If You Have 2 Or More Jobs

If youre employed, your repayments will be taken out of your salary. The repayments will be from the jobs where you earn over the minimum amount, not your combined income.

Example

You have a Plan 1 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £1,000 a month from one job and £800 a month for the other.

You will not have to make repayments because neither salary is above the £1,657 a month threshold.

Example

You have a Plan 2 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £2,300 a month from one job and £500 a month for the other.

You will only make repayments on the income from the job that pays you £2,300 a month because its above the £2,274 threshold.

How Much Money Does The University Of Michigan Have In Debt

Michigan also donated more than $1 million to the university from its share of Big Ten Network proceeds, which will be used to provide financial aid to non-student athletes. The debt service for sports facilities in Michigan exceeds $1 million per year, and the total outstanding debt of the sports department is $1 million.

What Are Student Loan Interest Rates

An interest rate represents the amount a lender charges you to borrow money. It is calculated as a percentage and multiplied by your principal amount.

Student loan interest rates can be . Fixed rates remain the same for the life of a loan, while variable rates fluctuate with market trends.

With many student loans, interest can start to accrue as soon as your loan is disbursed and will continue to accrue until you repay the loan in full.

Recommended Reading: How Can I Refinance My Car Loan With Bad Credit

How Can I Get A Lower Student Loan Interest Rate When Taking Out The Loan

Federal student loan interest rates are set by Congress, so they can impose rates that are as high or low as lawmakers see fit. Rates on federal student loans for new borrowers are determined each May. But once you take out a federal student loan, your rate will be set for life .

Private student loan rates, on the other hand, vary by lender. If you want to get a lower interest rate on private student loans, you should make sure you have good credit or get a creditworthy cosigner.

If youre still in search of the right student loan for your situation, youve come to the right place. Credible makes it easy for you to compare private student loans, so you can find the right fit. Just fill out a single form and you can see prequalified rates from all of our partner lenders below in just a few minutes.

| Lender |

|---|

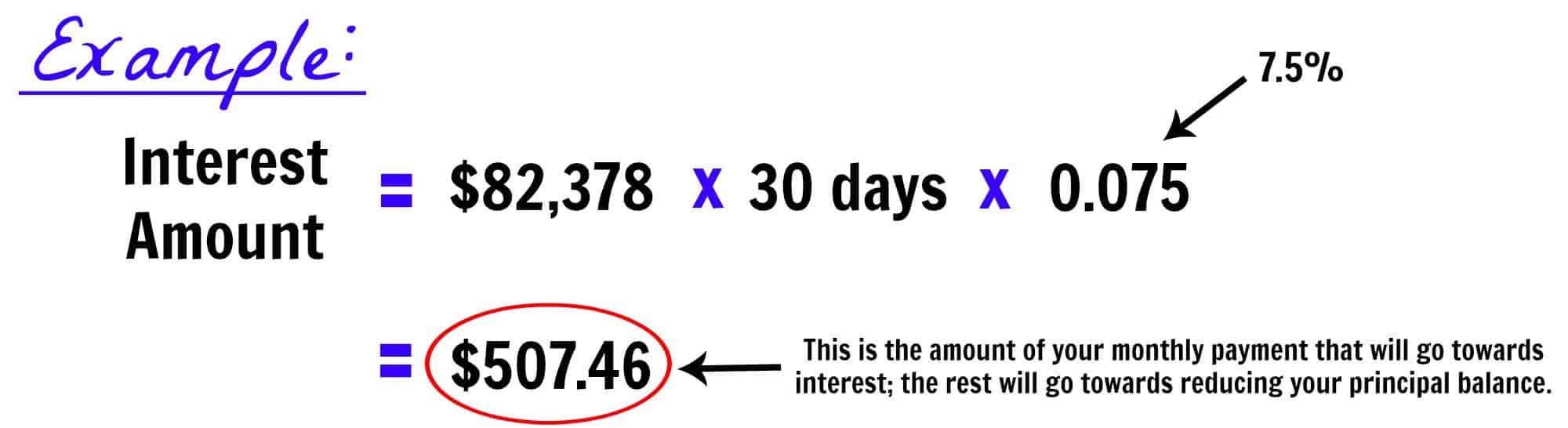

How Do You Calculate Loan Interest Rates

The interest on government student loans and many private student loans is calculated using a simple daily interest formula. To calculate the monthly interest on your student loan, find your daily interest rate and multiply it by the number of days since your last payment. Then multiply it by the loan balance.

Read Also: Usaa Student Loan Interest Rate

Different Loans For Different Folks

Before getting into the different types of available loan programs, lets do a quick refresher on how exactly student loans work. Like any type of loan , student loans cost some small amount to take out and they require interest and principal payments thereafter. Principal payments go toward paying back what youve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Typically, if you miss payments, the interest you would have had to pay is added to your total debt.

In the U.S.A., the federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Federal student loans are unique in that, while you are a student, your payments are deferredthat is, put off until later. Some types of Federal loans are subsidized and do not accumulate interest payments during this deferment period.

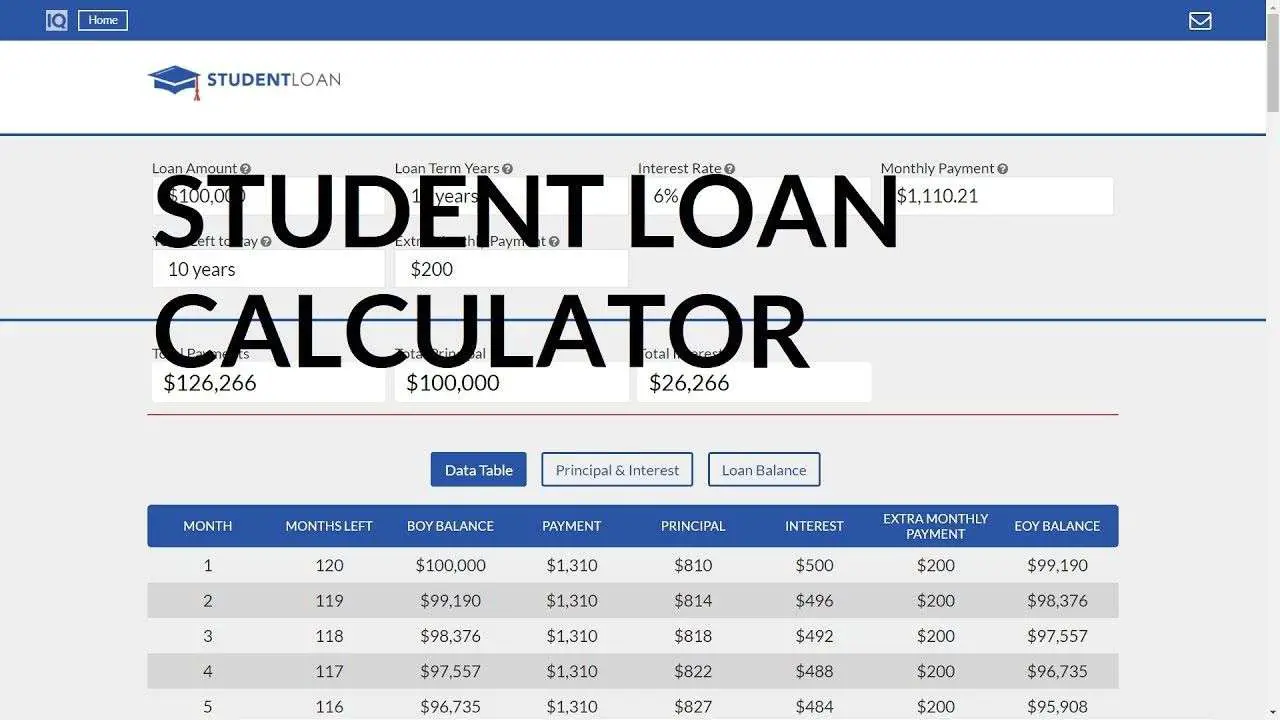

Your Student Loan Repayment Term

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 years.2 For , the repayment term can range anywhere from 5-20 years, depending on the loan. You’ll be given a definite term for your loan when you apply.

Interest rates for federal and private student loans

The average interest rate will be different for federal student loans and private student loans. Federal student loans have a single, fixed interest rate, which means that your loan’s rate doesn’t change over time.

You may have noticed that there’s a range of interest rates associated with a private student loan. Private student loans are . That means the rate you’ll be offered depends on your creditworthinessand that of your cosigner, if you have onetogether with several other factors. When you apply for a loan, you’ll be given an interest rate, either , depending on which is offered and which type of rate you’ve chosen.

How much you’ll need to borrow for college

If you’re wondering for collegewhether it’s a public university or private universitythe can help. You can search for college costs and also build a customized plan based on your own situation.

Don’t Miss: Usaa Pre Qualify Auto Loan

How Is Apr Calculated For Loans

A loans APR is calculated by determining how much the loan is going to cost you each year based on its interest rate and finance charges. While the APR will be displayed as a percentage, its not a new or different interest rateits a measure that can help you understand the cost of borrowing money given the specific terms.

Its also important to remember that a loans APR can change after you take out the loan. This could be due to a changing interest rate if your loan has a variable or adjustable rate. Or, if you pay off or refinance your loan before the end of its term, the effective APR of that loan may increase.

Increase Your Autopay Amount

If you can afford to do so, adjust your automatic payment amount every year. For example, you might increase it by 10% or by $100 per month annually, or when you get a raise. By gradually increasing automatic payments, youll work to pay off the loan faster, but the difference may not make a noticeable impact on your lifestyle.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

What Is The Maximum Debt To Income Ratio

The lender may set a 43% DTI for borrowers with a credit score of less than 640 credits. This is true, although the FHA allows a debt-to-income ratio to DTI for borrowers with a credit rating of at least 620 or higher. Lenders can limit the maximum debt-to-income ratio to a DTI limit of 55%, although the FHA allows DTI before DTI.

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Check Your Loan Payoff Date

Under your loan details, your loan servicer will list your expected loan payoff date. Federal student loans come with a standard repayment plan of 10 years, though your term can extend to 30 years if you switched to a different plan or consolidated your loans. Also, if you have private loans or you refinanced your student loan, your term may also be longer than 10 years. The longer the loan term, the more interest youll pay over time.

Sign Up For A Spare Change Savings App

If youre having trouble finding money to make extra payments toward your loans, sign up for a spare change app like ChangEd or Digit. These apps connect to your bank accounts or . Every time you make a purchase, they round the transaction up to the next full dollar and deposit the difference into a separate account. You can then use those savings to make a payment toward student loans.

Also Check: Usaa Auto Refinance Calculator

Student Loan Apr Vs Interest Rate: 5 Essential Faqs

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right. Read less

This article contains breaking news and events related to the current state of politics and the economy. While we try our best to keep our articles as up-to-date as possible, the ongoing effects of COVID-19 are happening in real time and information is subject to change.

Pop quiz: Whats the difference between student loan APR and student loan interest rate?

Both terms are related to how much money youll spend on total interest, so they should factor into your decision when comparing loans and lenders. It can be hard to weigh your options when some student loans display an interest rate, while others state an APR. The main difference is that APR includes any upfront charges and fees the lender may add to the loan principal and the interest rate does not. But there are complexities to each, which well break down here.

Penfed Student Loans Powered By Purefy

- Refinance federal and/or private student loans at lower rates with no fees.

- Choose a 5, 8, 12, or 15 year term to best fit your needs.

- Each applicant receives a personal loan advisor to help them through every step in the process.

- Spouses can refinance their loans together. Parents can refinance their loans too.

- Show more info »

1Rates and offers current as of April 1, 2021. Annual Percentage Rate is the cost of credit calculating the interest rate, loan amount, repayment term and the timing of payments. Fixed Rates range from 2.99% APR to 5.15% APR and Variable Rates range from 2.15% APR to 4.45% APR. Both Fixed and Variable Rates will vary based on application terms, level of degree and presence of a co-signer. These rates are subject to additional terms and conditions and rates are subject to change at any time without notice. For Variable Rate student loans, the rate will never exceed 9.00% for 5 year and 8 year loans and 10.00% for 12 and 15 years loans . Minimum variable rate will be 2.00%.

Also Check: Usaa Auto Loans Review

Dont Neglect Emergency And Retirement Savings

While repaying student loans is important, avoid neglecting other financial goals in the meantime. Building and maintaining an emergency fund and saving for retirement are essential even while you have student loan debt.

If you focus only on your student loan balance, you could be left in a lurch if you lose your job or face a medical emergency. And if you dont contribute to your retirement fund now, youll lose out on years of market growth.

When coming up with your student loan payoff strategy, make sure to land on a balanced approach that lets you set aside money for savings and retirement in addition to debt payments.

Why Do Credit Cards Have Different Aprs

You might notice that your credit card has an that shows more than one APR in the fee disclosures or your credit card statement. Credit card companies often charge a variable APR, according to the type of transaction.

The most common credit card APR categories apply to:

- Balance transfers usually at a lower fixed rate for a limited time

- Cash advances often higher and more expensive than the standard APR

- Introductory usually available for a limited time after sign-up

- Penalty or late payment often more expensive than the standard APR

- Standard purchases the main APR for store and online purchases

Read Also: What To Do If Lender Rejects Your Loan Application

Student Loan Repayment Great Lakes

If you have a government student loan in the Great Lakes region, keep in mind that your loans have several repayment options, including a standard 10-year plan, means-tested repayment , and extended repayment. If you do not apply for an alternative scheme, your student grant will remain within the standard scheme.

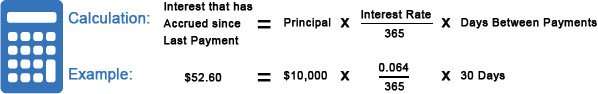

How Is Student Loan Interest Calculated

The thing to remember about interest is that its not a one-and-done calculation. Rather, interest is recalculated, or compounded, at specific intervals. Many student loans are compounded daily.

While that may sound confusing, know that compounding is built to work in your favor if you keep current on your loan. The idea is that with each on-time payment you make, youre paying slightly less toward interest and slightly more toward principal.

Lets go back to our $10,000 loan at 5% interest to illustrate how daily compounding works over time. To keep it simple, well look at a two-month period.

With daily compounding, the 5% APR is divided by the 365 days of the year to come up with a daily interest rate.

5% APR / 365 days = 0.0137% daily interest

The lender will apply 0.0137% interest to your principal every day. On the very first day that interest begins to accrue on your loan, the calculation would look like this:

$10,000 principal balance x 0.000137 daily interest rate = $1.37 in interest

The interest for day one of your loan would be $1.37.

Every day, from day one until you make your first payment, your lender would run the same calculation.

Day 1: 10,000 x .000137 = $1. 37Day 2: 10,000 x .000137 = $1. 37Day 3: 10,000 x .000137 = $1. 37

Month 1: $1.37 interest per day x 30 days = $41.10 in interest

So on day 30, your balance is $10,000 in principal and $41.10 in interest. Note that your principal didnt change, only your interest did.

| Month |

| $150.00 |

Read Also: How Do I Find Out My Auto Loan Account Number

Improving Your Credit Can Get You Lower Rates

Lenders may offer you a different APR on your loan depending on your creditworthiness and the repayment term you choose. Those applicants with higher credit scores and lower debt-to-income ratios may qualify for lower interest rates and finance charges, leading to a lower APR.

To improve your credit and avoid late payment fees, make all your debt payments on time. Paying down your credit card balances can also help your credit by lowering your .

If you need to borrow money now and dont have time to improve your credit first, you can still compare lenders offers to figure out which loan has the lowest APR. Often, you can start by getting prequalified or preapproved for a loan to see your estimated APRs and terms.

All else being equal, the lowest APR may be best. However, keep the big picture in mind before taking out a loan. For example, lenders may offer you a lower rate on shorter-term loans, which can lead to a lower APR but higher monthly payments. If thats not affordable, the longer-term loan with a higher APR may be best.

How To Calculate Loan Payments In 3 Easy Steps

Making a big purchase, consolidating debt, or covering emergency expenses with the help of financing feels great in the moment – until that first loan payment is due. Suddenly, all that feeling of financial flexibility goes out the window as you factor a new bill into your budget. No matter the dollar amount, it’s an adjustment, but don’t panic. Maybe it’s as simple as reducing your dining out expenses or picking up a side hustle. Let’s focus on your ability to make that new payment on time and in full.

Of course, before you take out a personal loan, it’s important to know what that new payment will be, and yes, what you’ll have to do to pay your debt back. Whether you’re a math whiz or you slept through Algebra I, it’s good to have at least a basic idea of how your repayment options are calculated. Doing so will ensure that you borrow what you can afford on a month-to-month basis without surprises or penny-scrounging moments. So let’s crunch numbers and dive into the finances of your repayment options to be sure you know what you’re borrowing.

Don’t worry – we’re not just going to give you a formula and wish you well. Ahead, we’ll break down the steps you need to learn how to calculate your loan’s monthly payment with confidence.

Also Check: What Do Mortgage Loan Officers Do

How Compound Interest Works In Your Favor

Looking at the examples above, its easy to see how this effect works over time. You naturally make a little more headway on your principal every month, even though your payment amount remains the same. This is known as amortization.

If you use amortization to your advantage, you can save yourself a lot of money over the life of your loan.

If your loan doesnt have prepayment penalties, you can pay it off faster by making higher payments every month. Because youve already paid the interest for that payment period, any additional money will go right toward the principal.

That will have a lasting benefit, because a lower principal amount means that those daily compounding calculations will be applied to increasingly smaller numbers.

Paying as little $10 extra per month can yield significant savings over the life of your loan. Paying $100 extra or more can save you thousands.