Shop Around For A Usda

This is the fun part: going on home tours and scrolling through Zillow. Whatever home youre seeking should be in an approved rural or suburban area. Otherwise, you wont be eligible for the USDA loan. Additionally, you should prepare to live in the home you purchase, since vacation homes and investment properties are not allowed.

Once youve put in an offer and been approved, youll start the underwriting process. USDA loans take longer to underwrite , so talk to your loan officer about the expected timeline. USDA mortgage applications are paperwork-heavy, says Green. You dont want long approval times to jeopardize your closing date.

What Are The Eligibility Requirements For A Usda Home Loan

The location of the home must have a population of 35,000 or less and the home must be a primary residence. Loans are available to those with low and moderate incomes. Income limits vary depending on where you live and the loan program. In general, a credit score of at least 640 is ideal, but you may still qualify if your score is lower. Also, you cannot be delinquent on any federal debt and must be a U.S. citizen or legal nonresident alien.

Usda Loan Location Requirements

The USDA loan is designed to help those in rural areas purchase a residential home. Fortunately, the USDAs definition of rural is generous and many suburbs qualify.

According to the USDA, rural areas are defined as open country, which is not part of an urban area. There are also population requirements that can reach up to 35,000 depending on area designation.

The agency’s broad definition makes approximately 97% of the nation’s land eligible for a rural development loan, which includes an estimated 100 million people.*

MORE: Find USDA eligible areas with our property eligibility map.

Don’t Miss: Genisys Credit Union Auto Loan Calculator

The Usda Loan Process: How Do I Apply Get Approved And Close On The House

Applying for a USDA loan is a bit different than other loan types. Many of the steps are the same, but there are a couple of unique rules worth noting.

Heres how to apply:

Qualifying For The Usda Rural Development Loan

Qualifying for the USDA Rural Development Loan is easier than qualifying for most other loans. However, you have to meet one strict requirement you cannot be eligible for any other type of financing. This means any other government program or conventional loan. If you are able to secure a different type of financing, you would not be eligible for a USDA loan.

If you are unable to qualify for any other financing, you have to meet the following requirements:

- You must live in the home

- You must not own any other properties

- You must be a US citizen

- Everyone on the loan must live in the home

If you meet these requirements, you can apply for a USDA loan.

You May Like: Texas Fha Loan Limits 2020

Can You Refinance A Usda Loan

Any USDA loan can be refinanced to a conventional loan, but the USDA will only refinance mortgages that are already USDA loans. Refinancing a USDA loan will usually reduce your interest rate by at least 1 percent, and its pretty simple to do as long as youre current on your agreed mortgage payments. You can refinance either a USDA guaranteed loan or direct loan through one of the USDAs three types of refinancing programs:

Expert Insights On Usda Loans

MoneyGeek spoke with industry leaders and academics to provide expert insight on USDA loans. All views expressed are the opinions and insights of the individual contributors.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Is A Usda Loan Right For You

These mortgage programs are more affordable than traditional mortgages, but they’re only possible if you do not exceed the income maximums and buy a home in a designated rural area. If you’re just above the income threshold or want to live in a city, you’ll need to explore other mortgage options.

A direct deposit of news and advice to help you make the smartest decisions with your money.

What Are The Rates For Usda Direct Loans

Fixed-interest rates for USDA direct loans are based on the propertys market value at mortgage approval or closing whichever is lower. Rates can sink to as low as 1% depending on your circumstances. The payback period usually stretches to 33 years, but it can extend to up to 38 years for very-low-income borrowers who cant afford the former.

The maximum mortgage amount depends on your ability to repay the loan as well as any applicable subsidies or repayment assistance. The USDA determines this factor by examining your employment, financial and credit history. However, you cant borrow more than the loan limit for the area you plan to live in.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Usda Mortgage Eligible Geographic Areas

The property must be located in a USDA-eligible area. Borrowers can search USDAs maps to browse certain areas or pinpoint a specific address. If you are unsure if a property is eligible, check with a USDA loan officer here

Think your area is not eligible? Well, about 97% of United States land mass is USDA-eligible, representing 109 million people. Many properties in suburban areas may be eligible for USDA financing. Its worth checking, even if you think your area is too developed to be considered rural. The USDA eligibility maps are still based on population statistics from the census in the year 2000. This is a unique opportunity to finance a suburban home with this zero-down mortgage program before the USDA updates their maps.

Usda Streamlined Assist Refinance Loan

The USDA Streamlined Assist Refinance Loan lets you refinance your current USDA mortgage to a more affordable payment. If you have a USDA loan and have made 12 consecutive on-time payments, you may be able to refinance to a lower interest rate.

There are no minimum equity requirements on a USDA Streamlined Assist Refinance Loan, meaning you can have no equity or even negative equity in the home.

You may be eligible if:

- Youve made 12 consecutive, on-time mortgage payments

- Refinancing would lower your monthly mortgage payment by $50 or more

Lenders do not need to run a credit check or assess your DTI for a USDA refinance, and you wont have to schedule another inspection. If you have a Guaranteed Loan, you wont need an appraisal either. However, local income limits still apply.

You May Like: Minimum Credit Score For Rv Loan

Whats The Role Of A Mortgage Underwriter

A mortgage underwriter is a financial specialist who works for your mortgage lender. They investigate your financial situation and decide how much risk a lender will assume if you are approved for a mortgage loan. The underwriter is responsible for determining how qualified a borrower you are and your ability to repay your mortgage.

Underwriters assess several variables while evaluating your application, including your credit history, income, and any outstanding obligations, Francies said.

A mortgage underwriter may request a number of documents to analyze your borrowing ability, including:

- Drivers license or another photo ID

- 30 days worth of pay stubs

- W-2 forms or I-9 forms from the previous two years

- Federal income tax returns from the past two years

- Bank statements or verification of other assets from the last few months

- Documentation of any other sources of income

- Information on long-term debts, such as educational loans or auto loans

- Information about a real estate property/acknowledged purchase offer

Usda Loans Require Mortgage Insurance

USDA guarantees its mortgage loans meaning it offers protection to mortgage lenders in case USDA borrowersdefault. But the program is partially self-funded.

To keep this loan programrunning, the USDA charges homeowner-paid mortgage insurancepremiums.

As of October 1, 2016, USDA has lowered its mortgage insurance costs for both the upfront and monthly fees.

The current USDA mortgage insurance rates are:

- For purchases 1.00% upfront fee, based on the loan amount

- For refinancing 1.00% upfront fee, based on the loan amount

- For all loans 0.35% annual fee, based on the remaining principal balance each year

As a real-life example: A homebuyer with a $100,000 loan size would be have a$1,000 upfront mortgage insurance cost, plus a monthly payment of $29.17 for the annual mortgageinsurance.

USDA upfront mortgage insurance isnot paid as cash. Its added to your loan balance for you, so you pay it over time.

USDA mortgage insurance rates are lower than those for conventional or FHA loans.

- FHA mortgage insurance premiums include a 1.75% upfront mortgage insurance premium, and 0.85% in MIP annually

- Conventional loan private mortgage insurance premiums vary, but can often be above 1% annually

With USDA-guaranteed loans, mortgage insurancepremiums are just a fraction of what youd typically pay. Even better, USDAmortgage rates are low.

For a buyer with an averagecredit score, USDA mortgage rates can be 100basis points or more below the rates of a comparable conventional loan.

Also Check: When Can I Apply For Grad Plus Loan

Who Determines That The Home Meets The Requirements

The USDA sets the home requirements, but it is the USDA-approved appraisers job to make sure the home meets the requirements. The USDA approves certain appraisers to work on their behalf, ensuring that the home meets the USDA requirements.

The appraiser has a lot of jobs when evaluating a home for USDA financing. First, he or she must make sure the home is worth as much as you bid on it. Then the appraiser must make sure the home meets all of the USDA guidelines. Finally, the appraiser must certify that the home is safe, sound, and sanitary. In other words, you must be able to move into the home right away and not be exposed to any hazards.

Debt Ratios 2020 To Maintain Changes Rolled Out In 2014

The program adopted new debt ratio requirements on December 1, 2014. There are no planned updates to this policy in 2020.

Prior to December 2014, there were no maximum ratios as long as the USDA computerized underwriting system, called GUS, approved the loan. Going forward, the borrower must have ratios below 29 and 41. That means the borrowers house payment, taxes, insurance, and HOA dues cannot exceed 29 percent of his or her gross income. In addition, all the borrowers debt payments added to the total house payment must be below 41 percent of gross monthly income.

For example, a borrower with $4,000 per month in gross income could have a house payment as high as $1,160 and debt payments of $480.

USDA lenders can override these ratio requirements with a manual underwrite when a person reviews the file instead of the algorithm. Borrowers with great credit, spare money in the bank after closing, or other compensating factors may be approved with ratios higher than 29/41.

Recommended Reading: How To Transfer Car Loan To Another Person

How Does A Usda Loan Work

Each year, the United States Department of Agriculture supports home loans for thousands of Americans. Interest rates on these loans can dip to as low as 1% and you can generally secure one with a credit score as low as 640.

Monthly payments on USDA loans are typically restricted to 29% or less of your monthly income, and other monthly payments cant exceed 41% of your monthly income.

So, whats the catch?

Your adjusted household income must be at or below the applicable low-income limit set by the government for the area you want to buy a home in.

In addition, you must use the USDA loan to purchase a home in a designated rural area. For many, that means giving up noisy city life to bask in open fields and surround yourself with the scenic beauty of rural America. But if youre not into that, several suburban areas in or near major cities fall under the USDAs broad definition of rural. And contrary to popular belief, you dont have to work in the agricultural industry to secure a USDA loan. Eligibility primarily depends on your income, location and household size.

But because down payments on USDA loans tend to dip far below those for traditional mortgages, borrowers usually must pay a pay a mortgage insurance premium that generally spans 1% to 2% of the loan amount.

USDA loans have been around since 2007 and are officially part of the USDA Rural Development Guaranteed Housing Loan Program. But there are different types of USDA loans.

The Usda Guarantee Fee

The lender guarantee is partially funded by the USDA mortgage insurance premium, which is 1.00% of the loan amount . The loan also has a 0.35% annual fee .

The annual fee is paid monthly in twelve equal installments. For each $100,000 borrowed, the upfront fee is $1,000 and the monthly premium is $29.

The borrower can roll the upfront fee into the loan amount or pay it out-of-pocket. Compared to other loan types like FHA, or the private mortgage insurance on conventional loans, the USDA mortgage insurance fees are among the lowest.

You May Like: Aer Loan Requirements

The Usda Does Not Require An Inspection

Dont confuse an inspection with what the USDA requires. The USDA requires an appraisal with a checklist showing that it meets the above guidelines. However, paying for an inspection is always a good idea as it helps you know the true condition of the home.

If your purchase contract has an inspection contingency on it, you can use this time to review the inspection report and decide if you want to move forward with the purchase. If the home has major problems, you may want to reconsider or re-negotiate with the seller to have him or her fix the issues before you move into it. This is especially important if you are going to pay for a USDA appraisal. If the issues are those that will interfere with the USDAs requirements, the lender will put a halt on the loan anyway, until the seller resolves the issues.

The USDA has strict guidelines to ensure that low to moderate-income families do not buy a home that becomes a money pit. The last thing you need is to purchase a home that needs thousands of dollars in work done to it. This puts you, the lender, and the USDA at risk for default, which is what the USDA tries to avoid.

What Are The Eligibility Requirements For A Usda Loan

The USDA loan program, like any other mortgage, has certain eligibility requirements you must meet. If you tick the following boxes, then you should be eligible for a USDA loan, if youre buying the right kind of property:

- Youre a U.S. citizen or a permanent resident with a Green Card

- Ability to prove creditworthiness

- The home would be your primary residence

- You meet income requirements

- Youre in good standing with all federal programs

- You can provide history or proof of on-time payments for bills such as rent or car loans

- The property is located in an eligible area

Don’t Miss: Does Va Loan Work For Manufactured Homes

The Purpose Of A Usda Loan

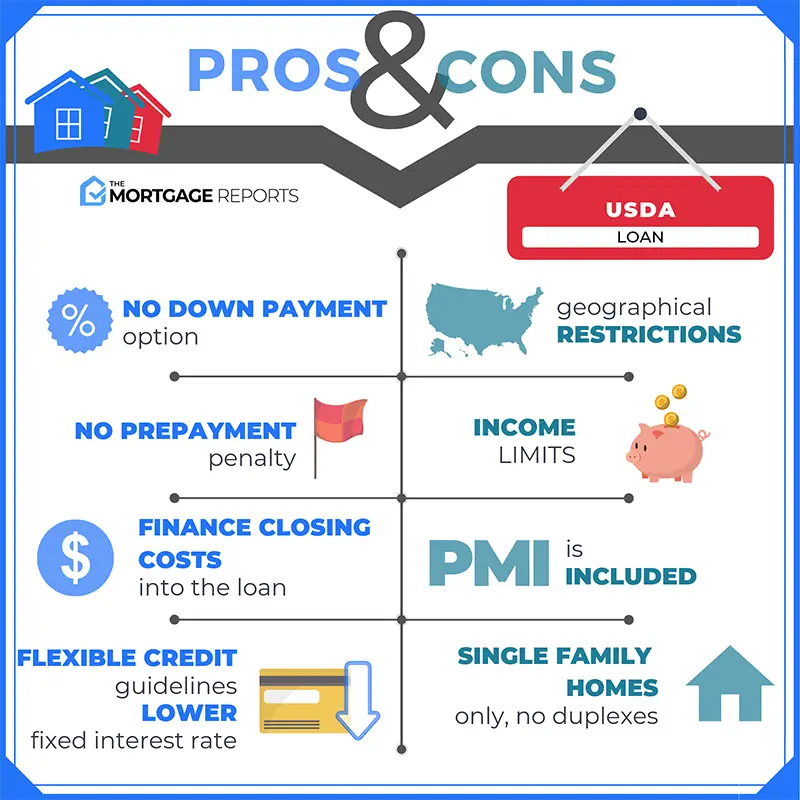

To encourage home ownership in rural areas, the government instituted the USDA loan program in 1991. The premise was that by committing to a community, the homeowner helps the economy of that community and stabilizes both the economy and the area. To attract homebuyers to rural areas, a USDA loan is available to those with low to average income for the area. There is no down payment required, mortgage insurance is less than other loan types and the mortgage rates are lower than for other loans, according to The Mortgage Reports.

Your income cannot be more than 15 percent above that of the local median income, and the home must be your primary residence. Your credit score must be at least 640, although there are some exceptions, and your debt-to-income ratio must be 41 percent or lower. If you meet those criteria, then you can start researching a USDA loan.

What Are The Qualifications For A Usda Loan In Michigan

Lastly, qualifying for a USDA Rural Development Loan is easier than conventional financing. You may be able to eligible buy a home with only 2 years following a bankruptcy and only 3 years after a foreclosure. Conventional financing requires 4 years after bankruptcy and 7 years after a foreclosure.

Riverbank Finance is a locally owned Michigan mortgage company specializing in home loans. Let us know how we can help your family with your next home purchase or mortgage refinance!

Submit your information now and a licensed residential loan officer will contact you within 24 hours. If you need immediate assistance then please call us now at 1-800-555-2098!

Riverbank Finance LLC is a Michigan mortgage company in Grand Rapids, MI specializing in mortgage home loans for both refinancing and new home purchase mortgages. Our extensive list of mortgage programs allows us to offer competitive low wholesale mortgage rates. We hire only the best licensed loan officers to serve our clients and take pride in our superb customer service.

Read Also: Usaa Auto Refinance Phone Number