Why Ltv Is Important

The higher your LTV ratio, the higher the mortgage rate youll be offered. Why? With a higher LTV, the loan represents more of the value of the home and is a bigger risk to the lender. After all, should you default on the loan and your home goes into foreclosure, the lender will need the house to sell for more to get its money back. Put another way, in a foreclosure, your down payment is the haircut the lender can take on the sale price of your house. So the smaller the haircut , the less likely the lender will get all of its money back.

Additionally, when your LTV is high and your down payment is relatively small, you have less to lose if you default and walk away from the loan . In other words, youre more likely to stick around if you put down 20% down than a 3%.

Ltv For Mortgage Vs Refinance

Lenders use loan-to-value calculations on both purchase and refinance transactions. But the math to determine your LTV changes based on the purpose of the loan.

For a home purchase, LTV is based on the sales price of the home unless the home appraises for less than its purchase price. When this happens, your homes LTV is based on the lower appraised value, not the homes purchase price.

With a refinance, LTV is always based on your homes appraised value, not the original purchase price of the home.

Loan to value is especially important when using a cash out refinance, as the lenders maximum LTV will determine how much equity you can pull out of your home.

Equity Increases With Market Appreciation

As long as housing market conditions are healthy, your homes value should appreciate over time. Of course, how much equity youll gain depends on your timing.

For example, if you bought at the height of the market in 2006, for instance and then tried to sell during the Great Recession, you might have ended up with negative equity. Also called being underwater, negative equity is when you owe more on your home than its worth. Since markets typically appreciate over time, being underwater on your loan is relatively rare.

You May Like: What Is The Commitment Fee On Mortgage Loan

Tips On Securing A Favorable Mortgage Rate

- If you cant make a reasonable down payment now, dont rush into the home buying game. Take some time to build up your funds so you can get a lower interest rate on your loan. Check out our reports on the best savings accounts and best certificate of deposit rates around.

- For help with budgeting and saving, consider working with a financial advisor. A financial advisor can help you define your goalsand reach them. SmartAssets financial advisor matching tool makes it easier to find an advisor who suits your needs. Simply answer a few of questions about your financial situation and preferences, and the program will connect you with up to three financial advisors in your area.

How Much Equity Do I Have In My Home To Borrow

If you want to tap into your equity to make home improvements or pay for other expenses, you have a few options, including a home equity loan and a home equity line of credit .

Here are a few common reasons homeowners might want to take out a home equity loan or HELOC:

- Pay for college, if the interest rate is lower than student loans

- Complete home improvements that raise the homes value

- Invest in other types of investments with a higher return

- Pay off high-interest debt

- Have an emergency fund available for medical bills or unforeseen expenses

Also Check: Aer Allotment

Presume Housing Market Shifts

Based on your homes location and how many people are interested in buying a home, your property value could naturally increase over time as demand increases. Of course, the market could experience a downturn. Before you decide to refinance your mortgage, try using the Federal Housing Finance Agencys House Price Calculator to see how homes in your area have appreciated in value.

With a lower LTV, you may qualify for a loan you werent eligible for when you purchased your home. It could be time to refinance your mortgage to improve your interest rate, take cash out or eliminate PMI.

Why Do Mortgage Lenders Offer Lower Interest Rates With At Lower Loan To Value Ratios

Lending money is all about risk. The risk in this instance is all about whether you, the mortgage borrower will repay the mortgage and interest payments so that the mortgage lender makes a profit. You may be thinking that the risk is the same regardless of how much you borrow. Sadly, that isn’t true, let’s look at why.

When mortgage lenders look at lending you money in the form of a mortgage, they look at the following factors:

Read Also: How Much To Loan Officers Make

Types Of Mortgages That Use The Ltv To Qualify Borrowers

The loan to value ratio is used to qualify borrowers, though it is just one of many different factors that may be considered. There are different choices for mortgages, and the type of mortgage you are seeking, along with the interest rate and payment, will be a part of both your decision and the lender’s offer.

Fha Loan: Up To 965% Ltv Allowed

FHA loans are insured by the Federal Housing Administration, an agency within the U.S. Department of Housing and Urban Development .

FHA mortgage guidelines require a downpayment of at least 3.5 percent. Unlike VA and USDA loans, FHA loans are not limited by military background or location there are no special eligibility requirements.

FHA loans can be an especially good fit for home buyers with less-than-perfect credit scores.

Don’t Miss: Becu Auto Loan Payoff

How Do You Calculate Loan To Value

Typically a loan-to-value ratio should be 80% or less to avoid having to add PMI.

Our financial calculators are provided as a free service to our members. The information supplied by these calculators is from various sources based on calculations we believe to be reliable regarding their accuracy or applicability to your specific circumstances. All examples are hypothetical and are for illustrative purposes, and are not intended to provide investment advice. TDECU does not accept any liability for loss or damage whatsoever, which may be attributable to the reliance on and use of the calculators. Use of any calculator constitutes acceptance of the terms of this agreement. TDECU recommends you to find a qualified professional for advice with regard to your personal finance issues.

- Routing Number: 313185515

Equity Increases With Home Improvements

You can also increase your equity by completing home improvements. New mechanicals, landscaping, additions and renovations often boost your homes value, in turn increasing your equity stake.

Some of the most popular home improvements include minor kitchen remodels, exterior improvements, bathroom remodels and finishing basements. Its rare to complete a home improvement project with a 100% return on your investment, but you can come close if you take a strategic approach. Focus on improvements that buyers love, and be cautious of overimproving.

You May Like: Does Va Loan Work For Manufactured Homes

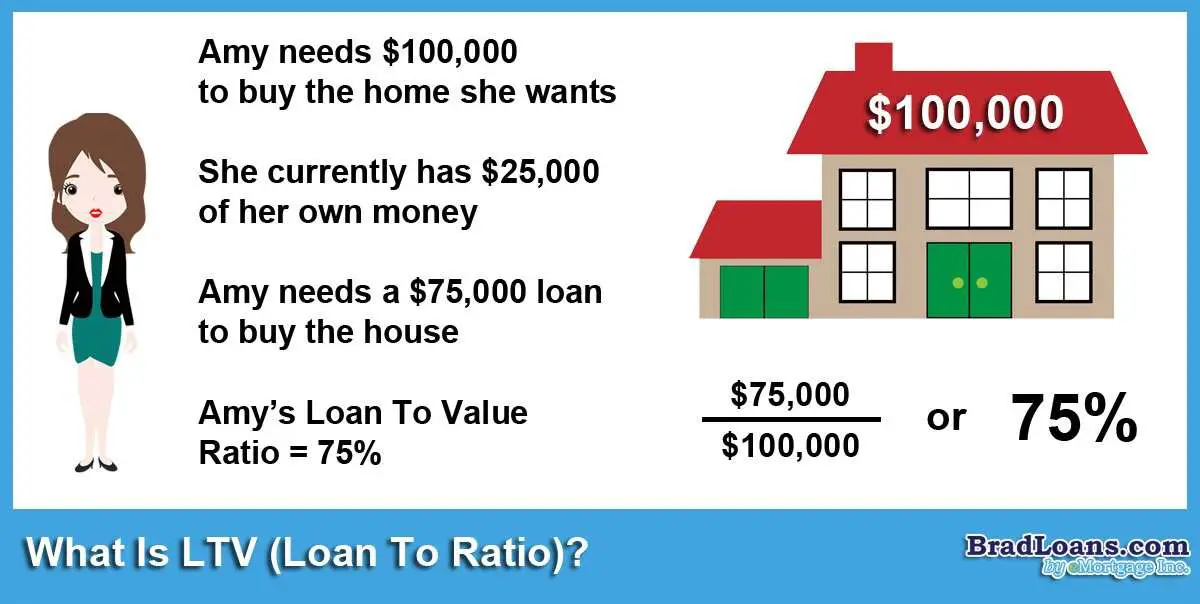

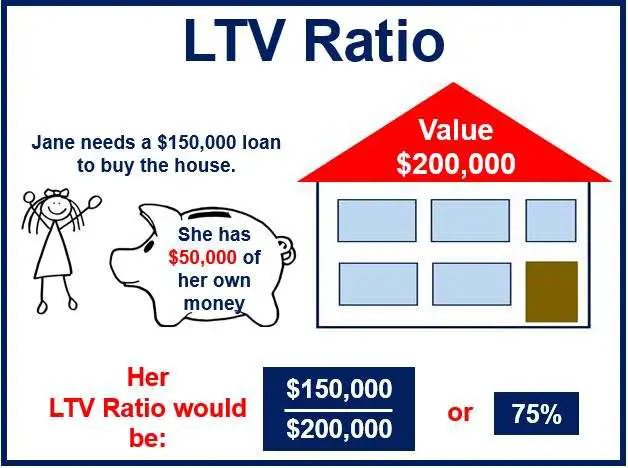

What Is Loan To Value

The ltv is the amount of the loan, in dollars, in relation to the value of the property, in dollars, expressed as a percentage that is typically rounded off to two decimal places . For example, if the ltv is exactly 90% there is no need to show any decimal places. Lenders use this ratio to determine the maximum loan amount for a given property based on the specific type of loan product that is offered by the lender.

There are two calculations when using the ltv. The first is calculating the ltv of a mortgage. To accomplish this we divide the amount of the loan by the value of the property. For example, if we had a $200,000 mortgage and a $400,000 house, the equation would look like this:

$200,000 / $400,000

Mortgage brokering in Ontario is regulated by the Financial Services Commission of Ontario and requires a license. To obtain a license you must first pass an accredited course. The Real Estate and Mortgage Institute of Canada Inc. is accredited by FSCO to provide the course. For more information please visit us at www.remic.ca/getlicensed or call us at 877-447-3642.

The second use for the loan to value is to determine a maximum mortgage amount. To accomplish this we multiply the loan to value by the value of the house. For example, if we have a loan to value of 90% and a $400,000 house, the equation would look like this:

90% x $400,000

To better illustrate these calculations lets look at a few examples.

Traditional Home Equity Loan

A home equity loan is a lump sum loan that you pay back in monthly installments over 5 to 15 years. It is secured by the equity in your home. Here are key features of a home equity loan:

You owe interest on the whole amount: When you apply for a home equity loan, you request a specific dollar amount, then pay interest on the entire amount youve borrowed. How much you borrow determines how much youll pay each month.

Interest rates are fixed: Home equity loans have a fixed rate that wont change over the life of the loan.

Recommended Reading: Do Pawn Shops Loan Money

Combined Loan To Value Ratio

Combined loan to value ratio is the proportion of loans in relation to its value. The term “combined loan to value” adds additional specificity to the basic loan to value which simply indicates the ratio between one primary loan and the property value. When “combined” is added, it indicates that additional loans on the property have been considered in the calculation of the percentage ratio.

The aggregate principal balance of all mortgages on a property divided by its appraised value or purchase price, whichever is less. Distinguishing CLTV from LTV serves to identify loan scenarios that involve more than one mortgage. For example, a property valued at $100,000 with a single mortgage of $50,000 has an LTV of 50%. A similar property with a value of $100,000 with a first mortgage of $50,000 and a second mortgage of $25,000 has an aggregate mortgage balance of $75,000. The CLTV is 75%.

Combined loan to value is an amount in addition to the Loan to Value, which simply represents the first position mortgage or loan as a percentage of the property’s value.

Summary: Ltv Is Just One Factor

Remember, your LTV is only one piece of your mortgage application. The lower your LTV, the lower your interest rates and mortgage insurance is likely to be. Understanding your LTV can help you determine if youre ready to get a mortgage and show you what home loans are available to you.

Our Home Loan Experts can guide you through each loan option and help you decide what will work for you. Visit Rocket Mortgage®or give us a call at 785-4788.

You May Like: How To Transfer Car Loan To Another Person

Loan To Value Example

Mr John wants to buy a new house and has applied for a mortgage at a bank. The bank needs to perform its risk analysis by determining the loan to value of the loan. An appraiser of the new house shows that the house is worth $300,000 and Mr John has agreed to make a down payment of $50,000 for the new house. What is the loan to value ratio?

- Loan amount: $300,000 $50,000 = $250,000

- Value of asset: $300,000

Using our formula we can substitute the values for the variables in the equation:

$$LTV = \dfrac000}000} = 0.83333$$

For this example, the loan to value amount is 0.83333. However, you would express the ratio in percentage by multiplying by 100. So the loan to value amount would be 83.33%. The loan to value ratio is above 80%, so analysts would consider it high.

Consider another scenario where the owner of the new house Mr John wants to buy is willing to sell the house at a price lower than the appraised value, say $280,000. This means that if Mr John still makes his down payment of $50,000, he will need only $230,000 to purchase the house. So his mortgage loan will now be $230,000.

Let us calculate the loan to value of the new loan application.

- Loan amount = $230,000

- Value of house = $300,000

$$LTV = \dfrac000}000} = 0.7667$$

Using Excel To Calculate The Loan

To calculate your LTV ratio using Microsoft Excel for the example above, first right click on columns A, B, and C, select Column Width and change the value to 30 for each of the columns. Then, press CTRL and B together to make the font bold for the titles.

Enter “Property 1” in cell B1 and enter “Property 2” in cell C1. Next, enter “Mortgage Amount” in cell A2, enter “Appraised Value of Property” into cell A3, and enter “Loan-to-Value Ratio” into cell A4.

Enter “$350,000” into cell B2 and enter “$1,850,000” into cell C2. Next, enter “$500,000” into cell B3 and “$200,0000” into cell C3. Now, the loan-to-value ratio can be calculated for both properties by entering “=B2/B3” into cell B4 and “=C2/C3” into cell C4.

The resulting loan-to-value ratio for the first property is 70% and the loan-to-value ratio for the second property is 92.50%. Since the loan-to-value ratio for the first property is below 75%, you are likely to be able to get a mortgage, and you would not have to pay for private mortgage insurance.

On the other hand, it would be difficult for you to receive a loan to purchase the second property because the loan-to-value ratio is well over 75%. Not only would you not qualify for the PMI exemption but most likely you would not qualify for the loan at all, as the lender would deem it too risky.

Also Check: Genisys Loan Calculator

Loan To Value Analysis

Loan to value is an important metric that categorizes borrowers. Though it is not the only metric that determines high-risk borrowers, it indicates how risky a loan is, and how the borrower will be motivated to settle the loan. It also determines how much borrowing will cost the borrower. The higher the loan to value ratio, the more expensive the loan.

Key factors that affect the loan to value ratio is the equity contribution of the borrower, the selling price and the appraised value. If the appraised value is high, that means a large denominator and hence a lower loan to value ratio. It can also be reduced by increasing the equity contribution of the borrower and reducing the selling price.

A major advantage of loan to value is that it gives a lender a measure of the level of exposure to risk he will have in granting a loan. The limitation of loan to value is that it considers only the primary mortgage that the owner owes, and not including other obligations like a second mortgage. A combined loan to value is more comprehensive in determining the likelihood of a borrower settling the loan.

Usda Loan: Up To 100% Ltv Allowed

USDA loans are insured by the U.S. Department of Agriculture. USDA loans allow for 100 percent LTV, with no down payment required.

Many also know the program as Rural Housing. You can find USDA loans in rural parts of the country, but also in many suburbs.

Learn more about USDA financing and how to qualify here.

You May Like: Oneaz Auto Loan

Significance Of Equity In Your Home

As we mentioned above, the amount of equity you would have in the home has a big impact on how low or high your mortgage rate will be and how much of a risk youre viewed as to your mortgage lender.The more equity you have in a home means youre less likely to default on your mortgage and in the event you did default, your lender would have a good chance of recouping the full amount owed in a foreclosure sale.

Hcltv: Refinancing With A Home Equity Line Of Credit

When you refinance with a home equity line of credit, a lender will consider your full second mortgage in its LTV calculation even if you havent withdrawn the full amount available to you.

Because of this, you actually end up with three measures of your loan to value.

The standard LTV the CLTV, which combines your first mortgage with the amount youve withdrawn from your second mortgage and the HCLTV, which considers your full first and second mortgage balance, regardless of the amount youve withdrawn.

- Home value: $200,000

- / 200,000 = 0.9

- HCLTV: 90%

Whether youre buying or refinancing, your loans loan-to-value is important because it helps to determine your mortgage rate and your loan eligibility.

You May Like: What Credit Score Is Needed For Usaa Auto Loan