New To Financial Aid Start With The Basics

Federal Direct Subsidized and Unsubsidized Loans

Subsidized and unsubsidized loans are federal student loans for eligible students to help cover the cost of higher education at a four-year college or university, community college, or trade, career, or technical school. The U.S. Department of Education offers eligible students at participating schools Direct Subsidized Loans and Direct Unsubsidized Loans.

Federal Direct loans do not require a credit check.

What Is An Unsubsidized Loan

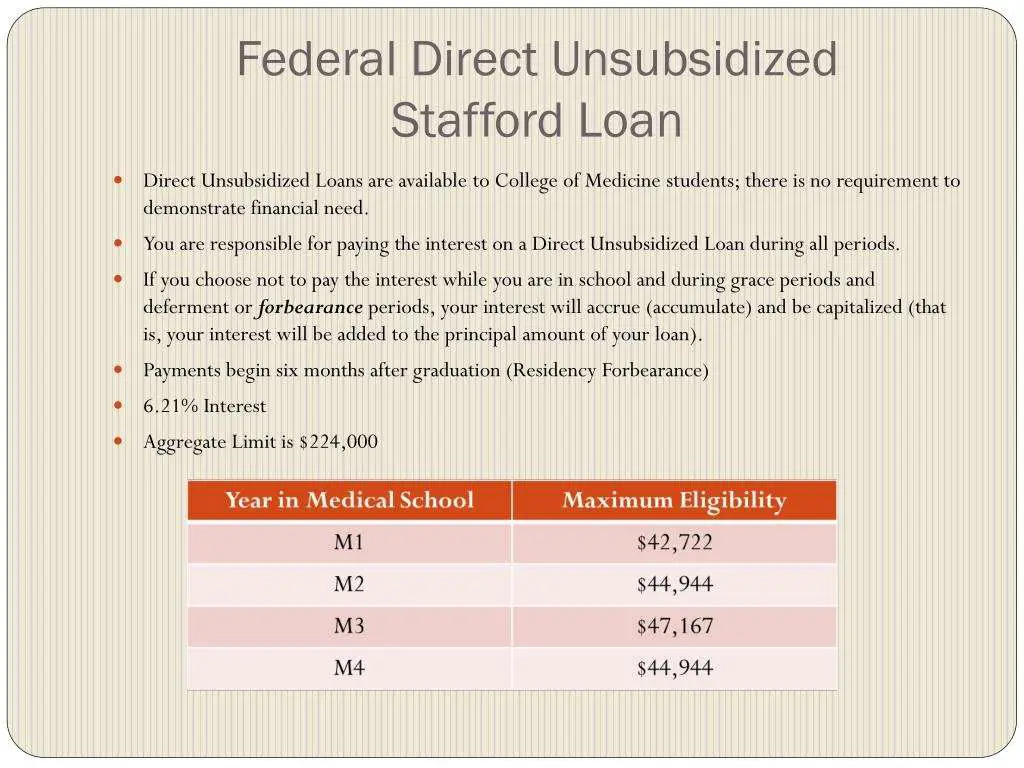

An unsubsidized loan, which is also referred to as a direct unsubsidized loan or unsubsidized Stafford loan, is a low-cost, fixed-rate federal government student loan that can benefit both undergraduate and graduate students. Financial need is not mandatory, which implies that students from wealthy families can still apply for the direct unsubsidized loans.

If you take an unsubsidized student loan, pay all interest accrued in the entire schooling period. It has no grace period and interest will accrue regardless of deferment periods. It differs from subsidized loans in different aspects. Subsidized loans are only meant for undergraduate college students still in school pursuing their courses and in need of help to pay for their tuition fees and related expenses. The loan is determined by the cost of the attendance minus the expected family contribution and other forms of financial aid the student is expected to receive, for example, scholarships and grants.

To qualify for an unsubsidized loan, you must first visit and complete the Free Application for Federal Student Aid . It is free to apply for FAFSA. If you qualify for the unsubsidized loan, your school notifies you.

To accurately know what is an unsubsidized loan, know what costs are covered. Unsubsidized loans cover for the cost of attendance, which includes:

- Room and board

Dont Miss: How Do I Find Out My Auto Loan Account Number

How To Apply For A Federal Stafford Loan

There are two types of Stafford Loans: subsidized and unsubsidized. You may be eligible for one or both types, as shown on your award notification. Freshmen may borrow up to $3,500, sophomores up to $4,500, juniors and seniors up to $5,500, and graduate students up to $20,500 annually. In order to accept your loan eligibility please return your signed award notification to our office. If you wish to borrow less than the amount you were awarded please indicate the accepted amount on your award letter. Federal regulations require the loan proceeds be disbursed in two equal amounts.These amounts will be disbursed no more than 10 days before the beginning of the enrollment period for the student. The Department of Education will withhold 1.059 percent in fees from the previous listed amounts.

Additional unsubsidized amounts up to $4,000 and $5,000 may be applied for upon your parents denial of a PLUS loan.

Elon will now participate in the Direct Loan program administered by the Department of Education. First-time borrowers are required to complete a Master Promissory Note with the Department of Education at studentaid.gov.

If you are a first time Stafford borrower you also will need to complete your Stafford Loan Entrance Counseling at studentaid.gov. This is a federal requirement to receive a Stafford loan, and your loan cannot be processed until it is complete.

Don’t Miss: How Long Does The Sba Take To Approve Ppp Loan

How Do You Pay Back Subsidized Loans

You can pay back your subsidized loan anytime. Still, most students begin paying their loans back after they graduate, and the loan payment is required six months after graduation, known as the grace period when the government continues to pay the interest due on the loans.

When your loan enters its repayment phase, your loan servicer will place you on the Standard Repayment Plan, but you can request a different payment plan at any time. Borrowers can make their loan payments online via their loan servicers website in most cases.

Also Check: Does Fha Loan On Manufactured Homes

Can I Buy A Car With Fafsa Money

You cannot use student loans to buy a car. You also cant pay for the purchase of a car with financial aid funds. In particular, a qualified education loan is used solely to pay for qualified higher education expenses, which are limited to the cost of attendance as determined by the college or university.

You May Like: Refinance My Fha Loan

Compare Your Financial Aid Offers

The financial aid offices at the colleges you apply to will use the information from your FAFSA to determine how much aid to make available to you. They compute your need by subtracting your EFC from their cost of attendance . Cost of attendance includes tuition, mandatory fees, room and board, and some other expenses. It can be found on most colleges’ websites.

In order to bridge the gap between your EFC and their COA, colleges will put together an aid package that may include federal Pell Grants and paid work-study, as well as loans. Grants, unlike loans, do not need to be paid back, except in rare instances. They are intended for students with what the government considers “exceptional financial need.”

Award letters can differ from college to college, so it’s important to compare them side by side. In terms of loans, you’ll want to look at how much money each school offers and whether the loans are subsidized or unsubsidized.

Direct subsidized loans, like grants, are meant for students with exceptional financial need. The advantage of subsidized student loans is that the U.S. Department of Education will cover the interest while you’re still at least a half-time student and for the first six months after you graduate.

Direct unsubsidized loans are available to families regardless of need, and the interest will start accruing immediately.

Payments and interest on these loans was suspended in 2020 during the economic crisis, with both resuming in early 2022.

The Duration Requirements And What Happens If You Miss One Academic Year

For you to qualify for the forgiveness benefit, you need to teach for five years consecutively in a low-income school. The government determines which school classifies as low-income schools. That means, before you teach in a school, you have to make sure that the school meets the standard set by the federal government.

For you to know if a school is a low-income school, you have to view the Department of Educations list, which is on their official website. Sometimes, the school may qualify as a low-income school, but they might not state on the record. In such instances, contact the State Education Agency to find out why the school is not part of the list.

If you fail to complete an academic year during your five-year consecutive period, there is a slim chance you can still qualify for the forgiveness benefit, if:

You May Like: How Much Interest Will Accrue On My Student Loans

Unsubsidized Direct Student Loans: How To Apply And Eligibility

Unsubsidized direct student loans are one of the options borrowers have to support their college education.

There are many types of loans availableboth federal and private.

Although each type of loan has certain eligibility requirements, they also fulfill different needs.

Find out if Unsubsidized direct loans are for you.

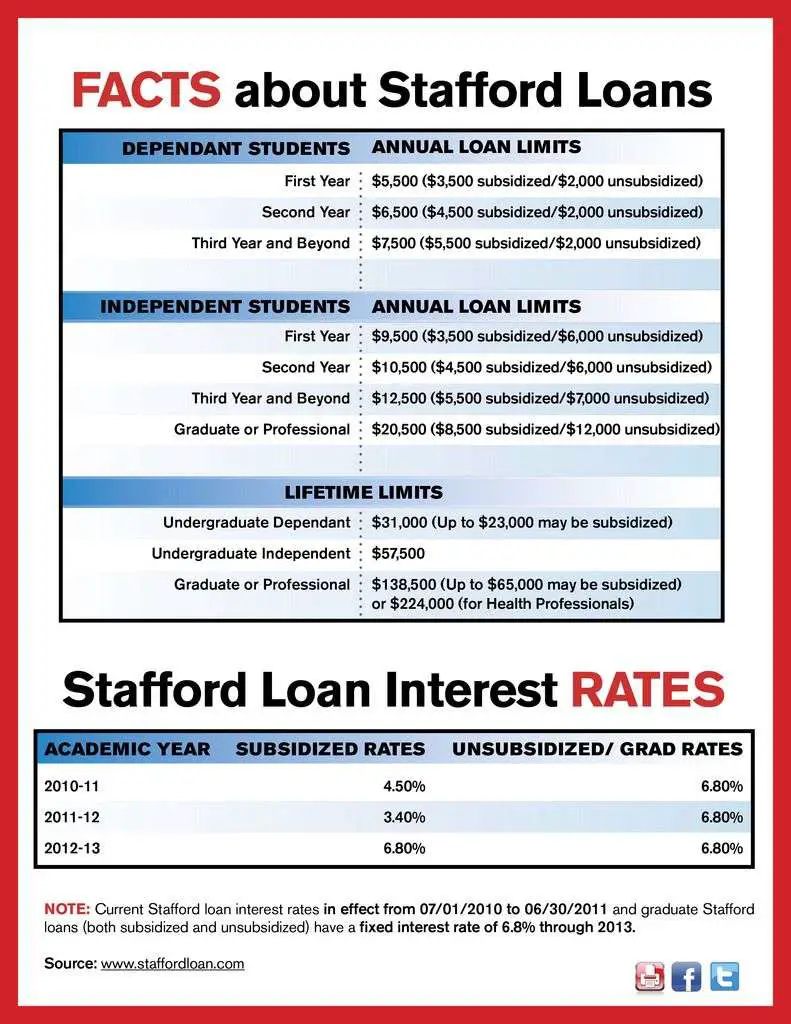

Subsidized And Unsubsidized Loan Limits

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

Don’t Miss: Usaa Auto Loan Rates Credit Score

How To Apply For Federal Student Loans For College

Applying for a federal student loan is free. All you need to do is complete the . In addition to federal student loans, the FAFSA also determines your eligibility for other federal student aid like grants and work-study. You need to submit the FAFSA every year youre enrolled in college to receive federal student aid.

Free money tip

Want to pay less for college? File the FAFSA® to see how much financial aid you can get. Sallie Mae and our partner Frank make applying easy with a faster, simplified process and step-by-step guidanceand it’s free.

The easiest and fastest way to file the FAFSA is online. Your application will be processed within 3-5 days. You can also mail in a paper application, but processing it will take about 7-10 days.

Submitting the FAFSA is totally free. If youre asked to pay, that means youre in the wrong place.

Subsidized And Unsubsidized Stafford Loans

Another set of terms you need to know when youre applying for financial aid regards subsidization. Federal loan subsidization is the process by which the government pays the interest on your loan.

There are two different types of Stafford Loanssubsidized and unsubsidizedand its important that you know which type of loan youre qualified to receive:

Also Check: Fha Refinance Pmi

Evaluate Costs/benefits Of Unsubsidized Loans

If a students parents have significant investments held in non-retirement accounts and/or have relatively high income, a family may not be eligible for subsidized loans, work-study programs, or need-based scholarships. But all families should qualify for unsubsidized loans. Students and their parents may consider the cost of borrowing to decide whether theyll accept these loans to pay for college.

How Much Can I Borrow With A Stafford Loan

Your school decides the size and types of Stafford Loans you can receive and may offer you Stafford Loans as part of its financial aid package, along with grants or work-study options.

However, the government sets maximums on the amount you can borrow each year in Stafford Loans, as well as on how much you can borrow over the entire course of your education.

These specific limits vary depending on your year in school, the type of school in which youre enrolled, and your parents ability to obtain their own federal loans to help pay for your education.

The following chart summarizes Stafford loan limits:

| Annual loan limits |

|---|

You May Like: Can You Refinance Sallie Mae Student Loans

How To Apply For A Federal Direct Unsubsidized Loan

Please allow three weeks for the processing of your loan request.

Requesting Your 2021-22 Loan :

Step 2: Visit our Application Page.

Step 3: Complete the Appropriate Loan Request Form

Details to keep in mind when completing your loan request:

- The number of credits for which you plan to enroll helps determine your budget and loan eligibility.

- The University may decrease your loan amount if your actual enrollment is fewer credits than the number you reported on your loan request.

- If you choose a loan period that includes more than one term, your total loan amount will be spread evenly across the number of terms you choose

- If you would like to make any changes to your request, email us at from your Fordham Email Address.

- Recommended Subject Line “Federal Unsubsidized Loan Request Adjustment”

- Recommended Body: “Please my Federal Unsubsidized Loan by for the “

Cost of Attendance

Cancellation/discharge Of Stafford Loans

Note that details provided on this page reference older loans made under the Federal Family Education Loan Program . All new federal student loans come directly from the U.S. Department of Education under the William D. Ford Federal Direct Loan Program . For information regarding Federal Direct Loans, refer to the Loans page of ED’s Federal Student Aid website or contact the college’s financial aid office.

Your entire student loan, or a portion of your obligation, may be cancelled or discharged for several reasons. Contact your loan holder to obtain the forms needed to apply for loan cancellation based on the following conditions.

If you feel you might qualify for loan forgiveness for reasons other than those listed here, refer to the page.

You may qualify for total or partial loan cancellation/discharge if:

- The school closed within 90 days of your enrollment and you were unable to finish your program of study

- The school did not properly qualify your status before you began studies

- You did not receive a refund that was due to you.

- Your signature was forged

- The school did not properly evaluate your ability to benefit from the coursework before you began your studies

Recommended Reading: Usaa Auto Refinance Rates

What Are The Different Types Of Federal Stafford Loans

The type types of Stafford Loans include the following:

- Subsidized Stafford Loans: These are only available for undergraduates. Students must show financial need to qualify for them, after considering both the students income as well as family financial resources unless the student is independent.

- Unsubsidized Stafford Loans: Both undergraduate students and graduate students can take out one of these loans from the Department of Education, even without demonstrated financial need.

Subsidized Stafford Loans can be far more affordable to repay than Unsubsidized Stafford Loans. Thats because, as the name suggests, the government subsidizes interest on them. You dont have interest accruing on your subsidized loans while youre in school, during the six-months after you graduate when you have a grace period before payment is due, or if you can qualify to have payments deferred for an eligible reason after graduation.

When the government subsidizes interest, your principal balance doesnt get bigger even if you arent making payments. This makes repayment much more affordable, particularly because you avoid capitalization that occurs when unpaid interest accruing on your student loan is added onto your principal. If this capitalization happens, as it does on Unsubsidized Stafford Loans and private student loans if payments dont cover interest, you end up paying interest on interest.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Manufactured Home Va Loan

Loan Entrance Counseling & Master Promissory Note For Direct Subsidized/unsubsidized Loans

After you accept a Federal Direct Subsidized or Unsubsidized Loan as part of your financial aid, our office will continue the loan process by submitting the accepted Federal Direct Loan information to the Federal Common Origination and Disbursement system for origination.

However, for first-time borrowers, an entrance counseling session is required and a valid Master Promissory Note for Direct Subsidized/Unsubsidized Loans must also be on file with the COD before our office can make any Federal Direct Loan disbursements to students.

After you have successfully completed your entrance counseling session and MPN, any future Federal Direct Loan offers that you accept will be linked to your original, completed MPN. This MPN is valid for up to 10 years from the date the first loan disbursement was made.

How Compound Interest Works

Compound interest is charged based on the overall loan balance, including both principal and accrued but unpaid interest .

So, compound interest involves charging interest on interest. If the interest isnt paid as it accrues, it can be capitalized, or added to the balance of the loan.

For example, if the loan balance starts at $10,000 and the interest due after one year is capitalized, the new loan balance becomes $10,500 and the interest accrued in year two is $525 .

You May Like: Do Mortgage Loan Officers Get Commission

What Is A Low

The Federal Government determines which schools count as Low-Income Schools, so even if you think that youre serving at a qualifying institution, youll have to make sure that they agree.

To find out if your school qualifies for the Low-Income School requirement, youll need to view the annual U.S. Department of Educations official list of Low-Income Elementary and Secondary Schools.

You can find the current 2017 list of low-income schools online here, but you will need to search for the year or years that you have been employed as a teacher to make sure that the school qualifies during the time period that you were teaching.

If you think your school should qualify, but dont see it on the list, the Federal Government requests that you contact the State Education Agency Contact for your state to find out why they havent been included in the list.

To do that, use the list of State Education Agency Contacts, here.

Determine Your Dependency Status

Another important piece of information you need to know going forward with your FAFSA and applying for a Stafford Loan is whether youre considered a dependent or independent student. Most traditional students are considered dependent, while many students over the age of 24 are considered dependent. Your status as independent or dependent can change the amount of money youre qualified to borrow with a federal loan.

Don’t Miss: Capital One Auto Loan Interest Rates