Myautoloan: Most Popular Marketplace

Starting APR:2.14% for new vehicles, 2.39% for used vehiclesLoan amounts:$8,000 purchase minimumLoan terms: 24 to 84 monthsAvailability:48 states Minimum credit score:575

The myAutoloan online marketplace lets you comparison shop for the best auto loan rates from a number of lenders. You can enter personal information into the sites online form and receive loan offers from lenders almost immediately, allowing you to compare offers side-by-side.

Our research indicates that myAutoloan rates are low for the industry. Borrowers can access rates as low as 2.14% APR for new vehicles through the marketplace. With a minimum credit score requirement of 575, myAutoloan can be a good option for people with below-average credit.

That said, the companys $8,000 purchase minimum loan amount may mean you need to spend more on a car than you planned to get a loan from the company. In addition, myAutoloan wont authorize a loan on a car more than 10 years old or with more than 125,000 miles on it. Some may find these restrictions a little too cumbersome.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

Also Check: Usaa Prequalify Auto Loan

Buying Used Could Mean Higher Interest Rates

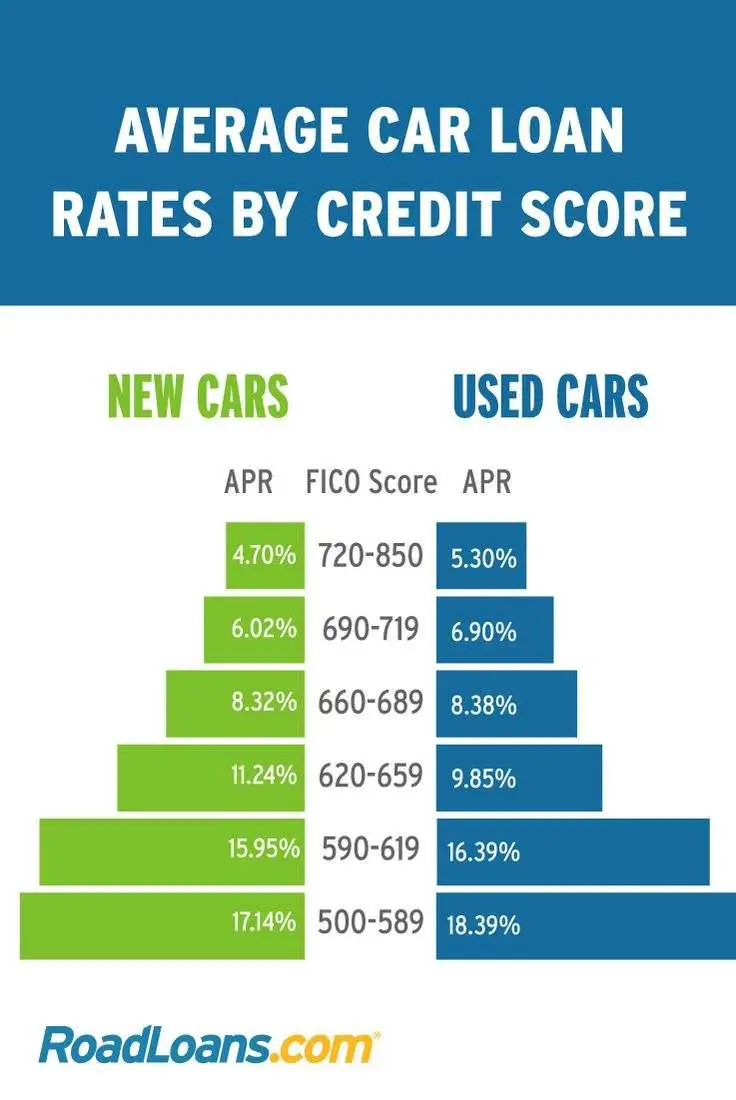

Buying a new car may be more expensive, all in all, than buying used. But, new and used auto loan interest rates are rather different, no matter your credit score. Based on Experian data, Insider calculated the difference between new and used interest rates. On average, used car financing costs about four percentage points more than new financing.

| Super Prime | 1.32% |

The gap between how much more a used car costs to finance narrows as credit scores increase, but even for the best credit scores, a used car will cost over 1% more to finance than a new car.

Used cars are more expensive to finance because they’re a higher risk. Used cars often have lower values, plus a bigger chance that they could be totaled in an accident and the financing company could lose money. That risk gets passed on in the form of higher interest rates, no matter the borrower’s credit score.

Month Auto Loan Vs 72 Month Auto Loan

Both the 84 month auto loan and the are considered long-term loans, but the 84 month loan will likely have a higher interest rate.

Because both of these loans are long-term, your car will depreciate and you may end up owing more than the car is worth. Additionally, a new car warranty will expire in 3-5 years, leaving you with several years of car maintenance repairs as well as your monthly auto loan payment.

Don’t Miss: Defaulting On Sba Loan

What Are The Current Auto Loan Rates In Texas

VEHICLE LOANS | Jun 8, 2021 8:00:00 AM | by TTCU

Auto loan rates in Texas can vary depending on lenders. Issued by financial institutions like banks or credit unions, auto loans are an affordable way to finance vehicle purchases over a period of months or years. Before you begin shopping for a new or pre-owned sedan or SUV, make sure youre aware of the states current auto loan rates.

The average auto loan rate in Texas is about 5.27 percent, and state law forbids lenders from charging interest rates above 27 percent. Although state auto loan rates will vary depending on the lending institution, the borrowers credit score and history will also impact the rate and loan term they receive.

What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, car insurance can be a significant expense. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Estimate your monthly payments with our handy Auto Loan Calculator.

You May Like: Usaa Loans For Bad Credit

Consumers Credit Union Reviews

Consumers Credit Union has a relatively strong standing in the industry. It is accredited by the BBB and holds an A+ rating from the organization.

There arent many Consumers Credit Union customer reviews across review sites. However, the positive reviews we found praise the lenders good customer experience, consistently great rates and low fees.

Customers are also pleased to be part of a member-owned organization instead of a bank. That said, people who reported a negative experience with Consumers Credit Union report technical issues and delays with applications.

Our team reached out to Consumers Credit Union for a comment on these reviews but did not receive a response.

How Do Auto Loans Work

Auto loans are typically secured loans that charge simple interest, interest calculated on your loan balance, over two to seven years. Your auto loan interest rate is determined by your , loan term and amount, along with the value of the car itself.

While many buyers shop for a car loan at the same time theyre shopping for a car, a better way is to compare annual percentage rates across multiple lenders to make sure youre getting a competitive rate.

If the dealer can beat it, youll know youre getting a fair offer.

Why you should compare auto loan ratesComparing loan rates before you buy a new or used car puts you in a stronger negotiating position at the dealership. This is true whether you have strong credit or need a car loan for bad credit. The lenders above are a good place to start your search.

Also Check: Usaa Auto Loan Process

Who Has The Best Rates For Car Loans

Automakers, credit unions, banks and online lenders could all potentially provide a low rate. Youll never know what you qualify for until you apply. Applying to multiple lenders within a two-week window will not hurt your credit score any more than applying to one lender. Any drop to your credit score will be slight and temporary.

What Is The Difference Between An Auto Loan And A Personal Loan

It’s possible to use a personal loan or an auto loan to finance a vehicle, but the two differ in some important ways:

- Purpose: Personal loans are unsecured or secured and can be used for many different purposes, including to finance a vehicle, pay for a vacation, or make improvements to a home. Car loans, however, are strictly to finance a vehicle and are secured against the vehicle you purchase. The vehicle serves as collateral.

- Interest rates: Because auto loans are secured, rates on car loans are generally lower than personal loans.

- Availability: Auto loans are typically easier to obtain than personal loans, especially for those with a poor credit history.

Recommended Reading: What Car Can I Afford Based On Salary

Historical Auto Loan Rates

Auto loan rates are at historically low levels as a result of an overall low interest rate environment. Over the last decade, the average interest rate on a 48 month auto loan from a commercial bank has fallen by over 40%. This is largely a result of the 2009 financial crisis, after which interest rates were lowered to incentivize consumers to stimulate the economy by spending on items like cars rather than saving.

Loans from auto finance companies have historically carried lower rates than loans from commercial banks. The large car manufacturers have “captive finance” arms that exclusively provide loans for consumers purchasing the parent companys cars this enables automakers to provide lower rates, as the car purchase, rather than the interest, is the manufacturers primary revenue stream.

*The Federal Reserve stopped reporting data on auto finance company interest rates after 2011.

Loans Under 60 Months Have Lower Interest Rates

Loan terms can have some effect on your interest rate. In general, the longer you pay, the higher your interest rate is.

After 60 months, your loan is considered higher risk, and there are even bigger spikes in the amount you’ll pay to borrow. The average 72-month auto loan rate is almost 0.3% higher than the typical 36-month loan’s interest rate. That’s because there is a correlation between longer loan terms and nonpayment lenders worry that borrowers with a long loan term ultimately won’t pay them back in full. Over the 60-month mark, interest rates jump with each year added to the loan.

Data from S& P Global for new car purchases with a $25,000 loan shows how much the average interest rate changes:

| Loan term | |

| 72-month new car loan | 3.96% APR |

It’s best to keep your auto loan at 60 months or fewer, not only to save on interest, but also to keep your loan from becoming worth more than your car, also called being underwater. As cars get older, they lose value. It’s not only a risk to you, but also to your lender, and that risk is reflected in your interest rate.

You May Like: Usaa Proof Of Residency Request Form

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

Pick The Option Thats Right For You:

Summit Expresssm Auto LoanGet a Summit Express Auto Loan right at the dealer. Simply visit one of over 300 participating area dealerships, find the vehicle you want, check current rates and apply. Be sure to say you want The Summit Express Auto Loan.

Standard Summit Auto LoanPurchasing a car from a non-participating dealer or third party? No problem. Just apply for a standard Summit Auto Loan online or at a Summit branch. Once youre approved, pick up your check from your preferred branch and take it to the dealership.

Rates effective January 16 through January 31, 2022

| Type | Fixed APR* w/ Auto Payment** | Payment per $1,000 |

Recommended Reading: Usaa Car Loan Requirements

Best For Fair Credit: Carvana

Carvana

For fair credit borrowers in the market for a used vehicle, Carvana provides the ability to shop online for financing and a vehicle at the same time. It has no minimum credit score requirement, providing a financing solution for those with damaged credit.

-

Entirely online dealer and lender

-

No negotiation

-

Excellent credit borrowers get the lowest rates

-

Minimum income requirement of $4,000 annually

-

Only for used vehicles

As with most lenders, borrowers with the best credit get Carvana’s most competitive rates. Carvana does not advertise its rates or publish a table, but you can estimate your monthly payment with an online calculator. That said, even the calculator does not reveal the rate it is using. You must prequalify to know what your interest rate will be.

Carvana is a completely online used car dealer that also provides direct financing. It makes it possible to secure financing, shop for a vehicle, and get a used vehicle delivered without leaving your house. There is no credit score minimum for its financing program, making this an attractive option for fair credit borrowers. However, you must have an income of at least $4,000 annually and no active bankruptcies.

Bank Of America: Top Choice For Bad Credit

Starting APR:2.29% for new vehicles, 2.49% for used vehiclesLoan amounts:$7,500 purchase minimum Loan terms: 12 to 75 monthsAvailability:50 statesMinimum credit score:580

Bank of America is one of the largest banks in the world, so its no wonder it offers a wide range of vehicle loan services. The Charlotte, North Carolina-based bank offers competitive rates to borrowers with a range of credit scores, with some of the best auto loan rates for people with less-than-ideal credit.

Rates start at 2.29% APR for new vehicles at Bank of America, which is about average for the industry. Unfortunately, the purchase minimum of $7,500 rules out using the company to finance some budget-friendly used vehicles. With loan terms limited to 12 to 75 months, Bank of America auto loans are slightly less flexible than some of the other providers we reviewed. The company does not have an option to allow you to get preapproved for a loan like some lenders do.

Also Check: How Long Do Sba Loans Take To Get Approved

Average Auto Loan Interest Rates: Facts & Figures

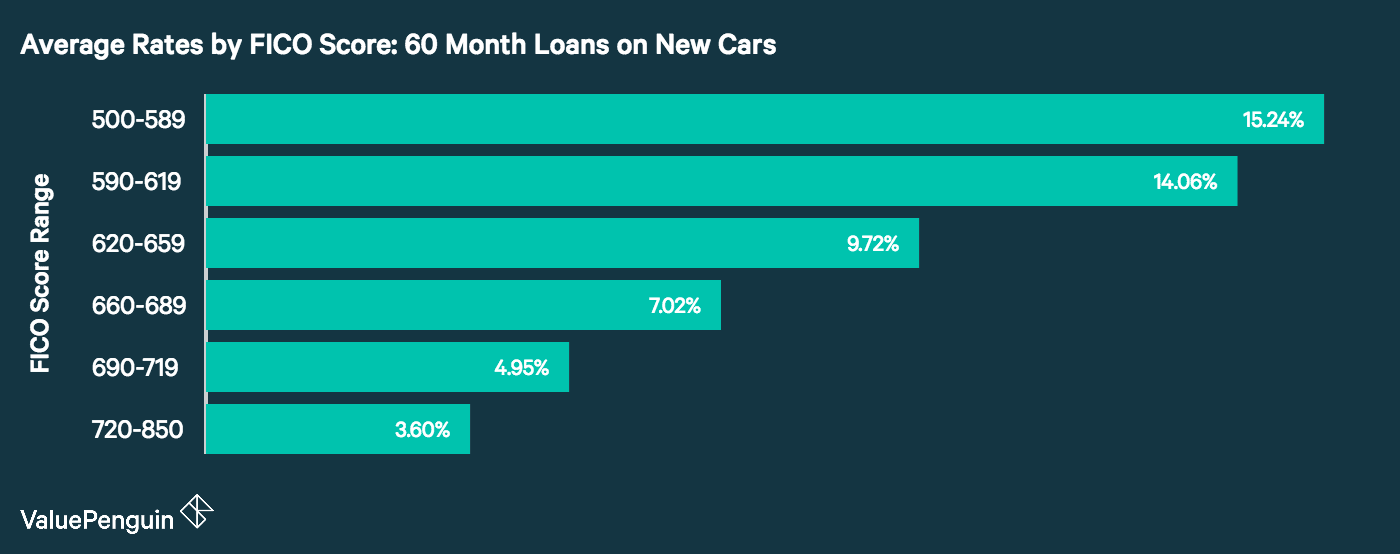

The national average for US auto loan interest rates is 5.27% on 60 month loans. For individual consumers, however, rates vary based on credit score, term length of the loan, age of the car being financed, and other factors relevant to a lenders risk in offering a loan. Typically, the annual percentage rate for auto loans ranges from 3% to 10%.

Bmw Launches The X3 M Suv In India

German automaker BMW has recently launched the BMW X3 M SUV in India. The price tag that the car comes with is Rs.99.90 lakh .

This is the first time that the automaker has brought a high performance M version of the SUV in the country. The company claims that the BWM X3 M comes with the most powerful straight-six engine ever which has been put under the hood of a BMW M series car. The car comes with a host of features and safety fitments such as adaptive LED headlamps, rain sensing wipers, parking assistant, powered tail gate, head-up display, tyre pressure monitor, vehicle immobiliser, ABS with brake assist, EBD, and so on. The engine powering the car is a Twin Power Turbo, 3.0-litre, inline six cylinder engine that churns out 480 hp of max power and 600 Nm of peak torque. It is capable of clocking 0 to 100 kmph in 4.2 seconds and can hit a top speed of 250 kmph.

3 November 2020

Recommended Reading: Usaa Pre Approval For Mortgage

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

You May Like: Auto Calculator Usaa

How Can I Get The Best Car Loan Interest Rate

Video: Rising mortgage rates hit housing affordability

Borrowers with a lower credit score may see higher auto interest rates. If your credit score is on the lower end , some lenders may offer higher interest rates. Taking steps to improve your credit score can go a long way toward getting a better interest rate.

Penfed Credit Union: Top Credit Union

Starting APR:0.99% for new vehicles, 1.99% for used vehiclesLoan amounts:$500 to $100,000Loan terms: 36 to 84 monthsAvailability:50 statesMinimum credit score:610

Pentagon Federal Credit Union, or PenFed, is a military credit union that offers some of the best auto loan rates on the market. We named it Top Credit Union for auto loans because of its availability and fantastic rates.

While PenFed is primarily for military members and their families, it is also open to people who work for certain government agencies and nonprofit organizations. Even if you dont fall into any of these groups, you can join by making a donation to an approved charity.

At 0.99%, PenFeds starting APR for new vehicles is the lowest of any of the auto loan providers we researched. To get that rate, however, youll need to buy a new car through PenFeds car buying service. If you shop for a car on your own, the APR starts at 1.79%. Like with most credit unions, PenFed members are eligible for special deals, such as discounts and reimbursements for shopping at partner dealerships.

However, qualifying for a PenFed auto loan might be hard for some. The credit union only accepts borrowers with credit scores of 610 or higher. In addition, PenFed has a steep $29 charge for late loan payments.

You May Like: Autosmart Becu