What Are Conventional Loans

Conventional loans are loans that conform to the requirements set by Fannie Mae and Freddie Mac.Fannie Mae and Freddie Mac buy home loans from lenders to provide liquidity.This allows lenders to continue lending to home buyers. Otherwise, banks might not have enough money on hand continue lending.Fannie and Freddie set strict standards for the types of loans they will buy.

Maricopa County has high cost limits to compensate for above average housing prices. Limits in Maricopa County are above the 2021 national floor.

Buying And Borrowing More

The limit on FHA mortgages will climb to $314,827 in 2019. Thats up from $294,515 last year and from $279,450 in 2017.

Though FHA loans require as little as 3.5 percent down and are easier for borrowers with less-than-stellar credit to get, they can be pricier.

The government-backed loans require home buyers to pay annual insurance of up to 1 percent of the loan, in case the homeowner stops making payments.

Dont Miss: Usaa Refinance Auto

Loan Limits Expand In 2022

With historical home price appreciation defining the past year, mortgage limits are growing for 2022.

Qualified borrowers will be able to take out larger loans backed by the government-sponsored enterprises Fannie Mae and Freddie Mac the Federal Housing Administration, and Department of Veterans Affairs.

For single-family home buying in 2022, you can borrow up to these limits in most areas of the U.S.:

- Conventional loan $647,200

- FHA loan $420,680

- VA loan No loan limit

However, you may have the opportunity to borrow more if you live in a medium to highcost locale. In these areas, 2022 conforming and FHA loan limits are close to $1 million.

Confirm your actual loan limit using the link below.

In this article

Read Also: Capital One Pre Approval Auto

New Fha Loan Limits For Phoenix Market

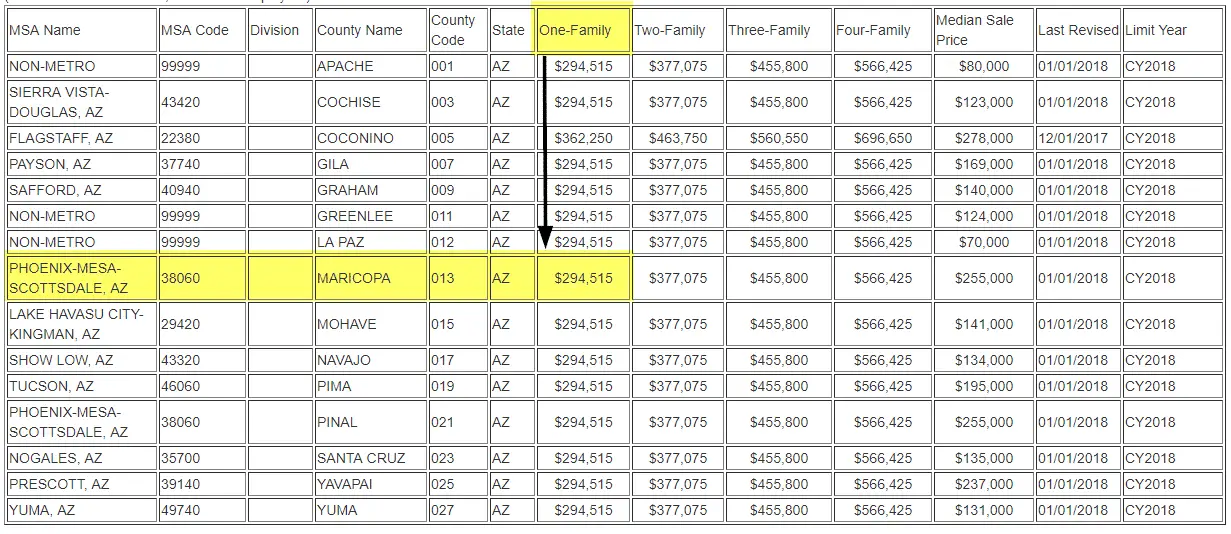

Have you heard the good news about the latest changes to the FHA Loan Limits for Phoenix and the Maricopa County area? And if you have, do you know what they mean for the Phoenix real estate market? The good news is you can now borrow more money in 2018 to purchase your next home with an FHA loan than you could in December of 2017.

Prime district in Singapore will see a new high rise pretigious new development along Bernam Street, One Bernam this will be a very good option with the new changes made.

In 2017 the loan limit on an FHA mortgage in Maricopa County was $279,450. How does that compare to the Phoenix real estate market? Lets take a look at non-luxury homes, under $750,000. The average sales price for a single-family home in Phoenix was around $290,000. That did not leave a lot of room for an FHA buyer looking to put down the standard 3.5%.

For 2018 the lending limit for FHA loans has been raised from the $279,450 to $294,515.

Is This Just For Single

Nope! FHA will do loans on a two-unit property, a three, and a four-unit. As long as you occupy it as your primary residence, one of the units, you can purchase a duplex, triplex, or fourplex using FHA. We actually do these quite frequently. Its a wonderful way to get into your first home, typically, and start your investment portfolio.These loam limits have also increased. The loan limits for the two-unit is going to be $434,800. The three-unit has a loan limit of $513,450, and the four-unit is $638,100. So, you can buy a fourplex for almost $650,000 using FHA.

Be sure to ask us for a free quote on your next mortgage. We will personally work with you and help you through the whole process.

Signature Home Loans, LLC does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only. You should consult your own tax, legal, and accounting advisors before engaging in any transaction. Signature Home Loans. NLMS 1007154, NLMS number 210917, and 1618695. Equal housing lender.

Recommended Reading: Usaa Approved Dealerships

Boost For New Home Market

Ali Wolf of national housing firm Meyers Research said Phoenix is one of the cities that will benefit the most from higher FHA loan limits.

Metro Phoenixs median existing-home price is about $262,000. The areas median new home price is about $318,000.

She estimates 35 Valley subdivisions are now selling new homes priced below the higher FHA loan limit.

Dallas only has about 15 developments selling homes priced in the FHA loan range.

READ MORE:

Va Loan Limits In Maricopa County

VA Loans are similar to FHA Loans in that it allows you to buy a home with very little money down.However VA Loans are only available to veterans of the Armed Forces.With VA loans the Department of Veterans Affairs guarantees the loan on the veteran’s behalf.The maximum the VA will guarantee is set to the same amount as the single-family Fannie/Freddie Loan Limit.So the Maricopa County, AZ 2021 VA Loan Limit is $548,250

You May Like: How To Transfer A Car Loan To Someone Else

What Are Fha Loan Limits

FHA loan limits range from 65% of conforming loan limits in most parts of the country to 150% of conforming loan limits in high-cost counties. The conforming loan limit is the largest mortgage a lender can issue a homebuyer if the lender wants to sell that loan to Fannie Mae or Freddie Mac. They often do: Selling loans to these huge mortgage market investors helps them get more money that they can use to make more loans.

For 2021, the conforming loan limit is $548,250 in most parts of the country. Do the math, and youll see that the FHA limit of $356,362 is 65% of $548,250.

In high-cost counties, the FHA loan limit is $822,375, which is 150% of the conforming loan limit of $548,250. The FHA calls its high-cost county loan limit the ceiling.

But wait: Theres an exception in really, really high-cost areas. In Alaska, Guam, Hawaii and the U.S. Virgin Islands, the limit is $1,233,550, or 150% of the normal ceiling. According to the law, the reason for these extra-high limits is the high cost of construction and housing shortages in these areas.

Several hundred counties have limits that fall somewhere between the floor and the ceiling. In these areas, the limit is 115% of the median price for a one-family residence. The easiest way to learn the FHA loan limit for the area where youre home shopping is to use the FHA Mortgage Limits lookup tool.

Here are a few examples of counties where these limits apply :

Dont Miss: Usaa Auto Loan Pre Approval

Fha Streamline Refinance In Arizona

The FHA streamline refinance program is available to existing homeowners who would like to refinance for a lower rate while eliminating some of the refinance costs such as an appraisal. You may also get a discount on the mortgage insurance premium which is another advantage.

For more information, please read our article on the FHA streamline refinance.

Read Also: Fha Title 1 Loans

Pay Attention To How Your Maximum Purchase Price Is Calculated

It is important that you know how your maximum purchase price is calculated so you can make sure your lender is giving you the best opportunity to buy in the price range you want. There are many different variables in play. Here are some things that you must consider:

- The lower the rate, the more you will qualify to buy.

- Loan programs have different interest rates.

- Each house has a different tax, insurance and HOA amount. Your loan officer needs to be fairly acquainted with the area where you are looking to buy.

- Lenders can calculate your income differently. If they are too conservative, they may qualify you for less than you want. If they are too aggressive, they may over qualify you.

- You need to check for errors on your credit report to make sure that it is reporting your monthly debt obligations correctly.

You might find out that your debt-to-income ratio is too high and it is keeping you from qualifying to buy homes in the price range that you want. If this happens, here are some things that you can do to lower your debt-to-income ratio:

- Ask a family member to co-sign for the loan.

- Ask your employer for a raise.

- Look for homes that are priced lower.

- Pay off or pay down some debts.

- Put more money down.

- Select a different loan program that has a lower rate.

- Get seller concessions and use them to buy down your interest rate.

If you have any questions, please contact us. We are eager to assist you in your homebuying journey.

Read Also: Transfer Auto Loan To Another Bank

See Mortgage Rate Quotes For Your Home

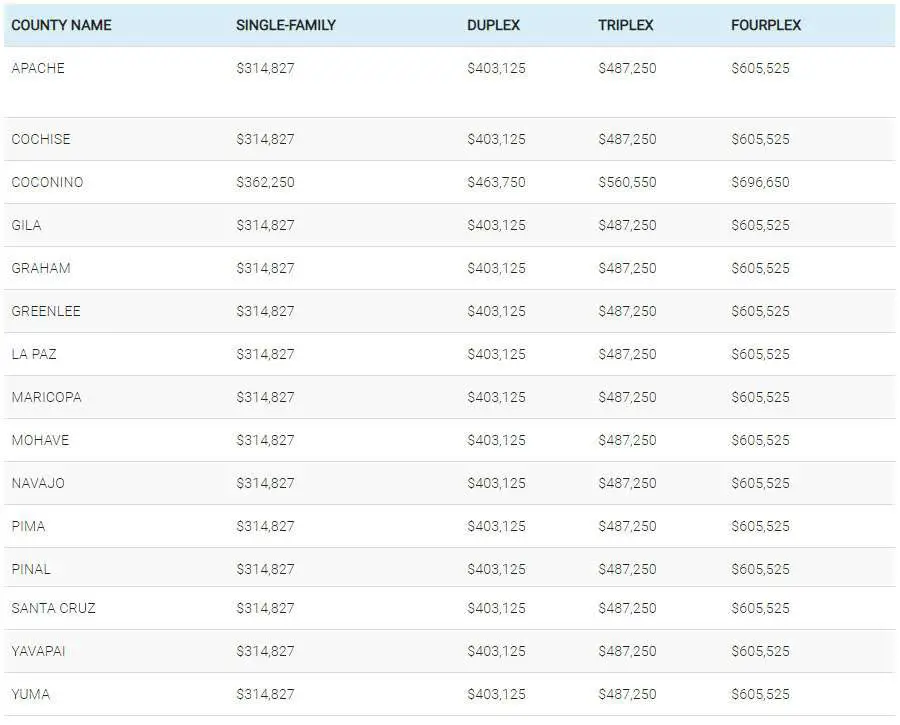

All of Arizonas counties except for one have a Federal Housing Administration loan limit of $314,827, which applies to most lower-cost counties across the U.S. Arizonas outlier. Coconino County, has a loan limit of $362,250.

FHA loans are actually quite popular in Arizona. According to a 2016 FHA report, there were 46,513 FHA home loans granted in the state, totaling $8.4 billion. Arizona had the third-largest percentage of FHA loans in the country with 34.8% of overall home lending in 2015 . In 2018, 3.24% of FHA loans issued nationwide were in Arizona.

Dont Miss: Bayview Loan Servicing Reviews

Recommended Reading: Usaa Car Loan Rate

Why Have The 2022 Loan Limits Increased And Is That A Good Thing

The Housing and Economic Recovery Act established in 2008 following the subprime mortgage crisis requires the baseline loan limits to be adjusted each year based on the average U.S. home price, according to the FHFA.

The FHFAs House Price Index shot up 18.05% annually in the third quarter of 2021 so the conforming loan limit increased by the same amount.

This is a positive development for consumers since expanding loan limits provides a higher amount to borrow and, ultimately, more homes they can potentially afford on the market.

If loan limits were not allowed to increase every year to keep up with home prices, first-time and moderate-income home buyers would not have access to affordable mortgage capital, which reduces homeownership opportunities for those who need it the most, according to 2022 California Association of Realtors President Otto Catrina.

See what loan types you qualify for and which gives you the best value, along with the latest mortgage rates here:

Conventional Loan Limit Increase About 75 Percent

Starting 1/1/2021, the 2021 conventional loan limit in Arizona Maricopa County for single-family properties will be $548,250, increased about 7.5% from up from $510,400 in 2020. This means first time home buyers using can buy at a maximum purchase price of about $565,200! This is great news for Arizona home buyers planning to use the conventional loan to buy a home in 2021.

Wondering how much house you can afford? to access the Mortgage House Payment Calculator. Simply add in the price of the home you are considering and the calculator will return your estimated house payment. Change length of loan and interest rates to adjust results.

Recommended Reading: Usaa Car Loans Review

Arizona Fha Loan Limits

FHA loan limits are the maximum amount that you may borrow using an FHA loan in a particular location. You may view the 2021 FHA loan limits for all counties in Arizona below.

If you would like to learn more about the requirements to get an FHA loan, and view some of the best FHA lenders in Arizona, visit this page.

| County |

|---|

New Fha Loan Limits For Maricopa And Pinal Counties Released

The Department of Housing and Urban Development has released upwardly revised limits for FHA loans.

The new FHA loan limits are the same for both Maricopa and Pinal counties.

One-Family: $346,250

Three-Family: $535,800

Four-Family: $665,850

If you are outside our local area, you can use the the HUD Mortgage Limits page to find the new limits across the country. .

If you are in the Phoenix area and looking for an FHA loan, youd be hard pressed to find better service than youll get with Shailesh and Aimee Ghimire.

Also Check: Usaa Apply For Auto Loan

Nc Ppp Loan List Of Recipients

1. FederalPay.org PPP Loan Recipient List By State North Advanced PPP Loan Search By FederalPay.org Scotland Motors Inc, LAURINBURG, NC Innkeeper Of Greensboro Inc, GREENSBORO, NC Rolands Barbecue LLC, DURHAM, NC StateTotal$150k or less$150k $350k$350k $1StateAlabamaTotal169,568$150k or less158,656$150k $350k6,558$350k $1StateAlaskaTotal23,694$150k or

Loan Places In Jackson Tn

1. 1st Franklin Financial in Jackson, TN 38305 1st Franklin Financial in Jackson, TN | Located at 25 Stonebrook Place | Personal Installment Loans, High Interest Investing Opportunities. Visit your local Regional Finance branch at 319 Vann Drive in Jackson, TN to get a personal loan to pay bills, car

You May Like: Bayview Loan Servicing Charlotte Nc

How To Qualify For Fha Loan In Arizona

- The home must be your primary residence

- Minimum

- Debt-To-Icome ration lower or at 43%, hovewer you might be able to qualify for a loan in Arizona with compestating factors if your DTI is higher.

- You need to purchase a MIP, a mortgage insurance premium required by FHA

- FHA only allows loans for a primary residence, so no vacation homes or investments

- For the past two years, you cannot have had bankruptcies or foreclosures

- Documented income in the past 2 years

- 3,5% for a down payment or 10% if your credit is below 580

Maximum Fha Loan Amount With A 500 Credit Score

You can get FHA financing with a low credit score however you need to put down as much as 10% down. The maximum loan amount in Arizona in Maricopa County is $441,600 so your score is at 540 you can purchase a house for up to $485,760. Different counties have different FHA loan limits in Arizona, make sure you check them before getting pre-qualified for a mortgage and start shopping.

Don’t Miss: How To Get Out Of Auto Loan

How To Qualify For An Fha Loan In Maricopa County Arizona

The minimum loan amount in Maricopa County is $5,000 dollars and may go up to $707,700depending on home size and loan type.In order to qualify for an FHA loan, you must be planning to live in the home.Although a loan can include some renovation costs,FHA loans cannot be used for real estate investments in Maricopa County.

Additionally, your loan amount cannot exceed the value of home you are purchasing. Learn more about FHA Loan Requirements.

Fha Loan Limit In Arizona Increase About 74 Percent

The department of Housing Urban Development announced an increase FHA loan limit in Arizona for 2021. Starting 1/1/2021, the new 2021 FHA loan limit in Arizona for single-family properties in Maricopa county will be $381,347, up about 7.4% from $331,760 in 2020. This means that the maximum purchase price using minimum down payment would be $381,347. This is great news for Arizona home buyers planning to use the FHA home loan product to buy a home in 2020.

Wondering how much house you can afford? to access the Mortgage House Payment Calculator. Simply add in the price of the home you are considering and the calculator will return your estimated house payment. Change length of loan and interest rates to adjust results.

Read Also: Auto Refinance Calculator Usaa

Who Has The Best Auto Refinance Rates

Category: Loans 1. 10 Best Auto Loan Refinancing Lenders of September 2021 Refinancing an auto loan could lower your rate and monthly payment, Apply to multiple lenders, because each one has different credit score requirements. Best Refinance Rates: OpenRoad Lending · Best Bank for Auto Refinance: Bank of America ·

Fha Loan Limits For 2022

The FHA, aimed at helping borrowers with moderate incomes and credit scores, also upped its loan limits for 2022.

| $809,151-$1,867,274 | $1,867,275 |

In 2022, you can get an FHAinsured mortgage up to $420,680 for a one-unit property or up to $970,800 in particularly expensive areas.

For a two-unit home, the standard FHA mortgage limit is $538,650 for a three-unit home, its $651,050 and $809,150 is the cap for a four-unit home.

Just like with conforming mortgages, the limits depend on location, differing for low, medium, and high-cost counties.

Alaska, Hawaii, Guam, and the U.S. Virgin Islands also have their own limits set higher due to elevated costs of construction. In those four places, the 2022 baselines are $1,456,200 for one-units $1,864,575 for two-units $2,253,700 for three-units and $2,800,900 for four-units.

> Related: Check our FHA loan guide

Read Also: Upstart Prequalify

Phoenix Az Housing Market Trends Report

View Phoenix AZ Housing Market Report. The data used this Phoenix AZ Market Report is consolidated from multiple sources and includes current listings, recent sales, inventory, market changes and more. Whether you are a buyer or seller, the knowledge you gain will help put you in control of your real estate transactions.

Swee Ng, Realtor and Phoenix East Valley resident specializing in win-win real estate transaction through great communication and fighting for his clients best interest. After all, this is more than real estates, this is about your life and your dreams.

If you are looking to buy or sell your home in Phoenix AZ and surrounding area, we hope you will consider us. Contact us today for complimentary consultation.

New Listing in Last 24 hour Phoenix AZ Under $300,000

| Homes for Sale in Phoenix AZ |

|---|

Maximum Mortgage Amount In Phoenix / Maricopa County

Maricopa County comprises some of Arizonas most populous cities, including Chandler, Glendale, Mesa, Phoenix and Scottsdale. That means for most home buyers across the state, the 2021 FHA loan limit will be $368,000.

That is the maximum mortgage amount when using a home loan that is insured through the Federal Housing Administration, within the Phoenix area.

Read Also: Usaa Rv Loan Calculator