Do Fha Loans Have Prepayment Penalties

- They do not have prepayment penalties

- But there is a caveat

- Depending on when you pay off your FHA loan

- You may pay a full months interest

The good news is FHA do NOT have prepayment penalties, meaning you can pay off your FHA loan whenever you feel like it without being assessed a penalty.

Prepayment penalties arent very common these days, though they were quite prevalent on conventional loans during the housing boom in the early 2000s.

There is a caveat

However, there is one thing you should watch out for. Though FHA loans dont allow for prepayment penalties, you may be required to pay the full months interest in which you refinance or pay off your loan because the FHA requires full-month interest payoffs.

In other words, if you refinance your FHA loan on January 10th, you might have to pay interest for the remaining 21 days, even if the loan is technically paid off.

Its kind of a backdoor prepay penalty, and one that will probably be revised soon for future FHA borrowers. If youre a current FHA loan holder, you may want to sell or refinance at the end of the month to avoid this extra interest expense.

Update: As expected, they eliminated the collection of post-settlement interest. For FHA loans closed on or after January 21st, 2015, interest will only be collected through the date the loan closes, as opposed to the end of the month. Legacy loans will still be affected by the old policy if/when they are paid off early.

Fha Home Loan Process Timeline

For many homebuyers, the biggest concern is whether or not they can afford the home of their dreams. An FHA loan may be the right loan for you, allowing you to purchase your dream home without the expense of a significant down payment. Purchasing a home is both a huge financial investment and a personal one this will be your primary residence for several years to come.

If you are a first-time homebuyer, you may be wondering how to start the FHA loan process. At CIS Home Loans, we developed this guide to break down the FHA loan process step by step.

Gifts As Down Payments

You must show proof of the gifted down payment by asking the donor to provide a letter with a statement that the money is a gift without expected repayment. The donor will also need to provide proof of the account from which he withdrew the funds. You cannot receive the gift in cash. Cashier’s check and money order are the preferred method, with a copy of both sides of the check and the bank statements showing where the money was taken from and deposited to.

You must document the source of any large sums of money deposited to your account recently, other than your regular paycheck. What the lender considers a large sum might be as little as $500.

You May Like: Penfed Credit Score Requirement Auto Loan

The Advantages Of Paying 20% Down

- Improves your chances of loan approval: Paying 20% down lowers risk for lenders. A larger down payment also makes you look like a more financially responsible consumer. This gives you better chances of qualifying for a mortgage.

- Helps lower your interest rate: Paying 20% down decreases your loan-to-value ratio to 80%. LTV is an indicator which measures your loan amount against the value of the secured property. With a lower LTV ratio, you can obtain a lower interest rate for your mortgage. This will help you gain interest savings over the life of your loan.

- Reduces your monthly payment: A large down payment also significantly decreases your monthly mortgage payments. Though you spend more now, having lower monthly payments will make your budget more manageable. This gives you room to save extra money for emergency funds, retirement savings, or other worthwhile investments.

- Helps build home equity faster: Paying 20% down means paying off a larger portion of your loan. This allows you to pay off your mortgage sooner. If you plan to make extra payments on your mortgage, having 20% equity will help speed up this process, allowing you to cut a few years off your loan term.

- Eliminates private mortgage insurance : As mentioned earlier, PMI is an added cost on a conventional loan if you pay less than 20% on your mortgage. Consider paying 20% down to avoid this extra fee.

Know the Closing Costs

Can You Get An Fha Loan With Student Loan Debt

Yes. Recent changes to FHA guidelines make it even easier for aspiring homeowners to apply for a mortgage with student loan debt and qualify based on the actual student loan payment. Prior to the change which went into effect in the summer of 2021, FHA-approved lenders were required to calculate 1% of the student loan balance to qualify, regardless of whether the actual payment was lower.

Recommended Reading: Upstart Can I Get A Second Loan

How Big Of An Fha Loan Do I Qualify For

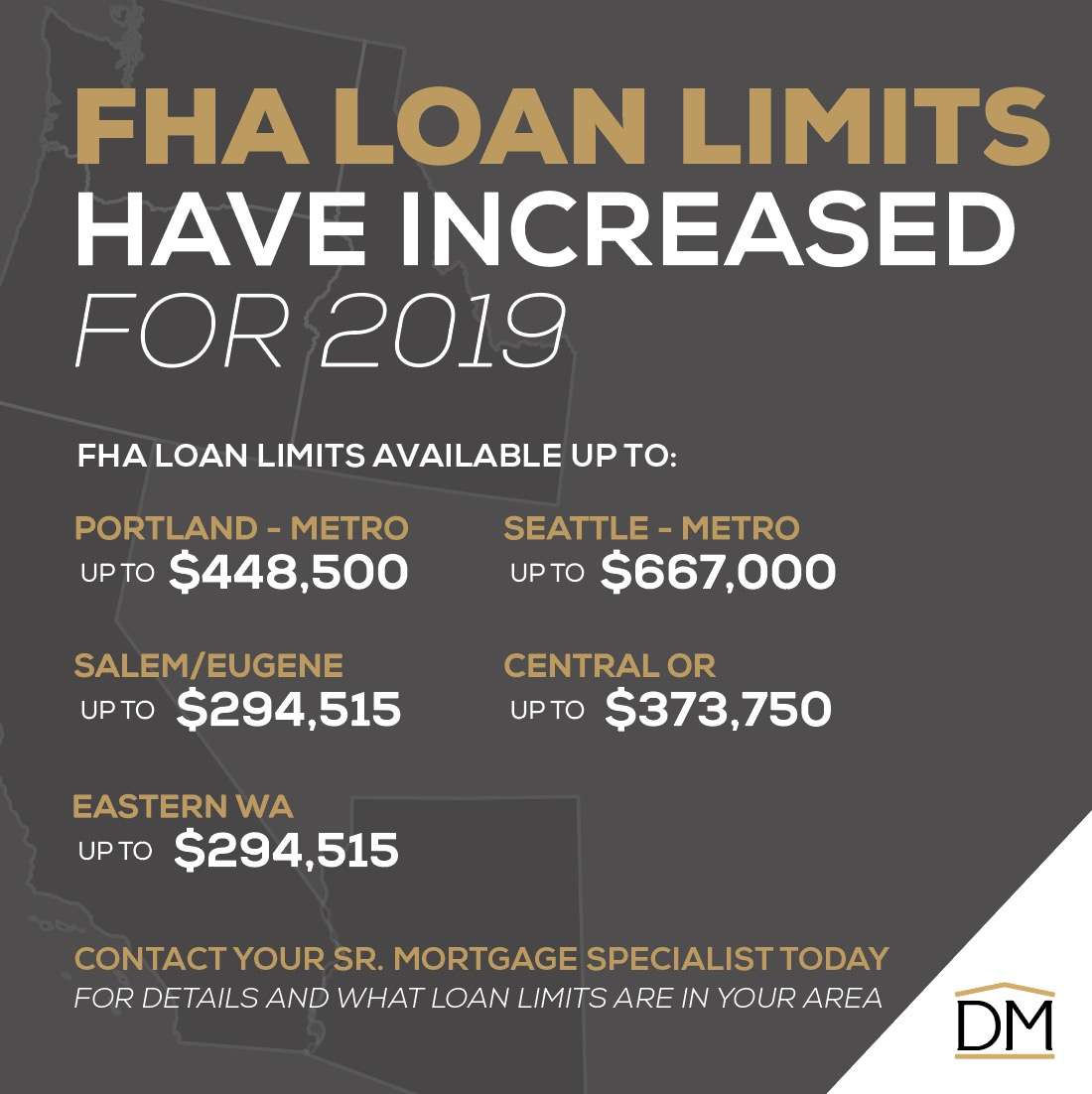

By 2022, the FHA loan limit has been set at 420,680 for single-unit homes in low-cost areas. In some higher-cost areas, the cap may be as high as $970,800, rising from $822,375.

The federal government requires FHA to adjust loans according to the FHFA-imposed limits or the Federal Housing Finance Agency. Upper and lower restrictions vary based on the living conditions in the area and can differ between counties in some cases. The FHSA limits areas that are rated for more living expenses.

How Much Income Do You Need For An Fha Mortgage

Lenders are much more concerned with your ability to comfortably afford mortgage payments than with your actual income level. So theyll be focused on your disposable income rather than how much you earn.

The industry term for this is your debttoincome ratio . And its calculated by comparing your gross monthly income with all your monthly debt payments. These include minimum credit card payments and loan installments as well as your future mortgage payment.

Your DTI ratio has a big impact on your loan approval. Someone with a low income and few debts might be approved for a loan while someone with a higher income but lots of existing debt could gets turned down.

Also Check: Using Va Home Loan For Investment Property

Are Fha Loans Only For First

No, you do not need to be a first-time home buyer to use an FHA loan. Lower credit score minimums and down payments certainly make FHA loans attractive to first-time home buyers, but current homeowners are eligible, too. In fiscal year 2020, about 83% of FHA purchase loans were made to first-time home buyers â which means 17% went to borrowers who were already homeowners.

Best Lenders for FHA Loans in April 2019 NerdWallet If youre interested in an FHA loan, well help you choose the right lender for you.. Best for online fha mortgage experience: Rocket Mortgage.. and flexible financial requirements so its easier for first-time borrowers to obtain a home loan.

Equity Home Loans Chase Some are more generous such as Tesco Bank which allows up to 20 per cent a year. According to online mortgage broker Trussle, the best fixed rate loans for landlords include a two-year deal priced.

Best Lenders for FHA Loans in April 2019 NerdWallet FHA loans in 2019 offer several benefits including low rates and low down payments. If youre interested in an FHA loan, well help you choose the right lender for you. Compare our best FHA.

FHA Loans Apply Online for an FHA Home Loan FHA Online Application. If you wish, we can also secure a no-obligation pre-qualification letter from a lender in your area who will guarantee your loan request and the lowest possible rate . This is a free service available to US citizens above the age of eighteen.

Are Daca Recipients Eligible For Fha Loans

Yes. After some years of confusion , HUD officially announced that effective January 19th, 2021, individuals classified under the Deferred Action for Childhood Arrivals program are eligible to apply for mortgages backed by the FHA.

Prior to the announcement , there was a lot of uncertainty regarding the latter because the FHA handbook stated, Non-US citizens without lawful residency in the U.S. are not eligible for FHA-insured mortgages.

That entire subsection has now been removed from the handbook to avoid confusion and provide clarity.

The one caveat is that they must also be legally permitted to work in the United States, as evidenced by the Employment Authorization Document issued by the USCIS

Other than that, you must occupy the property as your primary residence, have a valid Social Security Number , unless employed by the World Bank, a foreign embassy, or an equivalent employer identified by HUD.

And you must satisfy the same underwriting requirements, terms, and conditions set for U.S. citizens.

Don’t Miss: Ida Auto Finance

How To Qualify For Fha Financing

While an FHA mortgage could be your best option for a home purchase, you must meet several FHA home loan requirements to qualify for FHA financing. While these requirements are similar to those of a conventional mortgage, FHA loan programs may have other restrictions that might not be right for you.

Income:DTI ratio:Down payment:Employment history:Home appraisal:Occupancy:

How Do You Get An Fha Loan

Getting approved for an FHA loan depends on a few factors. These include your credit score, debt-to-income ratio, and how much of a down payment you can afford to pay. No single factor comes with a hard limit, rather the FHA will consider your situation in full based on a picture they can get from all the factors. So even if you don’t meet the minimum requirements, you might still be able to get an FHA loan. For example, if you have enough cash in reserve, you could qualify, even if you already have high debt.

| Requirements to Qualify for FHA Loan in 2021 |

|---|

| FICO Credit Score |

Read Also: Loaning Money To Your S-corp

Frequently Asked Questions About Fha Loans

FHA loans arent the easiest topic to wrap your head around, so its not surprising that people have many questions about them. In this section, weve compiled a list of some of the more commonly asked questions regarding FHA loans for your convenience. Weve also added links so you can fall further down the FHA rabbit hole if you so choose.

Fha Credit Score Standards

You credit score and credit history are different but related sources of information lenders use to decide whether to approve your loan application. Your score is a predictive statistic and guess at your likelihood of repaying a loan.

When it comes to credit scores, bigger is better. Why? Lenders offer the best rates to borrowers who have the highest FICO credit scores.

The FHA minimum credit score is 500. However, if you want a loan with a 3.5 percent down-payment, then you must have a credit score of 580 or higher.

If you have a FICO credit score between 500 and 579, you are still eligible for an FHA loan. Borrowers with low scores must come up with a 10 percent down payment.

The 580 credit score standard is a bit deceiving in practice. It is common for lenders to place the bar higher and require a 620, a 680 or even higher score. Lenders may not go below the FHA’s minimum credit score, but are free to require higher scores.

These higher standards are known as lender overlays and they vary from lender to lender. Lenders add overlays as a precaution, especially on credit score requirements, because borrowers with low credit scores are more likely to default. Lenders worry about their overall FHA default rate. Lenders with high default rates are not allowed to stay in the FHA program and may receive financial penalties for making too many bad loans.

Also Check: Usaa Personal Loan Approval Odds

Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Fha Loan For A $200000 Home

- Due upfront: $14,860

What youll pay at closing

Here are your figures for a typical cash requirement on closing:

- Minimum down payment: $7,000

- Possible closing costs: $7,720

- Upfront MIP: $3,375

You can normally roll up your initial MIP payment into your loan and pay it down along with your mortgage. Most people do that.

If you do, your total loan amount will be the original $193,000 plus your initial MIP payment of $3,735, which makes $196,375.

Because youre borrowing more, your 4% closing costs will inch up to $7,855 from $7,720.

So you could close on your FHA loan for a $200,000 home with as little as $14,860. Indeed, if you find a lender that charges lower closing costs of 2%, it might be as little as $10,930.

Remember, if youre eligible for help from a down payment assistance program, you might get all or some of that paid for you through a loan, forgivable loan, or grant.

Ongoing FHA loan costs

Assuming youve rolled up your initial MIP payment into your loan, youll be borrowing $196,375. And, remember, were assuming a fixed mortgage rate of 3.474%, which may have changed by the time you read this.

Based on those assumptions, our FHA loan calculator says your monthly mortgage payment should be $1,220. That breaks down as:

- Principal and interest: $879

- Monthly mortgage insurance fee: $139

- Property taxes: $162

- Homeowners insurance: $40

So take these as useful but rough estimates rather than firm figures.

Also Check: Capitalone Autoloans.com

What Is The Difference Between Fha And Conventional Loans

FHA loans are insured by the federal government, whereas conventional loans are not. FHA and conventional loans also differ in refinancing, loan limits, and owner-occupation requirements:

- Refinancing: While available for both loan types, refinancing is more detailed for a conventional loan and requires an appraisal, credit check, and income verification.

- Loan limits: Both loan types have maximum and minimum amounts you can receive, but they differ in how these limits are determined. The limits for an FHA loan are determined by the countys median home value, and conventional loans follow the protection standards under Fannie Mae and Freddie Mac.

- Owner occupation: While an FHA loan requires you to live in the property, a conventional loan does not.

What Is The Maximum Fha Loan I Can Qualify For

Because you have debt to income ratios and you have the county the limits, the maximum you can qualify for first and most importantly is determined by the maximum loan limit in the county.

So if lets say youre a, as long as your debt to income ratio meets the FHA guidelines, the published loan limit would be the maximum.

That you qualify for now, if your debt to income ratio is too high, you have to lower the loan amount until your debt to income ratio lines up with what the FHA guidelines are.

And in that case, the maximum that you qualify for is not going to be the maximum loan limit. Its going to be the maximum that you qualify for based on your debt to income ratio.

Now heres where it gets really exciting. If your debt to income ratio is fine and you had run into issues maybe last year and 2021 with the loan limits, 2022 FHA released new loan limits and theyve been increased across the country.

Read Also: Capital One/auto Pre Approval

Fha Mortgage Health Statistics

Historically, this market share has experienced lows and highs for a number of reasons, and it’s currently starting to go into a low point even with its popularity with the Millennial age group. The FHA’s mortgage market share by dollar volume was just 17.3% in the last quarter of 2016. A few reasons for this share shift are:

Housing Bubble

During the housing bubble credit standards were loose on conforming mortgages. This meant marginal home buyers had less incentive to seek out FHA loans since almost anyone with a pulse could “qualify” for a standard conforming mortgage.

Housing Market Crash

The FHA offers mortgages to people with lower credit scores and thin credit histories. When credit dried up in the wake of the housing market crash & many ARM loans reset many people rushed into FHA loans.

Fee Adjustment

Once the United States housing bubble crashed, the liquidity people had access to was drastically reduced. This caused an FHA share boost after the crash and this. The slow recovery, in turn, caused the FHA default rate shoot up and any cash reserves that the FHA set aside for emergencies was quickly depleted. To offset the losses, in 2013 the FHA to increase its fees. The fee increase caused dollar share of FHA loans to slide as:

- many people defaulted

- new borrowers preferred conforming loans which were in many cases cheaper on a relative basis

- people with strong credit profiles who used FHA loans refinanced into conventional mortgages

Similarities Between Conventional Loans And Fha Loans

Here are a few similarities between these two types of loans:

-

Conventional loans require you to purchase insurance if your down payment is less than 20 percent, while FHA loans require insurance from all borrowers.

-

Both types of loans have a minimum down payment in the 3 percent range

-

When reviewing your application, conventional and FHA loans consider your debt to income ratio.

Also Check: Capital One Car Loan Pre Approval Letter