Why Do Banks Use The Hem

Under the National Consumer Credit Protection Act 2009, Australian banks must make allowances for living costs when they run borrowing power or serviceability assessments for applicants.

Industry regulator, the Australian Prudential Regulation Authority doesnt provide specific dollar figures for banks to adhere to so for years they were using the Henderson Poverty Index or Henderson Poverty Line and added an allowance.

In 2012, the Commonwealth Bank switched to HEM and other banks followed.

Understanding Your Loan Estimate And Closing Disclosure

All lenders use standard loan forms called the Loan Estimate and Closing Disclosure.

Lenders are required to send you a Loan Estimate after you apply. This document will list your loan terms, interest rate, and every closing fee associated with the offer.

All Loan Estimates use the same format, making it easy for you to compare rates and fees to find the best deal.

You can also use your Loan Estimates as leverage. If one lender offers a great rate but another offers lower fees, you can bring your lowfee estimate to the first lender and see if it will reduce your costs.

Average Mortgage Records $80000 Increase Over The Year

Across the country, the new average mortgage stands at $580,900 as it saw a 16% increase totalling $80,000 over the past year, according to new data from CommSec.

New home loans went down by 4.3% in August the biggest fall in 15 months since the onset of the pandemic but increased 47.4% on the year.

New South Wales and Victoria had the largest number of declines in lending the same states where the highest average mortgages can be found at $760,800 and $629,300 respectively.

Construction loans have also fallen for the past six months after rising for eight months. This comes after the HomeBuilder scheme ended last April.

On the other hand, investor home loans have continued to rise for the past 10 months. With a 92.2% increase on the year, the current total value of investor loans is $9.5 billion the highest it has been in six years.

Next to NSW and Victoria, the highest average mortgage is in the Australian Capital Territory at $569,900 and Queensland at $466,000. The lowest average mortgages can be found in South Australia at $397,000 and the Northern Territory at $401,600.

Although mortgages can be influenced by many factors such as interest rates and home prices, the CommSec report noted Reserve Bank of Australia Governor Philip Lowes belief that the key to better housing affordability is greater supply of homes and higher wages.

The RBA is expected to release more insights Friday in its semi-annual Financial Stability Review.

Related stories:

Recommended Reading: Usaa Student Loans Refinance

How Fixed Rates & Floating Rates Work

Home loans are largely priced at fixed interest rates or floating interest rates. Fixed rate mortgage loans charge you a fixed interest rate for up to 3 years, though a small number of home loans only do this for 1-2 years. After the 3rd year, banks start charging you a floating rate. Floating interest rates fluctuate regularly because they are pegged to a pre-designated reference rates like SIBOR, SOR and fixed deposit rates. Therefore, if the market interest rate continues to rise when you have to pay a floating rate, your monthly instalment will also increase.

For example, let’s assume you take out a fixed rate home loan of S$500,000 with a tenure of 30 years. In order to get this loan, you agree to pay a fixed annual interest rate of 1% to the bank. By the end of the 3rd year, you will have paid total of S$14,368 in interest and S$43,527 in principal.

Then, you choose to refinance the remainder your loan at a rate that’s pegged to the 12-month SIBOR rate at the time, which we assume for now to be around 1.8% since rates are set to rise. Then, for the next 12 months, you will be paying around 1.8% of interest, which roughly translates to S$1,780 of monthly installments. At the end of the 12th month, you get to choose again among 1-Month, 3-Month, 6-Month, 12-Month SIBOR as your reference rate on which your home loan’s interest rate will be pegged.

What Are Closing Costs

Closing costs are a collection of fees required to set up and close a new mortgage. They can range from 25% of the mortgage amount for both home purchase and refinance loans.

For example, say youre purchasing a home. Closing costs on a $100,000 mortgage might be $5,000 , but on a $500,000 mortgage theyd likely be closer to $10,000 .

In addition, closing costs are often a smaller percentage on a refinance loan because some fees like transfer taxes and owners title insurance arent included.

Closing fees include everything charged by your lender, home appraiser, title company, and other third parties involved in the mortgage transaction.

For simplicity, borrowers pay all these fees together on closing day. Closing fees are paid to an independent escrow company, which handles distributing each fee to the right party. This is much easier than having borrowers pay each cost separately.

Note that closing costs are separate from your down payment, though some lenders may combine them into a single number on your closing documents.

The good news is that many closing costs are flexible. So borrowers can shop around for the lowest fees, and even negotiate with their lender to reduce certain items.

The key is to get offers from at least a few different lenders so you can see the range of closing costs for your loan and which company is most affordable.

You May Like: Conventional 97 Loan Vs Fha

What Is A Mortgage Rate Lock

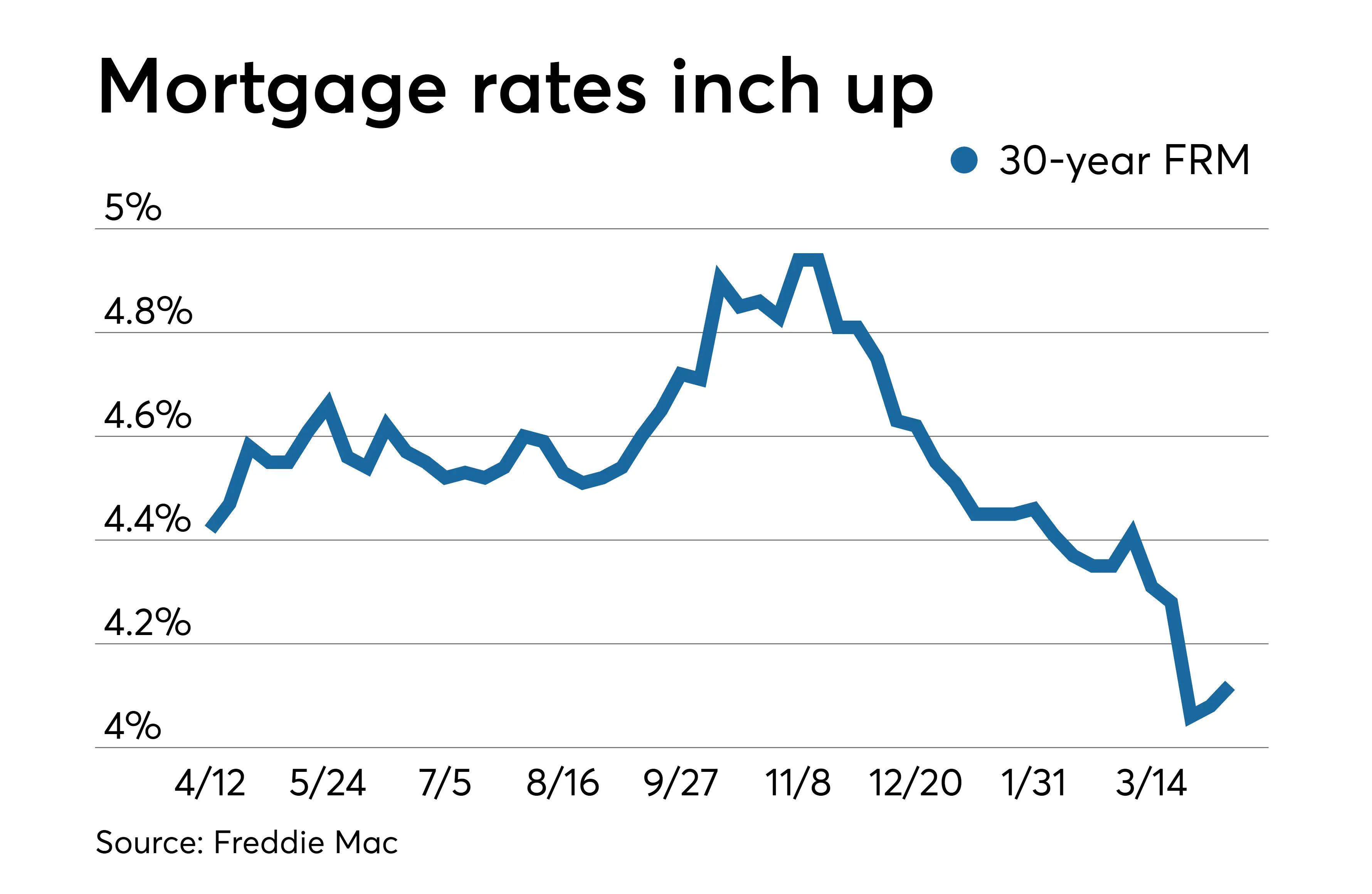

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

If you get a floating rate lock, then you can lock in a lower interest rate if rates fall, but you wont be obligated to pay higher interest rates than you were quoted if they go up.

While 30-day rate locks are typically included in the cost of a mortgage, a floating rate lock could cost extra. Depending on how volatile the rate environment is, you might find that a floating lock is worthwhile.

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, heres what youll need:

- The home price

Also Check: Sofi Vs Drb

How Much Is A Typical Down Payment On A House

Lenders and underwriters will usually offer more competitive interest rates when your loan-to-value ratio is low. In other words when youve invested in a home with a larger down payment, lenders will release the mortgage insurance requirement. And with these larger-than-average down payments, you may be able to leverage a big financial benefit. Take a look at this chart that compares the homes overall price to the down payment, PMI interest rates and cost implications:

| Home Price |

|---|

Average New Lending Amounts By States

- NSW $684,086

- WA $430,248

- QLD $457,006

Getting a pre-approval can potentially shave time and stress off your house hunt. Speak to one of our home loan consultants to get to the next steps to getting your pre-approval with a lender.

Heres how you get started online:

Step 1. Select your state below and whether you want to purchase or refinance.

Step 2. After answering a few questions, youll be given possible home loan options to start comparing straight away and work out your estimated borrowing capacity and break down your repayment and upfront costs.

Recommended Reading: Usaa Auto Loan Pre Approval

Important Information On Terms Conditions And Sub

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider’s website for further information before making any decisions about an insurance product.

How Do I Get The Best Mortgage Rate

To get the best mortgage interest rate for your situation, its best to shop around with multiple lenders. According to research from the Consumer Financial Protection Bureau , almost half of consumers do not compare quotes when shopping for a home loan, which means losing out on substantial savings. Interest rates help determine your monthly mortgage payment as well as the total amount of interest youll pay over the life of the loan. While it may not seem like much, even a half of a percentage point decrease can amount to a significant amount of money.

Comparing quotes from three to four lenders ensures that youre getting the most competitive mortgage rate for you. And, if lenders know youre shopping around, they may even be more willing to waive certain fees or offer better terms for some buyers. Either way, you reap the benefits.

Also Check: Can I Get A Car With A 600 Credit Score

Costs Included In A Monthly Mortgage Payment

In the Census Bureau’s American Community Survey’s data, the monthly mortgage payment includes things like insurance and taxes. In part, it’s because that’s how mortgages actually work oftentimes, you pay for more than just the loan’s principal and interest in your monthly payment.

If your mortgage includes an escrow account, you’ll pay for two costs each month in your monthly mortgage payment:

- Property taxes: You’ll pay tax on your home to your state and local government, if necessary. This cost is included in your monthly payment if your mortgage includes escrow.

- Home insurance: To keep your home covered, you’ll need to purchase a homeowner’s insurance policy. The average cost of homeowners insurance is about $1,200 per year.

In addition, mortgage payments can also change based on several factors. Two different people could face very different homeownership costs for the same house, even. There are two big factors that change your monthly payment:

Another monthly cost to consider should be how much you’ll need to save for repairs. In general, the older your home is, the more you should keep on hand for repairs. Utilities like internet, garbage removal, and electricity will also add to your monthly costs of homeownership.

Who We Are And How We Get Paid

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace business, we do earn money from advertising and this page features products with Go To Site links and/or other paid links where the provider pays us a fee if you go to their site from ours, or you take out a product with them. You do not pay any extra for using our service.

We are proud of the tools and information we provide and unlike some other comparison sites, we also include the option to search all the products in our database, regardless of whether we have a commercial relationship with the providers of those products or not.

‘Sponsored’, ‘Hot deal’ and ‘Featured Product’ labels denote products where the provider has paid to advertise more prominently.

‘Mozo sort order’ refers to the initial sort order and is not intended in any way to imply that particular products are better than others. You can easily change the sort order of the products displayed on the page.

You May Like: Refinance Auto Loan Usaa

Make A Detailed List Of Your Current Debts

The paycheque you collect every month should be adequate enough to not only cover all your current bills, but also leave some leftover to accommodate a mortgage payment. To find out how much of your income you can spare if you added a mortgage to the mix, you should make a detailed list of all your expenses and debts.

These can include any of the following:

- Miscellaneous expenses

Contact Us To Learn More

We know this example does not match everyones scenario. However, this simple calculation can give homebuyers a general idea of the average monthly mortgage payment in Texas. To learn more about particular home loans and get more specific scenarios, contact our expert team! Our Client Advisors are available 7 days a week for any questions by phone at 855-4491 or by email at .

Jay Voorhees

You May Like: Usaa Car Loans Credit Score

Why Does My Mortgage Interest Rate Matter

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, a borrower with a good credit score and a 20 percent down payment who takes out a 30-year fixed-rate loan for $200,000 with an interest rate of 4.25% instead of 4.75% translates to almost $60 per month in savings in the first five years, thats a savings of $3,500. Just as important is looking at the total interest costs too. In the same scenario, a half percent decrease in interest rate means a savings of almost $21,400 in total interest owed over the life of the loan.

How You Can Reduce The Interest You Pay

One way you can reduce the interest you pay over the life of your loan is through an offset account attached to your mortgage. The money held in this account is used to offset the interest charged on your home loan each month. You may pay for the privilege of an offset account, so ensure youre getting the most out of it by keeping money in the account.

Consider depositing your savings, lump sum payments, bonuses and your salary into the account every month to reduce the amount of interest you pay on your loan. Essentially, the more you keep in your offset, the less interest youll pay.

You May Like: Usaa Credit Score Range

Factors That Influence Cost Of Home Loans

The total cost of a home loan can be influenced by multiple factors. The core principle here to understand is that banks, as any business, wants to maximise profit while minimising losses. Therefore, they tend to offer lower costs for big, profitable deals. The flip side is that they charge higher rates for deals that have greater probability of loss than average in order to compensate for the risk. Below, we discuss each of the major factors so you have a better understanding of how it works.

What Is Home Equity

Home equity is the difference between the value of your home and how much you owe on your mortgage.

For example, if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

Your home equity goes up in two ways:

- as you pay down your mortgage

- if the value of your home increases

Be aware that you could lose your home if youre unable to repay a home equity loan.

Also Check: Usaa Rv Financing

What Is Mortgage Loan Insurance

Mortgage loan insurance protects the mortgage lender in case you cant make your mortgage payments. It doesnt protect you. Mortgage loan insurance is also sometimes called mortgage default insurance.

If your down payment is less than 20% of the price of your home, you must buy mortgage loan insurance.

Your lender may require that you get mortgage loan insurance, even if you have a 20% down payment. Thats usually the case if youre self-employed or have a poor credit history.

Mortgage loan insurance isnt available if:

- the purchase price of the home is $1 million or more

- the loan doesnt meet the mortgage insurance companys standards

Your lender coordinates getting mortgage loan insurance on your behalf if you need it.

National Average Monthly Mortgage Payment

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

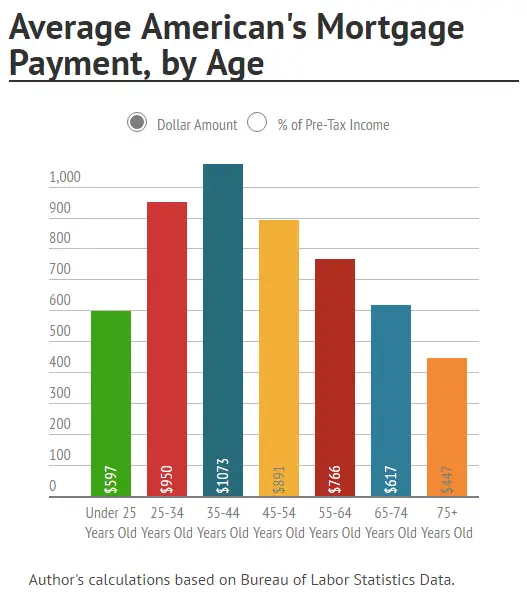

Housing is one of Americans biggest expenses. In fact, Americans now owe $14 trillion in mortgage debt. That sounds like a mountain of debt, but what does that figure really mean for average families?

LendingTree analyzed data from the 2016 U.S. Census Bureaus American Community Survey to figure out the average monthly mortgage payment on a national and state-by-state level. We also analyzed the affordability of these payments based on mortgage costs relative to homeowners incomes.

Also Check: Gustan Cho Mortgage Reviews

How Much Is The Average Monthly Mortgage Repayment

According to Canstars calculations , Australias average monthly mortgage repayment for an existing home is $2,489. In correlation with mortgage sizes, this amount varies depending on which state and suburb a property is located. Canstars calculations were based on principal and interest payments, paid monthly over 30 years. The estimations did not take any charges or fees into account and were based on the variable rate of 3.22% staying the same throughout the loan period.