What Loan Amount Can You Afford Based On Monthly Payments

When you are looking into getting a loan, it is easier to estimate the amount you can pay monthly, based on your current financial situation, as opposed to the total loan amount you can borrow, depending of course on its interest rate and its term. It is a common situation when you shop for a car or a home. In fact, knowing the total amount of the monthly payment is vital when applying for a loan.

This important number, the monthly payment, will inform you from the start if a cash down on the loan would be required on the transaction. For example, if you want to buy a house at $300,000.00 and you calculate that you can afford a mortgage of $240,000.00, you know that you require a cash down of $60,000.00 in order to be accepted by the lender, or at least, to avoid .

This approach can protect your credit score from decreasing since you would avoid making potential .

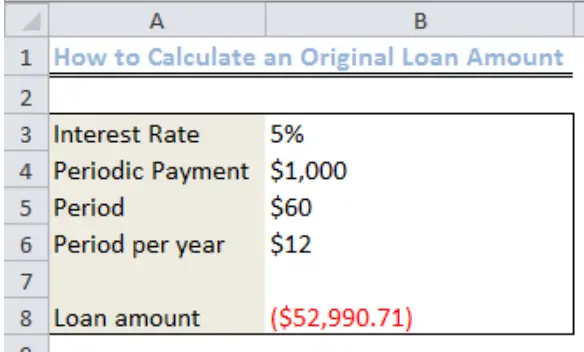

With the following calculator, you can predict the possible total loan amount, based on your monthly payments, the interest rate and the term.

The Easiest Way To Get These Numbers

If you have employees , you should be able to download a payroll report through your payroll provider. Many payroll providers are even offering âPPP reportsâ that tell you everything you need to know for your loan application.

If youâre self-employed and have completed your 2019 or 2020 tax return, your Schedule C will show your net profit. The Schedule C you provide does not need to be filed, but it should still be reviewed by a tax professional.

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

Don’t Miss: Refinancing Fha Loan

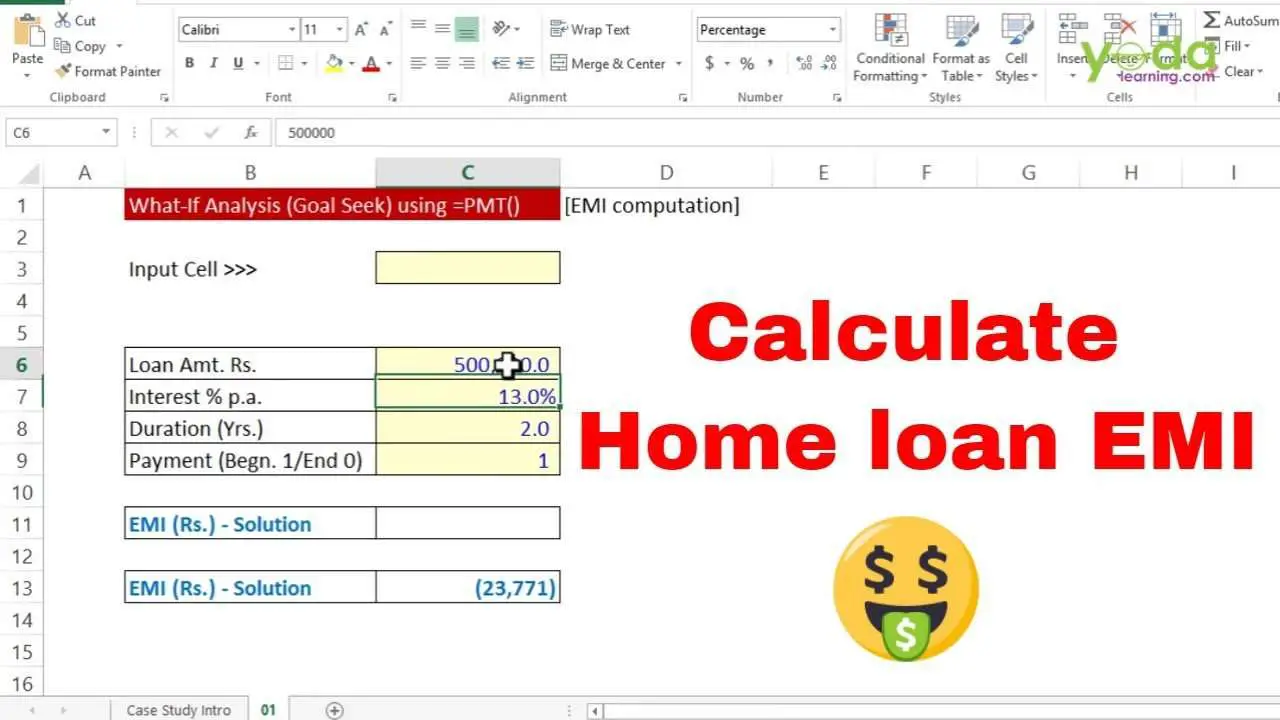

Results Overview In Emi Calculator

- EMI: Your monthly EMI which you have to pay to the lender to pay off your personal loan. Based on your loan EMI output you can check your personal loan eligibility in real time at BankBazaar.com.

- Break-up of your total amount payable: The EMI Calculator tool gives you the total personal loan amount payable to the lender. Your total loan amount payable is the sum of your loan amount , interest payable and processing fees. You can view this in the form of an amortisation table thats designed to give you a holistic view of your monthly/yearly repayment obligations.

Some Important Points For Sole Proprietors

-

While your rent and utility payments can be covered by this loan and help qualify you for loan forgiveness, they are not a part of the initial calculation.

-

If your gross profit for 2019 or 2020 is above $100,000, the maximum amount you can include for your calculation is $100,000. This would give you an average monthly payroll of $8,333.33, assuming you have no W2 employees.

-

Member draws do not factor into this calculation at all.

-

If your net profit for 2019 and 2020 was zero, meaning you were pre-revenue, you are only eligible for a PPP loan if you are currently running payroll. You may be better suited to applying for the EIDL program instead, or registering for Unemployment Benefits through your state.

-

Self-employed farmers should use Schedule F instead of Schedule C. Use the net profit as reported on line 34 of your Schedule F.

Read Also: Usaa Prequalify Auto Loan

Definition And Examples Of Monthly Loan Payments

When you receive a loan from a lender, you receive an amount called the principal, and the lender tacks on interest. You pay back the loan over a set number of months or years, and the interest makes the total amount of money you owe larger. Your monthly loan payments will typically be broken into equal payments over the term of the loan.

How you calculate your payments depends on the type of loan. Here are three types of loans you’ll run into the most, each of which is calculated differently:

- Interest-only loans: You dont pay down any principal in the early yearsonly interest.

- Amortizing loans: You’re paying toward both principal and interest over a set period. For instance, a five-year auto loan might begin with 75% of your monthly payments focused on paying off interest, and 25% paying toward the principal amount. The amount you pay on interest and principal changes over the loan term, but your monthly payment amount does not.

- A credit card gives you a line of credit that acts as a reusable loan as long as you pay it off in time. If you’re late making monthly payments and carry your balance to the next month, you’ll likely be charged interest.

Top Advantages Of Using An Online Personal Loan Calculator

- Accurate results

Individuals should calculate EMIs beforehand to manage their finances efficiently. While opting for these unsecured loans, one needs to make sure that the estimations are accurate. The manual calculations can be both tedious and erroneous. But an online interest rate calculator is programmed to display accurate results in split seconds.

The formula that a personal loan interest calculator follows is as stated below.

EMI= P × r × n/n 1)

Where, P = Principal,

R = interest rate,

N = tenor

So, even if one knows how to calculate personal loan EMI, the chances of getting incorrect results are quite high. However, with an online tool, you can avoid such errors efficiently.

- Compare interest rates easily

Individuals need to conduct thorough market research to avail better interest rates on their personal loans. This online interest calculator makes the process more convenient and hassle-free. Applicants can compare among different lenders and choose the one offering the most competitive rates.

To find the most suitable deal, one simply has to enter different rates while keeping the tenor and loan amount constant.

- Estimating the correct tenor

For instance, you take a personal loan worth Rs. 10 lakh at an interest rate of 15% for 36 months. The EMI outflow would stand at Rs. 34,665, and interest payable is Rs. 2,47,956.

Now, if the tenor is increased to 48 months, the EMI would drop to Rs. 27,831. However, the interest payable goes up to Rs. 3,35,870.

Read Also: Usaa Used Car Loan Interest Rates

Floating Rate Emi Calculation

We suggest that you calculate floating / variable rate EMI by taking into consideration two opposite scenarios, i.e., optimistic and pessimistic scenario. Loan amount and loan tenure, two components required to calculate the EMI are under your control i.e., you are going to decide how much loan you have to borrow and how long your loan tenure should be. But interest rate is decided by the banks & HFCs based on rates and policies set by RBI. As a borrower, you should consider the two extreme possibilities of increase and decrease in the rate of interest and calculate your EMI under these two conditions. Such calculation will help you decide how much EMI is affordable, how long your loan tenure should be and how much you should borrow.

Optimistic scenario: Assume that the rate of interest comes down by 1% – 3% from the present rate. Consider this situation and calculate your EMI. In this situation, your EMI will come down or you may opt to shorten the loan tenure. Ex: If you avail home loan to purchase a house as an investment, then optimistic scenario enables you to compare this with other investment opportunities.

Pessimistic scenario: In the same way, assume that the rate of interest is hiked by 1% – 3%. Is it possible for you to continue to pay the EMI without much struggle? Even a 2% increase in rate of interest can result in significant rise in your monthly payment for the entire loan tenure.

Having Correct Financials For Your Ppp Application Is Critical

Ensuring your profit is reported properly will maximize the loan amount you are eligible for. Additionally, if the numbers you provide your lender and the SBA are incorrect, you will run in to problems getting your loan forgiven. If you provide financial information youâre not confident in, you open your business up to penalties that include an audit, or possible fines and jail time.

To give you the confidence your application numbers are correct, you need to have strong bookkeeping in place. Accurate and up-to-date books will allow you to properly fill out your Schedule C for 2019 or 2020. Need historical bookkeeping done for 2019 or 2020? Bench can help.

Also Check: Is Flex Modification Program Legitimate

How Do You Calculate A Loan Payment

The first step to calculating your monthly payment actually involves no math at all – it’s identifying your loan type, which will determine your loan payment schedule. Are you taking out an interest-only loan or an amortized loan? Once you know, you’ll then be able to figure out the types of loan payment calculations you’ll need to make.

With interest-only loan options, you only pay interest for the first few years, and nothing on the principal balance – the loan itself. While this does mean a smaller monthly payment, eventually you’ll be required to pay off the full loan in a lump sum or with a higher monthly payment. Most people choose these types of loan options for their mortgage to buy a more expensive property, have more cash flexibility, and to keep overall costs low if finances are tight.

The other kind of loan is an amortized loan. These loan options include both the interest and principal balance over a set length of time . In other words, an amortized loan term requires the borrower to make scheduled, periodic payments that are applied to both the principal and the interest. Any extra payments made on this loan will go toward the principal balance. Good examples of an amortized loan are an auto loan, a personal loan, a student loan, and a traditional fixed-rate mortgage.

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

Don’t Miss: Usaa Proof Of Residency Request Form

What Is The Difference Between Apr And Interest Rate

The Annual Percentage Rate is the cost you pay each year to borrow money, including additional fees, expressed as a percentage. The higher the APR, the more youll pay over the life of the loan term.

The interest rate of a loan also describes the yearly cost of borrowing money, but it does not include additional lender fees. For that reason, your APR is usually higher than your interest rate.

In other words, an annual percentage rate is a broader measure of the cost of borrowing money that includes the interest rate and additional closing costs. These fees vary depending on the type of loan but can include origination fees, broker fees, points, and any other charge youll pay that is required to pay to get the loan.

A Note On Loan Calculators

In the following sections, well explain how to figure out the APR and total interest paid on several different types of loans. Of course, you can always use an APR calculator online, which can have your apr calculated in a matter of seconds. However, there is also value in knowing how to complete the work yourself. This allows you to know for sure that the APR calculator is giving you the correct information and that you inputted your numbers correctly. In other words, the following explanations will help you check the work of an APR calculator.

Also Check: Mlo License Ca

The Elements Of A Repayment Table Are:

- Principal Paid: This is the portion of your monthly payment that is applied towards the loan principal. This portion will keep increasing each month as the loan matures.

- Interest Paid: This is the portion of your monthly payment that is applied towards interest. This portion will keep reducing each successive month as the personal loan matures.

- Total Payment: Sum total of the principal and interest paid

- Outstanding Loan Balance: The ending balance of any given period corresponds to the principal amount that is owed to the Bank at the end of that period.

The repayment table provides year-wise and month-wise data. So, you can look at the details for each month as well as the cumulative data for each year.

How To Get The Best Deal On A Loan

This one is simple: get a loan that helps you manage your monthly payments.

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, it’s crucial you have a game plan for paying off your loan. Making an extra payment on your loan is the best way to save on interest . But it can be scary to do that. What if unexpected costs come up like car repairs or vet visits?

The Kasasa Loans® is the only loan available that lets you pay ahead and access those funds if you need them later, with a feature called Take-BacksTM. They also make managing repayments easy with a mobile-ready, personalized dashboard. Ask your local, community financial institution or credit union if they offer Kasasa Loans®.

Taking out a loan can feel overwhelming given all the facts and figures , but being armed with useful information and a clear handle on your monthly payment options can ease you into the process. In fact, many of the big-ticket items like homes or cars just wouldn’t be possible to purchase without the flexibility of a monthly loanpayment. As long as you budget carefully and understand what you’re getting into, this credit-building undertaking isn’t hard to manage – or calculate – especially if you keep a calculator handy.

Recommended Reading: Drb Refinance Review

Lenders And Sensitivity To Loan Amount

What do first-lien commercial mortgage lenders care most about when making a loan? Getting their principal back! Sure, its important they also get a return on their invested capital, but at the rates these last-in-first-out lenders put out their capital, theres not a lot of margin for error . Therefore, they are hypersensitive to the amount of capital they invest in any given property , since the more they put in , the higher the risk they will lose principal.

Thus, the lender puts a lot thought and analysis into the loan amount compared to the value of the property and the amount of cash flow the property produces. This process is colloquially called sizing the loan, or in other words using various metrics to arrive at a safe loan amount.

How Bench Can Help

With Bench, you get a team on your side who can help you make decisions to support the best interests of your business. Weâve helped thousands of small business owners access PPP loans and use our accurate reports to make the forgiveness process easy. With Bench on your team, youâll have properly completed books to help you:

Plus, if you ever have questions, your dedicated team of experts are just a quick message away in the Bench app.

If you donât have a reliable bookkeeping solution in place, check out Bench. Weâll do your bookkeeping for you.

Recommended Reading: California Mortgage License Requirements

How To Calculate Monthly Loan Payments

The Balance / Julie Bang

The monthly payment formulas calculate how much a loan payment will be and include the loan’s principal and interest.

Learn how to calculate how much you’ll pay on the most common types of loans and how to decide whether you can afford them or not.

Is The Hdfc Home Loan Rate Different For Women

Yes home loan interest rates for women are lower than those applicable to others. Women have to be a owner /co owner in the property for which the home loan will be availed as well as a applicant /co applicant in the HDFC home loan to avail a concession on the home loan interest rate applicable to others.

You May Like: Refinance Fha Loan

Can You Pay Your Emi At One Go

If you are referring to prepayment or foreclosure, yes you can do that. However, different banks have different conditions for personal loan prepayment. For instance, HDFC allows you to prepay only if you have completed 12 EMIs. Also, a certain prepayment charge may be levied depending on the bank at the time of pre-payment or foreclosure. So, read your lenders terms and conditions before opting for foreclosure or prepayment.