Why Origination Fees Are Charged

To understand origination fees, you need to understand the role of a loan originator. These professionals are also known as loan officers or mortgage brokers.

Loan originators go between the borrower and the bank to help negotiate mortgage terms. A mortgage origination fee is payment to the mortgage originator for their work. The fee is only paid if and when the loan is actually funded.

While many brokers charge origination fees, some do not. If you don’t want to pay an origination fee, look for a fee-free mortgage broker.

Business Balance Transfer Credit Cards

Business balance transfer credit cards involve transferring the balances of existing business credit accounts onto a new credit card with a lower interest rate. As with consolidation loans, this can be an effective way to reduce the cost of your debtsespecially if you qualify for a 0% APR introductory period. To take advantage of these benefits, you must repay the entire debt balance before the 0% interest period ends, and you may have to pay a balance transfer fee.

When Do You Pay Loan Origination Fees

Youll pay your origination fees at closing as part of your total closing costs.

Closing costs include other fees like:

- Prepaid interest, which covers the interest for the period between closing day and the end of the month.

- Discount points, which allow you to pay an upfront fee to lower your interest rate.

In some cases, lenders may offer credits to help offset some or all of these costs.

Also Check: How Much Car Loan Can I Get With Bad Credit

Information Needed To Complete The Loan Origination Process

While applying for a personal loan has become quicker than ever, sometimes a lender will ask you to help verify the information you shared in an application. They want to make sure they are depositing money to the right person, who can take on new debt in their budget. To complete this step in the process, you may be asked to log in to your bank or provide a document like a bank statement or a W-2. It may be helpful to have a paystub in hand when youre applying.

How Do Origination Fees Affect Your Apr

The annual percentage rate is different from the interest rate youâre charged on a business loanâand is generally higher. The APR tells you the total borrowing cost of your loan on an annual basis. APR takes into account the interest rate, the amount of the loan, the loan term , and any fees, including origination fees. Any fees that a lender charges end up increasing your borrowing cost. This is why itâs so important to include the origination fee in calculating your APR.

Funderaâs business loan calculators can help you figure out the APR of your loan. Calculating APR is important if you want to compare loan products apples to apples. Two loans for the same amount and with the same interest rate might have very different APRs when you factor in terms and fees.

For example, suppose you apply for a loan of $10,000 with a 10% interest rate. Depending on the terms of the loan and the amount of the origination fee, the APR can vary quite widely. Hereâs an example of how it works out:

- $10,000 loan, 10% interest rate, 2.5% origination fee, and 60-month term = 11.1% APR

- $10,000 loan, 10% interest rate, 5% origination fee, and 60-month term = 12.24% APR

- $10,000 loan, 10% interest rate, 2.5% origination fee, and 12-month term = 14.81% APR

- $10,000 loan, 10% interest rate, 5% origination fee, and 12-month term = 19.81% APR

Read Also: How To Calculate Income For Home Loan

Hidden Costs Of The No Origination Fee Mortgage

If a mortgage truly has no origination fees, youll end up paying a higher interest rate over the course of the loan in most cases. A lender must make money somehow. Depending on how long it takes you to pay off the loan, this could cost you up to tens of thousands of dollars over the life of the mortgage. While youre saving money up front, it could cost you way more in the long run.

If the interest rate isnt any higher, the lender is likely just calling the fee something else, like an underwriting or processing fee. In many cases, this is exactly what the origination fee is meant to cover, so its the same thing.

Can A Loan Origination Fee Be Waived

A loan origination fee may be waived or reduced, and here are a few ways to do it:

- Ask your lender to waive or reduce your fees upfront. Your lender may be willing to do it if you put up a sound argument or if you show that you are prequalified for a loan with smaller fees at a different lender.

- Take a higher interest rate. Your lender may be willing to waive or reduce your fees if you are willing to take a higher interest rate. You may decide it makes more sense to pay the fees instead.

- Ask your seller to cover the fees. Depending on the market, the seller may be willing to cover your loan origination fees. They are more likely to agree in a buyers market meaning there are more houses for sale than there are buyers so the seller may agree to these terms to quickly sell their home.

You May Like: How To Calculate Loan Payments In Excel

Bottom Line On Origination Fees

The origination fee is a key factor in determining your total borrowing cost. Not all lenders will tell you the origination fee , and not all will disclose it in the same way. For example, it may be a percentage or a flat fee. Before committing to anything or signing any documents, you need to make sure you understand the origination fee and include it in your calculations.

Knowing the APR of a loan or other financing product enables you to figure out the true cost of that financing over a year. As a result, you can compare different types of financing accurately and choose the product thats the best fit for your small business.

See Your Business Loan Options

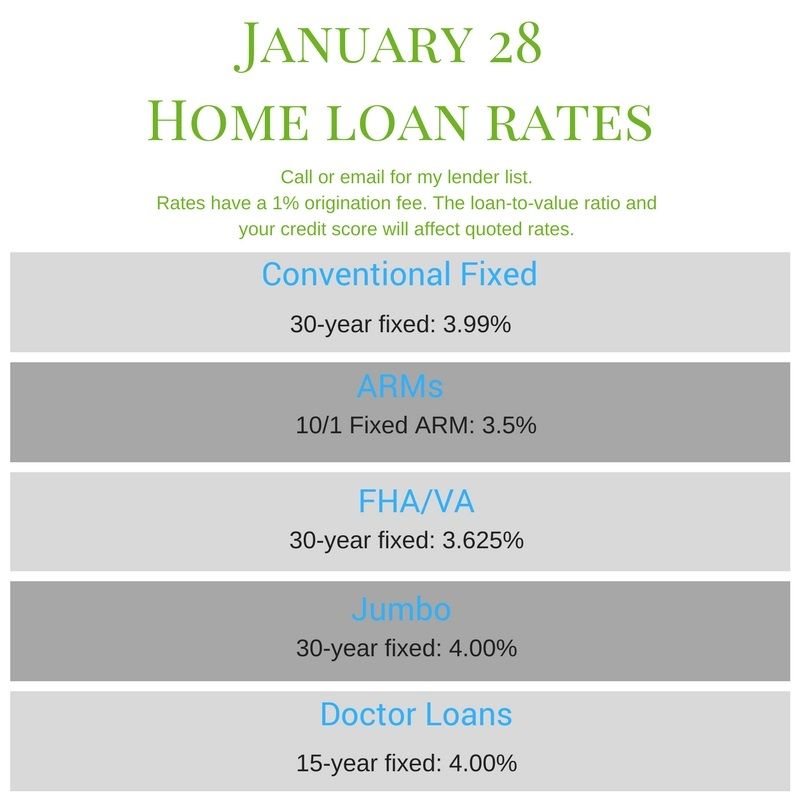

How Much Are Origination Fees On Average

Loan origination charges usually run about one-half to one percent of the total cost of the loan. On a $250,000 mortgage, youre going to pay an origination fee between $1,250 to $2,500 or 0.5 to 1.0 percent/point to the lender for the loan.

Depending on the type of loan, you may have the option of folding loan origination fees and points into the total amount of the loan. This affects you in two ways. First, youll pay less out of pocket at closing. And secondly, your total loan amount will be higher.

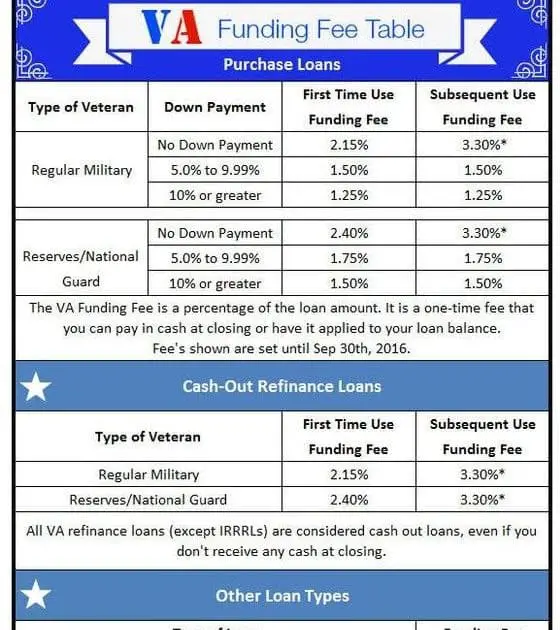

VA loan origination fees have rules that max out the allowable amount charged to 1 percent of the loan. And FHA origination fees also are capped by the Department of Housing and Urban Development at one percent as well.

A higher mortgage origination fee will frequently translate into a lower interest rate on your monthly mortgage payment. So if you can pay upfront for points at closing, you may be able to save a lot over the life of the loan.

Also Check: Can You Refinance An Upstart Loan

What Is A Loan Origination Fee And Is It Negotiable

Several fees come along with a mortgage. One of the more typical is the loan origination fee charged by your lender for processing and, sometimes, underwriting your loan.

The exact cost of these fees varies from one lender to the next, but they generally clock in at 1% or less of your total loan balance.

To get a feel for what your loan origination fee may be, get pre-approved for your mortgage loan. This will give you a good idea of your total loan costs both at closing and long-term.

How To Lower Your Origination Fee

Even if your lender is unwilling to remove the origination charge entirely, they still might lower it for you. It never hurts to try and negotiate better loan terms with your lender. Origination fees, interest rates, down payment options theyre all negotiable. Thats why its so important to check with multiple mortgage providers before agreeing to any home loan.

You May Like: How To Wipe Student Loan Debt

Mortgage Origination Fees: What You Need To Know

For most, your home is not only your greatest investment but your most expensive one. And that expense includes not just the purchase price but a list of other costs that some buyers gloss over when they sign on the dotted line. For example, you face insurance costs, taxes and closing costs. One of the expenses you face when buying a home is origination fees, also known as origination charges. These can actually add on thousands to your closing costs. Here is a breakdown of mortgage origination fees, their cost and how you can potentially lower them.

A financial advisor can offer you insights into buying a residence that could save you a significant sum over the life of a mortgage.

How Are Loan Origination Fees Paid For

There are two ways you can usually pay for your loan origination fees, the first option being the more common one:

Deducted From The Loan With certain lenders, the origination fee will be deducted from the total loan amount. For example, if you want $10,000, but your loan origination fee is 1%, youd only get $9,900 but you would have to repay $10,000.

Added To The Loan If you need the full loan amount, lenders may add the fee to the overall cost of your loan. That way your fee is spread along with your loan payments.

Don’t Miss: Eidl Loan Uses For Self-employed

Page 3 Is Even More Important

If page 2 is a powerful source of leverage, page 3 provides even more important information. Because it shows you your annual percentage rate , which is the actual effective rate youll pay, allowing for closing and all other costs. Thats a more useful indicator than your bare interest rate.

Better yet, it shows what your situation will be in five years time: How much youll have paid in dollars for the mortgage By how much youll have reduced the amount you owe

So spend a lot of time comparing all your page 3s.

Again, thats a screengrab from the CFPBs sample and the same caveats apply.

How Do Origination Fees Work

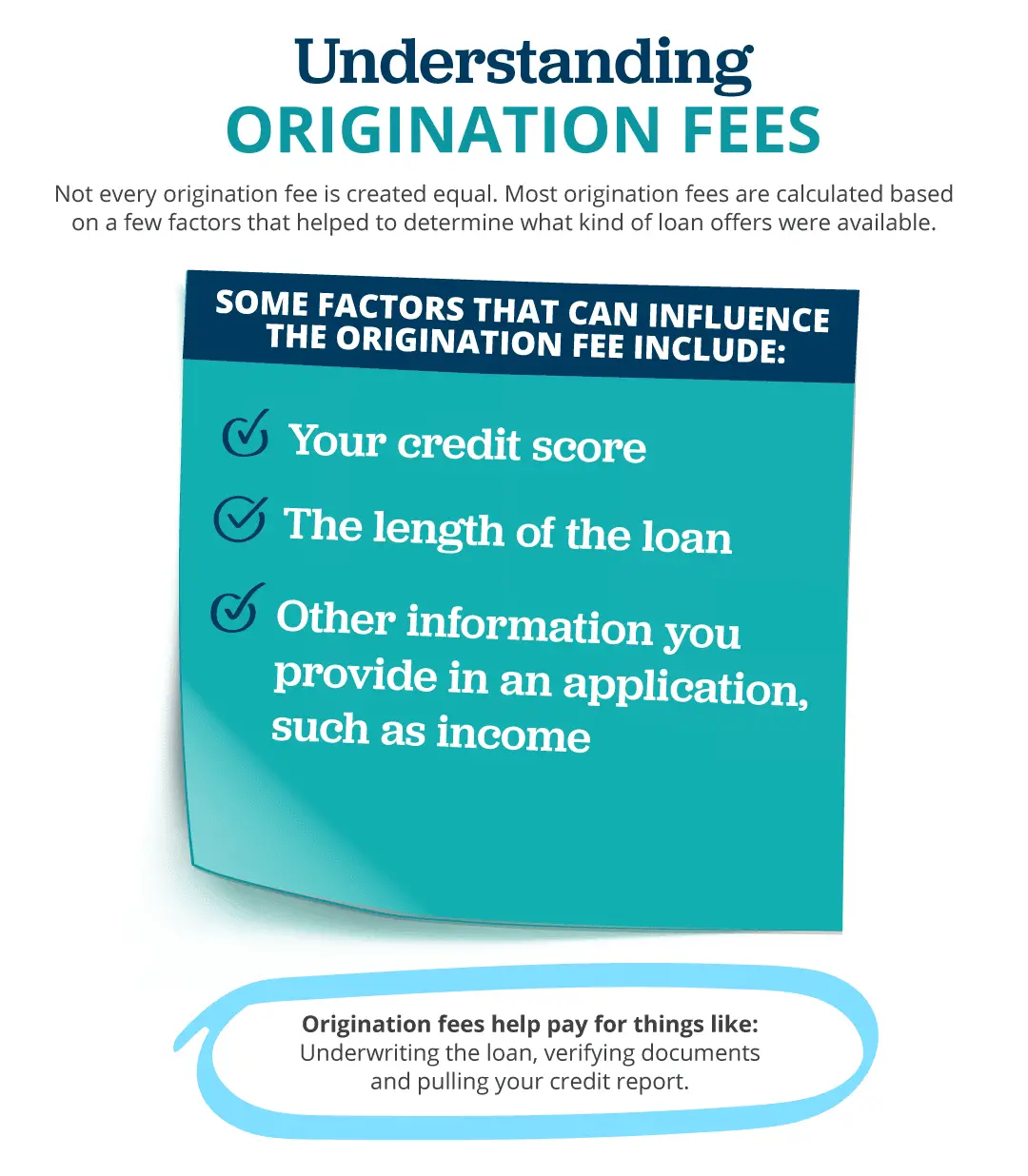

Not every origination fee is created equal. Most origination fees are calculated based on a few factors that helped to determine what kind of loan offers were available. Some of the factors that can influence the origination fee include:

- Your credit score

- The length of the loan

- The information you provided in an application, like income

Lenders charge an origination fee to help pay for things like: Underwriting the loan, verifying documents and pulling your credit report.

Recommended Reading: What Loan Will I Qualify For

Tips To Save For A Home

- Planning financially for a home involves more than picking the right price range. You have to account for smaller costs, like origination fees. If you need help budgeting for the wide range of charges home buying brings, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAssets mortgage calculator can help you know what you can afford by revealing the total cost of a loan spread over the duration of the mortgage.

- Mortgage rates are more volatile than they have been in a long time. Check out SmartAssets mortgage rates table to get a better idea of what the market looks like right now.

- You put plenty of funds into your home, whether its origination fees or a down payment. But did you know that you can use your house to pay for other costs in your life? Homeowners age 62 and above can borrow against the equity in their home with a reverse mortgage. Then, they can use any extra savings from it to fund their retirement.

What Are Loan Origination Fees

A loan origination fee is a charge assessed by a mortgage lender to process your loan. It typically amounts to about 1% of your total loan balance.

Almost all lenders charge origination fees to cover the cost of processing, underwriting, and executing your loan.

These fees can show up as a single origination fee or as several different charges like an underwriting and processing fee. Origination fees cover a variety of lender-side costs, including things like:

- Verifying your employment and income

- Processing your application and documentation

- Preparing your mortgage documents

- Underwriting your loan

Loan origination fees vary. Your loan amount, type of loan, , and the presence of a co-signer can all impact costs.

Thankfully, mortgage lenders break these fees down on your Loan Estimate, which youll receive when you get pre-approved. Youll also get an updated breakdown of your costs no later than three days before closing day.

Also Check: What Is Needed For Car Loan

Tips For Comparing Business Debt Consolidation Loans

When considering business debt consolidation loans, evaluate offers from multiple lenders to ensure you get the best possible deal. Here are a few tips to help you compare business debt consolidation loans:

- Evaluate qualification requirements. In addition to considering the borrowers credit score, business lenders often require applicants to demonstrate a minimum time in businessusually six months to a year but sometimes up to two to three years. Likewise, lenders look at annual revenue to evaluate a borrowers ability to repay the loan.

- Consider the interest rate and fees. Annual percentage rates encompass a loans interest rate and any other fees the lender charges. Business loan APRs vary by lender and the borrowers qualifications but generally can extend up to 30%. Also compare each lenders origination fees, as they often hover around 3% to 5% of the loan amount.

- Compare loan terms. The length of the loan repayment term directly impacts how much you have to repay each month, so make sure you choose a repayment schedule that you can afford. The best small business loans typically come with terms between three months and 10 years, but some are available for up to 25 years.

- Shop around. If you already have a relationship with a local lender, inquire about its debt consolidation options. Otherwise, research traditional banks and credit unions as well as online lenders to find the most competitive options.

Tips To Minimize Your Loan Origination Fee

These tricks can help keep your closing costs down.

1. Shop around. The more loan estimates you have, the better your chances of finding your best deal for your personal finances. And the wider your options for balancing your closing costs and mortgage rate.

2. Get lender credits. Some lenders will willingly trade you lower closing costs for a higher mortgage rate. Ask how flexible your shortlisted lenders are.

3. Negotiate. Lenders must by law send you a loan estimate within three working days of receiving your application. Once you have it, youll find the closing costs on page 2. Those in section A are negotiable. Get multiple loan estimates and you can play one lender off against another.

4. Get gifts. If you have family members who like to help, they may be happy to give you some money toward your loan. You need to be careful about how you receive this because there are often strict rules about gifts for down payments and its hard to differentiate between those and closing costs.

5. Use a down payment assistance program. There are more than 2,000 of these nationwide and many of them help with closing costs as well as down payments. Most lenders are cool with these.

6. Ask for seller concessions. Sometimes your seller may be willing to contribute to your closing costs in order to seal the deal. This happens most commonly in buyers markets.

Also Check: Find People Who Loan Money

Additional Fees To Look Out For

Keep an eye out for the following miscellaneous fees that you could be charged:

- Registration fees: Based on the state you want to register the vehicle in

- Destination fees: Which will cover any transportation/shipping costs

- Vehicle Inspection fees: To ensure your vehicle meets the standards of vehicle ownership in a state

- Dealership fees: Miscellaneous fees to cover dealership costs

Can I Deduct Loan Origination Fees On My Tax Return

The IRS lets borrowers deduct some housing costs, such as mortgage interest, from their income when they file their tax return.

You may be able to deduct some of the closing costs and origination fees, though you should ask your lender for a breakdown of the costs included in the fee to know what you can deduct.

You may deduct things like mortgage points and mortgage insurance, but cannot deduct things like the appraisal, notary, and document preparation fees.

Keep in mind, if you pay the fees out of pocket, you get a one-time, larger tax deduction. If you pay them as part of your monthly payment, you can get deductions over the life of the loan. If youre uncertain which option is best for you, you may wish to consult a tax professional.

Also Check: Loan With No Credit Check Online

Commercial Real Estate Loan Origination Fee

A commercial real estate loan origination fee is a fee charged by a lender for processing a loan application and generating a loan commitment. This fee is typically a percentage of the loan amount and is paid at loan closing.

The price of obtaining an agricultural license can vary greatly, ranging from 0.5% to 1%. The origination fee for multifamily mortgages is typically 1% for Fannie Mae, Freddie Mac, and HUD. If you own a private company and need funds, you can expect origination fees to range between 3% and 5%. In general, origination fees are higher for small loans and lower for large loans. The fee for negotiating a loan is negotiable. Borrowers with a higher net worth and a higher credit score have more bargaining power when negotiating commercial loan origination fees. In most cases, the lender does not charge any legal fees.

An Environmental Site Inspection typically costs between $1,500 and $6,000. A title search is required prior to obtaining title insurance. Property owners with a million-dollar home can expect title insurance rates to be between $2.50 and $3.00 per $1,000. An upfront payment may also be required at times. HUD multifamily loans do not require borrowers to purchase mortgage insurance, and commercial lenders do not require private mortgage insurance .