Monthly Repayments For A 150 000 Mortgage

How much you pay every month for a £150000 mortgage will depend on various factors. The most important ones are the length or term of the mortgage and the interest rate youre given.

Keep in mind that every lender is different, and theyll have their criteria to determine the rates they give you. Factors like your profile or credit history and your level of deposit can influence the interest rate a lender is willing to offer.

Interest Rates For A £150,000 Mortgage

The interest rate affects the monthly repayments on any loan, and you typically you may get a rate ranging between 1% to 5% for a £150000 mortgage in the UK based on current rates.

The interest is usually added to a portion of the capital or amount borrowed and paid back each month for the loan duration.

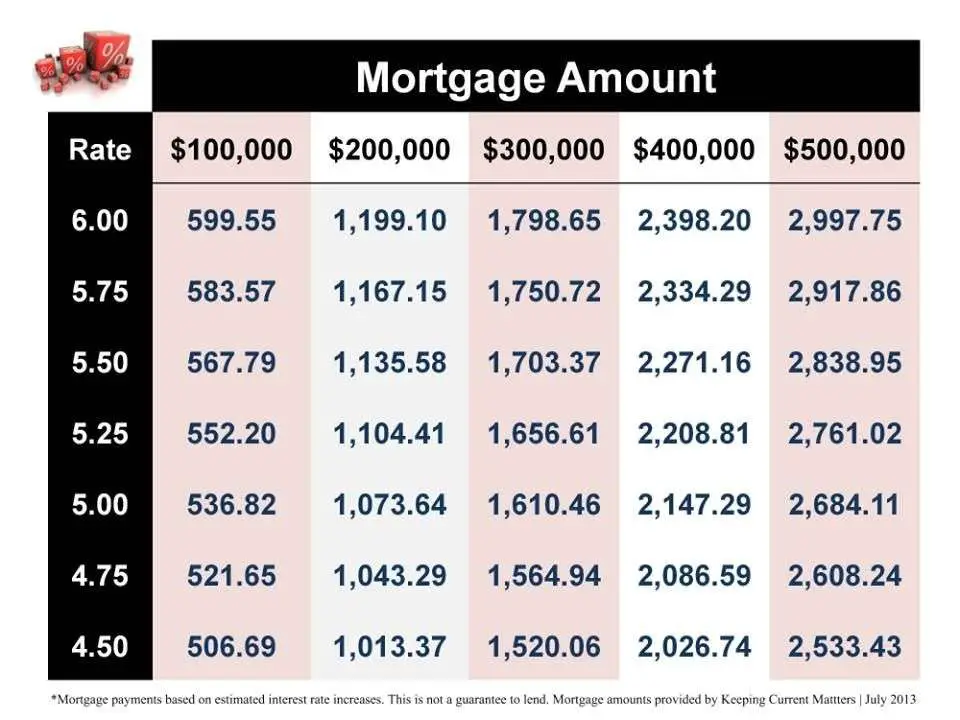

Heres an illustration of how the monthly repayments can differ on a £150000 mortgage with a 30-year term based on different interest rates:

- Interest Rate 1% 2% 3% 4% 5%

- Monthly Repayment £482 £554 £632 £716 £805

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

What Is A Minimum Down Payment

A down payment is the amount of money you put towards the purchase of a home. Your lender deducts the down payment from the purchase price of your home. Your mortgage covers the rest of the price of the home.

The minimum amount you need for your down payment depends on the purchase price of the home.

If your down payment is less than 20% of the price of your home, you must purchase mortgage loan insurance.

Table 1: The minimum down payment based on the purchase price of your home| Purchase price of your home | Minimum amount of down payment |

|---|---|

| $500,000 or less |

|

| $500,000 to $999,999 |

|

| $1 million or more |

|

If youre self-employed or have a poor credit history, your lender may require a larger down payment.

Normally, the minimum down payment must come from your own funds. Its better to save for a down payment and minimize your debts.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

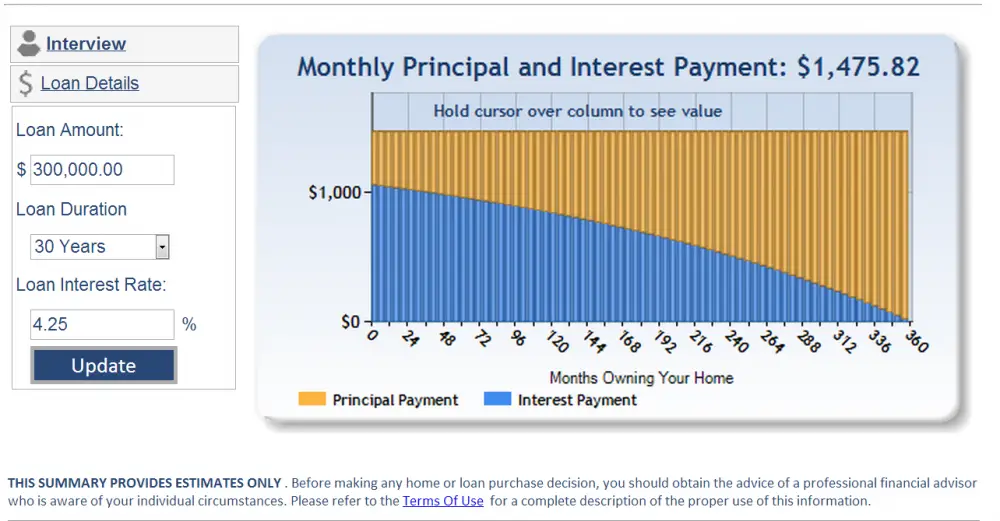

What Is Your Principal Payment

The principal is the amount of money you borrow when you originally take out your home loan. To calculate your mortgage principal, simply subtract your down payment from your homes final selling price.

For example, lets say that you buy a home for $300,000 with a 20% down payment. In this instance, youd put $60,000 down on your loan. Your mortgage lender would then cover the cost of the remaining amount on the loan, which is $240,000. In this case, your principal balance would be $240,000.

Your principal is the most important factor in deciding how much home you can afford. The principal you borrow accumulates interest as soon as you take it out.

If you arent sure how much home you can afford, a good place to begin is with our mortgage calculator. Simply enter your purchase price, down payment and a few other factors. The calculator will then give you a rough estimate of your monthly mortgage payment. When deciding on a mortgage payment thats in your comfort zone, dont forget that youre also responsible for maintenance, repairs, insurance, taxes and more.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Recommended Reading: Loan Without Income Proof

What Is A Mortgage Interest Rate

Mortgage interest rates reflect lenders cost of money, a cost that they pass on to you in the form of an interest rate. Your rate sets the amount of interest you pay over the life of your mortgage.

Even though nearly all mortgages come with fixed rates these days, small differences in interest rates can drive your monthly payments up or down. Over a 30-year term, that difference can add up. Just $50 a month equals more than $18,000 over the loans term. Knowing how interest rates factor into your loan pricing, as well as how your rate is determined, will help you evaluate your options and make the best decision for your situation.

What Is Your Interest Payment

The second major part of your monthly mortgage payment is interest. Interest is money you pay to your mortgage lender in exchange for giving you a loan. Most lenders calculate interest in terms of an annual percentage rate . APR is the actual amount of interest that you pay on your loan per year . For example, if you borrow $100,000 at an APR of 5%, youd pay a total of $5,000 per year in interest. At the beginning of your loan , most of your monthly payment goes toward paying off interest.

Just a few percentage points of interest can make a huge difference in how much you eventually end up paying for your loan. For example, lets say you borrow $150,000 at a 4% interest on a 30-year loan. With this loan, your monthly payment would be $716.12. If you take the same loan with a 6% interest rate, youd pay $899.33 each month.

The interest rate on your loan depends upon a number of factors. Your credit score, income, down payment, and the location of your home can all influence how much you pay in interest. If you know your credit history isnt that great, you may want to take some time to raise your credit score so you can save thousands of dollars in interest over time. Lets take a look at an example.

Say you have a choice between two lenders. One offers you $150,000 for a 30-year loan with 4% interest. The other lender offers you the same $150,000 for a 30-year loan, but with a 6% interest rate.

Find out what you can afford.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Benefits Of Paying Off Your Mortgage Early

Owning a home without a mortgage is financially liberating. Here are just a few of the key benefits:

- You save money. By paying off your mortgage you eliminate interest costs. This lowers your monthly expenses and reduces the total cost to own your home.

- No interest is better than a mortgage tax deduction. If you keep the mortgage to get the tax deduction then you’re paying $1 to the bank to get a $0.25 tax deduction . You’re still out $0.75. If you pay off the mortgage, you pay $0.25 in taxes and have $0.75 in your pocket.

- You will gain the flexibility of using what had been the mortgage payment to invest in retirement or save toward other financial goals. Imagine! Not only will you avoid paying mortgage interest, but you’ll be making money in higher-yielding accounts!

Home Loan Interest Rate Faqs

1. What is home loan interest rate?

Home loan interest rate is the percentage of the principal amount charged by the lender to the borrower for using the principal amount. The interest rate charged by banks and non-financial institutions determine the cost of your home loan. So, when you are paying your home loan EMI , the interest rate charged determines how much you have to pay your lender against your loan every month. Interest rates are usually linked to repo rate and can vary from lender to lender.

2. Which Bank has lowest home loan interest rate?

Though interest rates offered by banks can increase or decrease as per the banks discretion, right now the Union Bank of India is offering the lowest home loan interest of 6.70% p.a. to its customers. However, note that this rate is applicable only on home loan for women applicants.

3. How to Get Lowest Home Loan Rates in India?

Home loan interest rates are at a 15-year low, so almost all the banks are offering lower interest rates on home loans compared to what they were offering in the previous financial year. However, to get the lowest home loan interest rates, compare rates offered by lenders. Always use a home loan EMI calculator while comparing rates it will help you estimate how much you have to pay every month against your loan.

4. How to reduce home loan interest?5. How Home Loan Risk weightage is linked to LTV Ratio?6. Which bank has the lowest rate of interest for the self-employed?

Recommended Reading: How Much Car Can I Afford For 500 A Month

The Term For A 150 000 Mortgage

Typically you may get a term of between 5 to 30 years to repay a £150000 mortgage depending upon your circumstances. The term will have a massive effect on your monthly repayments as well as the total amount youll ultimately pay.

With a more extended period, youll have cheaper monthly payments. However, the total amount youll repay for the loan will be higher than a shorter period. You can save thousands by repaying your loan over a shorter period.

To give you an idea of how the term affects monthly and total payments of a £150 000 mortgage, check out the table below, which is based on a 3% interest rate.

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Is Home Equity

Home equity is the difference between the value of your home and how much you owe on your mortgage.

For example, if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

Your home equity goes up in two ways:

- as you pay down your mortgage

- if the value of your home increases

Be aware that you could lose your home if youre unable to repay a home equity loan.

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

Also Check: Usaa Pre Qualify Auto Loan

Refinance To Lower Your Mortgage Rate

To determine if you can save money with a lower mortgage rate, use our calculator to compare the monthly interest savings against the cost to refinance. As most mortgage brokers and lenders will cover your legal costs, the main cost you need to worry about is your break of mortgage penalty, or prepayment penalty. This penalty is charged by your lender for breaking your mortgage contract early and is based on your original contract date, current mortgage balance, mortgage rate, and other factors.

Does My Home Qualify For The Mortgage Interest Deduction

You can only claim the mortgage interest tax deduction if your mortgage is for a qualified home, as defined by the IRS. As long as they qualify, you can write off mortgage interest on both your main home and a second home, as long as each home secures the mortgage debt.

The IRS considers a home to be any residential living space â including houses, apartments, condos, mobile homes, and houseboats â that has âsleeping, cooking, and toilet facilities.â

Read Also: Mortgage Loan Officer Salary Plus Commission

Equation For Mortgage Payments

M = P

- M = the total monthly mortgage payment

- P = the principal loan amount

- r = your monthly interest rate. Lenders provide you an annual rate so youll need to divide that figure by 12 to get the monthly rate. If your interest rate is 5%, your monthly rate would be 0.004167 .

- n = number of payments over the loans lifetime. Multiply the number of years in your loan term by 12 to get the number of total payments for your loan. For example, a 30-year fixed mortgage would have 360 payments .

This formula can help you crunch the numbers to see how much house you can afford. Using our mortgage calculator can take the work out of it for you and help you decide whether youre putting enough money down or if you can or should adjust your loan term. Its always a good idea to rate-shop with several lenders to ensure youre getting the best deal available.

How Do I Get The Best Mortgage Rate

Shopping around is the key to landing the best mortgage rate. Look for a rate thats equal to or below the average rate for your loan term and product. Compare rates from at least three, and ideally four or more, lenders. This lets you make certain youre getting competitive offers. Check with a variety of types of lenders large banks, credit unions, online lenders, regional banks, direct lenders and mortgage brokers. Bankrate offers a mortgage rates comparison tool to help you find the right rate from a variety of trusted lenders.

Interest rates and terms can vary significantly among lenders depending on how much they want your business and how busy they are processing loans. Many lenders staffed up during the refinancing boom of 2020 and in 2021 are lowering their profit margins to keep enough new mortgages in the pipeline. As online and non-bank lenders take an ever-greater share of the mortgage market, expect to see the deals get even better no matter where interest rates go.

Keep in mind that mortgage rates change daily, even hourly. Rates move with market conditions and can vary by loan type and term. To ensure youre getting accurate rate quotes, be sure to compare similar loan estimates based on the same term and product.

Recommended Reading: What Kind Of Loan Do I Need To Buy Land

Mistake #: Not Putting Extra Payments Towards The Loan Principal

Throwing in an extra $500 or $1,000 every month wont necessarily help you pay off your mortgage more quickly. Unless you specify that the additional money youre paying is meant to be applied to your principal balance, the lender may use it to pay down interest for the next scheduled payment.

If youre writing separate checks for extra principal payments, you can make a note of that on the memo line. If you pay your mortgage bill online, you might want to find out whether the lender will let you include a note specifying how additional payments should be used.

How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Recommended Reading: Can You Refinance A Car Loan With The Same Lender

What Is A Home Loan Emi Calculator

The Home Loan EMI Calculator is a simulation that helps you calculate the EMIs, which you must pay on the home loan. The home loan calculator will calculate the monthly EMIs depending on the principal, interest, and the duration of the home loan.

It consists of a box, with three sliders, mainly Loan Amount, Loan Tenure, and Interest Rate. Once you fill in the details, you will be shown how much EMI , you must pay the bank each month, to repay the home loan within the selected tenure.