there you have 30 days to redeem your item by paying the loaned amount plus the service charge, or you can extend the loan by paying just the service charge and extending the loan an additional 30 days.

Borrowing Online Frequently Asked Questions

-

How does Speedy Cash Online work?

- Speedy Cash provides flexible loans around the clock. We have a 24-hour application process and online support during regular business hours. Were here to help solve urgent and short-term financial setbacks. Were more convenient than other online lenders because theres no paperwork or hanging on the phone the entire lending service is online! Its straightforward to submit an application, and if youre approved, you can have the money in your account within one business day.

Does Speedy Cash Online require a credit check?

-

What are the ways that I can receive my money?

- Electronic Email Money Transfer

- Direct Deposit into your bank account

How long will it take to get my loan?

How do I re-pay an online loan?

You May Like: Fha Limits In Texas

What Are My Payment Options

You can repay your loan online or by mail just give yourself a few extra days to make sure it gets there in time. If CashNetUSA doesnt receive the check by 5 p.m. CT on your due date, you might incur late fees.

If you choose to pay online, enter your checking account information and authorize it to make a withdrawal on the date your payment is due. CashNetUSA will automatically withdraw the funds from your bank account on the due date.

To make changes to your banking information, contact customer service by emailing through your account or calling 888-801-9078 at least two days before your payment is due. Youll also need to fax a copy of either a voided check or a bank statement from that account it doesnt accept starter checks.

I didnt get the loan. What can I do?

There are a number of reasons you might not have qualified for a loan. Depending on your income and employment history, CashNetUSA may have determined that you couldnt afford to borrow at this point in time. Or you might not have resided in one of its serviced states.

You may want to consider other lenders that may approve you instead.

Speedy Cash And Title Loans

A title loan is a secured loan that requires the borrower to offer up collateral to receive one. The collateral, in this case, would be the title and ownership rights to your vehicle. This means that if you dont repay the loan in time, the lender might take your car to recover their loss. As you can imagine, this is a very risky situation.

IF YOU NEED YOUR CAR TO GET TO WORK, TAKE THE KIDS TO SCHOOL, AND RUN ERRANDS, THEN OFFERING IT UP TO GET QUICK CASH WITH A TITLE LOAN IS PROBABLY NOT WISE.

In addition to being risky, these loans also come with high interest rates and short repayment periods. Some title lenders even require the cash to be repaid in one lump sum, which is sometimes difficult.

We would encourage you to think twice before risking your vehicle to get some quick cash online.

You May Like: How To Get Mortgage License In California

Speedy Cash Loans: Sensible Loans For Emergencies

Speedy Cash Loans began operating in 1997, and currently, they have hundreds of physical loan stores in more than 14 states. Borrowers can take out loans by visiting any of their locations or by making applications through their website. States with both online and in-store services are 14, but the lender has plans to expand into new locations. To know if they serve your state, check out their Find a Store Page.

An Instant Online Title Loan Or Paycheck Advance: Simple And Easy

Another advantage to these types of loans is that they are easy to qualify for. In fact, most lenders dont even check your credit score. As long as they know when youre getting paid and how much, they will give you cash.

With a title loan, borrowers must sign a contract that gives the issuer the right to tow and sell their vehicle if the amount isnt paid back. That, in itself, acts as collateral.

Payday loans follow the same process, but without handing over your cars title.

Also Check: Fha Mortgage Insurance Cut Off