How Do You Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the top amount you can pay for a house, as well as your estimated monthly payment.

Understand The Different Types Of Mortgages

Conventional loan: A conventional loan will allow you to get a home with as little as 3% down. Another big advantage of this option is if you’re moving to put down a little bit more, you can get a vacation home or investment property.

VA loan: A VA loan is a mortgage option available to United States veterans, service members and their non-remarried spouses. Theyre offered by traditional lenders and backed by the U.S. Department of Veteran Affairs. VA loans are no-down-payment loans that offer more lenient credit and income requirements. Rocket Mortgage® requires a 620 median credit score.

FHA loan: An FHA loan is a loan that is backed by the Federal Housing Administration. If you have a lower credit score and less money for a down payment, you might qualify for an FHA loan. To qualify through Rocket Mortgage®, youll need a 580 median credit score and a 3.5% down payment.

Jumbo loan: Jumbo Smart loans allow you to get a loan amounts higher than $548,250, the current conforming loan limit. You’ll need a higher down payment, at least 10.01% for loans up to $2 million and a credit score of at least 680.

USDA Loan: A USDA loan is backed by the U.S. Department of Agriculture. You could be eligible for a USDA loan if you want property in a qualifying rural or suburban area and if youre a low-to-moderate income earner. You can get a USDA loan with no down payment.

How To Use Loan Calculator To Qualify For An Fha House Loan

Learning to use the loan calculator the right is also an essential part of knowing how of an FHA loan you need in order to buy a mortgage. There are plenty of websites that can walk you through step by step, still, you need to be alert to awkward websites that provide no useful information to the borrowers.

Also Check: Does Va Loan Work For Manufactured Homes

Be Conscious Of Changes In Employment

If you lose your job, how will you pay your mortgage? When you apply for a mortgage, your lender ideally will want to see a 2-year work history before they grant approval. If you choose to take the largest loan you qualify for, will you be able to make those higher monthly payments during a period of unemployment?

Fha Loan Limits In 2021

The U.S. Department of Housing and Urban Development sets the lending guidelines for all FHA-insured mortgages. One of the biggest differences between FHA home loans and conventional loans is their loan limits, which reflect the maximum amount a person can borrow. There are two types of loan limits: FHA loan limits and conforming loan limits .

In 2021, the FHA floor in low-cost areas is set at $356,362 for single-family homes, an increase of $24,602 over the 2020 limit of $331,760. The FHA ceiling is $822,375 for single-family homes in 2021, an increase of $56,775 over the 2020 high-cost limit of $765,600.

The FHA floor is set at 65% of the national conforming loan limit of $548,250 in most of the country in 2021. Meanwhile, the FHA ceiling is set to 150% of the national conforming loan limit amount a higher maximum limit that applies to high-cost areas. FHA county loan limits adjust every year based on median home-price changes. Look up your countys FHA loan limit using HUDs search tool.

Read Also: How Do I Find Out My Auto Loan Account Number

How To Calculate Your Dti Ratio

There are two ways to calculate a DTI ratio. Most loan officers call one the front-end ratio and the other the back-end ratio. The FHA uses different terminology to express the same ideas. Your loan officer might use either set of terms to describe your DTI.

How does your DTI measure up? Use our quick and easy calculator to find out.

Conventional or conforming lenders call the typical maximum ratio the “28/36 rule.” For FHA loans, it’s the “31/43 rule.”

Increase Your Down Payment

If you have the cash, you may want to up your down payment to 10 or 20 percent. A down payment raises your maximum home price, which may be enough to buy a home that you want.

If you dont have the cash, keep in mind that you can ask relatives for gift money.

You can also apply for homebuyer assistance programs from state and local government programs that provide down payment and closing cost funds. Your eligibility for these programs may vary based on your personal finances.

Don’t Miss: Aer Loan Balance

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is unless you have enough cash to purchase a property outright, which is unlikely. Use the above mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

How Is Dti Calculated For An Fha Loan

To calculate your debt to income ratio, FHA looks at a variety of obligations, including but not limited to:

- Student loan payments Learn FHA student loan payment requirements

- Other installment loans or leases

- Mortgage payments

- Taxes, insurance, and association dues on free and clear properties

- Payment plans for IRS and state income tax

- Alimony and child support

- The amount of the proposed new mortgage

If you have any debts not reported to the , you must disclose those as well for the FHA to include them in their calculations.

The FHA doesnt count any loan payments taken against retirement funds. So, for example, borrowing from your 401 for a down payment isnt included in the DTI calculation however, your total assets will be lower. Always discuss borrowing from your retirement funds with your financial advisor first.

Once all of your debts and income have been calculated, the FHA uses the following formulas:

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Don’t Be Fooled By The 5

Kaplan says homeowners usually need to stay put for at least five years to make the closing costs of buying a home worthwhile. That’s a useful rule of thumb, but if you’re thinking of staying that long, you may be tempted to opt for a mortgage that’s higher than you can comfortably afford now. Be careful. Predicting future income isnt as easy as it may seem. Kaplan cautions that stretching your budget can backfire if you become unemployed for an extended period.

When they’re planning for the long term, many homebuyers may also see their home as an investment for the future, which can be an excuse for spending more today than they can easily afford. But real estate can be volatile, as we saw in the 2008 housing crash. Having too much of your net worth tied up in your home can be risky.

What Is The Fha

The FHA was created in 1934 to make homeownership possible for Americans at a time when the country was mostly a nation of renters. Buying a home back then required a 50% down payment that had to be paid off within three to five years.

Today, FHA loans are offered to borrowers with down payments as low as 3.5% and loan terms as long as 30 years. Borrowers pay FHA mortgage insurance to protect lenders against financial loss in case they default, or fail to repay their loan.

Recommended Reading: How Do I Refinance An Auto Loan

What Can I Afford Calculator

Includes mortgage default insurance premium of $

A maximum purchase price that is over $1,000,000 will use 20% minimum down payment for illustrative purposes, however a higher percentage may be required by your lender. Speak to your lender for exact amount.

Must be a valid email.

Must be a valid 10-digit phone number.

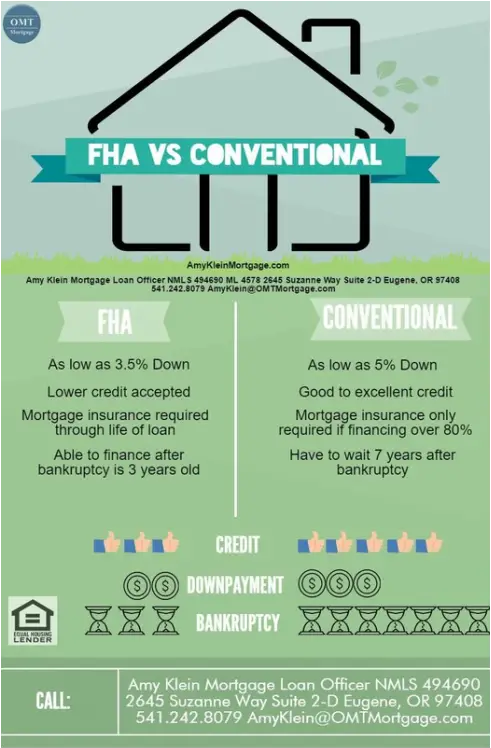

Fha Vs Conventional Loan

There are far more similarities than differences, but the differences are important. To recap:

The down payment and credit score requirements are lower with an FHA loan. Thats the upside. The downside is an FHA borrower has to pay a hefty premium for mortgage insurance and that charge never goes away.

| 500 580 580+ | 620+ | |

| Interest Rates | As low as 3.5%, generally lower than conventional loans, but you may pay more in the long run thanks to PMI. | As low as 3%, but generally higher than FHA loans. |

Read Also: Genisys Credit Union Auto Loan Calculator

Making A Down Payment

You not only need to be able to afford the monthly payment to qualify for a mortgage, but you will also need to show that you have the funds for the down payment and closing costs. Plan to save at least 5% to 10% of the total purchase price of the home for the down payment. While there are mortgage options that require a lower down payment, having the savings is a good financial strategy.

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Don’t Miss: What Credit Score Does Usaa Use For Auto Loans

Total Debt To Income Ratio Calculation :

Total housing payment, HOA dues, and other debts / calculated income / $5000 income = 40% total ratio

Once calculated, your numbers are run through an automated underwriting system. However, if you arent approved right away, it doesnt mean youre denied a loan. The FHA also allows for manual underwriting, but you still must meet their guidelines.

Have Questions about FHA Loans?

Contact our dedicated team online or via email to get personalized answers to your questions.

View Affordability From Two Perspectives:

- Your overall monthly payments which included household expenses, mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Don’t Miss: Can You Use A Va Loan To Buy Land And A Manufactured Home

How Much House Can I Afford Through Fha

Though we have already defined the FHAs DTI ratio above, it is also what the loan lender decides in terms of giving you the qualification. All of this works in accordance with the guidelines of HUD Department of Housing and Urban Development.

In simple words, we can say that HUD provides you with instructions using which you can determine the value of your house through FHA Appraisal and how much of an FHA house mortgage you can afford to buy. In this area, the FHA Loan Calculator can be used in order to understand the working of it and to eventually come up with an estimate of buying Mortgage.

The official lender that will be lending you a home/house will look into the detailed guidelines as mentioned in the official HUD Handbook 4000.1 so that you can safely get a loan for buying a house. There are requirements that need to be met in this regard.

If you are a borrower, you will come across all of the FHAs ratio requirements in the handbook . The ratio we are referring here is the FHAs DTI ratio and we earlier talked about passing which you can easily qualify for a mortgage loan.

We know that DTI ratio is not the only factor that affects the approval of your loan, but if you clearly satisfy the requirements of the ratio, we believe that you wont have any problem meeting other criteria. So, the DTI ratio plays a significant role in the overall process of deciding how much house you can afford via FHA through Calculator with an intention to buy a Mortgage.

Negotiate With The Seller

There is no reason you cant ask for seller contributions instead of negotiating for a lower purchase price. Depending on the type of mortgage you choose, the seller can contribute 3 to 6 percent of the home price in closing costs.

This can make all the difference when you want to buy a new home and stop renting. Seller contributions can cover closing costs, buy your interest rate down to a more affordable level, or make a onetime payment to cover your mortgage insurance.

Also Check: Is Bayview Loan Servicing Legitimate

Understanding How Much Mortgage You Can Afford

Buying a houseis a huge undertaking, and its easy to get wrapped up in the excitement of it all. Its crucial to be realistic about what you can afford.

You want to hunt for homes that are in your price range so you dont fall in love with a house thats simply out of reach. Knowing your budget and sticking to it will make the entire home buying process run smoothly.

What Else Will I Need To Get An Fha House Loan Approval

The required income plays an important role in the overall process of getting an approval, however, there are things you can have in mind in order to make it work like a charm. And who doesnt want that?

Herere a few things that a mortgage lender will look out for:

Debt-to-Income Ratio: Weve already talked about it above briefly. If you need to know about it in detail, weve suggested the same through a link above. See why a DTI is important in getting loan approval on behalf of a mortgage lender.

One of the things that have an effect on the approval is your Credit Score which, in accordance with HUD, must be 580 or more than that i.e., in order to get approved for an FHA loan with the highest financing . The FHA mortgage lenders may often ask for the higher credit scores.

Down Payment: Among others, the down payment required for an FHA loan is also significant. One who is lent an FHA loan is required to pay 3.5% of the appraised value or the purchase price. Therefore, this is something you must pay heed to when comprehending how much house you will need to afford for an FHA loan.

Recommended Reading: How Can I Get An Rv Loan With Bad Credit

Fha’s Equivalent To Private Mortgage Insurance

The FHA also offers mortgage insurance, and they based their rates using the risk-based model. This means any applicants that are considered to be a higher risk of defaulting will pay more in insurance fees each month. Additionally, anyone who gets an FHA mortgage will pay an insurance premium of 1.75% when they close on the deal. They can either pay this out-of-pocket in cash or have it rolled into their premium.

For a 30-year loan with a minimum down payment of 3.5%, the annual insurance premium is currently 0.85%. If you have an FHA loan with a term of 15 years and you pay a down payment of 5.00%, your insurance premium is 0.70%.

Read And Understand The Fine Print

Know your rights. Homebuyers should understand their mortgage contract and be on the look-out for scam artists and predatory lenders. Consider all the options, educate yourself, and be informed before you sign on the dotted line. Consumers have more ways than ever to buy a home. A HUD-approved housing counselor can help.

Read Also: Va Manufactured Home 1976

What Should My Dti Be

Every person, family, and homebuyer is different. There is no DTI that works for everyone, other than to say that lower is better.Every person, family, and homebuyer is different. There is no DTI that works for everyone, other than to say that lower is better. While not set in stone, the 31/43 roadmap established by FHA is a good place to start.

31 refers to your housing ratio, which is simply your total proposed monthly house payment plus monthly HOA fees divided by your gross monthly income. Having a housing ratio of less than 31% is not mandatory, but itâs a benchmark to consider when determining your price range.

The 43 in 31/43 is your DTI ratio. It is everything included in the 31% plus your total monthly debt payments. The more debt you have the larger the gap between your housing ratio and DTI. Having front-end and back-end ratios that are similar means you have managed your debt well.

When considering your DTI, it is important to understand your financial position and not use a firm DTI figure. A large family with thousands of dollars of monthly child care expenses may not be stretched with a 35% DTI mortgage payment, while a single person living a modest lifestyle may easily be able to handle one at 40%. The payment and home budget calculated using the FHA affordability calculator should be used as a guide. Consider the complete picture, which includes your DTI, lifestyle, monthly bills, and everything else, when determining your new home budget.