Will Paying A Charge

Paying will not increase your credit scores. If you are facing a debt collection lawsuit, paying a charge-off can avoid legal actions. But even with a zero balance, your credit reports still show a history of late payments and the fact the account was charged-off. A FICO Scores purpose is to help lenders predict the likelihood that youll fall 90 days or more behind on any credit obligation during the next 24 months.

How Does A Charge

Once an account has been charged off, two things will likely happen:

- First, youre going to start receiving calls and letters from collection agencies attempting to collect the debt.

- Second, the account will be marked as a charge-off on your credit report.

A charged off account on your credit report will devastate your FICO score. A single charge-off can cause your to drop 100 points or more. Its a big deal.

In addition to your credit score dropping, youre also going to have a really difficult time getting approved for any new , mortgages, or auto loans. Lenders rarely extend credit to people with even one charge-off on their credit report.

How Much Can A Charge

Think back to the months before your account was officially charged off you probably missed a number of payments. These missed payments alone can significantly damage your credit, because payment history is a major factor in determining your credit scores.

But your scores will most likely suffer further if the account is finally listed as a charge-off because of that derogatory mark.

Next, if your account is in collections, it could also lower your scores. And not paying the collections agency can further damage your credit, because the agency can report missed payments to the credit bureaus.

Theres a bit of good news, though: If you show that you use credit responsibly from here on out like making on-time payments and being proactive about your debt then the effects of derogatory marks on your credit reports can begin to diminish after about two years. And, thanks to the Fair Credit Reporting Act, you have the right to have negative information like a charge-off removed from your credit reports after seven years.

Read Also: How To Refinance An Avant Loan

When Do Bad Debts Get Charged Off

Missing a payment or two on a or loan wont necessarily land your debt in the bad debt category. Generally, for a debt to go bad and be charged off, it has to be delinquent for an extended period of time.

Typically, a debt has to go unpaid for anywhere from 120 to 180 days after you become delinquent before a creditor moves ahead with a charge-offit varies based on the type of account and repayment terms. During this time, you may receive phone calls or letters from the creditor requesting that you make a payment or get in touch to discuss payment options. Any late payments that happen prior to the charge-off can be reported to the credit bureaus.

This can be damaging in itself, as 35% of your FICO credit score is based on payment history. If you do nothing and allow late payments to pile up, your creditor could decide to cut their losses and charge off the account.

Once the creditor wipes the account from their books, its charged off as bad debt. Just like late payments and other negative credit information, charge-offs can linger on your credit reports for up to seven years. The creditor, or the entity that owns the debt if its been sold, also can move ahead with collection actions.

How Do You Remove A Charge

According to Freddie Huynh, vice president of data optimization at Freedom Debt Relief, if a charge-off listed on your credit reports is legitimate, there isnt a whole lot that a consumer can do to remove it.

One thing you can do is try to negotiate with the original lender. If the lender hasnt sold the account, you can offer to pay the debt in full in exchange for the charge-off note to be removed from your reports.

Some debt collectors may offer to remove the charge-off note from your credit reports this is sometimes known as a pay for delete offer. But keep in mind that lenders are required to report accurate and complete information, so any pay for delete service is unlikely to be successful.

Otherwise, you can just wait out the clock. A charge-off should automatically drop off your credit reports after seven years.

You May Like: Va Loan Requirements For Mobile Homes

Get Any Agreement In Writing

A pay-for-delete arrangement is legal under the Fair Credit Reporting Act. However, the lender isnt legally obligated to honor the request and remove a charge-off from your account. So, while you may ask for the arrangement, the lender can say no.

For this reason, you want to ensure you get the pay-for-delete arrangement in writing. You should get the details of the arrangement written out on the companys letterhead. This includes the amount youre going to pay, that you wont owe any more after you make the payment and that the creditor intends to remove the charge-off from your credit reports.

Why Is A Repo So Bad For Your Credit

Of all the negative marks that can build up on your credit report from late payments to missed payments to high loan balances a repossession can have the biggest negative impact.

A repossession means you probably missed three or four car payments in a row and didnt respond to phone calls and letters from your lender. It means your lender has lost money on your loan.

Plus, for you, the repossession isnt the only negative mark that results from the ordeal. Your credit history will also show the monthly payments you missed leading up to the repossession.

If the lender hired a collection agency, the same debt may appear twice on your credit file, exacerbating the problem even more.

Thats why a repo could drop your FICO credit score by 100 points and possibly more.

Also Check: Commitment Fee On Mortgage

How Many Points Will A Credit Score Decrease

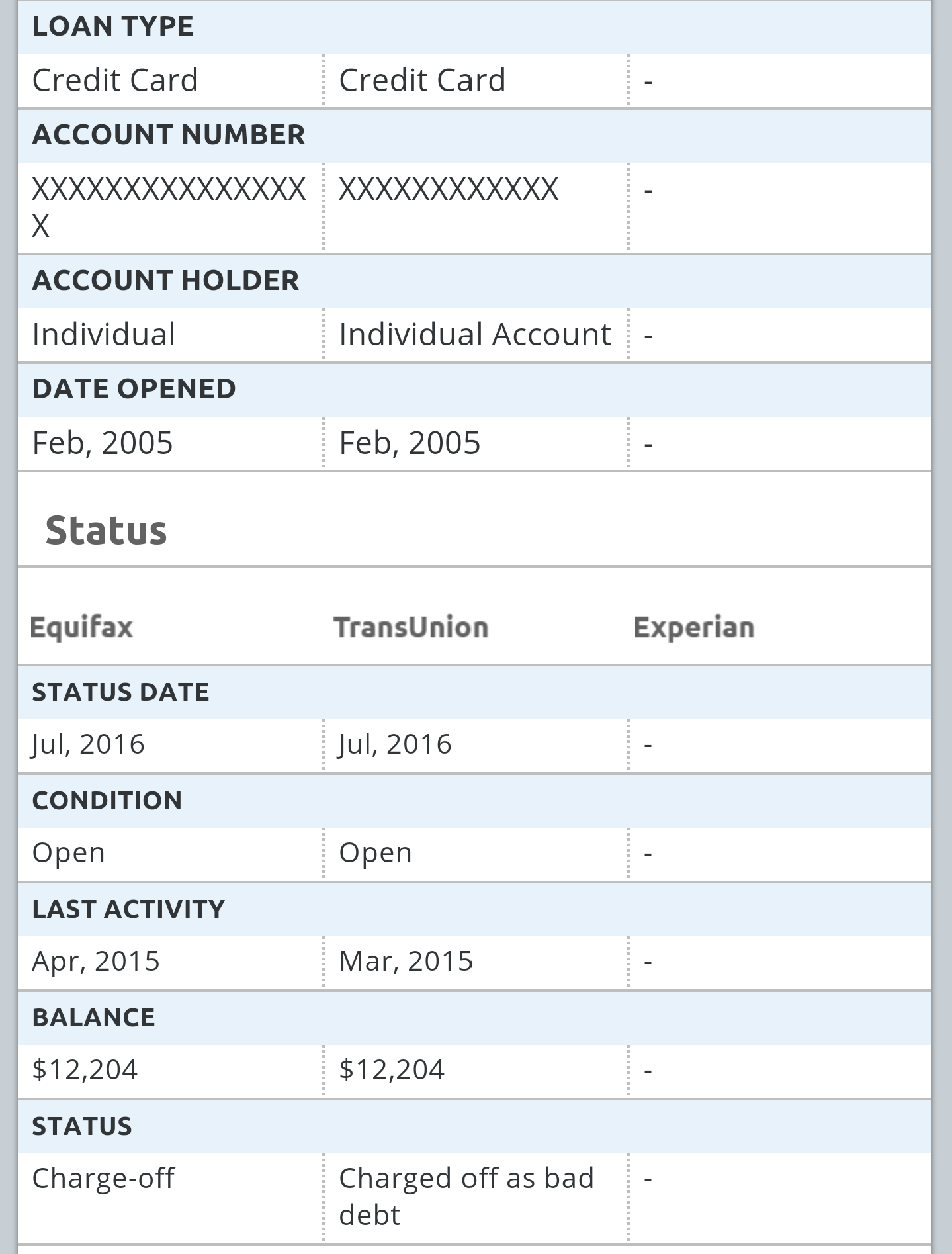

A charge-off is considered a significant event with regard to your score and will likely have a severe negative impact, especially if its a recent charge-off. If a charge-off was just added to your reports last month, the account may have a significant impact on your credit scores.

FICO, the most widely used credit scoring system says a charge-off can take up to 150 points off a credit score. The higher your score was to start with, the greater the damage will be. And, keep in mind its not just one credit score. Most consumers have at least 3 credit scores One at Experian, Equifax and Transunion that will be affected.

There is some good news. As negative history grows older , its impact starts to fade. A charge-off from three years ago hurts your scores far less than a charge-off from last month.

You Still Owe Your Debts

Considering your account as uncollectable is an accounting term, and it doesnt affect whether you owe the debt. Your lender is still entitled to the full amount owed, though it can only collect until the state-mandated statute of limitations expires. Your card issuer may still decide to pursue the debt in full, and its legally entitled to do so.

Don’t Miss: Pre Approved Auto Loan Usaa

What Is An Auto Loan Charge

An auto loan charge-off represents an amount that the bank or other lender assesses as an outstanding debt from someone who has bought a car, truck or other vehicle on credit. Banks find the charge-off amount by taking back the vehicle, reselling it, and sending the resulting amount, minus the sale price of the vehicle, to collection agencies for further attempts at collection.

Dealing With A Charged Off Debt During Bankruptcy

Whether you file for bankruptcy under Chapter 7 or Chapter 13, you will need to provide the court and the bankruptcy trustee with a comprehensive accounting of your finances. Part of your bankruptcy petition comprises a list of your debts. You should be aware that you will need to list debts that appear as charged off on your credit report. This is because debts that are charged off are still valid. If you do not list a charged off debt, you may not be able to get it discharged in bankruptcy.

If the charge off involves an unsecured debt, which may be a credit card debt or a debt owed to a health care provider, you can get the debt wiped out in either Chapter 7 or Chapter 13. A Chapter 7 case takes only a few months, while a Chapter 13 case lasts three to five years. If you have discretionary income or non-exempt property, your Chapter 13 repayment plan will consist in part of paying off these unsecured debts to the extent possible. However, many debtors cannot fully pay off unsecured debts or pay them off at all. These debts still will be discharged at the end of your repayment plan, as long as you have kept up with payments under the plan.

Also Check: What Is The Commitment Fee On Mortgage Loan

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Can A Repossession Be Removed From Your Credit Report

Yes, if you have a repossession in your credit history you have a few options to remove this negative item from your credit report.

You could try to remove the repossession yourself, or you could hire a professional credit repair company to help remove the negative mark.

But if youd like to take the DIY credit repair approach, heres how to go about it:

Don’t Miss: How To Get Loan Officer License In California

Does The Statute Of Limitations Stop Collection Of Charge

A statute of limitations on debt collection doesnât make debt go away, but it does protect you. A statute of limitations for debt sets a time limit for creditors to get a court judgment against you, not a time limit for debt to go away. Once the statute of limitations has passed, the debt is âtime-barred.â

There may be a two-year statute of limitations in one state, and a ten-year statute of limitations in another state. The rules for collecting on charge-offs and other types of debt differ among states. There are federal laws and state laws governing debt collection. On top of that, laws applying to original creditors can be different than those applying to collection agencies. Bankruptcy attorneys and consumer protection attorneys get paid to know the details.

Get The Agreement In Writing

When the creditor agrees to remove the charge-off from your credit report, get the agreement in writing.

You can do this in one of two ways:

Avoid making payment until you have the agreement in writing and can prove beyond the shadow of doubt someone from the creditors office agreed. Once you have fulfilled your part of the agreement, check your credit report to make sure the creditor has removed the charge-off.

Recommended Reading: What Car Loan Can I Afford Calculator

What Is A Charge

When you havent paid on an account for six months to a year, a credit card issuer or other debt collectors will often mark your account as a charge-off. This means the creditor has determined itll likely never collect your debt. It considers the debt a business loss. The company can write off debt at tax time.

But writing off the debt doesnt mean the creditor will stop its debt collection efforts. In fact, the company might even hire a third-party debt collector to handle the collection process. This is important to understand in case youre contacted by a collection agency you dont recognize. Either the collection agency bought the debt from your original creditor and now wants to collect on it or the agency has been hired by your credit card issuer, lender, or creditor to collect the debt on behalf of the original creditor.

This can happen with credit card debt, unpaid personal loans, or even hospital bills. One or two late payments shouldnt result in a charge-off, but ongoing delinquency will eventually turn into a charge-off.

Getting Rid Of A Charge

When a debt is charged off, youre still responsible for it unless the statute of limitations has expired. The good news is that you have options to choose from when it comes to getting rid of a charge-off:

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Other Products & Services:

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, member FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. . JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

“Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

What Is The Best Way To Remove Charge

Getting a charge-off removed from your credit report can make the difference between qualifying for a loan for a house or car. This is where hiring a credit repair company can really make a difference.

They help clients remove charge-offs on their credit reports by disputing errors with the credit bureaus on their behalf. This means you dont have to contact any of the credit bureaus or collection agencies yourself directly.

If you arent sure where to start when it comes to disputing charge-offs on your credit reports, talk to one of their credit repair professionals and get your questions answered. You can do it on your own, but youre likely to have more success by enlisting professional help.

They offer a no-obligation consultation to explain what they can do to help in your particular situation.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

When Removing A Charge

If you’ve tried to negotiate with a creditor for the removal of a charge-off but hit a dead end, your only option may be to simply wait it out until the seven-year mark passes. Once that period is up, the charge-off will fall off your credit report naturally and no longer be included in your credit score calculations.

Again, this doesn’t mean that you can ignore the debt altogether. You’re still legally obligated to pay it. At some point, however, the statute of limitations on the debt may expire. When that occurs, debt collectors can no longer sue you to recover the money. The statute of limitations for different types of debt varies from state to state.

How To Remove A Repossession From Your Credit Report

When you stop making payments on an auto loan, the lender will take the vehicle back. In lending terms, this is called repossession.

A repossession could happen in two ways:

Either kind of repossession hurts your credit score. The negative item could crush your credit score if you have good credit otherwise.

Whats worse: You could still owe money on the car loan, even after the repossession, if the bank cant pay off your balance by selling the car. This will make your bad credit even worse.

You May Like: What Credit Score Is Needed For Usaa Auto Loan