Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How To Better Understand A Loan Origination Fee

The origination fee definition is straightforward it covers the costs of the loan process, which makes it easier for all parties involved. When you ask for a mortgage loan, you might use a calculator to add up all the costs. For example, if you have a 30-year fix on a long-term loan, the calculator makes it easier to plan months and years in advance. You should also include interest rates when you perform these calculations with a lender.

Be mindful not to fall for junk fees, which are unnecessary add-ons. They might enclose these fees right before a mortgage closure, which makes it difficult to go back on the deal. Its not a pleasant situation to be in, especially with out-of-nowhere fees. Make sure your lender lets you know everything upfront.

Ask For Seller Concessions

You might be able to get your loan origination fee included in closing costs covered by the home seller. That way, the seller of the home covers these costs instead of you. However, depending on the situation, you might need to increase your offer price a little bit. Additionally, make sure that this condition appears in the purchase agreement.

Recommended Reading: What Happens To My Parent Plus Loan If I Die

Breaking Down The Loan Origination Fee

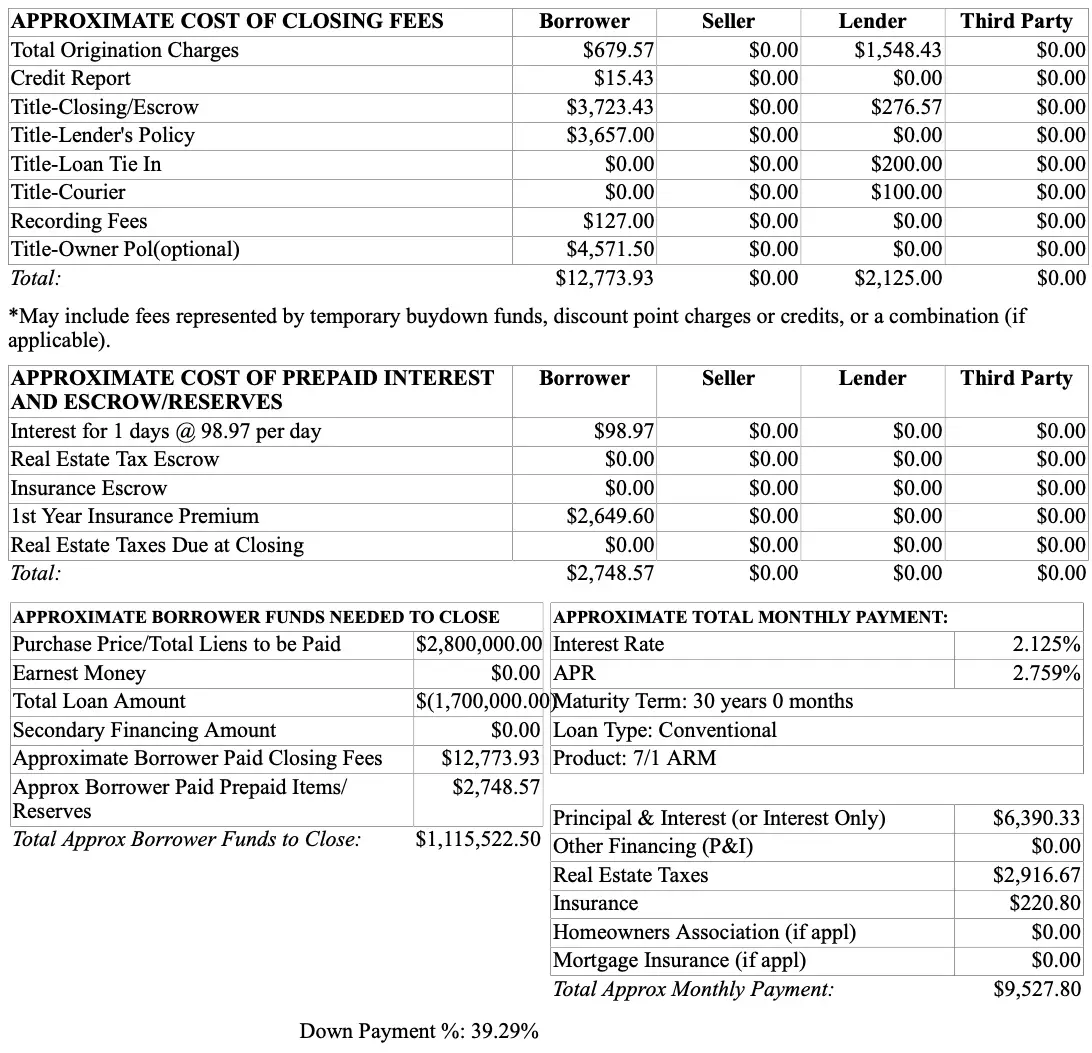

This is a screenshot of an actual Good Faith Estimate , which displays the adjusted origination costs.

In the example above, the loan origination charge is $1,840 on a $348,000 loan amount, which makes the fee roughly half a percentage point .

This particular broker charged a $250 origination charge, a $695 processing fee, and an $895 underwriting fee, which combined make up the $1,840 total.

Note that these fees are represented as one lump sum on the Good Faith Estimate, so ask for a breakdown to see what youre actually being charged. Or refer to your Fees Worksheet.

The corresponding Fees Worksheet pictured above breaks down the origination charges so you can better understand what youre being charged and why.

Although not pictured here, lenders typically display a percentage on the same line as the Loan Origination Fee, such as 1.000%, if applicable. This will give you a better idea as to what youre actually being charged.

Now lets refer to the top screenshot again. Our borrower also received a lender credit of $3,076.32, which offset the entire origination charge and more, resulting in an adjusted origination charge of -$1,236.32.

This amount was put toward other closing costs, reducing the borrowers out-of-pocket expenses.

Whats Included In Origination Charges

This category includes lender fees for underwriting and processing your loan. Every lender is slightly different in how they label their fees in this section, so the names you might see in this section are:

- Underwriting fee

- Application fee

Some lenders combine all of these into one single fee, and some break them out.

One thing all lenders will show consistently here is whether theyre charging a percentage of the loan amount as an additional fee on top of the fees noted above. These fees are also known as points, and should be labeled as points on the Loan Estimate and Closing Disclosure.

Points are an extra fee you pay for a lower rate. You arent required to pay points, so ask your lender to explain the rate difference between points and no-points options, and also ask them to tell you how long it will take the rate savings from paying points to repay the cost of the points.

Don’t Miss: What Is Fha And Conventional Loan

When Do You Pay Origination Fees

Origination fees are due at closing and will be included in your itemized closing disclosure document along with other closing costs such as a title search. As the buyer, you will be responsible for covering this expense. While other mortgage processing expenses paying for an appraisal report and putting down earnest money, for instance will come before the origination charge, its still considered an upfront fee.

Should You Buy Discount Points

“With mortgages, a borrower can also pay a point, or a fraction of a point, to buy down their interest rate,” said Snow. These are often referred to as discount points.

One discount point will generally cost you 1% of your total amount. So for a $200,000 mortgage loan, one discount point would raise your origination fee by $2,000 . And two discount points would raise your origination fee by $4,000 .

You can typically expect to earn a 0.25% interest rate deduction for every point that you pay. So if you were originally quoted an interest rate of 4.50%, paying for two discount points could drop your rate by 0.50% to a flat 4.00%.

If you’re trying to decide whether or not paying discount points would be worth it, consider how long you plan to stay in your home.

For example, let’s say you paid $2,000 for a discount point and your lower APR will save you $50 per month on your mortgage. In that case, it will take you 40 months to break even on the decision .

The longer you plan to stay in your home, the more rewards you’ll get out of paying for discount points. But short-term homeowners may want to stick with their original quoted rate.

Recommended Reading: How Much To Loan Officers Make

What Is An Origination Fee

An origination fee is what a lender charges in order to set up the loan.

Some lenders split this into a processing fee and an underwriting fee . For others, this is one fee.

You may think that a lender makes money off the interest charged with each monthly payment, but this is increasingly not the case. Most mortgages are sold shortly after closing to one of the major mortgage investors who then makes them available on the bond market. This provides easy liquidity rather than lenders having to wait 30 years for the loan to pay off.

The money a lender makes is generally based on the origination fee and any money collected by servicing the loan taking your payment and handling the escrow account.

How Much Are Closing Costs For A Buyer

Not every buyer will pay the same amount in closing costs. Some costs are lender requirements, some are government requirements and others may be optional will vary depending on the situation. What youll need to pay for will depend on where you live, your specific lender and what type of loan you take.

At least 3 days before you attend your closing meeting, your lender will give you a document called your Closing Disclosure. This will list out every closing cost you need to cover and how much you owe. Here are some of the most common closing costs you might see on your disclosure.

Read Also: How To Eliminate Student Loan Debt

Average Closing Costs For A Mortgage

See Mortgage Rate Quotes for Your Home

A home purchase at the national median value of $198,000 requires an average of $7,227 in mortgage closing costs. We arrived at this figure by collecting mortgage estimates from several major banks and direct lenders. Major components of the closing costs on a home loan include prepaid taxes and interest, as well as discount points and service charges.

Ways To Avoid Paying A Loan Origination Fee For Your Mortgage

Here are the key ways you can minimize this fee on your home loan. Mortgages 101

A house is usually one of the biggest purchases a person will make in his lifetime, which means the loan taken out for it will probably also be one of the biggest. If youre applying for a mortgage or deed loan, as a potential borrower, you need to understand all the fees associated with your loan and shop around for the best offers. One of these fees is the loan origination fee.

Your loan origination fee is typically a percentage, usually about 1 percent, of the total loan amount, said Betty Locher, senior loan officer at Regions Mortgage in St. Petersburg, Fla. The loan origination fee is how the lender or loan originator makes his money basically, the cost of a loan origination fee is used to compensate the lender for handling and underwriting your loan and any other tasks he has to perform, Locher said.

Loan origination fees are normally negotiated in your loan estimate and typically will not increase at closing. The lender will give you three days to compare your closing disclosure with the loan estimate to see if any numbers have changed. But before you get to the closing disclosure stage, make sure you have negotiated whatever you can and that includes the loan origination fee. You can angle for a better deal, as long as you know what cards youre holding.

Recommended Reading: What Is The Current Va Loan To Value Ltv Rate

What Are Origination Fees

An origination fee is a fee the lender charges for a new loan. Its a one-time fee charged at the time the loan closes. The fee covers the costs the lender incurs for processing and closing your loan.

How much a lender charges and what the fee is called varies based on the type of loan and the lender. A traditional origination fee is usually calculated as a percentage of the loan amountand that percentage depends on the type of loan.

There are a variety of other origination fees that lenders may charge which are a flat amount rather than a percentage of the loan amount. Other fees that lenders may charge to originate a loan could be called processing, underwriting, administration, or document preparation fees.

Who Pays Closing Costs

Both buyers and sellers pay closing costs. However, the buyer usually pays most of them. You can negotiate with a seller to help cover closing costs, which are called seller concessions. Seller concessions can be extremely helpful if you think youll have trouble coming up with the money you need to close. There are limits on the amount that sellers can offer toward closing costs. Sellers can only contribute up to a certain percentage of your mortgage value, which varies by loan type, occupancy and down payment. Weve broken this down below:

Recommended Reading: How Much Do You Need Down For Fha Loan

Getting The Best Mortgage Rates

Regardless of which option is best for you when it comes to fees, there are many other general tips we can give you to get the best rate on your mortgage. These include:

- Checking your credit score and working to improve it. As a result, lenders are understandably more confident lending to lower-risk buyers.

- Saving up a bigger down payment. This may help you negotiate a smaller lender origination fee, and it will also reduce the overall interest you pay on your loan.

- Increase your income and decrease your debt. If vetting indicates you are reliable financially, you may be able to barter for a lower rate.

- Keep an eye on mortgage rates, as they fluctuate constantly. Ask your lender to lock in a rate when they move in your favor.

- If youre buying your first home, find out if there are any programs that you are eligible for to make the process less costly.

How To Save On Origination Fees

Mortgage origination fees can be negotiable, but a lender cannot and should not be expected to work for free. Obtaining a reduced origination fee usually involves conceding something to the lender. The most common way to lower the fee is to accept a higher interest rate in return.

Effectively, the lender earns its commission from the YSP instead of the origination fee. This is executed through something called “lender credits.” They are calculated as negative points on a mortgage. As a general rule, this is a good deal for borrowers only if they plan to sell or refinance within a few years because on longer mortgages what you cumulatively pay in interest will generally outstrip what you would have paid in an origination fee.

You can negotiate to have the home seller pay your origination fees. This is most likely to happen in the event that either the seller needs to sell quickly or is having trouble selling the home. You can also negotiate with the lender to have the origination fee reduced or waived. This may not involve accepting a higher interest rate if, for example, you have shopped around and can present evidence of a better offer from a competing lender.

Also, if the mortgage is for a large amount and long term and you have excellent credit and a safe source of income, a lender may find your business attractive enough to go easy on fees.

Also Check: How Many Years After Foreclosure For Conventional Loan

What About Hidden Origination Fees

There is a hidden fee you need to know about before taking out a mortgage loan. Many mortgage companies charge you an origination fee, and then take a hidden fee paid by the lender on top of it. This hidden fee drives up your mortgage payment unnecessarily and often doubles even triples the compensation your broker receives for their work. You get stuck paying as much as a hundred dollars or more per month more than you need to and the broker doubles their take at your expense.

What is this hidden fee the Secretary of Housing and Urban Development blames for overcharging homeowners in the United States to the tune of sixteen billion dollars this year alone? I am of course talking about Yield Spread Premium. Dont worry if youve never heard of Yield Spread Premium as most homeowners have not.

The simplest definition of Yield Spread Premium is a fee paid by mortgage lenders for home loans that are locked and closed with higher than necessary mortgage rates. Your mortgage lender approves you for a specific mortgage rate based on your credit and financial details however, the mortgage company or broker almost always quotes you a much higher rate to get this extra commission from the lender. As a result your mortgage payment is much higher than it need be and the reason most people overpay for their mortgage loans.

Why Origination Fees Are Charged

To understand origination fees, you need to understand the role of a loan originator. These professionals are also known as loan officers or mortgage brokers.

Loan originators go between the borrower and the bank to help negotiate mortgage terms. A mortgage origination fee is payment to the mortgage originator for their work. The fee is only paid if and when the loan is actually funded.

While many brokers charge origination fees, some do not. If you don’t want to pay an origination fee, look for a fee-free mortgage broker.

Also Check: How To Get 150k Business Loan

How To Lower Your Origination Fee

Even if your lender is unwilling to remove the origination charge entirely, they still might lower it for you. It never hurts to try and negotiate better loan terms with your lender. Origination fees, interest rates, down payment options theyre all negotiable. Thats why its so important to check with multiple mortgage providers before agreeing to any home loan.

What Does The Origination Fee Include

Some lenders charge just the origination fee. Others itemize their closing costs along with the origination points. Each lender has a different method.

Itemized closing costs are the line items on your loan estimate. On Page 2, you’ll see a breakdown of the fees charged. You may see any of the following:

- Points

- Application fee

- Processing fee

- Document preparation fee

Some lenders itemize the fees. Others charge one lump sum. You won’t see the above charges. Instead, you’ll just see points charged. The amount is usually larger than lenders who itemize the fees.

Since the housing crisis, governing agencies try to keep loan fees below 3% of the loan amount. This includes origination fees and all other itemized costs.

You May Like: What The Highest Apr For Car Loan

Should You Pay An Origination Fee

A loan with an origination fee may not be a reason to decline an offer, especially if the loan’s overall APR is lower than the APRs on other loan options. Its always wise to pre-qualify for multiple loans, including those with origination fees, to compare rates. If the loan with the lowest APR has an origination fee, review the amount youll receive after the fee is applied.

Direct lenders such as banks and credit unions typically don’t charge origination fees, while online lenders are more likely to.

Though mortgage origination fees may be negotiable, this likely isnt the case with personal loans.

Sometimes The Seller May Pay Some Or All Of Your Closing Costs But That Doesnt Mean The Closing Costs Are Free

You would need to negotiate directly with the seller not the lender for the seller to pay some of the closing costs. Depending on the particular market in your area, sellers may be more or less willing to pay for some of your closing costs. Typically, sellers might agree to pay closing costs if:

You have agreed to pay more for the home

A seller will usually require a higher purchase price if they are paying for the buyers closing costs. For example, a seller might agree to sell the home for $200,000 and contribute $4,000 to your closing costs. But if you did not ask the seller to contribute to your closing costs, the seller would probably have accepted only $196,000 for the home. Youre still paying the $4,000, just as part of your loan instead of as closing costs. Be aware that in this type of situation, the home may not appraise for $200,000, which could cause problems for your loan.

The home needs repair

If your home inspection shows that there are costly repairs that need to be made, the seller may offer to contribute to your closing costs instead of making the repairs or reducing the sales price. This reduces your costs at closing, but it doesnt reduce your overall costs you will need to spend the money to make the repair yourself after closing.

Don’t Miss: Where Can I Find My Student Loan Account Number