Graduate Or Leave Full

You have six months after you graduate or leave full-time studies before you need to start repaying your OSAP loan. This is your 6-month grace period.

You will be charged interest on the Ontario portion of your loan during your 6-month grace period. This interest will be added to your loan balance .

Is Student Loan Forgiveness Still Possible

Even if government officials conclude that Biden doesn’t have such authority, there could still be hope.

Although Democrats might find it hard to pass legislation forgiving student debt in Congress, given their razor-thin majority, they could turn such a bill into law though;the budget reconciliation;process in the fall. That avenue wouldn’t require the support of Republicans.

If Youre Pursuing Student Loan Forgiveness

Public Service Loan Forgiveness and income-driven repayment plans provide potential paths to student loan forgiveness and repayment. But both programs require that borrowers make a certain number of on-time payments to be eligible to have their remaining student loan balance canceled.

The good news is that the CARES Act student loan forbearance will still count toward satisfying these requirements for federally owned loans, even if you suspend payments now.;

Recommended Reading: How Much Is My Student Loan Payment Going To Be

Student Loans In Canada: The Basics

The term student loan encompasses a broad array of financial products, from personal loans, bank issued student lines of credit, to government-backed installment loans. In Canada, the most common type of student loan is issued by the provincial or federal government , so thats where were going to focus the majority of our attention.

How To Get A Student Loan

Few students right out of high school can afford to cover the cost of attending college or university. While scholarships are great if you can get them, what do you do if you can’t? That’s where student loans come in. We’ll break down the two major types of student loans available and get you up to date on what you can expect when applying for each.

Read Also: How To Get Rid Of Pmi Insurance On Fha Loan

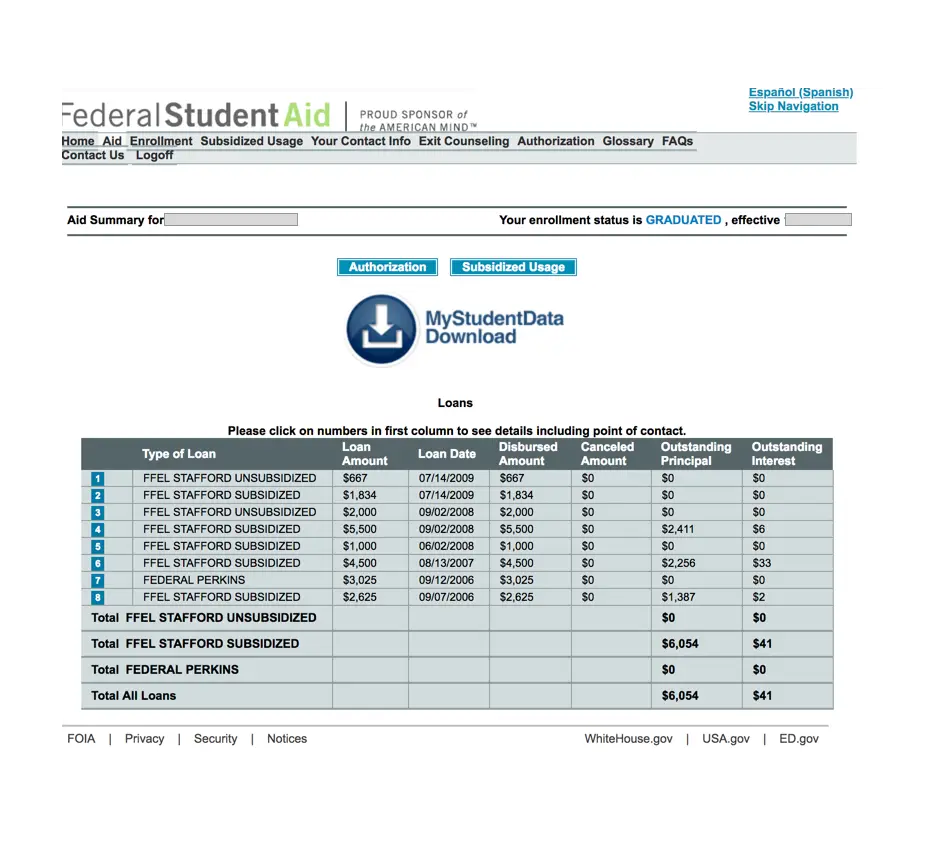

Manage Your Student Loan Balance

Sign in to your student loan repayment account to:

- check your balance

- see how much youve repaid towards your loan

- see how much interest has been applied to your loan so far

- make a one-off repayment

- set up and amend Direct Debits

- tell the Student Loans Company if youve changed your contact details

- tell SLC if youre going overseas for more than 3 months

This service is also available in Welsh .

You can also make one-off repayments towards your student loan, or towards someone elses loan, without signing in.

To sign in youll need your:

- customer reference number or email address

- password

- secret answer, for example your mothers maiden name

If you do not know these, you can reset them using the email address you had when you applied for your loan. Contact SLC if youve changed your email address.

Do Student Loans Go Away After 7 Years

Student loans don’t go away after 7 years. There is no program for loan forgiveness or loan cancellation after 7 years. However, if it’s been more than 7.5 years since you made a payment on your student loan debt and you default, the debt and the missed payments can be removed from your credit report. If that happens, your credit score may go up, which is a good thing. But you’ll remain responsible for paying back your loans.

You May Like: What Is Auto Loan Interest Rate

Average Medical School Student Loan Payment

- Standard repayment plan $3,533

- Refinance into 10-year loan at 5% $2,912

- Refinance into a 5-year loan at 4% $5,057

With an average medical school debt of $251,600, new doctors must cope with sizable monthly student loan payments. But they typically earn a lot, too, once they have completed their residencies.

If you tried to start paying off your medical school loans right after graduation on the standard 10-year repayment plan, youd be looking at monthly payments of $2,870. Many doctors cant afford to do that, and put their loans in forbearance or enroll in an income-driven repayment plan like REPAYE during residency.

| Repayment plan | |

|---|---|

| 10 years | $361,645 |

| Average monthly payment for $251,600 in medical school debt with a weighted average 6.6% interest rate at graduation. REPAYE estimates based on $56,000 salary during residency, $211,000 after residency. |

If You Have 2 Or More Jobs

If youre employed, your repayments will be taken out of your salary. The repayments will be from the jobs where you earn over the minimum amount, not your combined income.

Example

You have a Plan 1 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £1,000 a month from one job and £800 a month for the other.

You will not have to make repayments because neither salary is above the £1,657 a month threshold.

Example

You have a Plan 2 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £2,300 a month from one job and £500 a month for the other.

You will only make repayments on the income from the job that pays you £2,300 a month because its above the £2,274 threshold.

You May Like: Who Will Loan Money With Bad Credit

How Much Maintenance Loan Will You Get

The size of the Maintenance Loan you’re entitled to will depend on the following three factors:

It’s easiest to break things down by country, so just scroll through to where you currently live to see how big a Maintenance Loan you could receive .

And remember: your Maintenance Loan is provided by the part of the UK you normally live in,;not where you will be studying. So, for example, if you lived in Northern Ireland but planned to study in Scotland, you’d apply for funding from Student Finance Northern Ireland.

How Is The Maintenance Loan Paid

Maintenance Loans are paid straight into your student bank account in;three equal instalments throughout the year one at the beginning of each semester . That means it’s down to you to budget your loan responsibly and make sure you don’t spend it all in freshers week!

Students often ask why the third payment is as big as the others when you’ll likely be at home over the summer, but the answer is simple: you’re still a student, and some of you still have rent to pay during July and August.

And it’s thanks to that same logic that things change slightly in your final year. Your final Maintenance Loan payment is smaller than it would have been in previous years, as after June/July you’re no longer a student and therefore not entitled to a Student Loan.

Note that not all of your Student Loan will be paid directly to you. Your Tuition Fee Loan will be paid straight to your university, and you’ll never see the money. That means you shouldn’t have to worry about your uni chasing you down for payment, nor the temptation to spend the cash yourself.

Also Check: How To Take Name Off Car Loan

Smart Moves To Make If You Can Afford Your Student Loan Payment

If you have plenty of income left each month after paying your student loans and other bills, that could be a sign that you could save money by paying down your student loans faster.

Here are a few ways to pay off your student loans faster:

- Accelerate payments on your student loans: You can always make more than the minimum payment without being penalized by your loan servicer.

- Refinancing your student loans: If youre paying high interest rates on your loans, refinancing them at lower rates can help you pay them back even faster.

The good news is, Credibles done the heavy lifting for you. Weve partnered with top student loan refinancing lenders to make it easy for you to compare rates all in one place. You can compare your prequalified rates from each of these lenders in two minutes without hurting your credit.

Find out if refinancing is right for you

- Compare actual rates, not ballpark estimates Unlock rates from multiple lenders in about 2 minutes

- Wont impact credit score Checking rates on Credible wont impact your credit score

- Data privacy We dont sell your information, so you wont get calls or emails from multiple lenders

Additional Factors To Consider When Calculating Student Loan Interest

When calculating your student loan interest, keep in mind that there are a few other key factors at play:

- Fixed vs. variable rates. Unlike federal student loans, which offer only fixed interest rates, some private lenders offer fixed or variable student loan interest rates. A fixed rate wont change during your loan term, but variable rates can decrease or increase based on market conditions.

- Term length. How short or long your student loan term is dramatically changes how much total interest youll pay. In addition to calculating your total interest paid, the student loan calculator above shows you how much of your monthly payment goes toward interest; to see this view, click on show amortization schedule.

- Private student loans require a credit check. The stronger your credit, the more likely youll be offered competitive, low interest rates. Borrowers with bad credit might be approved at a higher interest rate, which means more money spent on interest charges overall.

Also Check: Can You Ask For More Federal Student Loan

If You Declare Bankruptcy

If you declare bankruptcy, you still have to pay your OSAP loan. This means you must continue to make a regular monthly payment.

Apply to the;Repayment Assistance Plan if you cant make these monthly payments.

If youve been out of;studies for more than five years, you can ask a bankruptcy court to have your;OSAP;loan included in your discharge. Contact your bankruptcy trustee for help.

How And When Do I Repay

- Full-time courses youll be due to start repaying the April after you finish or leave your course, but only if you’re earning;over the repayment threshold. For example, if you graduate in June 2021, youll be due to start repaying in April 2022, if you’re earning enough.

- Part-time courses; youll be due to start repaying the April four years after the start of your course, or the April after you finish or leave your course, whichever comes first, but only if you’re earning over the repayment threshold.

How you’ll repay depends on what you choose to do after your course:

- If you start work, your employer will automatically take 9% of your income above the threshold from your salary, along with tax and National Insurance.

- If you’re self-employed, youll make repayments at the same time as you pay tax through self-assessment.

- If you move overseas, youll repay directly to the Student Loans Company, instead of having it taken automatically from your pay. The repayment threshold could be different from the UK, which means the amount you repay could be different. Find out more about repaying from overseas.

Don’t Miss: Can I Get An Emergency Loan With Bad Credit

Managing Your Debt Repayment Assistance Plan

As a borrower, you are required to repay your loan. Missing payments could damage your credit rating. Your student loan could go into default. Contact the National Student Loans Service Centre at 1-888-815-4514 before you miss a payment. There are options available to help you manage your payments and avoid defaulting.

The Repayment Assistance Plan makes it easier to manage your debt. You pay back what you can reasonably afford, based on your family income and size. Monthly payments are limited to no more than 20 per cent of your gross family income. No borrower on RAP will have a repayment period lasting more than 15 years. If you have a permanent disability, your RAP repayment period will not last longer than 10 years. If you earn very little income, you might not be required to make loan payments until your income increases. Contact the National Student Loans Service Centre to apply.

Save It In Your Emergency Fund

Around 1 in 8 federal student loan borrowers say they put loan payment money into a savings account, according to the survey. The COVID-19 pandemic has been financially devastating for many, highlighting the importance of emergency savings. Ideally, youd save three to six months worth of expenses, but even $500 or $1,000 stashed away can make a big difference in your peace of mind and ability to handle the unexpected.

Also Check: Can I Roll My Closing Costs Into My Va Loan

What If I’m Worried I Won’t Be Able To Start Making The Payments Again

If you’re still unemployed or dealing with another financial hardship because of the pandemic, you’ll have options come October.

First, put in a request for the economic hardship or the unemployment deferment, experts say. Those are the ideal ways to postpone your payments because interest doesn’t accrue under them.

If you don’t qualify for either, though, you can use a forbearance to continue suspending your bills. But keep in mind that interest will rack up and your balance will be larger when you resume paying.

More from Invest in You:Here’s how to decide what debt you should tackle first

If you expect your struggles to last awhile, it may make sense to enroll in an income-driven repayment plan. These programs aim to make borrowers’ payments more affordable by capping their monthly bills at a percentage of their discretionary income and forgiving any of their remaining debt after 20 years or 25 years.

Repaying Your Canada Student Loans

If you have a government student loan, you have a six-month grace period when you graduate before you must start repaying your student loans. During that time, youll receive a letter in the mail outlining your loans interest rate and monthly payment. Your loan will usually default to a fixed interest rate, but if youd prefer your Canada student loan interest rate to be a variable interest rate, you can call your loan provider to make this change. If youd like to pay more toward your student loan to pay it off sooner, you can contact your provincial or federal student loan centre to change your payment terms.

Paying down your student loans is a long and arduous process, but there are ways to speed up your debt repayment progress. A tried-and-true method is to apply for student loan forgiveness . Many provinces offer student loan forgiveness to individuals working in specific professions.

For example, if you are a nurse and you are working in a rural area, you may be eligible to have some of your student loans forgiven. Another typical student loan forgiveness program is to forgive loans through non-refundable tax credits, as long as you live and work in your home province. These loan forgiveness programs can reduce your student loan debt by thousands and dramatically decrease the length of your loan, so its worthwhile to research loan forgiveness programs in your province.

Read Also: How To Apply For Loan Consolidation

When Will Bills Be Due Again

In October. Your exact due date will vary depending on the time of month you began paying your student loans.

There’s still a chance borrowers could get more time: Recently, Education Secretary Miguel Cardona said that;an extension was under consideration.

“It will likely depend on the state of the economic recovery by then,” said higher education expert Mark Kantrowitz. “I doubt they’ll extend it beyond the end of the year.”

Don’t count on getting more time, said Betsy Mayotte, president of The Institute of Student Loan Advisors, a nonprofit.

“While it is still a possibility, it is not guaranteed,” she said. “It’s best to prepare now student loan servicer call centers will get busier as we get closer to October.”

Class Of 2021 Student Loan Payments

Because student loan interest rates are at historic lows, current students may reasonably expect to pay off their student loan debts within the recommended 10-year timeline.

- Between $354 and $541 is the ideal monthly payment for a newly graduated Bachelors degree holder.

- 2.75% is the interest rate for Direct Subsidized and Unsubsidized federal student loans to undergraduate borrowers.

- Undergraduates of public institutions owe an average of $29,500 per enrolled student.

- $42,500 is a low-end starting salary for a new graduate with a Bachelors degree.

- $73,800 is a high-end salary.

- $64,900 is the average annual salary for a recent graduate with a Bachelors degree.

- $52,000 is the median salary for new graduates with Bachelors degrees.

Undergraduate Class of 2021 Student Loan Payments

Average Payments on a Low-End Starting Salary| Monthly Payment |

|---|

| $50,400 |

You May Like: Can I Get Another Loan From Upstart