How Does Wells Fargo Work

Wells Fargo is a huge bank thats over 160 years old. So its a direct lender. In other words, its lending you its own money. Under the hood, that makes it very different from a peer-to-peer lender, which introduces you to individual investors who want to lend to you.

But, in practical terms, it most obviously means that you might get your loan approved and the money in your bank faster. And that it doesnt charge origination fees, which nearly all P2P lenders do.

How To Find Your Best Personal Loan

Never apply to just one lender for a personal loan, even if thats your own bank or credit union. This is an exceptionally competitive market and you may well find better quotes if you shop around. Thats especially important because different lenders specialize in borrowers with different profiles. So one may give you a worse rate than another, not because theres anything wrong with you but because it prefers working with people who are different from you.

If possible, plan ahead and improve your credit score and finances before you apply. Lending decisions are made by computers and a score thats just a point or two higher can shift you into a more creditworthy category. And that could earn you a lower rate.

Finally, try to match how long your loan lasts to the purpose behind your borrowing. You could be making your last payment to Wells Fargo in eight years time. And you dont want to be doing that if youve used the money to buy gaming equipment that youve had to replace two or three times by then. On the other hand, you may be perfectly fine doing so if you used the cash to invest in home improvements or a classic car. So try to align the length of time youre going to be making payments with the period for which your expenditure will bring you joy, satisfaction or peace of mind.

Understand Important Loan Features

When researching loan options, its important to understand the features of two types of loans: federal student loans and private student loans.

Federal student loans are provided through the government, and the amount granted to you is determined by the information on your FAFSA . Alternatively, private student loans are provided by banks or other private lenders and usually require applicants to undergo a credit check. Students with little to no credit history may use a cosigner to qualify.

Beyond the types of loans available, its helpful to look at the impact of the interest rate on student loans as these rates make a difference in the amount you pay during the loan term. Interest rates can be either fixed or variable in other words, a rate may stay the same over the life of the loan or fluctuate based on market conditions. Try using the Student Loan Interest Calculator to discover how you can potentially pay less interest on your student loan.

Finally, consider your student loan repayment options. The loan term is the allotted period of time you have to repay the borrowed amount. You can try using a loan repayment calculator to calculate your student loan payments.

Don’t Miss: Va Loan For Land And Manufactured Home

What To Do After Receiving A Student Lon From Wells Fargo

Youve been financed and youre ready to move forward. Now its time to plan:

1. If youre a student, youll have six months after you finish school to start payments. That isnt to say you cant start early though. If youre able to make payments while youre still in school, you can avoid some interest accumulation.

2. If youre a parent or consolidating your debt, you will need to start payments as soon as you receive financing. Setting up automatic payments will get you a 0.25% discount on your APR, saving you money in the long run.

CSN Team

What Is Wells Fargo

Wells Fargo is the fourth largest bank in the United States. It was founded in March 18, 1852 in San Francisco, California by Henry Wells and William Fargo. Today their headquarters are located in San Francisco, California.

Currently, they have over 8,050 branches and 13,000 ATMs worldwide. They also provide a 24/7 phone support financial service for those clients that cant make it into a Wells Fargo location.

Wells Fargo offers many financial products to make your life easier.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Wells Fargo Student Loans Overview

Before this change was announced, Wells Fargo offered private student loans and private consolidation loans. Loan terms and rates varied based on the amount borrowed, consumer credit scores and other eligibility criteria. Generally speaking, however, Wells Fargo was known for offering student loans with competitive rates and loan terms especially for those with good or excellent credit.

According to the bank, it is currently selling and transferring its student loans. This means that current Wells Fargo private student loans will be transitioned to a new loan holder. This new servicer will handle all payments once the transition is completed.

Wells Fargo Home Mortgage Review For 2021

Its hard to think about Wells Fargowithout remembering some of the banks recent issues.

Reports of millions of accounts beingwrongly opened emerged in 2016. And more recent problems have come to lightabout unnecessary fees being imposed on some mortgages, and a computer glitchthat led to hundreds of people facing foreclosure.

And yet Wells Fargo was the most popular U.S. mortgage originator in 2019, according to the Consumer Financial Protection Bureau.

So clearly, the company is getting thingsright for many homeowners.

This could have something to do with its competitive rates, helpful online tools, and steadily rising customer satisfaction scores.

Here we explore the ins and outs of WellsFargo Home Mortgage, so you can decide for yourself whether this is the rightmortgage lender for you.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Is Wells Fargo The Best Mortgage Lender For You

Competitive rates and rising customer satisfaction scores are a testament to Wells Fargos popularity as a mortgage lender.

And while its hard to ignore the banks spotty track record, there may be a silver lining. The bank is now under intense scrutiny from customers and regulators. Its making a serious effort to improve and data shows that for many, its succeeding.

So if Wells Fargo can offer you a competitive mortgage rate, its definitely worth your consideration. You can check your personalized rates right here.

Wells Fargo Credit Score Standards

760+, Excellent

You generally qualify for the best rates, depending on debt-to-income ratio and collateral value.

700-759, Good

You typically qualify for credit, depending on DTI and collateral value, but may not get the best rates.

621-699, Fair

You may have more difficulty obtaining credit, and will likely pay higher rates for it.

620 & below, Poor

You may have difficulty obtaining unsecured credit.

No credit score

You may not have built up enough credit to calculate a score, or your credit has been inactive for some time.

You May Like: Which Fico Score Is Used For Rv Loans

How Wells Fargo Works

Wells Fargo offers unsecured personal loans that can be used for many reasons, including debt consolidation, home improvement, and major purchases. To get an unsecured personal loan, you don’t need collateral, like a house or a car.

You can get your money as soon as the next business day with Wells Fargo depending on when your application is approved. Wells Fargo won’t charge you origination fees or prepayment penalties, but the lender may stick you with a $39 charge for late payments.

While Wells Fargo offers personal loans in all 50 states, it doesn’t have branches in 14 states. States where branches aren’t available are Ohio, Michigan, Kentucky, West Virginia, Missouri, Oklahoma, Louisiana, Maine, Vermont, New Hampshire, Massachusetts, Rhode Island, and Hawaii.

This may pose a problem, as only current customers qualify to apply for loans through Wells Fargo’s online portal or by phone. If you aren’t a customer, you have to apply by visiting a branch and talking with a banker.

To contact customer support, call the lender Monday through Friday, 7:00 a.m. to 7 p.m. CT, or message the company’s chatbot on its personal loan webpage. Wells Fargo has a well-reviewed app that has received 4.8 out of 5 stars on both Apple store and the Google Play store.

You can receive your money as soon as the next business day after you apply and your loan is approved.

You’ll need to meet the following requirements to apply for a personal loan with Wells Fargo:

Donotpay Can Assist You In Your Wells Fargo Small Business Loan Application

Applying for a loan at Wells Fargo might seem challenging, but DoNotPay is here to make the process easier! We can help you draft an error-free loan request letter instantly. Here is what you need to do:

We will generate a personalized loan request letter and send it to the Wells Fargo loan department.

If you are looking for banks that offer the best loan terms and conditions, our learning center has helpful guides on loans offered by:

In case you want to find a perfect online lender, our integrated Find Online Business Loan Lender is here to help you out. Provide us with some relevant info and we will return a list of the top lenders perfect for you!

Don’t Miss: Usaa Auto Loan Eligibility Requirements

Loan Products At Wells Fargo Home Mortgage

As youd expect of a big bank, WellsFargo has a wide range of mortgage options.These include:

- Fixed-rate mortgages Choose your fixed-rate loan term from 30, 20 ,or 15 years with low down payment options

- Adjustable-rate mortgages Choose a fixed rate for an initial 5- or 7-year period . After that, your rate can fluctuate each year

- VA loans VA loans offer zero down payment for qualifying service members and veterans, plus other privileges

- FHA loans Use an FHA loan to put down as little as 3.5% of the purchase price. But note that youll have to pay continuing mortgage insurance premiums

- USDA loans Wells Fargo calls this program the Easy to Own Guaranteed Rural Housing program. Like all USDA loans, it allows zero down payment in qualified rural or suburban areas

- Jumbo loans For when you want to borrow more than Fannie Mae and Freddie Mac allow in your area. In most of the U.S., a jumbo mortgage is any loan amount bigger than $548,250

- New construction loans An easier way to borrow when youre building from the ground up

- yourFirst Mortgage A Wells Fargo proprietary product that lets you buy with a low down payment of 3%. Available to both first-time buyers and existing homeowners, in spite of the name

Theres a very good chance the type of mortgage youll need is on Wells Fargoslist.

Though Wells Fargo hassuspended its home equity lines of credit during the COVID-19pandemic, the bank has cash-out refinancing and rate and term refi optionsavailable.

Wells Fargo Vs Upgrade Personal Loan

If this lender is still not what you are looking for, we can help you with another lender option. So, Upgrade is a lender that offers personal loans to those who have a credit score of at least 580 points and need a loan to make major purchases. Therefore, here is our comparison between Wells Fargo and the Upgrade personal loan.

You May Like: Avant Refinance Application

What Kind Of Loans Does Wells Fargo Offer

Here are the quick FAQs you should know about Wells Fargo personal loans:

- Minimum loan amount of $3,000, rising to a maximum of $100,000

- Loan terms of 12, 24 or 36 months for loans of $5,000 or less and of 12, 24, 36, 48, 60, 72 or 84 months on higher amounts

- Wells Fargo doesnt publish a minimum credit score But online reviewers suggest you neednt apply if yours is less than 600 and youre unlikely to secure an affordable rate if yours is under 660

- Maximum DTI* isnt published but expect it to be relatively low, especially if you dont have an existing relationship with Wells Fargo

- No prepayment fee So you can reduce or pay down completely your loan balance at any time without penalty

- Co-signers are allowed

- No prequalification When you apply, Wells Fargo will make a hard credit inquiry which should deliver a small hit to your credit score

- Fixed rates only

- Lender fees are not levied on originations

*DTI stands for debt-to-income ratio. Its the percentage of your pretax income that you spend for rent or mortgage plus monthly accounts like auto loans and credit cards. Not utilities or living expenses.

How Do I Make A Payment

You have many options for making payments.

Set up automatic payments

You decide which savings or checking account you would like the money to come from each month. There is no charge for enrollment, and you can easily change or cancel the automatic payments online.

To set up automatic payments, sign on, select your auto loan from Account Summary, and then select Enroll in Auto Pay. You can also call us at 1-800-289-8004 or download the automatic loan payments authorization , complete the form, and return by mail or fax.

Pay Online

Sign on and select your auto loan from Account Summary. You can make a payment immediately or schedule a payment up to 30 days in advance. Not enrolled in Wells Fargo Online®? Enroll now.

Pay by phone

Pay by mail

Make your check or money order payable to Wells Fargo Auto. Be sure to fill in all sections of a money order. Write your account number on your check or money order. Mail your payment to:

Wells Fargo AutoDenver, CO 80217-0900

Pay in person

You can make payments at any Wells Fargo banking location at no charge, and a Wells Fargo account is not required.

Other ways to pay

- MoneyGram® – Include your 10-digit Wells Fargo Auto account number and Receive Code 1815. Please note: third-party fees may apply.

- Western Union® – Include your 10-digit Wells Fargo Auto account number, Western Union City Code CATX, and State Code TX. Please note: third-party fees may apply.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Is Loan Amortization

Loan amortization is the reduction of debt by regular payments of principal and interest over a period of time. For example, if you make a monthly mortgage payment, a portion of that payment covers interest and a portion pays down your principal.

Typically, the majority of each payment at the beginning of the loan term pays for interest and a smaller amount pays down the principal balance. Assuming regular payments, more of each following payment pays down your principal. This reduction of debt over time is amortization.

Applications Refinance And Repayments

Apart from dealer-based applications, you can apply online to receive their loan offerings. Create an account and provide your social security number as well as your employment and income details. As part of the application, Wells Fargo will run a credit check that may dent your credit score.

Long-term refinancing is a viable option that may reduce your monthly payments. However, it will increase your cumulative interest for the newly acquired loan over its lifetime. Still, youre likely to benefit from lower-than-normal interest rates if you choose to refinance with Wells Fargo.

You can make payments via phone by calling 1-800-289-8004. Alternatively, you can sign up for the Wells Fargo Automated Payment service. It is available 24/7 for checking account holders with the bank.

Youll need your wells Fargo auto loan number for monthly loan repayments. There are two places you can find the 10-digit loan account number printed on your monthly loan statement. Check the top center of your statement for the place marked Account Number. The right side of your statement above the due date is a tear-off coupon where you can also locate your loan number.

Read Also: What Credit Bureau Does Usaa Use For Auto Loans

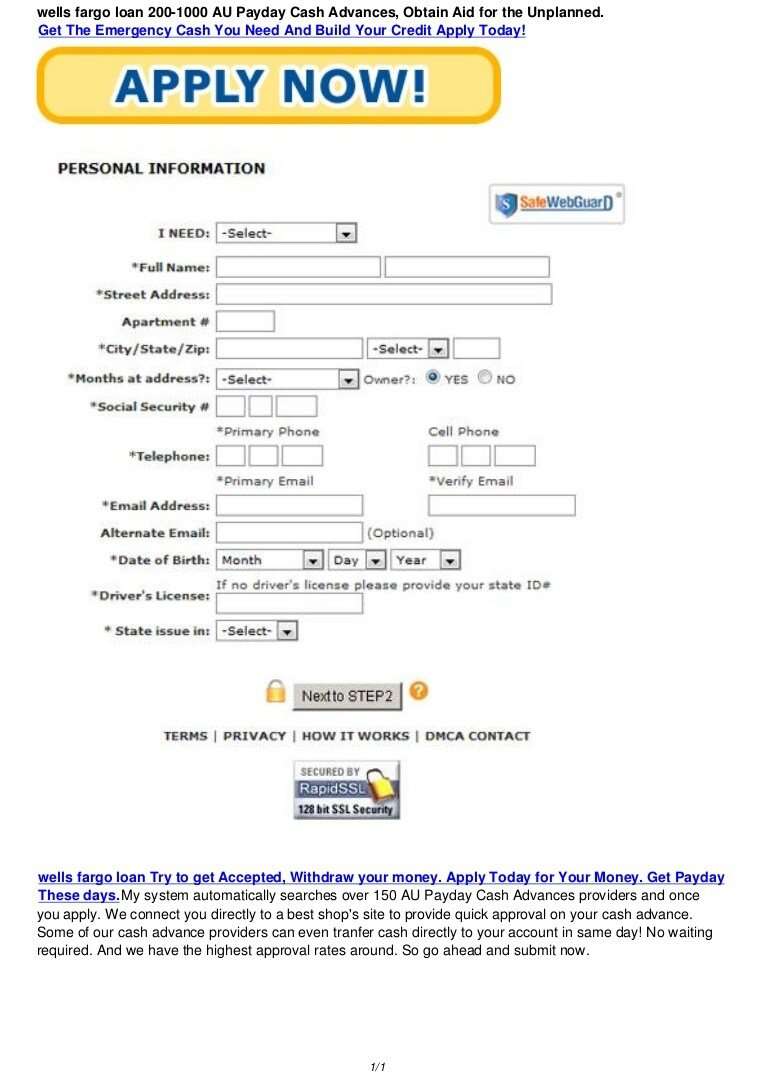

Apply For A Wells Fargo Personal Loan

There are three ways to apply for a personal loan from Wells Fargoonline, over the phone, or in person. If you dont already have an existing account with the bank, you will need to visit a Wells Fargo branch in person to apply. Its wise to schedule an appointment in advance if you plan to fill out an application with a banker.

Before you begin, gather the following information to complete your application:

- Personal Contact Information: Social Security number or individual taxpayer identification number , date of birth, citizenship status, marital status , address, email address, and phone number

- Employment and Income Details: Employment status, the name and phone number of your employer, your gross monthly income, any additional income sources you wish to include on the application, and your monthly rent or mortgage payment

- Loan Information: The type of loan you are seeking, your desired loan term, the loan amount, and your ideal payment due date

Additionally, the lender may ask you for documents to verify the information on your application. Verification documents may include recent pay stubs, W-2s, tax returns, utility bills, drivers license, Social Security card, payoff information for current debts, and more.

If youre applying for a loan online, you should receive a response to your application quickly. There is even a chance your loan could be funded as soon as the next business day.

Wells Fargo Bbb Rating

Most of the public is aware that Wells Fargo was hit by scandals in recent years. And, as a result of those and failures to respond to complaints, the Better Business Bureau gives it an F rating. Thats its lowest.

When those scandals emerged, the bank changed its leadership, altered its structures and processes, and set about reestablishing its reputation. Some may think that means its now less likely to rip off its customers than certain other lenders.

Don’t Miss: Va Loan For Modular Home