What Is A Down Payment

A down payment is an upfront partial payment toward the purchase of a home. Down payment requirements are typically expressed as a percentage of the sales price of the home. For example, if a mortgage lender requires a 3 percent down payment on a $250,000 home, the homebuyer must pay at least $7,500 at closing.

A down payment reduces the amount the buyer needs to borrow to buy the home. It also represents the buyers immediate equity in the home. In the previous example, for instance, the buyer has $7,500 in equity.

A down payment is a standard requirement for most mortgage loans, but how much you need to put down varies depending on the type of loan youre applying for, your financial situation and your goals. How much youll be able to afford to put down depends on a few factors, but in general, the bigger your down payment, the better. Thats because the less you have to finance with your mortgage, the cheaper that loan will be.

Many people get their down payments from savings, and others source funds from selling their current house or from gifts or grants from family, friends or special programs for homebuyers.

Does 3% Down Conventional Loan Payment Include Mortgage Insurance

The best thing about a 3% conventional loan down payment program is that there is an option of not having to pay mortgage insurance which is called Lender Paid Mortgage Insurance.

This option could help bring down your payments. Most of the time, it is built into the interest rate.

So you might pay a slightly higher rate, but because the mortgage insurance isnt there, your payment could be reduced by a couple of hundred dollars.

Even if you opt to pay the private mortgage insurance included in your mortgagee payments, you have to pay it until the loan to value ratio is paid down to 80%.

The mortgage insurance for a 3% Down Conventional Loan Program is risk-based which depends on your credit score.

Why A 10% Down Conventional Loan Can Be A Smart Choice

- A larger down payment may mean a lower interest rate and smaller monthly payment

- Youll pay PMI for less time than homebuyers who put 3% or 5% down

- You can use the mortgage to buy a second home

In 2020, the average first-time homebuyer bought their first home with a down payment of just 7%, so by making a down payment of 10%, youre already ahead. And with a larger down payment, your mortgage will be smaller, so youll have to pay less each month .

See how down payment amounts affect monthly costs with this mortgage calculator.

With a 10% down payment, homebuyers can qualify for fixed-rate and adjustable-rate mortgages up to $548,250 for single-family homes, condos, townhouses, and planned unit developments for both primary and secondary residences. As the down payment is less than 20%, youll likely need to pay PMI until your home equity reaches at least 20%.

For homebuyers in especially costly areasthink San Francisco or Hawaiiif youve got a down payment of 10.1% and an excellent credit profile, you may be eligible for a jumbo loan. However, lenders require homeowners who apply for jumbo loans to have between 18 to 24 months of asset reserves, a credit score of at least 700, and a debt to income ratio of 43%.

You May Like: Loan Options Is Strongly Recommended For First-time Buyers

Minimum Down Payment For Conventional Loans

Although 20% is often suggested for a minimum down payment, its not a requirement. You can put as much down as youd like, or as little as 3%, depending on your lender and the loan.

A 20% down payment avoids PMI, so your monthly payments will be lower compared to a borrower who does pay PMI. Heres what the difference looks like for a home with a sales price of $250,000, a 30-year fixed-rate mortgage, and a borrower with a good credit score, using our mortgage calculator:

| Down Payment | |

| $148.44 | $1,610.16 |

The difference in the monthly payment is $309 more for the buyer with PMI compared to the one who doesnt have to pay it. This amount includes the PMI payment itself, plus additional interest expense. Thats an extra $3,708 per year or $55,620 over 15 years if you pay this until youre midway through your 30-year loan, when your lender will remove PMI regardless of your equity.

PMI is required for conventional loans that dont have a 20% down payment, but having that much as a down payment isnt required. But keep in mind that youll have an additional PMI expense if you choose this option.

Theres no one minimum down payment for everyone because each homebuyer brings their own financial situation to a home loan, including debt-to-income ratio, income, and credit score.

More Money Down = Lower Monthly Payments

The more you put down, the less youll have to borrow. The less you borrow, the less interest youll pay over the life of the loan.

Lets compare monthly payments based on down payment sizes. In this example, your home costs $300,000 and youre getting a fixed rate of 3% and a 30-year loan term:

| % down | |

|---|---|

| $240,000 | $1,012 |

*The monthly payments shown here do not include additional fees such as homeowners insurance, property taxes, or PMI on conventional loans. Payments are for example purposes only. Not based on currently available rates. With 20% or more down on a conventional loan you wouldnt pay any PMI.

Don’t Miss: Why Is My Car Loan Not On My Credit Report

How Much Is The Average Down Payment

The median down payment on a home was 12 percent for all buyers, according to a 2020 National Association of Realtors report. It was lowest for first-time homebuyers, at only 6 percent, and highest for repeat buyers at 16 percent.

Only 28 percent of homebuyers put down 20 percent or more, according to a separate 2021 NAR report.

Conventional 1 Percent Down Mortgage

Riverbank Finance LLC is pleased to offer the Conventional 1% Down Mortgage with Equity Boost home loan program. In this program, you can purchase a home with 3% equity, but only 1% down payment. How does that work? You, the buyer, contribute 1% and we, your lender, contribute 2% giving you a total of 3% equity at close.

Online Security Policy: By clicking “Submit” , I agreen to I agree to Riverbank Finance LLC ‘s Privacy Policy and Terms of Use and authorize contacts via telephone, mobile device and/or email, including automated means even if your telephone number is currently listed on any state, federal or corporate Do-Not-Call list. This no obligation inquiry does not constitute a mortgage application. To apply now or get immediate assistance, call us at 1-800-555-2098.

You May Like: What Do Loan Officers Look For In Bank Statements

What Is A Conventional Mortgage Or Loan

A conventional mortgage or conventional loan is any type of home buyers loan that is not offered or secured by a government entity. Instead, conventional mortgages are available through private lenders, such as banks, credit unions, and mortgage companies. However, some conventional mortgages can be guaranteed by two government-sponsored enterprises the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation .

Average Credit Score And Report

Your credit report and credit score are the first things mortgage lenders look at when determining if a borrower is eligible for the loan program. On average, lenders require a of at least 620, but a credit score of 680 may give you an even better chance at loan approval.

Your credit history and credit score are both important factors. Your credit history shows lenders if you make your payments on time, especially any monthly mortgage payments. Lenders also consider your credit score, which determines if you qualify for the Conventional 97 program.

Your credit score also determines your interest rate, which affects your mortgage payment. Higher credit scores, especially those over 680, provide access to the best interest rates. If youre approved with a lower credit score, youll likely pay a higher interest rate.

Recommended Reading: Does Carmax Pre Approval Affect Credit Score

What Is A Conventional Mortgage

The term conventional mortgage refers to a mortgage that does not carry any form of high-ratio or lender insurance premium. The Bank Act of Canada controls many facets of the finance industry, and the mortgage industry is not immune to its effect.

As a law, no chartered bank or is able to offer mortgage financing without insurance beyond a certain percentage of the value of the property. This limit used to be 75 percent, but was changed on April 20th, 2007 to 80 percent for most residential single-family mortgages.

A high ratio mortgageexceeds 80 percent of the property value, and must therefore be insured by CMHC, Genworth or AIG . The price of the insurance premium IS added directly to the mortgage amount, going on TOP as an insurance premium vs. being deducted like a lender fee in trust company or private mortgages.

As conventional mortgages do not exceed this 80 percent maximum of the propertys value, an ample cushion of 20 percent remains. As such, the basic principle is that the financial institution is insulated enough from risk in order to provide such a loan without any 3rd party insurance coverage.

By insuring a mortgage loan, Canadian banks are able to reduce the capital allocation required on a per dollar basis as a result of reduced capital requirements due to the insurance component.

Non Arms Length Transactions

- A non-arms length transaction occurs when there is a business or personal relationship between the borrower and the builder or seller it has to be disclosed, and it is only allowed on primary residences.

- It is not allowed on a short-sale when seller and buyer are related, and not allowed as a means to bail out the current owner from an existing delinquent mortgage.

You May Like: Refinancing A Fha Loan To A Conventional Loan

Home Financing With A 5% Down Conventional Loan

Conventional loans are a great home financing option for people who are in the market for purchasing a home because they offer lower costs and a variety of different loan options. It is a common misconception that in order to obtain a conventional loan, you must pay a 20% down payment, but that is not the case. In fact, you can qualify for a conventional loan by putting down as low as a 5% down payment. Our loan specialists at Foundation Mortgage can help you determine if a conventional loan suits your situation, and can help you understand the different loan types that are available to you. We serve the areas of Knoxville, Maryville, Lenoir City, Oak Ridge, and Gatlinburg, Tennessee. Contact us today for a consultation.

Other Conventional Loan Requirements

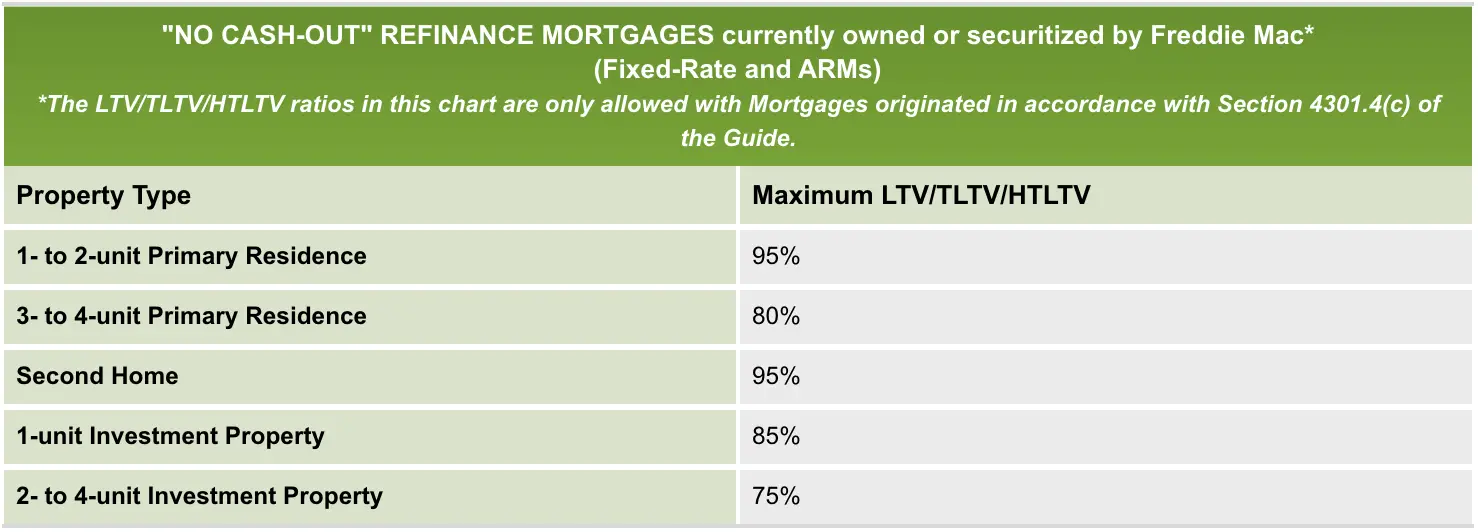

Conforming conventional mortgages adhere to underwriting guidelines set by the mortgage financing giants Fannie Mae and Freddie Mac. These Government Sponsored Enterprises play a major role in the mortgage market. The GSEs purchased 62% of the loans originated in 2020, shaping the entire market. Because of the GSEs’ influence, 97% of loans that originated in the first half of 2020 were conforming.

- Your credit score:Conventional loans have credit score requirements that vary based on lender and loan. The higher your credit score, the lower your interest rate. Getting the lowest interest rate available means youll pay less in interest over the total life of your mortgage. You should have at least a 620 credit score if you want to get a conventional loan.

- Your DTI:Your debt-to-income ratio is another factor that lenders look at. This ratio is all your monthly debts divided by your gross monthly income. Your DTI shouldnt exceed 43%, but the lower it is, the more likely you are to get approved for the full loan amount youre requesting. A low DTI tells lenders you can comfortably pay your mortgage in the event of an emergency.

- The full loan amount:Conventional conforming loans have a maximum amount you can borrow. It was $548,250 for most counties in 2021, or $822,375 for high cost-of-living areas. This increases to $647,200 in 2022, or $970,800 for high cost-of-living areas. You may want to explore other financing options if you think your home price exceeds these amounts.

Read Also: Fha Loan Limits Fort Bend County

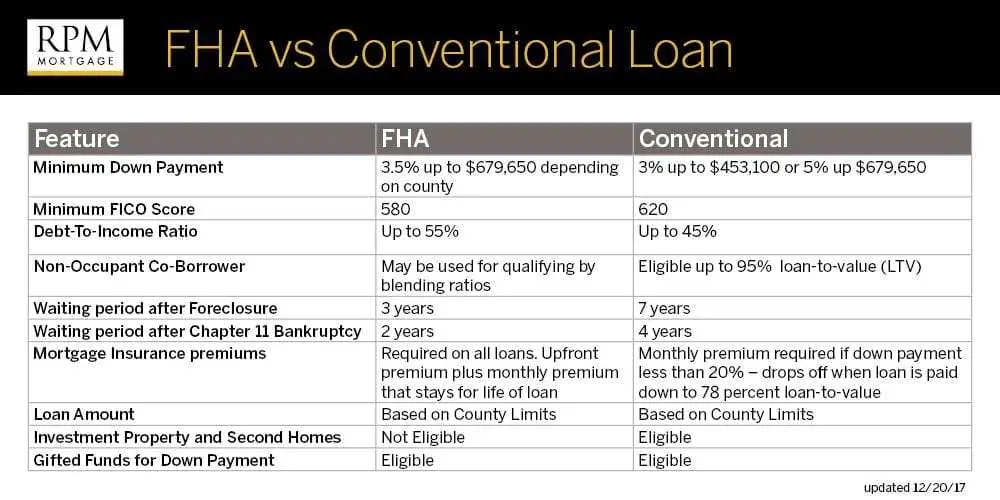

% Down Conventional Loan Vs Va Loans Vs Fha Loans

If you are an active-duty military member, veteran, or surviving spouse, VA loans may seem like a no-brainer alternative to a conventional loan. With no down payment required, no mortgage insurance, and great interest rates, whats not to love?

However, its still worth weighing up the differences between VA loans and conventional loans, especially if youre planning to put a small down payment down anyway.

With VA loans, theres the VA funding fee to think about which you need to pay to close a VA home loan. Theres also private mortgage insurance to consider if youre taking out a conventional loan.

One thing to weigh up is the differences in eligibility requirements. For a VA loan, theres no down payment required and no minimum credit score .

With a conventional loan, the minimum down payment is as low as 3% and a score of 620 is generally expected.

Another alternative if youre not eligible for VA loans, is the Federal Housing Administration loan program which offer similar terms. An FHA loan is a loan insured by the government and issued by FHA- approved lenders. FHA loans also have low down payment requirements 3.5% if you have a FICO score of 580 and above, or 10% if your score is below that.

If you are struggling to decide how much down payment you need to make or which type of home loan to take out, get in touch with OVM Financial today to see how we can help.

Jumbo Loan: 10 Percent

Jumbo loans are a specific type of conventional loan that dont conform to Fannie Mae and Freddie Mac standards for loan amounts. In 2021, that means any conventional loan not backed by a government agency that exceeds $548,250 though high-cost areas have higher limits. Jumbo loans typically require 10 percent down or more.

Read Also: Usaa Used Car Interest Rates

Utah Conventional Mortgage Loan Eligibility

When applying for a Utah mortgage loan, your credit, income and property information will usually run through an automated underwriting system. This is done by either the loan officer or his/her processor, and the system used can be either Fannie Maes DU or Freddie Macs LP .

There are slight differences between DU and LP, and you can notice some in the below eligibility matrix. DU is most widely used for Conventional loans, but LP can sometimes make the difference between a loan being approved or denied. This is something that your loan officer should know.

The following Utah Conventional Mortgage Loan Eligibility Matrix is based on occupancy status, loan to value and credit score requirement. The loan to value the percentage of the loan vs the value of the home .

For high balance loans :

Private mortgage insurance is mandatory on Utah Conventional mortgage loans that have less than a 20% down payment. The largest and most known mortgage insurance companies are Radian, United Guarantee , MGIC, Genworth. Your lender is generally the one that decides which company to use and sets up the private mortgage insurance.

Doesnt Exceed Conforming Loan Limits

Conventional loan lenders must abide by the conforming loan limits for Fannie Mae or Freddie Mac to invest in them. If they lend more than the annual limits, theyll be stuck with the loan on their books, which reduces their liquidity to offer more loans and make more money.

In 2021, the conforming loan limit is $548,250. If you need a larger loan, youd need a jumbo loan, which is a non-conforming loan and has different qualifying requirements.

Read Also: Car Refinance Rates Usaa

If You Dont Want More Debt: Get An Investment Instead

The biggest problem with piggyback loans? You still finance 90% of the home purchase. But instead of dealing with just a mortgage, you have a second loan to manage and repay.

If you dont want to take on more debt but want to get a mortgage with just 10% down, you can use a home ownership investment instead.

Home ownership investment programs like the Unison HomeBuyer program only require a 10% down payment. Unison provides you with the other 10% so you can approach a lender with a full 20% down payment and avoid PMI and higher monthly mortgage payments in the process. Because this is an investment, theres no money to repay as part of your monthly mortgage payment and no interest rates to worry about either. Instead, Unison shares in the future change in value of the home when you sell it up to 30 years later.

Conventional Loans From Jts & Co

When you know that it is time to buy a home, you might not be clear on which mortgage is right for you. Perhaps you already have a home, and want to upgrade to something larger, or maybe you are just starting out. Whatever your reasons for the mortgage loan, let the loan experts at JTS & Co. talk to you about the most popular loan on the market today, a conventional home mortgage loan.

Also Check: How To Get A Loan Officer License In California

What Does Conventional Loan Mean

A conventional home loan is a standard mortgage overseen by the government-sponsored enterprises , Fannie Mae and Freddie Mac.

Unlike government-backed loans, such as FHA, VA, and USDA loans, Fannie Mae and Freddie Mac set the borrower criteria that lenders use to approve borrowers for conventional loans.

Because the government doesnt insure conventional loans, the requirements can be stricter than the federal mortgage programs. Lenders may require higher credit scores and lower debt-to-income ratios for conventional borrowers.

And although the minimum required down payment is 3%, borrowers may sometimes need to put down more to qualify for a conventional mortgage, especially if they have less-than-perfect credit.

Still, the benefits of conventional loans can outweigh the higher barriers to entry especially for borrowers with strong credit profiles.