$755 Billion In Student Loans Discharged For Defense Claims Against Specific Schools

Student loan borrowers who have been misled or defrauded by educational institutions have a right to file “borrower defense claims” with the Department of Education. If these schools are found to have violated state laws, borrowers may be eligible for partial or complete student loan cancellation.

Throughout 2021 and 2022, the Department of Education has announced specific relief measures for student loan borrowers who attended colleges and universities that made fraudulent claims about their schools or misled students when they were applying for loans.

These student loan discharges include:

- ITT Technical Institute: 115,000 borrowers were given $1.1 billion in loan cancellations in August 2021.

- DeVry University: In February, 16,000 borrowers received $415 million in student loan discharges, along with additional forgiveness for students at Westwood College, the nursing program at ITT, and criminal justice programs at Minnesota School of Business and Globe University.

- : Due to “pervasive and widespread misconduct” at Marinello schools, 28,000 borrowers had $238 million in loans discharged in April.

- Corinthian Colleges: In the largest defense claim discharge of the year so far, the DoE announced $5.8 billion in forgiveness for 560,000 borrowers on June 1.

The Three Big Changes

Below are the three actions the U.S. Education Department are taking to address the aforementioned issues:

Additionally, the U.S. Education Department has also announced the restoration the FSA Office of Enforcement and begun strengthening key rules, such as borrower defense to repayment and gainful employment, in order to safeguard both students and taxpayers from predatory or low-value colleges.

Loan Forgiveness For Nurses

Registered nurses, nurse practitioners and members of nursing faculty, who work in high-need population areas or areas where there is a critical shortage could qualify to have up to 85% of their loans forgiven under the NURSE Corps Loan Repayment Program.

Qualified candidates can have 60% of their student loans forgiven for working two years in an underserved area. Another 25% could be forgiven for working three years.

Some states also offer loan repayment assistance. Go to the Loan Forgiveness for Nurses website to see if yours is one of the 33 states that has one and what the eligibility requirements are.

Recommended Reading: Best Rates On Auto Loans

How To Get Your Student Loans Forgiven: Three Paths

Cancelling student loan debt is a popular subject in todays climate, but its been a popular topic for more than 20 years and 45 million people still owe $1.7 trillion.

That could change if Biden and Congress reach some sort of compromise on how much to cancel and qualifying requirements.

In the meantime, option No. 1 for student loan forgiveness is having a job that serves the public good. If youre a teacher or police officer or firefighter or social worker or health care worker or government employee who kept up with payments for 10 straight years, youve got a good shot. If you are a sign spinner or pet psychic, forget it.

Option No. 2 is through a repayment plan that is based on your income. You will still have to pay a large chunk of your debt over a long period, but under the current laws, a portion will be forgiven at the end.

Those options are available for federal student loans.

Option No. 3 is called a discharge and its available for federal or private loans, but you probably dont want to go there. A discharge is when you cant repay the loan for a variety of reasons, like death, disability, fraud, identity theft or bankruptcy.

Expansion To The Payment Pause And Interest Waiver

Borrowers with a federally-held federal education loan are eligible for administrative forbearance and an interest waiver through January 31, 2022. Unfortunately, borrowers with defaulted loans in the Federal Family Education Loan Program were not eligible because those loans were held by guarantee agencies on behalf of the U.S. Department of Education. The U.S. Department of Education has decided to make these borrowers eligible for the federal student loan payment pause and interest waiver, affecting more than one million FFELP borrowers. FFELP borrowers who defaulted during the pandemic will also have their loans returned to good standing and the defaults removed from their credit histories.

Also Check: Is Direct Plus Loan Good

Will More Student Debt Be Forgiven

On the campaign trail, Biden said he’d support legislation canceling a minimum of $10,000 of federal loans per borrower. Democratic lawmakers would like to see that amount upped to $50,000, Bloomberg reported, in hopes of swaying young voters in November.

If he does forgive more student debt, Biden would likely cap eligibility at individuals earning $125,000 or $150,000 a year.

Republicans in Congress have argued the president doesn’t have the authority to cancel billions in student debt and have introduced legislation to block him.

But there are signs the White House sees it differently: Following the Department of Education’s revamp of its Public Service Loan Forgiveness program in October 2021, more than 750,000 borrowers have had their student loans extinguished, totaling more than $18.5 billion as of May 2022.

In 2019, Harvard Law School’s Project on Predatory Student Lending filed suit against then-Secretary of Education Betsy DeVos, claiming her office had stalled applications for the Borrower Defense to Repayment program, which allows federal student loan debt to be canceled if the borrower was defrauded by their school.

The Biden administration in July agreed with the plaintiff’s arguments that the Secretary of Education has “considerable discretion” to cancel federal student loan debt, Forbes reported.

That was nearly three months ago.

Circumstances For Student Loan Discharge

- Permanent disability or death

- Unauthorized signature of the loan by the school without your knowledge

- False certification of student eligibility

- Unpaid refund, which is when you withdrew from school and it didnt return the required loan funds to your loan servicer

- School closure while you were enrolled

Discharging student loans through bankruptcy is extremely rare. It is technically not impossible, but demonstrating undue hardship is very difficult. Read more about the differences between forgiveness and discharge.

Don’t Miss: What Do I Need To Get Home Equity Loan

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Have More Than One Servicer: How To Find Out

If you have loans with more than one servicer, you will need to make a payment to each. If you’re not sure which servicers have your loans, go to StudentAid.gov and log in with your FSA ID, or call the Federal Student Aid Information Center at 800.433.3243.

It’s your responsibility to be aware of the number of student loans that have been taken out in your name, the amount owed, the timing of repayment, and where to send payments. If you make two or more monthly student loan payments, it may be wise to consider consolidating them into one loan.

Recommended Reading: What Is The Best Loan To Get For College

Dept Of Education Seeks People Needing Student Loan Forgiveness No Comments On Dept Of Education Seeks People Needing Student Loan Forgiveness

The US Department of Education continues to take applications for a student loan forgiveness program that will wipe out all or a portion of student loans for people who work at schools or for nonprofits, the Associated Press reports.

The Biden Administration introduced an expansion to the Public Service Loan Forgiveness Program last October to ease student loan debt for people in public service jobs. Some people who were eligible for the loan forgiveness after the October expansion were deemed ineligible because they did not have complete paperwork or their employers inadvertently didnt submit proof of employment to the proper officials. Others could not prove they were eligible under the rewritten eligibility guidelines. Still, the acceptance rate for loan forgiveness exceeded the previous benchmark of 10% in 2019.

With the deadline for applications coming up at the end of October 2022, the Department of Education is encouraging people who may have applied improperly earlier to resubmit their applications.

Student Loan Debt Forgiveness: Who’s Received The $25b In Loan Cancellations So Far

Peter Butler

How To writer and editor

What’s happening

President Biden still hasn’t announced his decision on widespread student loan forgiveness, but millions of borrowers have already had $25 billion in debt canceled during his term.

Why it matters

With one in five Americans owing student debt, loan forgiveness can help ease the pain of soaring inflation and economic uncertainty.

With only about a month left before the pause on student loan payments expires, there’s still no indication of a decision from President Joe Biden on widespread student loan forgiveness. On April 28, Biden promised a decision “in the next couple of weeks,” but almost three months have passed with no action.

Though the Biden administration hasn’t acted on student loan forgiveness yet, the Department of Education has been busy over the past year and a half — more than $25 billion in student loan debt has been forgiven since Biden took office in January 2021. About one in five Americans owe money on student loans for a total of $1.6 trillion, or an average of $37,013 per borrower.

Learn who has qualified for student loan forgiveness so far, and how you can check to see if you’re one of the borrowers eligible for debt cancellation. For more, here’s what we know about how debt forgiveness could affect your credit score and why you might continue to make student loan payments even though you aren’t required.

Also Check: How To Reduce School Loan Debt

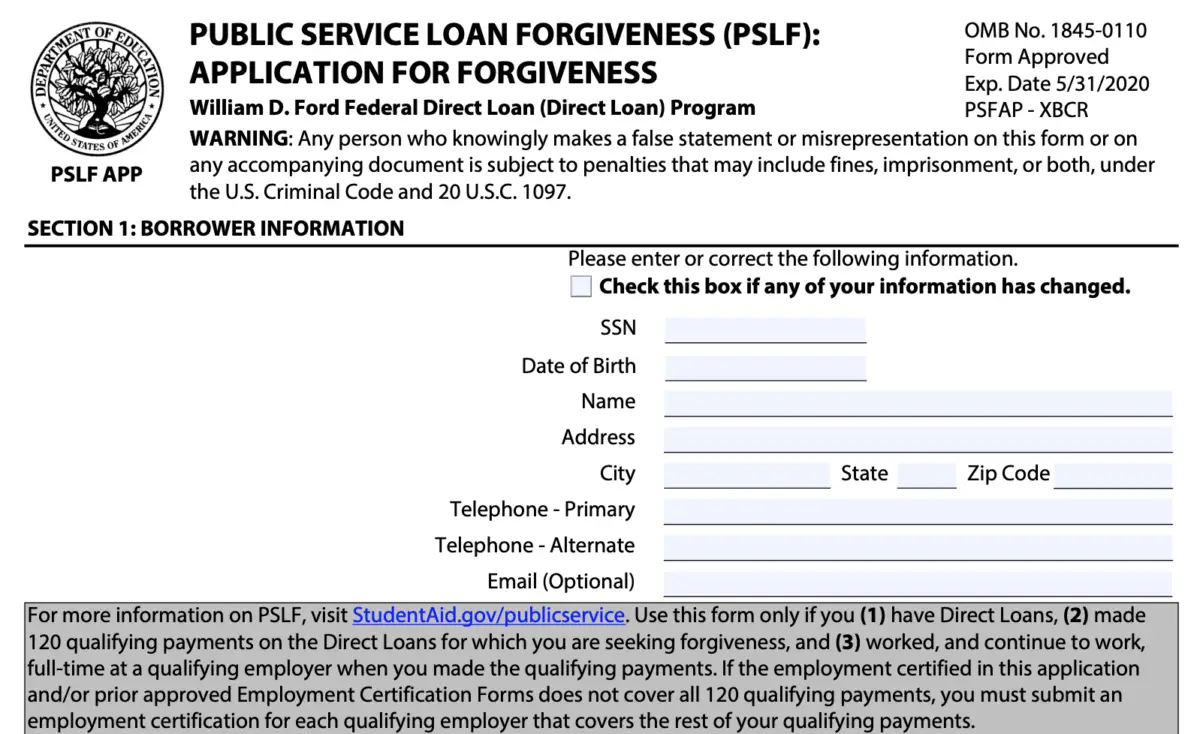

How To Apply For Public Service Loan Forgiveness

To apply for PSLF, you must fill out an Employment Certification Form every year and make pay stubs, W-2 forms or other documentation available as requested.

If you have met the repayment requirements, submit a PSLF application to the Department of Education. If its approved, the remaining balance of your loan will be forgiven.

But be aware, the whole PSLF program is in limbo until President Biden or Congress submit a plan for changing the program. Its possible that monthly payments would also be slashed. People earning less than $25,000 a year and couples earning less than $50,000 would pay nothing toward their loans until their incomes rose above those levels.

Cancel Student Debtalmost All Of It

An obscure, decades-old provision called compromise and settlement authority could allow the Department of Education to opt out of collecting trillions in debt.

This story is part of the Prospects series on how the next president can make progress without new legislation. Read all of our Day One Agenda articles here.

Right now, more than 44 million Americans hold nearly $1.6 trillion in student debt, and this debt is ruining lives. It prevents people from buying a house or car, getting married, and starting a family. To activists, its a policy failure. The idea of making individuals and families pay out of pocket for something thats a right and public good is wrong, says Ann Larson, co-founder of the Debt Collective, an organization that advocates for student debt cancellation.

Both Elizabeth Warren and Bernie Sanders have boldly called for student debt to be forgiven, giving students financial freedom and allowing a reset for the tragic way we finance higher education. Clearly, such a plan would run into resistance from Mitch McConnell and Republicans in Congress, and perhaps even some Democrats. But Warren and Sanders dont need Congress to cancel at least 95 percent of all outstanding student debt.

Compromise and settlement gives the Education Department this explicit authority. Herrine writes: ED has absolute discretion to determine when to stop collections, when to collect less than the full amount, and when to release debtors claims in toto.

Read Also: How To Pay Off Home Loan Faster Calculator

Student Loan Forgiveness: Total And Permanent Disability

Total student loan cancellation: $9 billion

- The Biden administration wants to help more student loan borrowers who have a total and permanent disability get student loan cancellation

- The proposed regulations would allow a broader set of disability statuses to qualify for student loan forgiveness

- the three-year income-monitoring period would be eliminated and

- the requirements for documentation would be relaxed.

Loan Forgiveness For Doctors

The healthcare professions, especially physicians, dentists, pharmacists and mental healthcare workers, have several options, both national and local, to receive loan forgiveness.

The requirements and the amount forgiven vary dramatically, depending upon which program you enter. Check out the links to see the amount of loan forgiveness available and requirements for Army doctors Indian Health Services, National Institute of Health, as well as state-by-state programs.

Don’t Miss: How Much Loan Can I Afford Based On Monthly Payment

Education Department Has Plan To Cancel Student Loan Debt For Millions

The federal Education Department has developed detailed plans to cancel student loan debt for millions of Americans if President Joe Biden gives his approval, according to a report from Politico.

The Biden administration has been deliberating how to cancel student loan debt for months. Most recently, Biden has said he plans to make a decision on the matter by the end of August. Thats also when the current pause on federal student loan payments is set to end.

Documents obtained by Politico detail the mechanics of how the Education Department expects to manage and operate a mass debt cancellation program that would be unprecedented, the website said.

Officials are ready to provide debt relief automatically to millions of borrowers for whom the agency already has income information, Politico said. Others would apply through a form online to certify they qualify for relief.

The departments plan says all types of federal student loans would be eligible for forgiveness, including Grad and Parent PLUS loans as well as federal loans owned by private entities, according to Politico. Plans also suggest borrowers who received Pell grants could receive additional forgiveness.

The Biden administration is considering providing $10,000 in relief per borrower, Politico said.

You can read more on the departments plans on Politicos website.

Note to readers: if you purchase something through one of our affiliate links we may earn a commission.

You Previously Tried To Certify Employment For Pslf But Were Denied

If the Department previously said your employer was not eligible for PSLF then you need to submit a new form through the PSLF Help Tool to see if you can receive credit toward forgiveness. You can also see which employers the Department has already deemed eligible through the PSLF Help Tool. Please note that this waiver does not affect qualifying employer rules. Your employer still needs to be a governmental organization, a 501 organization, or a not-for-profit organization that provides a designated public service to get PSLF under normal rules and the Limited PSLF Waiver.

Don’t Miss: Can I Loan Money To My S Corp

Timeline: Federal Student Loans During The Covid

This article presents a timeline of recent events related to student loans and takes a look at whats to come for student loan borrowers.

Since the start of the pandemic, the federal student loan system has been in a constant state of flux. Two presidents and Congress have put loan repayment on hold and stopped the accumulation of interest to help borrowers weather the economic fallout from COVID-19. In addition, the U.S. Department of Education has undertaken massive new initiatives to address some of the failures of the Public Service Loan Forgiveness program and income-driven repayment , which the department estimated could bring millions of borrowers closer to forgiveness. Meanwhile, four of the companies that serviced student loans under contract with the department announced that they would no longer participate in the federal student loan program, meaning the borrowers assigned to them must be transferred to other servicers.

The emergency measures provided much-needed relief to borrowers, but the frequent changes also caused confusion. And there are likely more announcements to come as President Joe Biden decides whether to extend the student loan relief measurescalled the payment pause by the Education Department and the national emergency forbearance by student loan servicersas well as how to carry out a plan to cancel some amount of student debt.

Who Pays For Student Loan Forgiveness

The U.S. government does. Most student loan lenders are huge institutions, such as commercial banks or the government . Until 2010, student loans were usually originated by a private lender but guaranteed by the government. The Health Care and Education Reconciliation Act of 2010 ended the practice, replacing such guarantees with direct lending from the federal government. Today, more than 90% of student debt consists of public loansthat is, financing provided or backed by the government.

Read Also: How Long It Takes For Home Loan Approval