What Do You Need To Qualify For Capital One Auto Refinance

To qualify for auto loan refinancing with Capital One Auto Refinance, applicants need a minimum annual income of $18,000 or higher. Capital One Auto Refinance only considers borrowers who are employed and meet the minimum income requirement. Note that borrowers can add a cosigner to either meet eligibility requirements or qualify for lower interest rates.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members and their covered dependents are eligible to apply for a loan via Capital One Auto Refinance. Their rates fall within the limits of The Military Lending Act.

U.S. citizens are, of course, eligible for the services offered by Capital One Auto Refinance. Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Proof of income

Option : Refinance To Lower Your Car Payment By Extending Your Term

For car loan terms, a shorter loan term means less interest paid over the life of a loan. However, lengthening your loan term can reduce your car payment every month, sometimes significantly. The car loan market is massive, with over one trillion dollars in loans outstanding. That means every kind of lender and investor is involved in the auto loan market. As a result, the variety of car loan terms available may surprise you. Loan terms extend all the way out to 84 months and beyond at the extreme.

Lets take a typical example. Assume you have a $25,000 principal loan balance and 50 months remaining on your car loan at a 5% interest rate. If you could refinance to a 60 month term at the same 5% interest rate, your monthly payment would drop from about $550 to $470. Thats $80 per month freed up in your budget. It is true that you will spend more in interest expense over the life of your new 60 month term, but there are times when that can make sense based on your other budgetary priorities.

Capital One Auto Financing Options

Capital One offers a variety of auto financing options, including loans for new cars and used cars, but they do not finance lease buyouts or cash-out refinancing.

- New Car Loans: New car loans start at 2.99% for customers with excellent credit.

- Used Car Loans: Used car loans startup 3.39% with minimum loan requirements of $4,000.

- Auto Refinance: Auto refinance loans start at 4.07% and go up to 24.99%, with minimum loans starting at $7,500.

You May Like: How Long For Sba Loan Approval

Things To Consider Before Refinancing

Capital One Reviews And Reputation

Capital One is accredited and holds an A rating from the Better Business Bureau . It was named one of the best places to work by Fortune magazine in 2017 and is well regarded within the financial services industry.

Despite this, Capital Ones online customer review profile is average. It has a 1.2 out of 5.0-star customer rating on the BBB website and a Trustpilot score of 1.4 out of 5.0 stars. Its important to note a few things about these low ratings. First, many customer reviews mention Capital Ones banking services, not its auto loans. Second, although auto loans are only a small part of Capital Ones business, complaints from banking customers may still speak to the overall quality of the company.

Finally, keep in mind that Capital One is a large company with many products and services, millions of customers, and billions of dollars of revenue. Though there are thousands of complaints online, these represent a small fraction of total Capital One customers.

Also Check: Can You Transfer Car Payments To Another Person

How Do Repayments Work

Although the dealership you buy from will be the primary lien holder on your vehicle, Capital One will still service your loan. To make a repayment, you can log in to your Capital One account online or through its mobile app. From there, you can schedule a one-time payment or set up recurring payments. If needed, you can also change your due date but it isnt clear how many times you can do this.

You can also make payments by mailing a cashiers check, money order or personal check to Capital One or by sending a payment through Western Union or MoneyGram.

What Could Capital One Auto Refinance Do Better

One of the drawbacks of a Capital One Auto Refinance is that there are a lot of eligibility requirements. If you want to refinance with Capital One your loan must meet the following requirements.

- The remaining term of your existing loan must be at least 12 months and more than 99 months

- New loan terms must be at least 24 months and no more than 72 months

- Vehicles must be less than seven years old

- You must owe between $7,500 and $40,000

There are additional requirements, including make and model restrictions and monthly income minimums.

Also Check: How To Get An Aer Loan

Compare The Best Auto Loan Refinance Banks

| Company | |

|---|---|

| LightStreamBest for Great Credit | 2.49% |

| Capital OneBest for Checking Rates | Varies |

| Bank of AmericaBest Trusted Name | 3.39% |

| AutoPayBest for the Most Options | 1.99% |

| USAABest for Members of the Military | 3.04% |

| LendingClubBest for Peer-to-Peer Loans | Varies |

| Consumers Credit UnionBest Credit Union | 2.24% |

You Wont Be Penalized For Repaying Your Existing Loan

Refinancing your auto loan means paying off your existing loan early. This could be a problem if your existing loan contract includes a prepayment penalty clause.

Take a look at your contract to see if youll be charged fees for early repayment. Before applying for auto refinancing, make sure to crunch the numbers so you can determine whether prepayment fees would cancel out the financial benefit of refinancing.

Don’t Miss: How Much To Loan Officers Make

How To Calculate Monthly Car Payments

One of the most important considerations when you take out a car loan is your monthly payment. You want to be sure the payment will be affordable. Your car payment is affected by the cars price, the size of your down payment, your interest rate, and your loan term. When you know these factors, you can use an amortization calculator to figure out what your monthly payments will be.

You can increase or decrease your monthly payment in a few ways. First, you can lower your monthly payment by buying a more affordable car or increasing the size of your down payment. A lower interest rate or longer loan term will also reduce the amount youll pay each month. However, know that extending the duration of your loan means youll be accruing equity slower.

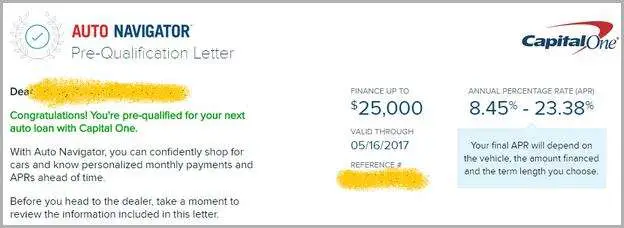

Using Capital One Auto Navigator

Auto Navigator® is a useful tool that helps check for pre-qualifying eligibility, and it helps find cars that are within your budget and desired make and model.

Customers can search for cars they may be interested in test-driving and purchasing by inputting specifications such as make, model, and mileage so that they can see their options.

Auto Navigator® also provides estimated monthly payments and interest rates using the data compiled for loan prequalification, which enables customers to see what types of cars are in their budget and an accurate depiction of their monthly payments if they choose that vehicle.

You May Like: Va Manufactured Home 1976

What Types Of Car Loans Does Capital One Offer

Capital One offers three loan options:

- New car loan. Provided your chosen vehicle costs between $4,000 and $40,000, you can use a Capital One car loan to finance your purchase.

- Used car loan. Your vehicle must be a 2010 model or newer with less than 120,000 miles. However, there are cases where Capital One will finance a 2008 model with less than 150,000 miles.

- Auto refinancing. Capital One allows you to refinance vehicles that have resale value and are seven years old or newer.

What We Love About Capital One Auto Navigator

Capital One Auto Navigator makes it easy to get pre-approved for a car loan before you visit a car dealership. You can also set your desired terms for an auto loan. The tool can pre-approved you without affecting your credit and will direct you to a participating dealership. You can also view dealer inventory online so you can do most of the car buying through the internet. All you have to do in-person is test drive the car and fill out an official loan application.

Don’t Miss: How To Transfer A Car Loan

How The Application Works

Capital One allows you to apply as an individual or with a coapplicant. To get prequalified, youll need to submit some information about yourself and your finances, including your income and Social Security number.

If youre prequalified, you can use your finances to shop at participating dealerships for up to 30 days. The dealership will present you with a final loan contract.

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

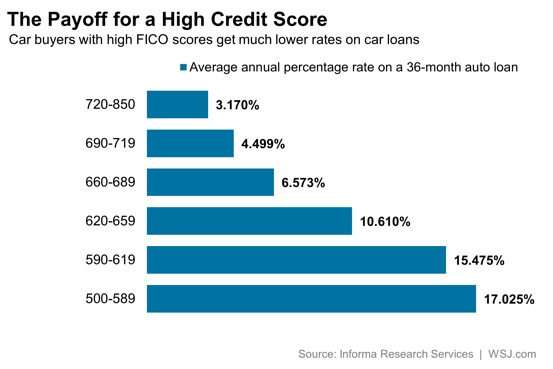

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Recommended Reading: Genisys Credit Union Auto Loan Calculator

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

Westlake Financial Auto Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

If you are shopping for a new or used car, you may come across Westlake Financial when you discuss your financing options at the dealership. Westlake Financial is whats known as an indirect lender: It offers auto loans through car dealers instead of directly to consumers. Even though you cant complete a Westlake application on your own, its still a good idea to do your research on the company and what it offers. With more than 30,000 dealers in Westlakes network, chances are good you may be presented with one of its loans.

Here, well explain how getting an auto loan with Westlake Financial works and what you can expect as you go through the approval process.

Recommended Reading: Do Pawn Shops Loan Money

Best For Members Of The Military: Usaa

USAA

USAA is a great choice for auto loan refinancing for members of the military and their families, with competitive rates and the option to take your car overseas when deployed, moving, or travelling.

-

No payments for up to 60 days

-

Easy application process

-

Only available to USAA members

-

Borrowers canât prequalify

USAA only works with members of the military and their families, but for those who serve our country, this nearly 100-year-old organization offers rates and customer service that is often hard to beat. You wonât have to pay for up to 60 days after you start the loan, giving you time to catch up if you are behind. You can also choose from many of their vehicle protection plans if thatâs something youâd like to add on as well. USAA offers to refinance for up to 60 months, and longer terms are also available. USAA takes the hassle out of refinancing by working directly with your lender. Their rates are stated on their website as being as low as 3.04% APR which is noted as including a discount of .25% for automatic payments. Rates are subject to change without notice and vary based on approved credit and other factors, such as term, model year, and loan amount.

You Want To Remove Or Add A Co

To remove or add a co-borrower from your car loan, youll need to refinance it under the name of the person youd like on the loan. You may have a co-borrower if you were unable to get approved for a car loan on your own.

If this holds true and youve built up or improved your credit history, it may be time to remove your co-borrower through refinancing.

Don’t Miss: Aer Loan Requirements

Refinance Your Auto Loan

Refinancing your existing loan might reduce your monthly payments. If interest rates have dropped since you got your original loan, your credit has improved, or you just arent confident you got the best possible rate to begin with, you may be able to get a new loan with a lower rate and better terms. Keep in mind that refinancing involves opening up a new loan with new terms that means the potential for brand-new loan fees on top of interest youd pay. And if you end up extending your loan term and are able to lower your monthly payments, youll be paying interest for longer.

Apply At Capital One Auto Navigator

On the online form, you will need to supply:

- Personal information: Name, email, phone number and Social Security number.

- Residential information: Address, duration at current address, whether you rent or own and monthly house expenses.

- Employment information: Employer, length of employment and gross annual income.

You may be asked to upload proof of your residence or employment such as a copy of a utility bill or pay stubs.

Read Also: How Does Paypal Business Loan Work

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How To Calculate Amortization Schedule For Car Loan

Does Refinancing An Auto Loan Hurt Credit

In a perfect world, youd refinance your car loan and keep your credit score where it is. The reality, however, is that refinancing can hurt your credit because lenders will assess your creditworthiness or how worthy you are to receive credit.

To do this, theyll likely pull a hard inquiry, which may bring your credit score down by up to five points. Lets dive deeper into how refinancing an auto loan may hurt your credit.

Should You Get An Auto Loan Through Capital One

A Capital One auto loan might be for you if you have a nonprime or subprime credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates.

Capital One works with borrowers with credit scores as low as 500. Auto loan interest rates at Capital One tend to start lower than the typical interest rates, and could help people in this credit category get lower interest rates, too.

Also Check: How To Get Loan Originator License