Fha Minimum Credit Score: 500

FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

However, it’s important to bear in mind that while the FHA sets out guidelines for credit score minimums, FHA lenders may require higher minimum scores. FHA loans don’t come directly from the government the FHA insures them on behalf of the lender. Despite having that as backup, lenders often choose to minimize their risk by mandating higher credit minimums. This is one of the reasons why it’s smart to shop and compare FHA lenders. Not only might they have different qualifications, but you can also weigh different lenders’ rates and fees.

It’s worth noting that even with a lender who’s following FHA guidelines to the letter, you’ll get better terms if you have a higher credit score. A stronger credit score should also help you get a better FHA mortgage rate.

What You Cannot Do With Your Fha Home Loan Money

Some new borrowers have misconceptions about home loans in general they may think that FHA mortgages are for first-time buyers only, they may assume you have to make a 20% down payment, and they may also hope to apply for more home loan than they need to make the purchase with the idea of taking the excess in cash.

If you make plans for a home loan based on some of those assumptions, you may be in for a surprise.

FHA loans do not require you to be a first-time home buyer, you do not have to make a 20% down payment, and you generally cannot take cash at closing time except for refunds.

When you apply for an FHA home loan, that application will be for a loan amount based on the fair market value of the property plus any permitted items that can be financed into the loan amount.

If you apply for a construction loan or an FHA 203 Rehabilitation loan, you will have loan funds going into escrow to pay for contractors and materials.

For such loans, there may be borrowers who want to be their own builders. FHA loan rules say that this is possible but typically, participating FHA lenders typically dont permit you to be your own contractor.

That means you wont have access to loan funds in escrow, and this money is used strictly to handle the payments for the labor, inspections, materials, etc.

This is also true of loan funds provided through the FHA Energy Efficient Mortgage add-on, which provides extra loan funds for approved improvements to the home.

Fha Down Payment Requirements

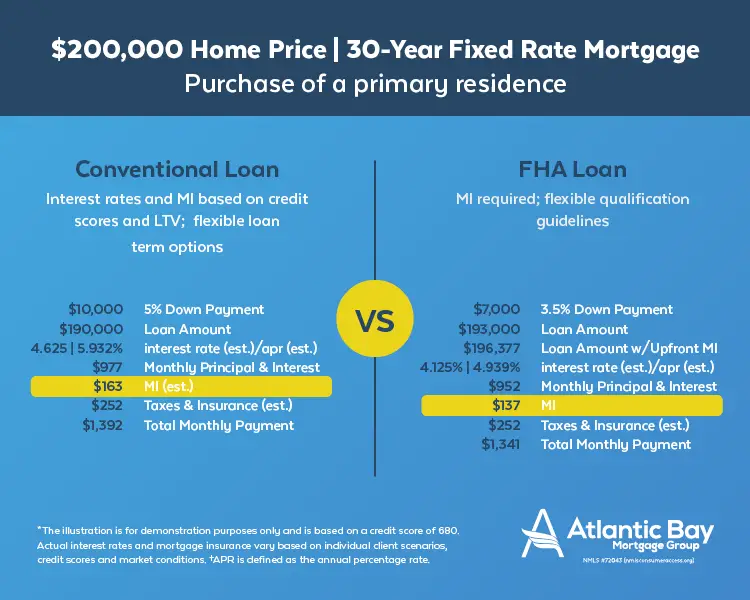

The FHA down payment requirements are 3.5% of the purchase price if your credit score is 580 or higher. If your score is below 580, then you will be required to put 10% down. If you do not have the down payment, then read aboutFHA gift funds and learn how you can get a gift from a relative to use for your down payment.

If you do not have the down payment now, but will sometime in the near future, then connect with one of our FHA lenders here and begin the discussion. They will help guide you through the process and prepare you for a successful real estate transaction.

You May Like: Small Loans No Credit Checks

Fha Debt To Income Ratio Requirements

The FHA debt to income requirements in general are 31% for only housing related expenses, and 43% for the total debt including the proposed housing expenses and all other monthly debt that appears on the credit report.

The FHA guidelines permit lenders the flexibility to allow for a total DTI of up to 50% if there are additional compensating factors such as no payment shock, a high level of cash reserves, or additional income that may not be documented on the loan application.

The debt to income ratio calculations are as follows:

Front End Ratio Housing OnlyMonthly gross income = $5,000

Monthly credit card minimums = $75Total monthly debt = $1825$1825 ÷ $5,000 = 37%

In the scenario above, the debt to income ratios are 30% / 37% which is well within the FHA guidelines for debt ratios.

Federal Housing Administration Loan Relief

When you get an FHA loan, you may be eligible for loan relief if youâve experienced a legitimate financial hardship such as a loss of income or an increase in living expenses. The FHA Home Affordable Modification Program , for example, can permanently lower your monthly mortgage payment to an affordable level.

To become a full participant in the program, you must successfully complete a trial payment plan in which you make three scheduled paymentsâon timeâat the lower, modified amount.

You May Like: How Much Loan Can I Get Approved For

How The Pandemic Has Affected Fha Loans

This past year, the lending industry has become more risk-averse as unemployment numbers rose to historic highs. The combination of low FHA interest rates and urgent need for cheap loans has led to increased demand for FHA loans, and that, in turn, has caused lenders to raise their eligibility standards. According to a report from the Urban Institute, the median credit score for a completed mortgage jumped from 741 in February 2020 to 764 in October 2020 and its not expected to let up anytime soon.

Homeowners with FHA loans have been disproportionately impacted by the pandemic, compared to those with conventional loans. In a survey conducted by the Mortgage Bankers Association, 10.76% of FHA borrowers surveyed had a loan either in the process of foreclosure or that was past due by 90 days or more.

As a result, you may find the FHA lending market to be much more competitive than usual. Prospective borrowers with fair credit who would have qualified for an FHA loan prior to the pandemic may now find their applications rejected or their interest rates higher.

To increase your chances of success, we recommend shopping around to get the best deal, as you may receive more competitive offers from particular lenders. Those who are rejected for FHA loans will want to take steps to rebuild their credit for the long term.

Other Fha Loan Considerations

For FHA loans, the property being financed is to be your primary residence and the loans cant be used for investment or rental properties. Eligible residences include semi-detached homes, townhouses, row houses, and certain condominiums.

For approval, you will need to show that your mortgage payments, HOA fees, property taxes, mortgage and homeowners insurance are no more than 47% of your gross income. You can use a mortgage calculator to estimate your monthly mortgage payments.

The amount of the loan you qualify for will depend on where you are located. You will also be required to have the property appraised by an FHA-approved appraiser. You will be forced to pay for repairs at closing if the home does not meet certain FHA standards and the seller refuses to make repairs.

Lastly, it will need to have been at least two years since any Chapter 7 bankruptcy discharge, and you will need to have re-established good credit or chosen not to incur new credit obligations. If you are in an active Chapter 13 bankruptcy but have been paying for 12 consecutive months, you may be eligible for an FHA loan.

If you have been foreclosed upon, it must have been no more recent than three years ago.

Also Check: Can You Get Personal Loan From Bank

What You Can Do If You Dont Meet Fha Requirements

If youre initially ineligible for an FHA loan, here are a few strategies that can help improve your chances:

Rates and terms vary greatly across lenders. So if youre considering getting an FHA loan, make sure you shop around for mortgages first.

Credible makes getting a mortgage easy

Fha Loans Dont Have Income Or Geographic Limits

Other low-down-payment mortgage programs may have special eligibility requirements. Many are limited to those with low, very low, or moderate income. Or they are available to only certain groups.

The VA loan, for example, allows 100% financing. But you must be an eligible military borrower to use it.

The USDA Rural Development loan also allows 100% financing, but the program requires you to buy in a designated rural area and imposes income limits, too.

For most buyers, FHA mortgages require a 3.5% down payment. This makes the FHA mortgage one of the most lenient mortgage types available nationwide.

Your down payment money could be a gift from a family member, employer, charitable organization, or government homebuyer program.

Read Also: How To Pay Off Personal Loan Faster Calculator

Proof Of Steady Employment

Mortgages must be repaid, and the FHA-approved lender will want assurances that the applicant can achieve this. The key to determining if the borrower can make good on their commitment is evidence of recent and steady employment.

This can be documented by tax returns and a current year-to-date balance sheet and profit-and-loss statement.

If you’ve been self-employed for less than two years but more than one year, you may still qualify if you have a solid work and income history in the same or a related occupation for the two years before becoming self-employed.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Read Also: Where Can I Find My Student Loan Information

History Of Honoring Debts

A lender will look at your work history for the past two years as well as your payment history for bills such as utility and rent payments.

People who fall behind on federal student loan payments or income tax payments will be rejected unless they agree to a satisfactory repayment plan. A history of bankruptcy or foreclosure may prove problematic, too.

Typically, to qualify for an FHA loanâor any type of mortgageâat least two or three years must have passed since the borrower experienced bankruptcy or foreclosure. However, exceptions can be made if the borrower demonstrates having worked to re-establish good credit and get their financial affairs in order.

Calculated And Updated Annually

The FHA sets annual lending limits for home loan amounts that it will insure. These limits are determined based on the county in which you live and the type of property you’re purchasing. Low-cost areas of the country have a lower limit, known as the “floor,” and high-cost areas have a higher figure, called the “ceiling”. It’s not uncommon for the ceiling loan limit to be more than double the floor for single-family properties.

The limits also vary based on the type of property. For instance, Houston, TX loan limits for duplexes can be almost 30% higher than for a single-family home. That number increases to more than 50% for a triplex.

You May Like: How To Get Mobile Home Loan

Wondering If You Qualify For A New York Fha Loan

Curious if you might be eligible for an FHA mortgage? There are a lot of factors to consider, which can make it difficult to determine your eligibility yourself. If youre interested in purchasing a home in New York and youre hoping to do so with the help of an FHA loan, give us a call today at or contact us online. Wed be happy to explore your eligibility with you and help you determine which mortgage options will work best in your specific scenario.

Have questions about your mortgage options? We can help with that too! At Maple Tree Funding, we offer a wide variety of mortgage options, giving our clients the opportunity to explore a number of loan choices before deciding on whats right for them. We work with dozens of lenders to provide competitive rates, and will guide you every step of the way as youre navigating the mortgage process.

Looking for more information about FHA mortgages?Check out our FHA mortgages page, and be sure to visit our guide to FHA mortgages as well to get answers to some of the most frequently asked questions we hear about FHA home loans in New York.

How Fha Loans Work

FHA loans are mortgages that are insured by the U.S. government , but you obtain one by applying through an FHA-approved mortgage lender. This could be a bank, credit union or online lender like Quicken Loans.

FHA loans are considered slightly more risky to the lender since borrowing criteria is less strict, so the government backs the loan to reduce the lender’s risk, and you have to pay insurance for the life of the loan. If you qualify for an FHA loan , you can apply through any FHA-approved mortgage lender. The amount you can borrow with an FHA loan depends on where you live, since housing costs vary greatly across the country.

Also Check: What Will My Auto Loan Interest Rate Be

What To Consider Before Applying For An Fha Loan

Be aware that you can’t use an FHA loan for every type of property. You can’t use one to buy fixer-uppers or certain foreclosures, and there are strict requirements for condos. Additionally, the property has to be your primary residence, so it can’t be used on an investment property. The home you buy with an FHA loan must also meet strict government appraisal standards.

Also, keep in mind that some sellers might avoid buyers who use FHA loans. That’s because some sellers assume that FHA borrowers have financial issues and that the transaction may not pan out, or that the buyer won’t be interested in paying for any repairs. To make yourself competitive with non-FHA borrowers, you could make a full-price offer, or offer to buy the house as-is .

It’s also important to recognize that while scoring a low down payment is a huge perk for someone with minimal savings, it also has a drawback: You’ll pay more interest over the life of the loan since you’re starting off with so little equity in the home. On the other hand, the less you have to borrow, the more of your payment that will go toward the principal and allow you to build equity in the home fasterso you might want to put down more than the minimum down payment if you can.

Who Qualifies For An Fha Loan

Qualifying for an FHA loan is often easier than qualifying for a conventional loan because the credit requirements aren’t as strict. You need a FICO credit score of at least 580 to qualify for a 3.5% down payment. If your score is between 500 and 579, you can still qualify for an FHA loan with a 10% down payment from some lenders.

FHA loan qualifications are relatively straightforward, but lenders can impose their own minimums on credit scores. Borrowers pay private mortgage insurance every month, which usually has an annual cost of around 0.85% of the loan amount. The PMI is rolled into your monthly payment and protects the lender if the borrower defaults on the loan.

Once you have paid off enough of the loan that you owe 80% or less of the home’s value, you can refinance your FHA mortgage to a conventional mortgage and get rid of your PMI payment. For more information, read about how an FHA loan works.

You need a FICO credit score of at least 580 to qualify for a 3.5% down payment. If your score is between 500 and 579, you can still qualify for an FHA loan with a 10% down payment from some lenders.

You May Like: How Long To Close On Home Equity Loan

When Second Appraisal Is Required

A lender must obtain a 2nd appraisal by another HUD-approved appraiser when

- The resale date of a property is between 91 and 180 days after the seller acquires it, and

- the resale price is 100% or more over the price paid by the seller when the property was purchased.

- The 2nd appraisal cannot be charged to the borrower, a lender or loan officer needs to cover it.

FHA might revise the resale percentage at which this second appraisal is required by publishing it in the Federal Register. The FHA appraisal guidelines are updated periodically to reflect changes in the housing market. For example, in January 2013, the FHA announced a new policy that requires mortgage lenders to verify a borrowers income and employment before issuing an FHA loan. This policy was added to protect borrowers from being approved for a loan they cannot afford. The FHA appraisal guidelines are just one part of the mortgage process and real estate. Its important to consult with a mortgage lender to find out which guidelines apply to your specific situation.