State Va Loan Limits By County

- AlabamaVA Loan Limits by County

- All areas$548,250

How Can You Increase Your Home Loan Eligibility

We hope this short bite on eligibility has helped you understand the basics of eligibility. Please make the best use of housing loan eligibility calculator below and be on your way to finding your dream house

How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Recommended Reading: Can I Refinance My Sofi Personal Loan

How To Use Myloancare Home Loan Eligibility Calculator

You can check your home loan eligibility at MyLoanCare with the following steps:-

- Fill in the required details like name, mobile number, income etc in form.

- Complete OTP authentication by entering OTP , which you have received on the entered mobile number.

- After OTP verification, enter additional details about your profession, the reason for taking a home loan, and your current work experience.

- Verify all the details and click Get Offers.

- You can now view the multiple banks for which you are eligible based on the details filled in by you.

- You can choose the bank after a complete comparison, or a MyLoancare advisor will contact you in a while to assist you with the process.

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

You May Like: Aer Allotment

How To Use A How Much Can I Borrow Mortgage Calculator

With this calculator, you can run some what-if scenarios. For example, you may consider:

-

How long will I live in this home? That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly payment, but youll pay a lot more interest over the long term. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan, but your monthly payment will be considerably more.

-

Is an adjustable-rate mortgage a better option for me? If you plan on being in this home for just a few years, a 5/1 ARM could be a good option. Youll enjoy a lower initial interest rate thats fixed for five years, but the rate changes annually after that.

-

Am I trying to buy too much house? Sure, lenders may be more than happy to put your name on a big loan, but how do you feel about it? Are you comfortable with how it may impact your monthly budget, or are you feeling a bit stretched? Consider how your new home costs may impact your other spending goals, such as travel and savings.

-

How much of a down payment should I make? Its always the big question. Are you putting down as little as possible and having to make up for it with larger monthly payments and possibly having to pay mortgage insurance?

Home Loan Eligibility Based On Age

Age is another determining factor when it comes to loan tenure. The maximum tenure that you can avail is 20 years.You will be able to avail a longer repayment tenure if you are of a lower age. You can also avail a home loan of higher value provided you have a high income.Salaried applicants have to be between the ages of 23 and 62 years to apply for a home loan. Self-employed applicants have to be within the age bracket of 25 and 70 years to avail one.The following table shows the maximum tenure individuals are eligible for based on their age:

| Age | Maximum tenure for salaried applicants | Maximum tenure for self-employed applicants |

|---|---|---|

| 25 Years | ||

| 20 Years |

Don’t Miss: Usaa Vehicle Refinance

What Is The Maximum Home Loan That I Can Obtain

You are required to pay 10-25% of the total property cost as own contribution depending upon the loan amount. 75 to 90% of the property cost is what can be availed as a home loan. In case of construction, home improvement and home extension loans, 75 to 90% of the construction/improvement/extension estimate can be funded.

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partners income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you dont know them.

With these numbers, youll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

Recommended Reading: What Car Loan Can I Afford Calculator

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

What Security Will I Have To Provide To Avail Of A Home Loan

Generally, the first mortgage of the property is provided as the security against loan but that differs according to your lender.

DisclaimerThe information contained herein is generic in nature and is meant for educational purposes only. Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product. Readers are advised to exercise discretion and should seek independent professional advice prior to making any investment decision in relation to any financial product. Aditya Birla Capital Group is not liable for any decision arising out of the use of this information.

OTHER CALCULATORS

Don’t Miss: Usaa Auto Refinance Rates

Figuring Out How To Qualify For A Home Loan Auto Loan Etc

The first step in researching how to qualify for a home loan or any loan is to take a long hard look at your finances. Exactly how big of a loan are you trying to take out and whats an interest rate that sits right with you? Are you currently paying off any existing debt that could have an impact on your ability to qualify for this new loan? These are important questions to answer if you want to pre-qualify for a home loan, and our loan prequalification calculator is a great tool to help you get started.

Hdfc Offers Various Repayment Plans Enhancing Home Loan Eligibility:

HDFC offers various repayment plans for maximizing home loan eligibility to suit diverse needs.

- Step Up Repayment Facility

SURF offers an option where the repayment schedule is linked to the expected growth in your income. You can avail a higher amount of loan and pay lower EMIs in the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in your income.

- Flexible Loan Installments Plan

FLIP offers a customized solution to suit your repayment capacity which is likely to alter during the term of the loan. The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in proportion to the income.

- Tranche Based EMI

If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed.

- Accelerated Repayment Scheme

This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster.

- Telescopic Repayment Option

With this option you get a longer repayment tenure of up to 30 years. This means an enhanced loan amount eligibility and smaller EMIs.

Recommended Reading: When Can I Apply For Grad Plus Loan

How To Use The Borrowing Power Calculator

Using a borrowing power calculator is very simple. Here are the different fields you need to fill out on the calculator:

While its impossible to be able to use a calculator to see if youre eligible for a home loan, its important to use tools such as a borrowing power calculator to see if your income, debts and liabilities would enable you to pay off a home loan. If you also take into account the eligibility criteria offered by most banks, you could have a fairly good idea of whether or not youll be approved for a certain loan.

My Monthly Rbc Mortgage Payment Will Be

$0*/month

The mortgage amount is based on the qualifying rate of%.* The payment amount is calculated based on an interest rate of %.

View Legal DisclaimersHide Legal Disclaimers

Enter your annual household salary. This includes your spouse/partner.

Consider car payments, credit cards, lines of credit and loan payments. This should not include your rent.

Enter the amount of money you plan to use as a down payment. Donât forget you can also leverage your RRSPs.

The Home Buyers’ Plan allows you to borrow funds from your RRSP to purchase your first home. Here are some of the key facts:

- You and your spouse can each withdraw up to $35,000 from your RRSP.

- The funds must have been on deposit at least 90 days before you withdrew them.

- At least 1/15 of the funds must be repaid each year, beginning two years after the funds were withdrawn.

- A signed agreement to buy or build a qualifying home is required.

- You can only participate in the program once.

For details,watch this video or seeCanada Revenue Agency

Default insurance covers the lender in case of a failure to pay off the full mortgage amount. If your down payment is from 5-19%, a default insurance premium will automatically be applied to your mortgage.

Other monthly expenses you may want to consider include such items as alimony and condo fees .

Recommended Reading: Personal Loan To Buy Land

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner’s income and the typical local home value.

Va Loan Limit Calculator

VA loan limits no longer apply to qualified Veterans with their full VA loan entitlement. Veterans with reduced VA loan entitlement must still follow VA loan limits. Keep in mind, VA loan limits are not a maximum on how much you can borrow but help determine how much you can borrow without needing to factor in a down payment.

Enter your city and state below to find your area’s VA Loan limit amount or learn more about VA loan limits changes in 2021.

VA loan limits determine how much a Veteran with reduced entitlement can borrow before needing to factor in a down payment. VA loan limits vary by county and currently range from $548,250 to $822,375.

While qualified Veterans with their full entitlement can borrow as much as a lender is willing to extend, those with reduced or diminished entitlement are bound to VA loan limits. Less-than-full entitlement is typically due to having one or more existing VA loans or because of default on prior VA loan.

Recommended Reading: How To Get Pmi Off Fha Loan

Va Loan Limit Example

Letâs assume youâre currently using $60,000 of your VA loan entitlement and want to purchase a new home in a standard cost county . Because the VA guarantees a quarter of the loan amount, the maximum entitlement in this county is currently $137,062.

Generally, hereâs how the loan limit calculations would look:

- $137,062 – $60,000 in current entitlement = $77,062 remaining entitlement

- $77,062 remaining entitlement x 4 = $308,250

That $308,250 figure represents how much you could borrow before needing to make a down payment. This Veteran could buy with $0 down all the way up to $308,250. Purchasing above that mark would require a down payment equal to 25 percent of the difference between that ceiling and the purchase price.

What Is Mortgage Affordability

Mortgage affordability refers to how much youre able to borrow, based on your current income, debt, and living expenses. Its essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term affordability is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but its important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

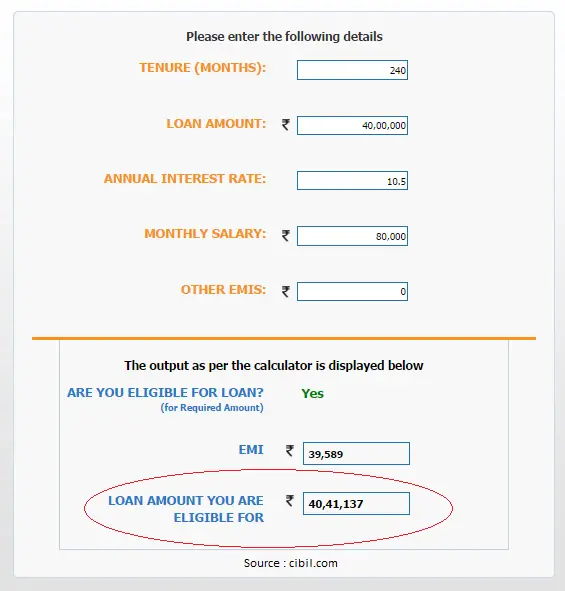

What Does An Emi Mean

EMI refers to the Equated Monthly Installment which is the amount you will pay to us on a specific date each month till the loan is repaid in full. The EMI comprises of the principal and interest components which are structured in a way that in the initial years of your loan, the interest component is much larger than the principal component, while towards the latter half of the loan, the principal component is much larger.

Following are the benefits of an EMI calculator for a home loan-Helps in planning your finances in advanceAn EMI calculator is useful in planning your cash flows much in advance, so that you make your home loan payments with ease whenever you avail a home loan. In other words, an EMI calculator is a useful tool for your financial planning and loan servicing needs.Easy to useEMI calculators are very simple and easy to use. You need to provide only three input values namely:

a. Loan Amountb. Interest Ratec. Tenure