How Usda Calculates Income

Income is a key factor in qualifying for a USDA home loan. But calculating your income for USDA loan eligibility is a little more complicated than with other loans.

Not to worry, though a USDA lender can run the numbers for you. Still, it helps to understand what theyll look for.

USDA lenders look at three numbers to determine income eligibility:

Usda Student Loan Payment Guidelines

Out of the monthly payments above, a prevalent situation deals with USDA student loan payment requirements. Unlike Fannie Mae and Freddie Mac loans which allow low, income-based repayment figures, USDA does not. USDA will not use any payments considered graduated, adjustable, or other repayment types not considered fixed. Therefore, student loans with these characteristics must be calculated at 1% of the balances. Although, fixed student loan payments may be used. Thus, assuming documentation is provided to prove the payment, interest rate, and repayment term are fixed. In reality, this guideline mirrors FHA student loan guidelines. If this guideline causes issues, lets discuss low down payment HomeReady or Home Possible options.

Deductions To Reduce Your Usda Household Income Calculation

-

$480 from the annual total for each minor child living in the household

-

$480 from the annual total for each student living in the household who is not on the mortgage application

-

$400 from the annual total for each disabled household member who is not on the mortgage application

-

Documented Child Care Expenses for household members under the age of 13

-

Documented Medical/Disability Expenses for household members age 62 or older

Also Check: Refinance Usaa Auto Loan

What Is A Usda Loan

This is a great question. The last thing most people picture when they hear âUSDAâ is a home loan option with no down payment. Usually, people think of steakâUSDA Prime, USDA Choice, etc. Thankfully, the diversity of the U.S. Department of Agriculture gives us both.

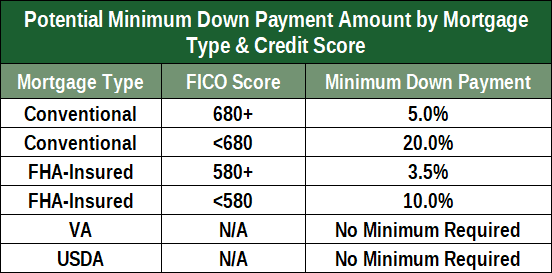

Now, USDA loans arenât for everybody. There is little reason to get all excited and gung-ho over a home loan for which you may not even be eligible. However, if you meet their requirements, excitement is warranted. USDA loans require no down payment, typically carry very competitive interest rates, have lower upfront and annual mortgage insurance premiums than FHA loans, and weâll say it again – no down payment.

NOTE: If you or your spouse are eligible for veteran’s benefits, VA loans also don’t require a down payment and might be a better choice. Try our VA loan calculator to compare payments.

Also, if you’ve found your dream home but it falls outside an eligible area or your income is above allowable USDA limits, although your payment may be higher, an FHA loan might save the day.

USDA loans are no down payment home loans guaranteed by the U.S. Department of Agriculture . For homebuyers in eligible areas who meet the income requirements, they are a wonderful option.

Usda Debt To Income Ratio Exclusions

There are exceptions to the USDA DTI rules. One exception allows lenders to exclude obligations with ten months or less remaining on the term. Examples include all installment loans, alimony, child support, student loans, or other commitments. Other payment types which may be excluded from USDA debt to income ratios include:

- Childcare expenses

Recommended Reading: How Long Does It Take Prosper To Approve A Loan

The Advantages And Drawbacks Of Usda Loans

Obtaining a mortgage with no downpayment sounds like a good deal. With USDA loans, you can get low rates even with a less than perfect credit score. Plus, it has no prepayment penalty. This mean you can make additional payments to pay your mortgage faster.

However, there are a couple of trade-offs. Though you can qualify with limited funds, consider the following disadvantages. First, think of the geographical requirement. If youre not sure about moving to a suburban or rural area, find another option. Next, if your household generates high income, you may not qualify for a USDA loan.

Since its a government-backed mortgage, USDA loans follow minimum health and safety standards. Appraisers might not readily approve old houses that need many fixes. Furthermore, you must pay the guarantee fee for the entire life of the loan. Finally, USDA loans are only available for primary homes. They do not apply to vacation houses or investment property.

Below are the pros and cons of choosing a USDA loan. Reviewed together, it should help you determine whether this option is right for you:

| Pros |

|---|

| May come with prepayment penalty |

Check Your Usda Loan Income Status

A USDA mortgage loan can be a great tool for achieving homeownership, particularly if you earn a modest income.

The next step is to get preapproved to find out whether you are eligible for a USDA loan.

For licensing information, go to: nmlsconsumeraccess.orgFairway Independent Mortgage Corporation NMLS # 2289

Complaints may be directed to: or

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity.

This site is not authorized by the New York State Department of Financial Services. No mortgage loan applications for properties located in the state of New York will be accepted through this site.

Pre-approval is based on a preliminary review of credit information provided to Fairway Independent Mortgage Corporation, which has not been reviewed by underwriting. If you have submitted verifying documentation, you have done so voluntarily. Final loan approval is subject to a full underwriting review of support documentation including, but not limited to, applicants creditworthiness, assets, income information, and a satisfactory appraisal.

You May Like: How Does Usaa Auto Loan Work

Usda Housing & Total Debt To Income Ratios

When it comes to USDA qualification, there are two debt to income ratios to consider. The first is called the housing ratio or front ratio. The USDA housing ratio compares the new mortgage payment including escrows with the gross monthly income. Generally, 29% should be the USDA buyers goal. Next, is the total debt ratio which includes all monthly payments compared to the gross monthly income. 41% is the general rule for USDA total debt to income ratio, but as we explain later, there are exceptions to exceed these limits with an income waiver or USDA automated approval. Combining the housing and total ratios are usually shown as 29/41%.

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Recommended Reading: Usaa Used Car Loan Rates

How Do I Apply For A Usda Loan

You can apply for a USDA loan by taking the following actions:

Usda Income And Property Eligibility

Here is a rundown of income and property eligibility requirements:

- Income limits: Your income cant exceed 115% of area median income

- Household income of all adults: The USDA examines your households income to ensure it doesnt exceed area limits.

- Employment requirements: The USDA looks for a stable employment history of two years.

- Debt-to-income ratio: Your DTI ratio calculates how much of your monthly income goes into monthly debt payments. The maximum DTI the USDA allows is 41%.

- USDA property eligibility: The USDA allows single family homes, planned-unit developments, condominiums, modular and manufactured homes and new construction for homes that have never been occupied. For USDA direct loans, properties need to be 2,000 square feet or less and cannot have an in-ground swimming pool.

- Occupancy: You can only use single family USDA loans for a primary residence, not a second home.

- Residency: You must be a U.S. citizen, U.S. non-citizen national or qualified alien

Also Check: How Long Do Sba Loans Take

What Counts As Income According To Usda

As for income eligibility though, the government counts income from all adults in the household who are 18 or older not just parties who are signing the mortgage loan. Their income must be included in the annual income for eligibility purposes, according to the USDA guaranteed loan handbook.

For instance, the Social Security checks received by your mother-in-law who lives with you will also go towards that income eligibility. You also will have to count up to the first $480 of earnings for any children, including full-time college students even if they live away from home temporarily during the year.

- Employee housing or automobile expense allowances

- Military and self-employed income

What Are The Rates For Usda Direct Loans

Fixed-interest rates for USDA direct loans are based on the propertys market value at mortgage approval or closing whichever is lower. Rates can sink to as low as 1% depending on your circumstances. The payback period usually stretches to 33 years, but it can extend to up to 38 years for very-low-income borrowers who cant afford the former.

The maximum mortgage amount depends on your ability to repay the loan as well as any applicable subsidies or repayment assistance. The USDA determines this factor by examining your employment, financial and credit history. However, you cant borrow more than the loan limit for the area you plan to live in.

Read Also: How Long Does Sba Loan Take

How To Improve Your Dti

We’d like to tell you to just spend less and save more, but you’ve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

Usda Debt To Income Ratio Waiver

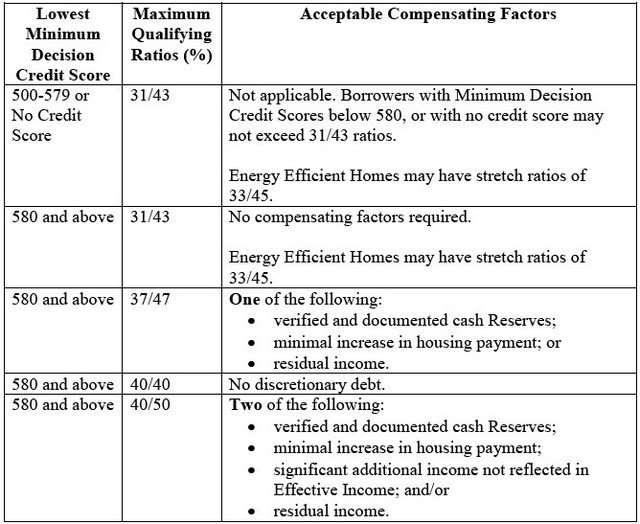

For a manually underwritten loan debt to income ratio to exceed 29/41%, the lender must request a debt ratio waiver, but to receive a debt ratio waiver, ALL of the following conditions must be met:

Housing ratio is between 29 & 32%, and the total ratio is between 41 & 44% AND The credit score of all applicant is 680 or greater AND At least one of the acceptable compensating factors is identified and supporting documentation is provided .

You May Like: How Many Aer Loans Can I Have

The Misconception About Maximum Loan Limits & The Facts

The Misconception: USDA loans limit how much homebuyers can borrow in addition to setting income limits.

Maximum loan limits do not apply to USDA home loans. USDA limits are often confused with maximum loan limits applying to FHA or other home loans, regardless of the buyer repayment ability. In reality, there is no such rule for USDA home loans.

The Facts: USDA loans empower buyers to borrow as much as they are able to repay.

What makes a future homebuyer USDA eligible?

- Meeting USDA loan limits for total household income

- Property must be in USDA-designated rural area

In other words, if you meet the above USDA requirements, you can likely borrow as much as a lender will give you. Speak with a Neighbors Bank home loan specialist today to get started!

Company

How To Exceed Manual Usda Debt To Income Ratio Requirements

Did you catch that we said up to 46% earlier? We sure did! As mentioned, lenders must use the automated underwriting system up-front for pre-approval. If the file characteristics are strong enough, it is possible to receive an automated pre-approval with these ratios. Although, lenders may have their own limits of 43% or 45%, when we have received an automated approval through GUS above 45%, we have been able to close these.

Read Also: Www.capital One.com/autopreapproval

What Is Included In The Usda Debt To Income Ratio

We mentioned total debts earlier, but what is included in total debts? Here is a detailed list from the USDA Rural Development guidelines:

- New housing payment including escrows

- HOA dues

- Revolving payments

- Child support or alimony

- Student loan payments Payment types vary

- Mortgage payment on other retained property

- IRS payment plans

- Rental loss

- Auto allowance or expense account payments the amount of payment exceeding the reimbursement

- Non-medical collections with collective balances of $2,000 or more use 5% of the balances for a payment or if payment arrangement in place, use that and document history.

New Usda Student Loan Repayment Guidelines

Until September 23, 2019, USDA used all of the rules above for calculating a USDA debt to income ratio. Although, there are new student loan guidelines to help buyers qualify for a higher house payment or even one at all. So, any type of non-fixed student loan payment will now be able to use the following debt ratio calculation:

Use the higher of one-half percent of the student loan balance or actual payment reported on the credit report. No other documentation is necessary.

Recommended Reading: Nerdwallet Loan Calculator

Usda Loan Terms & Eligibility

The home must be purchased in an area designated eligible by the USDA. USDA Loans location eligibility can be found by going to the USDA eligibility pagehere. Applicants for loans may have an income of up to 115% of the median income for the area they are interested in. State and county income limits can be found on our state pages hereUSDA home loan state and income information.

Individuals or families must be able to afford the housing payment, which includes taxes and homeowners insurance, along with reasonable credit and not own a home by the closing date.

The mortgage will be for a term of 30 years with interest rates that are comparable with any other 30 year government mortgage. Because of the terms of a USDA home loan, payment are lower than most other loans on the market today. There is no maximum loan amount. There is a yearly fee that is .35% of the loan amount per year broken down into 12 monthly payments.

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

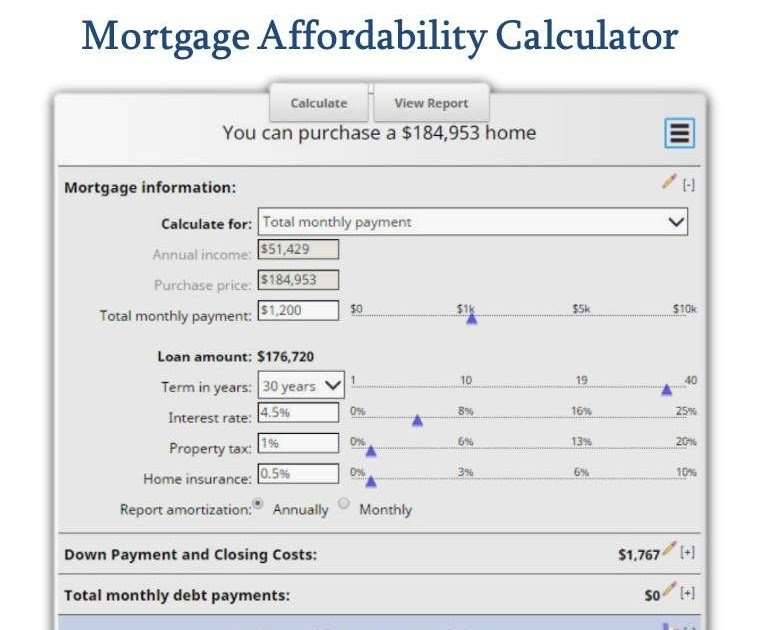

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Also Check: Car Loan Interest Rates Credit Score 650

Types Of Usda Mortgage Loans

There are two categories of rural housing mortgage loans offered under the USDA umbrella:

- Single-Family Housing Guaranteed Loan

- Single-Family Housing Direct Loan

The USDA Single-Family Housing Direct Loan serves low and very-low-income applicants. These borrowers are those whose median income falls between 50 to 80 percent of the area they reside in. Individuals cant access USDA Direct Loans through private lenders, as the government issues them directly.

In this piece, our focus will be directed towards the Single-Family Housing Guaranteed Loan, which seeks to serve Low to Moderate-income borrowers. These loans may be accessed through third-party private lenders, so you dont have to make your applications directly to the government.

What Are The Rates And Terms For A Usda Guaranteed Loan

Fixed-interest rates for USDA-guaranteed loans typically measure below the rates for conventional mortgages, which usually range from 3% to 5% of the homes value. Your interest rate ultimately depends on the lenders review of your financial, credit and employment history.

Qualified borrowers can take out USDA-guaranteed loans for 15 or 30-year payback periods.

The USDA sets no official mortgage amount limits for guaranteed loans. However, your income and market rates in the location where you plan to settle determine your loan amount. Homes can rack up a price tag of more than $500,000 in places like California, or they can dip to as little as $100,000 deeper into rural America.

Because down payments for USDA loans can be low or zero, youd need to shell out an up-front insurance premium to protect the seller in the event you default. This payment usually measures about 1% to 2% of the loan amount. Youd also need to pay a fee of about 0.35% to 0.40% of the loan throughout the year.

Consider a $200,000 loan. Say it carries a 1% up-front cost and a 0.35% premium throughout the year. In this case, youd pay $2,000 up-front. Your monthly premium would be $58. However, you can factor the upfront premium into the mortgage amount. In such a scenario, youd roll over the upfront cost into the loan making it a $202,000 mortgage.

Also Check: Can You Refinance With An Fha Loan