Unsubsidized Vs Subsidized Direct Student Loans

Let us clarify matters first.

For Direct Loans you have subsidized and unsubsidized ones.

What makes one different from the other?

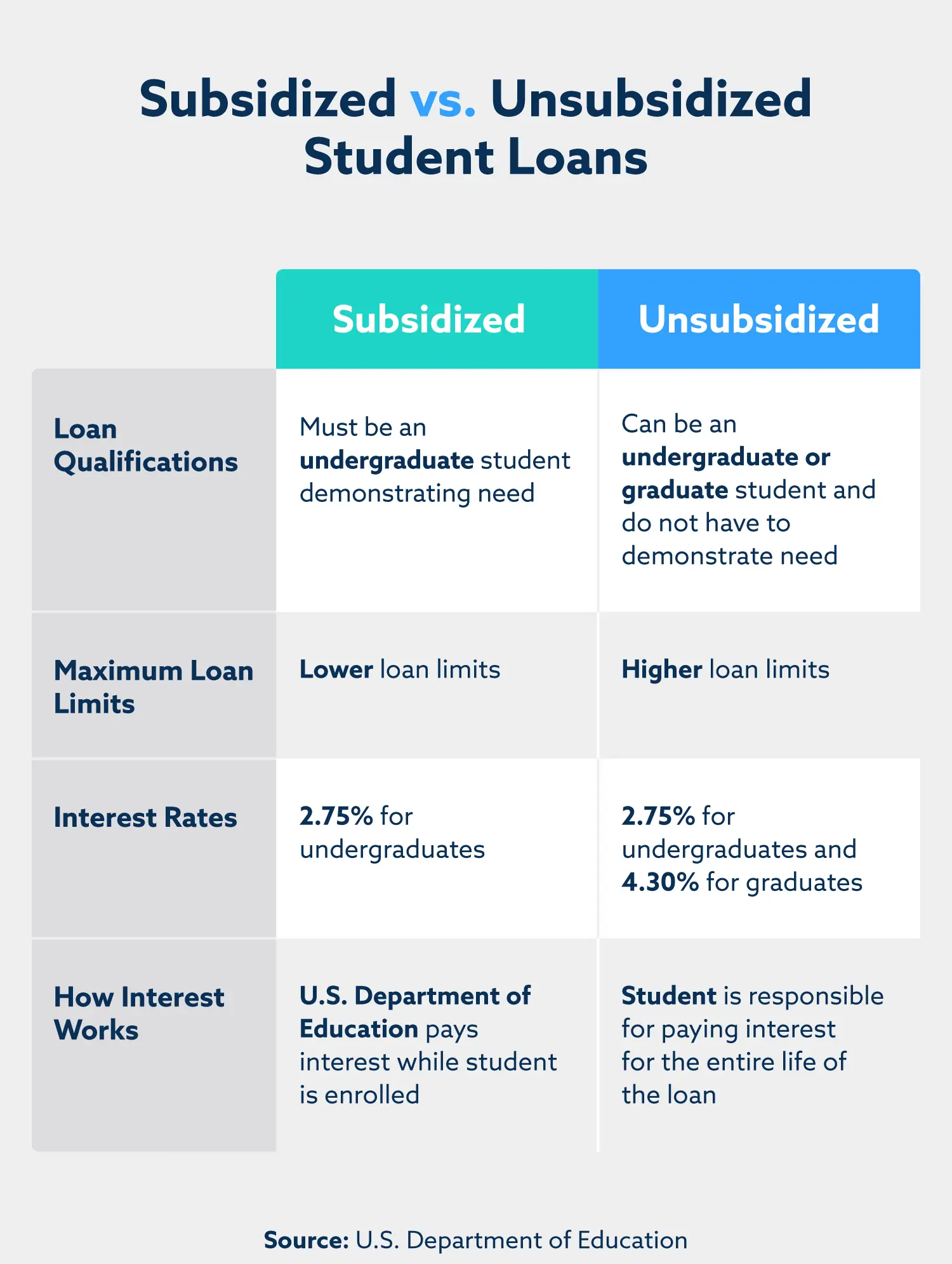

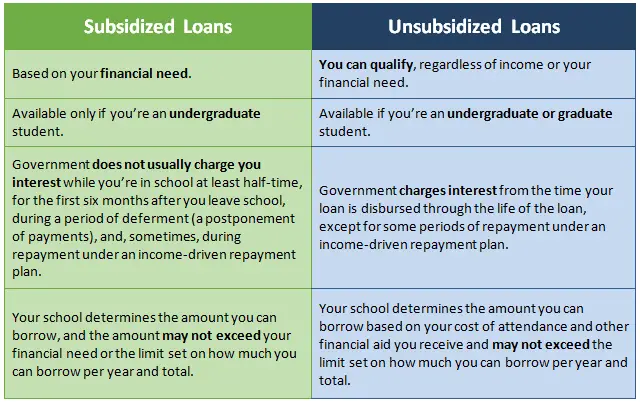

Subsidized direct student loans are open only to those who have financial need.

Application for this type of loan requires you to show that you are financially incapable of paying for your cost of attendance.

In short, subsidized direct loans have a more stringent process.

They are, however, still very helpful.

In contrast, anyone may avail of unsubsidized direct student loans.

This kind of loan does not require any proof of financial incapacity.

Unsubsidized direct student loans are the most popular form of federal loans.

They cater to everyone, but this is not an issue.

Everyone has equal chances of obtaining unsubsidized direct student loans.

Furthermore, the issue of interest varies between subsidized direct loans and unsubsidized ones.

For the former, the government pays the interest of the loan.

On the other hand, the borrower is required to pay the interest for unsubsidized direct student loans.

If the borrower chooses to wait until after graduation, the interest still accrues.

Download this free cheat sheet to repayment plans to make sure you are taking advantage of the best one for you. Learn more here.)

To Receive Your Subsidized Or Unsubsidized Loan:

How To Apply For Federal Direct Subsidized Or Unsubsidized Loans

- Apply for FAFSA

- Florida SouthWestern State College school code is: 001477

- Be enrolled in at least 6 credit hours

- Accept or decline loans offered to you based on your eligibility through FSW Portal

- Complete Entrance Counseling at www.studentaid.gov

- Complete a Master Promissory Note at www.studentaid.gov

Don’t Miss: What Car Loan Can I Afford Calculator

Which To Borrow: Subsidized Vs Unsubsidized Student Loans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read more on federal student loans

-

Government loan rates:Current student loan interest rates

When choosing a federal student loan to pay for college, the type of loan you take out either subsidized or unsubsidized will affect how much you owe after graduation. If you qualify, youll save more money in interest with subsidized loans.

|

What you need to qualify |

Must demonstrate financial need |

Don’t have to demonstrate financial need |

|

How much you can borrow |

Lower loan limits compared with unsubsidized loans |

Higher loan limits compared with subsidized loans |

|

How interest works while you’re enrolled in college |

Education Department pays interest |

|

|

Undergraduate and graduate or professional degree students |

Accepting Or Declining Your Loans

Once you receive your financial aid offer notification, you may be offered Federal Direct Subsidized or Unsubsidized loans or Federal PLUS .

- You may accept or decline the Federal Direct Subsidized or Unsubsidized loans

- You can accept a partial amount or the full loan

If you plan to enroll during the summer term, you may want to reserve a portion of your loans. You will automatically be considered for summer loans if you are enrolled at least half-time, have loan eligibility remaining and meet all other awarding requirements.

Students who are first-time borrowers on or after July 1, 2013 have a time limit on how long they may receive Subsidized loans. The time limit is up to 150 percent of the published length of the borrowers current educational program.

Don’t Miss: Avant Refinance Apply

Federal Direct Plus Loan Application

There are 2 kinds of Federal Direct PLUS Loans:

- PLUS Loan: You can apply for a fixed-rate Direct PLUS Loan if you are a graduate or professional student. Learn more about this loan >

- Parent PLUS Loan: You can apply for a fixed-rate Direct PLUS Parent Loan if you are the parent of a dependent undergraduate student. Learn more about this loan >

The process for applying for eitheror bothof these loans is generally the same. But, there are added considerations parents will need to know.

Here are the 4 steps for applying for Federal Direct PLUS Loans:

Note for parents applying for the Parent PLUS Loan: Note that the student must submit the FAFSA in order for the parent to apply for the Parent PLUS Loan.

Is There A Grace Period For Direct Subsidized Loans

Once you complete your degree program or stop going to school, your grace period begins. This is typically the six month time frame you receive until you have to start making payments on your loan. During this time, no payment is due, but you may make payments if you decide to do so. A six month grace period may be one of the most important tools these loans offer. They allow you the opportunity to complete school, find pursue a job, and start earning money that you can may then use to repay your loans.

You May Like: How Long Does Sba Loan Approval Take

Unsubsidized Direct Student Loans: How To Apply And Eligibility

Unsubsidized direct student loans are one of the options borrowers have to support their college education.

There are many types of loans availableboth federal and private.

Although each type of loan has certain eligibility requirements, they also fulfill different needs.

Find out if Unsubsidized direct loans are for you.

Repaying Federal Direct Loans

Youll begin repaying your loans six months after you graduate or drop below half-time status. First, youll be asked to complete exit counseling, which will provide you with information on repaying your loans. Well send you email with the details when its time for you to go through exit counseling.

Read Also: Usaa Rv Rates

Loan Entrance Counseling & Master Promissory Note For Direct Subsidized/unsubsidized Loans

After you accept a Federal Direct Subsidized or Unsubsidized Loan as part of your financial aid, our office will continue the loan process by submitting the accepted Federal Direct Loan information to the Federal Common Origination and Disbursement system for origination.

However, for first-time borrowers, an entrance counseling session is required and a valid Master Promissory Note for Direct Subsidized/Unsubsidized Loans must also be on file with the COD before our office can make any Federal Direct Loan disbursements to students.

After you have successfully completed your entrance counseling session and MPN, any future Federal Direct Loan offers that you accept will be linked to your original, completed MPN. This MPN is valid for up to 10 years from the date the first loan disbursement was made.

How Can You Apply For A Federal Stafford Loan

If you are interested in applying for a Federal Stafford Loan, youll need to submit your Free Application for Federal Student Aid . This application becomes available on October 1st each year. While you can submit it through June 30, its best to send it in as soon as possible because there are some types of federal aid that are limited.

Youll provide financial details on the FAFSA that are necessary to determine if you can qualify for Subsidized and Unsubsidized Stafford loans. Youll find out if you qualified, and how much aid youre eligible for when you receive a financial aid award letter from colleges you applied to attend.

Remember, always max out Stafford Loans before taking on other kinds of debt as these loans have the best borrower protections and terms for most student loan borrowers. Always keep in mind how to borrow student loans responsibly, too.

Don’t Miss: Can I Refinance My Sofi Personal Loan

Who Can Get Federal Student Loans

Anyone attending a four-year college or university, community college, or career school can apply for federal student aid, including:

- Grants, which dont need to be paid back

- Work-study, which is part-time work that allows students to earn money while in school and

- Federal student loans

Most federal aid is decided based on financial need. Students must submit the FAFSA® and meet several other basic eligibility requirements to qualify.

Parents may also apply for federal student loans, called Federal PLUS Loans. These loans can also be applied toward the students educational costs.

Types of Federal Student Loans| for Loans Disbursed Between July 1, 2021 and June 30, 2022 | |||

| Direct Loan for Dependent Undergraduates | Direct Loan for Independent Undergraduates | Direct Loan for Graduates | |

|---|---|---|---|

| No |

1Limit of combined subsidized and unsubsidized funds. back2Additional unsubsidized eligibility available for student whose parent is unable to obtain a PLUS loan. back

Interest On Subsidized And Unsubsidized Loans

Federal loans are known for having some of the lowest interest rates available, especially compared to private lenders that may charge borrowers a double-digit . Loans disbursed on or after July 1, 2021, and before the July 1, 2022 school year, direct subsidized and unsubsidized loans carry a 3.73% APR for undergraduate students.

The APR on unsubsidized loans for graduate and professional students is 5.28%. And unlike some private student loans, those rates are fixed, meaning they dont change over the life of the loan.

One other thing to note about the interest: While the federal government pays the interest on direct subsidized loans for the first six months after you leave school and during deferment periods, youre responsible for the interest if you defer an unsubsidized loan or if you put either type of loan into forbearance.

Income-driven repayment plans can mean lower monthly payments, but you might still be making them 25 years from now.

Read Also: Oneaz Auto Loan

Student Loans And Rising Education Costs

Having a plan for how youll pay for college is pretty important. Thats mostly because the tuition continues rise:

- According to The College Board, tuition and fees for a public four-year institution in the academic year of 198990 were $3,510, in 2019 dollars.

- For the academic year 20192020, those costs exceeded $10,000. In the same time span, tuition and fees for a private four-year institution rose from $17,860 to nearly $37,000.

- In the last 10 years alone, tuition and fees for four-year public schools have increased $2,020, while costs for four-year private schools have grown $6,210.

But as we mentioned, total costs include a lot more than tuition, and these other cost items have shown the same upward trend:

- Data from the U.S. Bureau of Labor Statistics shows college textbooks costs increased 88% from 2006 to 2016.

- Average dorm costs at all postsecondary institutions were $6,106 in 2017, per data from the National Center for Education Statistics . Boarding costs, including meal plans, were $4,765. A decade earlier those costs, respectively, were $4,777 and $4,009.

- Costs rose 24% for students living off-campus at public four-year universities between 2000 and 2017, according to The Hechinger Report.

The growth in college costs has occurred rapidly, outpacing wagegrowth. This has made a degree unaffordable for many. Thats where student loans come in.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Accept The Loan In Mynevada

After receiving your Award Letter, review it in MyNEVADA. Consider your budget and anticipated expenses, then decide how much of the loans offered to accept. The next step is to accept your loan in MyNEVADA.

Remember, you may accept your loans 48 hours after the following occur:

- Accepted admission to the University

- Completed the supplemental admission questionnaire

- Paid advanced registration fee

Reason For Taking Federal Student Loans

Federal student loans are an investment in your future. You should not be afraid to take out federal student loans, but you should be smart about it.

Federal student loans offer many benefits compared to other options you may consider when paying for college:

The interest rate on federal student loans is fixed and usually lower than that on private loansand much lower than that on a credit card!

You dont need a credit check or a cosigner to get most federal student loans.

You dont have to begin repaying your federal student loansuntil after you leave college or drop below half-time.

If you demonstrate financial need, the government pays the interest on some loan types while you are in school and during some periods after school.

Federal student loans offer flexible repayment plans and options to postpone your loan payments if youre having trouble making payments.

If you work in certain jobs, you may be eligible to have a portion of your federal student loans forgiven if you meet certain conditions.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

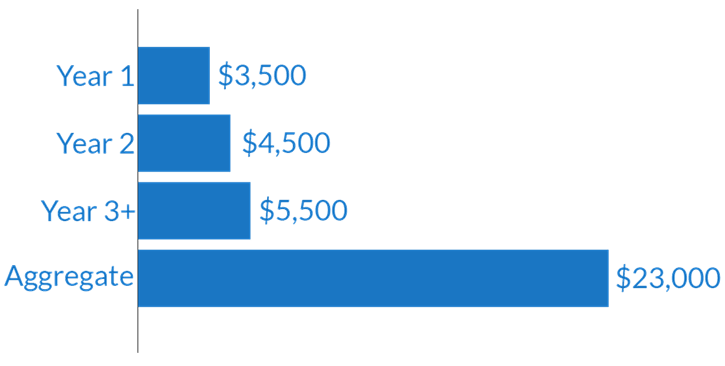

Subsidized And Unsubsidized Loan Limits

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

What Is The Borrowing Process For Subsidized Loans

For students who wish to be considered for subsidized loans, the first step is to complete the FAFSA. The schools financial aid office may then determine the eligibility for the program. Students typically receive an award letter outlining their financial aid information. They also state the amount a student may borrow.

Students may not borrow more than they need to pay for their education. They may not borrow more than the maximum loan amount allowed for the type of study the student is receiving either. These loans typically have a fixed interest rate. It does not change from the first day until the final payment is made. No payment is typically made by the borrower during their time in school. Students may choose to make payments during this time.

The students award letter may also outline how much direct unsubsidized funds the student qualifies. It is possible to use both types of loans to cover the cost of education. The loan limits apply to the total amount of both direct student loan options.

Don’t Miss: Loans Without Proof Of Income

Interest Rates And Processing Fees For Subsidized And Unsubsidized Loans:

- 2.75% fixed interest rate for undergraduate loans disbursed between July 1, 2020 and June 30, 2021

- 3.73% fixed interest rate for undergraduate loans disbursed between July 1, 2021 and June 30, 2022

- 1.057% origination fee rate for undergraduate loans disbursed on or after October 1, 2020 and before October 1, 2021

Direct Unsubsidized Loan Eligibility

Most students who qualify for federal aid are eligible to take out a Direct Unsubsidized Loan.

Your familys financial circumstances do not matter. Even wealthy families can qualify.

Required:

U.S. citizen, national, or eligible non-citizen

Have received a high school diploma or the equivalent

Enrolled at least half-time in an eligible degree or certificate program

Not in default on any existing federal student loans

Meet general eligibility requirements for federal student aid

Not Required:

Separate loan application

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Direct Plus Loans For Parents

Parents may choose to offset the cost of higher education by obtaining loans to help pay for those expenses.

Benefits: PLUS loans can help cover the educational expenses not met by federal student aid. Additionally, parents can defer payment on loans until after the student’s graduation. As these loans are not need-based, parents don’t need to demonstrate financial need to apply.

Eligibility: Eligibility depends on a modest credit check. An endorser may be required if the borrower has adverse credit. Some schools require that a FAFSA be completed before a PLUS loan can be awarded, but some do not.