What Is The Difference Between Getting A Heloc And Refinancing My Mortgage

Refinancing your mortgageallows you to borrow a lump-sum at an interest rate that is usually lower than what you would be able to get on a HELOC. Unlike a HELOC, however, you will have to make regular payments torwards your mortgage that include both principle and mortgage payments. With a HELOC, you can make interest-only payments, significantly reducing the amount you have to pay back each month. This can be helpful if you will only be able to make a repayment sometime in the future, like in the case of renovating your home.

For a HELOC, the interest rate is typically a lenders prime rate + 0.5%. Prime Rates are set by the lenders and can differ from institution to insitution. This means, unlike the fixed payments in a fixed-rate mortgage, a HELOC’s rate is variable. So if a lender increases its prime rate, then your HELOC interest payment increases. The rates are typcially higher than the rate of the initial mortgage.

Mortgages also often come with pre-payment limitations and penalties. You will not be able to pay off the amount you borrowed immediately, and it will continue to accrue interest. A HELOC, on the other hand, gives you the flexibility to borrow and pay off the credit whenever you want.

Interest Rates And Fees If You Refinance Your Home

The interest rate on the refinanced part of your mortgage may be different from the interest rate on your original mortgage. You may also have to pay a new mortgage loan insurance premium.

You may have to pay administrative fees which include:

- appraisal fees

Your lender may have to change the terms of your original mortgage agreement.

How Is My Heloc Limit Calculated

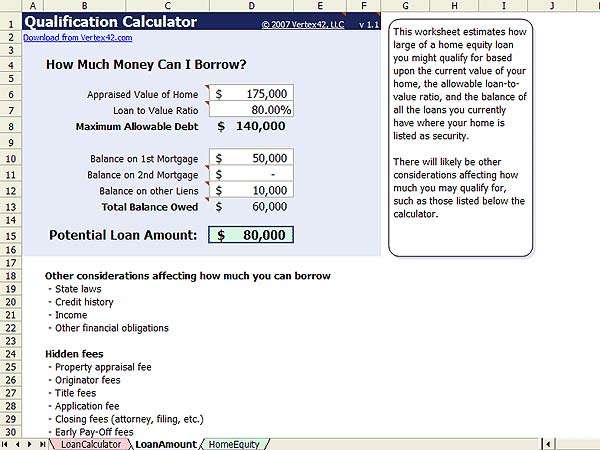

In Canada, you can only borrow up to 65% of your home’s value with a HELOC. When combined with a mortgage, your Cumulative Loan To Value cannot exceed 80%. This means that your mortgage and HELOC combined cannot exceed 80% of your home’s value. If you owe 50% of your home value on your mortgage, you would be eligible for a HELOC of up to 30%. Below is the formula used:

Recommended Reading: Usaa Auto Refi Rates

Home Equity Line Of Credit Calculator Faqs

You can calculate home equity by subtracting the amount owed due to the mortgage from the current estimated value of the house. You may also make use of our Home Equity Line of Credit Calculator to determine further how much you can borrow based on your current home equity.

A home equity loan provides a line of credit from which you can borrow over time up until a specific limit. The loan, however, is secured by the equity of your home. The loan is to be repaid over a period, and failure to do so leads to foreclosure of the home used as collateral.

The amount of money you can get for a Home Equity Loan is chiefly determined by how much equity your home currently has. Your equity, in turn, is arrived at by subtracting the amount you owe in mortgage loans from the current value of your home. Most lenders offer only 75-90% of your current home equity up for borrowing.

An equity line of credit calculator shows you how much you can borrow based on your current home equity. It also clarifies how that amount will vary with a change in the value of your home.

To use an equity line of credit calculator, you feed in the current estimated value of your home, then the amount owed on your mortgage, and the loan-to-value ratio which your lender offers. The calculator provides you with the line of credit that would currently be available to you. The calculator also reveals what line of credit that will be available to you if the appraisal value of your home changes.

Sample Home Equity Payment Calculator

For a property valued at $500,000, with a first mortgage of $300,000, first multiple $500,000 x 0.90% = $450,000. Then calculate the difference between the total equity available and the total mortgage registered. In this case, you will calculate $450,000 $300,000 = $150,000.

For a home equity loan of $150,000, with an interest rate of 7.99%, a 1 year term, no amortization, calculate $150,000 x 0.70% = $11,985. Then divided $11,985 by the number of months in the one year term . $11,985 / 12 = $998.75 per month.

Recommended Reading: Rv Loan With 670 Credit Score

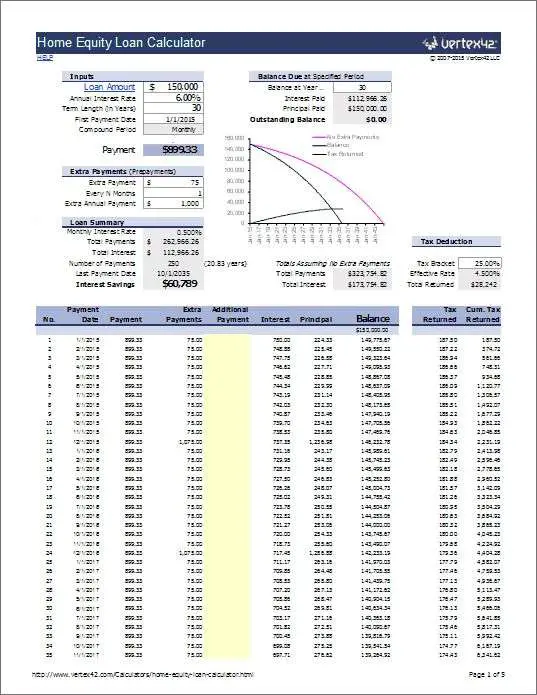

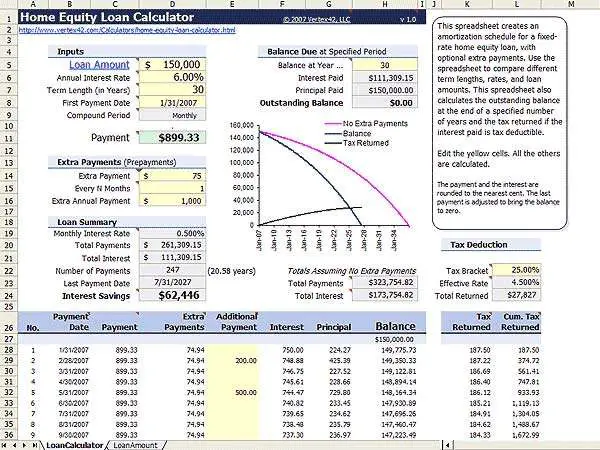

How Do I Calculate A Home Equity Loan Payoff +

Using our calculator to do your home equity loan payment calculations is pretty easy. The home equity loan has a fixed interest rate, so all you need to know is your loan amount, the fixed interest rate, and the loan term. Input these values into the loan calculator and it will provide your monthly home equity loan payments.

How Do I Grow My Home’s Equity

If youre sure all the information entered into the home equity loan calculator is correct and it shows you have less than 20% equity in your house, you probably wont be eligible for a loan or HELOC at this time. You may be able to speed up equity growth by:

-

Refinancing into a shorter-term mortgage.

-

Making home improvements that increase value.

-

Paying a little extra toward your mortgage principal every month.

More from NerdWallet

Read Also: How To Refinance An Avant Loan

Is Getting A Heloc A Good Idea

With financial discipline, a HELOC can be a great idea and here is why. One of the best uses of HELOC is to improve an existing asset to generate wealth. For example, if you borrow money from a HELOC to do home renovations the return from the improvements could be greater than what needs to be paid on the interest of the HELOC. This is especially worth it if you are selling a home. Another example is financing something long term like a student loan. Again, the interest on the HELOC could be lower than a regular student loan.

A common question generally asked is, can’t I do the above with a loan? You could, but with more restrictions that may not make it worth it. With a HELOC, when carrying a balance, all that needs to be paid is the minimum interest unlike various loans. A lot of the time different forms of loans charge a penalty to pay off the principal. With a HELOC, you pay off the pricinpal without penalty.

Mobile Home Loans Requirements For Loan Approval

Different lenders have different requirements when it comes to granting mobile home loans.

Youll need to be sure you meet all of the following criteria to get approved:

1) You must have a steady job or income source with verifiable income.

2) Your credit score must be at least 600. If your score is lower than this, ask your lender if they can work with you to establish credit or improve your score before applying for a loan. Work on rebuilding your credit by paying down debt and avoiding new lines of credit.

3) Your total debt-to-income ratio must not exceed 45 per cent. For example, if after you pay your monthly housing costs and all other debts you have left, you bring in a total of $100 a month, the maximum amount that the lender will let you borrow is $4,500.

4) You must be able to make at least a 10 percent down payment on your manufactured home loan . These are non-refundable deposits that can either be paid with cash or from money from an approved second mortgage lender.

5) You must ensure that your new mobile home purchase fits in with your local zoning ordinances and does not violate any use laws that regulate what kinds of structures can be built on a property.

7) You must also either own or rent the land on which youre planning to place your newly purchased mobile home. If you plan to buy, build, or rent this space after making an application for financing, this requirement is waived.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Whats The Difference Between A Home Equity Loan And A Home Equity Line Of Credit

As mentioned above, a home equity loan is paid out in a lump sum and repaid in fixed monthly installments over a set term. On the other hand, a home equity line of credit , works much like a credit card. You can use the credit line up to the established limit, but you pay only for what you use plus interest. HELOCs have a set draw period, during which you can use the credit line. When the draw period ends, the HELOC goes into repayment and you cant tap any more equity from the credit line.

How To Calculate An Equity Line Payment

This article was co-authored by Scott Maderer, MBA. Scott Maderer is a Certified Financial Coach and Stewardship Coach in San Antonio, Texas. He received a Master of Business Administration from Texas A& M University-Commerce in 2013 and is a Licensed Human Behavior Consultant by Personality Insights, Inc. This article has been viewed 39,110 times.

Lines of credit taken against the equity in your home are called a “home equity line of credit” or “HELOC.” HELOCs are provided to you at either a fixed interest rate, so that the payment will not fluctuate from month to month or change drastically each year on the anniversary date, or a variable rate for which the monthly payment will change as the interest rate changes. You need not use the entire amount of your HELOC all at once, but can use the money as needed. This way, you pay for what you use. Calculating HELOC payments, both in the draw period and the repayment period, is simple if you have right information.

Also Check: Usaa Rv Loan Rates Calculator

Know Your Home’s Value

The amount of equity that you have in your home is equal to its value minus any outstanding loans. To calculate your equity, you need to know your home’s value.

When you apply for your home equity loan, your lender may require an appraisal to determine your property’s value. However, you have options to estimate the value beforehand. One alternative is to use an online valuation tool. These tools use information from public records and nearby home sales to approximate your home’s value, notes Nerd Wallet.

You can also contact a local real estate agent to approximate your home’s value. The agent can evaluate your home’s specific characteristics and use market data to calculate the value.

Determining Principal And Interest Payment

The first step in calculating HEL payments is to determine the principal. The principal on the HEL is the amount you borrowed. This will usually not exceed the equity in your home.

Next compute the first interest payment. The interest is usually fixed as agreed upon when you apply for the loan. For example if you borrowed $50,000 at a 5 percent interest rate, the monthly interest payment for the first month is $208.33, based on the formula: /12 the monthly interest rate is 5 percent divided by 12.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Find Out How Much Untapped Cash You Have In Your Home

It is generally assumed that most people know what their home equity is. However, many people are still confused about the topic. As a homeowner, you need to understand how home equity works. That is especially true if you are looking to refinance a mortgage or borrow money against your residence.

Mobile Home Loan Calculator

Do you own a mobile home? Do you want to buy one?

If so, you might be wondering if your mortgage can include your mobile home. The answer is yes, but some things should be considered before making this decision.

Mobile homes have become increasingly popular over the years because they offer people an affordable option to live somewhere other than their parents house.

Many people purchase these homes for vacations, second homes and retirement spots. So why not make them eligible for mortgages too?

However, it doesnt work out that way all of the time because banks dont typically get involved with financing mobile homes without land unless they are on leased land or owned by a community association .

Most mobile homes are financed through a personal property loan, and this is what we will focus on in the rest of our article.

Read Also: Car Loan Transfer To Another Person

Home Equity Loan & Heloc Payment Calculator

Home equity loans and HELOCs are two versions of the same type of loan but with some major differences. Both are secured by the equity in your home, but the way you borrow money and calculate your loan payments are completely different. This Home Equity Loan and HELOC payment calculator is versatile enough to calculate payments for both types of loans. It can also calculate your total payments over the life of the loan, the total amount of interest you’ll pay, your loan balance at any point in time and provides an amortization schedule for paying off the loan.

How Home Equity Loans And Helocs Differ

Both a home equity loan and a HELOC are ways to cash in on your homes equity, but they work differently.

A home equity loan gives you all the money at once with a fixed interest rate. HELOCs act more like credit cards you can borrow what you need as you need it, up to a certain limit. HELOCs have adjustable or variable interest rates, meaning your monthly payment can change, but you only pay interest on the amount you draw.

You May Like: How Long Does Sba Loan Take To Get Approved

Understand Your Home Equity Loan Payments

Our home equity loan calculator doesnt calculate monthly payments youll see the monthly payment information on the loan estimates you collect while youre comparing offers.

There are three factors that will affect your monthly home equity loan payments:

About Home Equity Lines Of Credit

A home equity line of credit, or HELOC, is a special type of home equity loan. Rather than borrowing a specific sum of money and repaying it, a HELOC gives you a line of credit that lets you borrow money as needed, up to a certain limit, and repay it over time. It’s like having a credit card secured by your home equity. How much can you borrow? That’s where a home equity loan calculator comes in. It helps you figure how much of a line of credit you can secure with your available home equity.

All home equity loans and HELOCs are secured by the equity in your home that is, you’re using your home equity as collateral. That allows you to get a much lower interest rate than you can get with a credit card or other unsecured loan. And because home equity loans are a type of mortgage, the interest you pay is tax-deductible up to certain limits. HELOCs and other home equity loans are considered second liens that is, they are second in line behind your primary home loan when it comes to getting repaid in the event of a loan default or foreclosure. As a result, they are somewhat riskier for lenders than primary mortgages are, so they charge higher interest rates and generally have stricter qualification standards than regular mortgages do.

Want to see what sort of rate you can get on a HELOC? Use the “Get Free Quote” tab at the top of this page.

You May Like: What To Do If Lender Rejects Your Loan Application

Home Equity Lines Of Credit And Traditional Second Mortgages

The fixed amount of money repayable by a second mortgage is done over a fixed period of time. In many cases, the payment schedule calls for payments of equal amounts to be paid throughout the entire loan period. One may decided to take a second mortgage rather than a home equity line if, for example, the set amount is needed for a certain purpose such as building an addition onto the home.

However, deciding which type of loan suits the need of the customer involves considering the costs that come along with two alternatives. It is important to look at both the APR and all other charges. The APRs on the two different types of loans are figured in different ways:

- The interest rate charged plus other financial charges for a traditional second mortgage is taken into consideration by the APR

- The APR is based on just the periodic interest rate. It does not include other charges or points.

How To Use Our Home Equity Loan Calculator

Our home equity loan calculator can help you determine how much available equity you might qualify to borrow with a home equity loan or home equity line of credit.

Heres the information youll need to use the calculator:

- Your homes most recent appraised value

- Your outstanding mortgage balance

- Your credit score range

If you need help determining your homes value, reach out to your real estate agent to request a competitive market analysis. Another option is to use LendingTrees home value estimator.

Find out how much you owe on your mortgage by taking a look at your most recent mortgage statement. And if you dont already know your credit score, you can get a free credit score online.

Once youve input this information, the calculator provides the estimated home equity loan amount you might qualify for.

HOME EQUITY LOAN SHOPPING TIP

Once the home equity loan calculator generates a number for you, use it to gather quotes from multiple home equity lenders to find the best deal. Compare the interest rates and costs on each loan estimate you receive, and make sure you gather your quotes on the same day .

You May Like: How To Get Loan Originator License