How To Get The Cheapest Business Loan

Getting the cheapest business loans will depend on a lot of different factors and relies on you having the very best credit rating, but a lot comes down to how much you want to borrow, and where you look for the loan in the first place. Different lenders will always have different criteria and will offer different business loan rates accordingly, so comparing the options is essential to make sure youre getting the very best business loan in the UK. Our comparison table can help.

What Is A Prepayment Penalty

Commercial loans come with a built-in expectation that interest will be paid over a set amount of time, ensuring that the lender will receive a continuous stream of revenue for the duration of the loans term. When a borrower decides to pay off a loan early, whether to refinance at a lower interest rate or get out early in anticipation of a higher rate in the future, they canand most likely willface prepayment penalties.

The borrower would then pay the difference between the loans original interest rate and the current rate for the remainder of the term of the loan or offer up another mode of collateral, such as treasury bonds . If your business is doing well and you can afford it in the short term, youre in a slightly better position to take the hit of a prepayment penalty. A cash-strapped business, on the other hand, should probably avoid deviating from the loans term.

Understanding Commercial Mortgage Rates And Terms

As you dive into the world of commercial mortgage loan rates and terms, its easy to become overwhelmed by all of the terminology thats used to describe the process. Commercial mortgage rates and terms arent the same as residential or personal loans, so youll want to develop an understanding about what that means for you and the future of your financial situation.

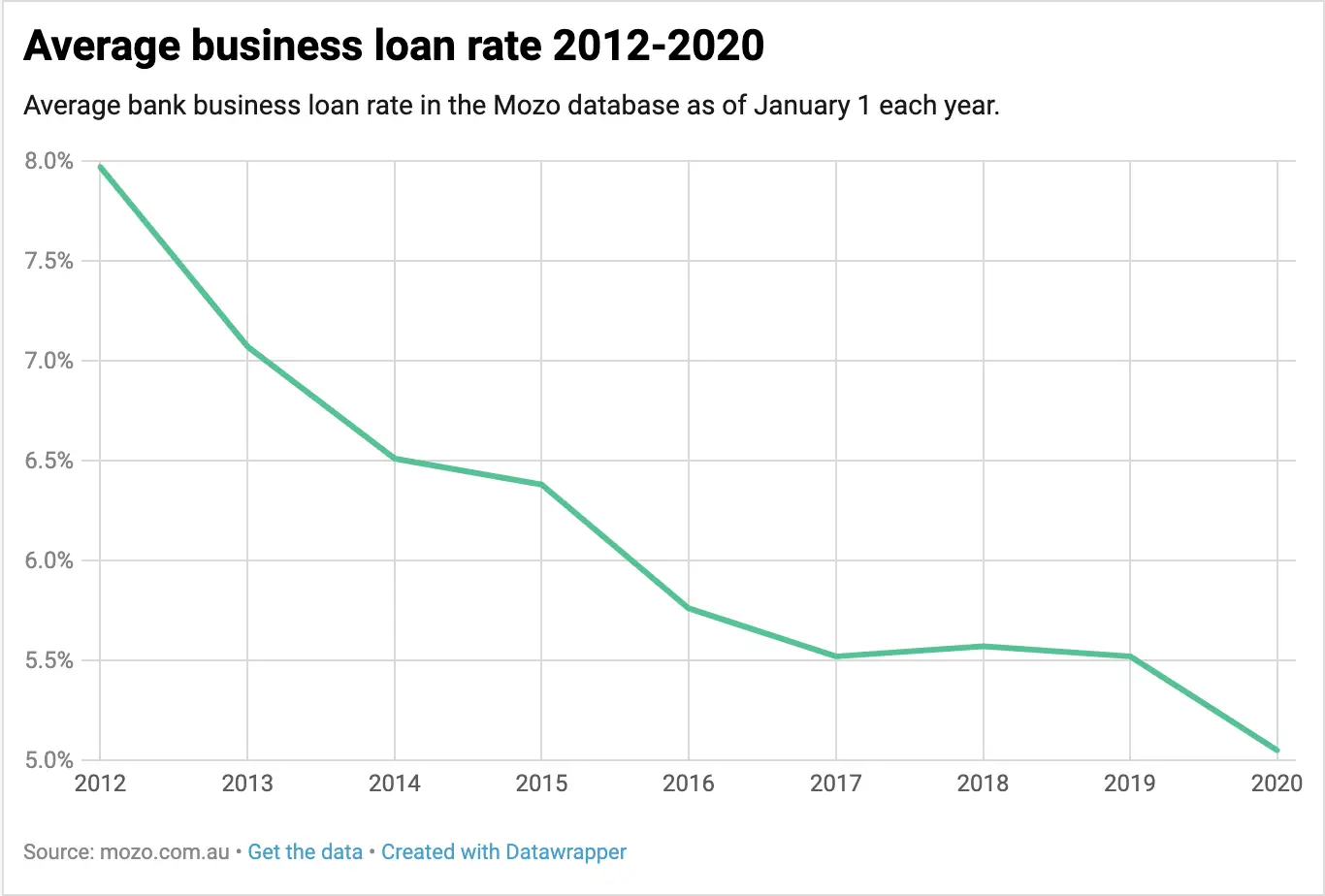

Mortgage rates and terms are determined by a wide range of factors that fall into two categoriesnationwide trends and case-by-case situations. In terms of nationwide trends, everything from economic inflation to growth and employment can have an impact on these rates and terms. When the economy performs well, interest rates go up. When the economy seems to stagnate, these rates will correct downward. Its a cyclical pattern that requires a sharp eye to stay informed.

Read Also: What’s Needed To Qualify For A Home Loan

Two: Check Your Credit History

Having a poor can hold you back from getting a business loan approved, so if its been a while since youve checked your profile, nows the time to see where you stand. You can check your credit score through a number of different platforms TotallyMoney give you completely free access to your credit report and if its less than perfect, make sure to find ways to improve your score before you apply for finance.

If youve already been trading for a while, bear in mind that the credit worthiness of your business will also be taken into account in your application, as your business will build up its own credit rating. This means you need to make sure that you stay on top of your financial commitments at all times in order to prove to a lender that your business can repay its debts. However, even with a poor credit history, all may not be lost its possible to get bad credit business loans from certain providers, though be prepared to pay higher interest rates for the privilege.

Year And 15 Year Commercial Mortgage Rates

While ten year commercial mortgage rates are available, and range from 4.61% to 5.01% for commercial fixed rate loans. Youre less likely to find 15 year terms in commercial lending, though it does occur from time to time.

If youd like to learn more about how commercial interest rates differ from residential loan rates, contact us directly for a thorough walk through of what you can expect when moving from the residential lending market to the commercial lending sphere.

Don’t Miss: Usaa Auto Loan Calculator

Advantages Of A Commercial Loan

Getting a commercial loan can give small business owners a number of benefits and advantages, especially if theyre starting a new business.

One of their most important benefits is that they generally have lower interest rates than other types of loans. This means business owners can get the funds they need while keeping costs low, allowing them to increase their profits more quickly while they pay the loan off.

Commercial loans also tend to have longer repayment terms, giving business owners more time to pay with smaller regular payments. And they can provide larger sums of money than other types of loans, enabling greater options on spending.

Commercial Mortgage Interest Rates Range From 2% Over Base Rate Upwards

Interest rates for commercial mortgages dont tend to be set based on Loan to Value, as they often are with many residential mortgages.

Commercial mortgage interest rates and fees will be based on a consideration of the following factors:

How long the business has been trading – Businesses that have been established longer will be considered less risk. Unless of course it is a business that the lender feels may have a limited future. For example a video library or cigarette vending machine manufacturer .

New businesses tend to be considered higher risk because when compared to established businesses a higher proportion of new businesses fail.

Don’t Miss: What Loan Options Are Strongly Recommended For First Time Buyers

Choosing The Right Commercial Real Estate Loan

If youre thinking about purchasing or renovating an income-earning property or one to run your business from, one of the first steps youll need to take is to determine which lending option is best suited for your needs.

For many, this decision comes down to traditional small business loans from financial institutions such as a bank or credit union vs. SBA-specific loans. There are, however, other commercial real estate loan options that you may want to consider, including commercial bridge loans, hard money loans, and construction loans.

Today, well take a quick look at some of the most popular commercial lending options, starting with one of the most popular and often most affordable commercial real estate loans the SBA 504 loan.

What Are Commercial Loan Rates Now

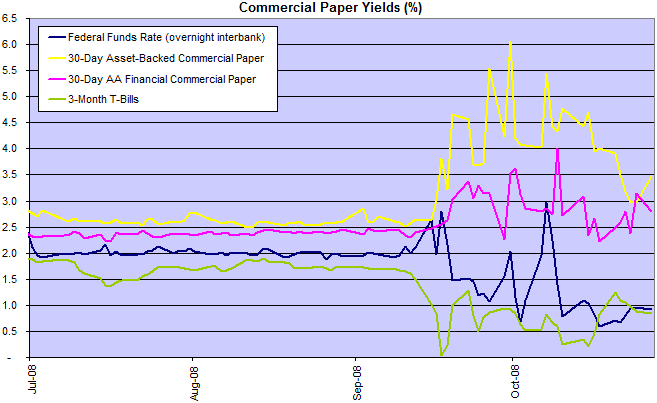

There are several factors that affect the interest rates of commercial loans. Depending on whether the commercial loans are fixed or variable, the interest rates that the receivers will have to pay will either fluctuate or stay steady.

The interest rates of commercial loans is established depending on different factors. On the one hand, the individual factors such as profit, turnover or credit will be analysed by the lenders to determine the risk and the interest rates in most cases. On other hand, economic indicators, such as the Annual Percentage Rate , the London Interbank Offered Rate or the interest rates of government bonds will have a great influence on the interest rates of commercial loans.

The rates of government bonds directly affect the interest rates as lenders use this indicator to compare and set up their prices. These types of bonds are one of the safest, as the government is backing up the product. Thereby, lenders calculate the risk of the market in relation to this interest rates of commercial loans.

Long- and Short-Term Interest Rates UK| Year |

|---|

Source: OECD

What Is a Good Commercial Loan Interest Rate?

The interest rate depends on many factors, influenced by both economic and political situation as well as the borrower’s situation . To achieve a favourable rate, you might wait until there is an economic growth dip when banks are more willing to loan out, or if it is more urgent, you can try haggling by getting offers from several banks.

Recommended Reading: Usaa Consolidate Student Loans

Should You Fix Your Mortgage Rate

This is really an individual decision and its an important one.

Fixed rates are generally taken for between 2-5 years and in the current, low rate climate could be a good choice as rates are unlikely to drop, but they could rise.

That said, fixing your payments usually means tying yourself into early repayment charges for the duration of the fixed rate period. As such, If flexibility is important to you, fixing your monthly costs may be less of a priority if it comes at the expense of reduced flexibility.

What Government Business Loans And Grants Are Available

The Government offers several loans and grants to businesses, particularly those who are just starting out. Perhaps the most well-known is the Start Up Loan scheme, which offers loans of up to £25,000 with terms of between one and five years and a fixed interest rate of 6%. Theres also the Seed Enterprise Investment Scheme , which offers tax relief to investors who buy shares in your company, and there are a range of other grants that are dependent on your location and available through various local enterprise partnerships, such as the New Enterprise Allowance Scheme and Innovate UK. See whats available with the help of the business finance support finder.

A more recent form of support has come from the Recovery Loan Scheme , which has been specifically set up to offer loans to businesses that have been affected by the Coronavirus pandemic. This is available up to 31 December 2021. In a similar vein, SEISS grants are available for self-employed individuals who have either been unable to trade or have seen their income drop due to the pandemic, but must be claimed before 30 September 2021. There may be additional support available as well depending on your industry find out more on the Government website.

Recommended Reading: Auto Loan Calculator Usaa

Types Of Commercial Mortgage Rates

Commercial mortgage rates are either Fixed Rate or Variable Rate.

Fixed rates are set for a period of time before either reverting to the variable rate or re-negotiated. This could be anything from two years, to the end of the loan itself. They tend to be slightly higher than variable rates.

Variable rates change depending on the Bank of England base rate. Lenders will price each fixed mortgage loan rate on individual merits, it is not possible to advise value or reasonable rates.

Four: See If Youre Eligible For Government Support

While you may be tempted to head straight to providers in search of business finance, dont forget the possibility of seeking Government support. This is particularly the case in the current climate, with the UKs Recovery Loan Scheme the replacement to the Coronavirus Business Interruption Loan Scheme accepting applications from those businesses that have been impacted by the Coronavirus pandemic until 31 December 2021. Find out more about how to apply for the Recovery Loan Scheme and see if youre eligible for Covid business loans.

Youll be able to find other Government loans for small businesses in the UK as well, with particular support available for those starting new ventures . There are also various grants that can be applied for, again, make sure to do your research to see what Government business loans and grants are available.

Recommended Reading: Usaa Auto Loan Credit Score

How Do I Get The Best Commercial Mortgage Loan Rates

When customers ask us what are the rates for commercial mortgage loans? we find that its more productive to tell them how to get the best rates, rather than cite average/typical commercial mortgage rates to them. Interest rates are always in flux and can change at any time, not to mention the fact that business lending is usually bespoke.

The most important thing to keep in mind when it comes to getting the best commercial mortgage rates in the UK is that finding a broker with access to the entire market is the place to start. That way, all of the best deals you qualify for will be within reach.

The specialist advisors we work with are whole-of-market and have the expertise to offer insight on your application, and connect you to the provider best positioned to offer a low-interest commercial mortgage to a lender with your needs and circumstances.

Other Prevailing Interest Rates

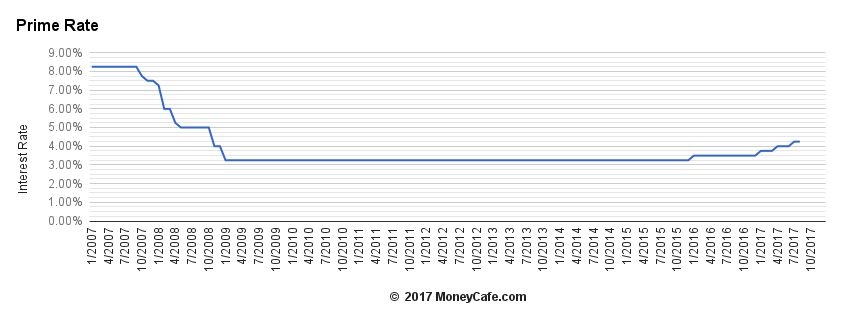

Aside from the prime rate, a commercial mortgages interest rate could also be affected or even set using other prevailing interest rates in the industry. For example, if the Small Business Administration is having issues with the U.S. Treasury, it may have higher than average interest rates on SBA loans, which could affect the costs for lenders handing out commercial mortgages.

Again, this is at least somewhat tied to the state of the broader economy. In times of economic strength, prevailing rates will usually be favorable to drive business.

You May Like: What Percentage Do Loan Officers Make

How Can A Small Business Use A Business Loan

Small business loans can be used for just about anything your business needs, from buying premises to employing staff, and even buying stock or vital equipment. You may need a loan at the outset to set up your company, or further along your journey if youre looking to expand, depending on your business status and your level of capital. You may even want a loan to buy a business outright, allowing you to take over an already-established company. No matter your plans, youll be expected to tell your lender what youre going to use the money for, but they cant dictate what you do with it.

What Is Bank Rate

Bank Rate is the single most important interest rate in the UK. In the news, it’s sometimes called the Bank of England base rate or even just the interest rate.

Our Monetary Policy Committee sets Bank Rate. It’s part of the Monetary Policy action we take to meet the target that the Government sets us to keep inflation low and stable.

Bank Rate determines the interest rate we pay to commercial banks that hold money with us. It influences the rates those banks charge people to borrow money or pay on their savings.

You May Like: Diy Loan Agreement

Interest Rates For Commercial Mortgages

As with regular mortgages, the interest rates for commercial mortgages are essentially the fees you have to pay to borrow money in the first place. Interest is accrued over time with each billing cycle and is represented by a percentage rate.

Its important to remember that commercial mortgages are for buildings with distinctly different purposes than residences. For example, commercial buildings are designed to:

- Take more foot traffic, especially if they are storefronts. This may affect depreciation or wear and tear

- Last for longer, particularly if the property is in a good location

- Take up more space, so theyre often more expensive

All of this results in buildings that are more expensive than normal homes. So they require larger loans for a buyer to complete the purchase. This necessarily affects the interest rates for commercial mortgage loans.

So, what real estate ranges can you expect if you take out a commercial mortgage? It depends on the type of loan you take out and whether you are purchasing the property for commercial business or for investment. Here are some basic examples:

But the above examples are just estimates based on past rates. In truth, commercial mortgage rates can be based on a variety of factors.

Determining The Prime Rate

Default risk is the main determiner of the interest rate that a bank charges a borrower. Because a bank’s best customers have little chance of defaulting, the bank can charge them a rate that is lower than the rate they charge a customer who has a greater likelihood of defaulting on a loan.

Each bank sets its own interest rate, so there is no single prime rate. Any quoted prime rate is usually an average of the largest banks’ prime rates. The most important and most used prime rate is the one that the Wall Street Journal publishes daily. Although other U.S. financial services institutions regularly note any changes that the Federal Reserve makes to its prime rate, and may use them to justify changes to their own prime rates, institutions are not required to raise their prime rates in accordance with the Fed’s.

Read Also: Can I Refinance An Fha Loan

How Do Banks Determine Commercial Bank Mortgage Rates

As touched on above, national and global trends play a big part. But so does your unique financial situation. A wide range of factors including your financial situation, credit history, loan type and terms, and other matters will all determine in large part how your interest rates are impacted. Thats why were unable to offer a universal interest rate guaranteeeach business and situation brings its own set of parameters to the table, and each one can result in a unique interest rate. But throughout our site you can learn about what factors can impact your commercial mortgage loan rates.

How Are Commercial Mortgage Loan Interest Rates Determined

Most business lenders will take the following into account when determining interest rates for a commercial mortgage

- Whether its a commercial investment mortgage or an owner-occupier deal

- The loan to value ratio

- You and/or your businesss financials

- The viability of the investment

- The size of the loan

We outline how each of the above can impact interest rates for commercial mortgage loans in the section below, but you can always make an enquiry to speak with an expert commercial mortgage broker on the phone for more information and access to the best lenders in the business.

Also Check: How Long Before Sba Loan Is Approved