How To Get A Loan With A Low Interest Rate

Finding your best personal loan usually means going over a range of options. One of the most efficient ways to do this is to shop online. Before you start your online loan shopping, checkout how online loans work. Experian CreditMatch can provide a free personalized list of loan options based on your credit profile, but you can make your own comparisons. You may also want to compare rates and terms from traditional banks and credit unions.

As you go, keep the impact on your credit score to a minimum by sticking to preapprovals until you’re ready to apply. Preapprovals won’t cause a hard inquiry to appear on your credit like a loan application would. Each hard inquiry may ding your credit score by a few points, although the effect is typically minor and short-lived. Credit bureaus generally group similar inquiries together if they’re done within a short time frame, but there’s no reason to submit applications simply to compare your options.

When you’re comparing loans, don’t overlook additional opportunities to save, such as autopay discounts. Check reviews on customer service and support, as well: You may find out about other borrowers having problems with approval, funding or servicing that can be costly and aggravating.

Lendingclub $5000 Loan 60 Months

- Join Americas largest personal loan marketplace with over 3 million members

- Choose the most experienced personal loan company thats helped issue over $50 billion in loans since 2007

- Get fixed monthly payments with no prepayment penalties

- Take control of your debt and circle the date your loan will be paid off

Are There ‘no Credit Check’ Personal Loans In Australia

If you apply for a cheap personal loan with a major lender such as Commbank, you can expect to undergo a credit history check. If you have good credit or excellent credit, you may qualify for a lower interest rate that may help you save money on your personal loan. For those with a bad credit rating this can be a daunting experience, especially as having a loan application rejected can negatively impact your credit score.

It’s still possible for people with bad credit to borrow money. Payday loans and peer-to-peer loans often dont involve credit checks, and may allow bad credit borrowers to borrow smaller amounts of money.

However, these types of loans arent always cheap, as they often charge high fees. It may take just one missed repayment to find yourself up to your neck in huge penalty fees, putting you in financial trouble.

You May Like: Can You Buy A Manufactured Home With A Va Loan

Where To Find The Best Personal Loan Rates Online For You

If you want to refinance or consolidate debt, make a major purchase or cover another expense, a personal loan might be one of your best options as it will come with Fixed monthly payments Fixed APRs A set payoff period One of the best ways to get the lowest possible personal loan rates for your financial situation is to prequalify through several lenders, so you can compare offers. As long as you shop with lenders that use a soft credit pull, you can check your rate without hurting your credit score. In this guide … Personal loans for…

How To Compare Cheap Personal Loans

The best way to find out the true cost of a loan is to calculate the APR.

- The Annual Percentage Rate incorporates the fees as well as the interest rate to show you the true cost of the loan. Comparing APRs across different loans is the best way to find the cheapest loan.

Its also important to consider:

- Interest rate. Interest rates are only one important element that can impact the cost of a loan. Make sure youre getting a competitive loan by shopping around.

- Upfront and ongoing fees. These fees will likely be added onto your principal loan amount and will therefore affect your repayments and the interest you have to pay.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

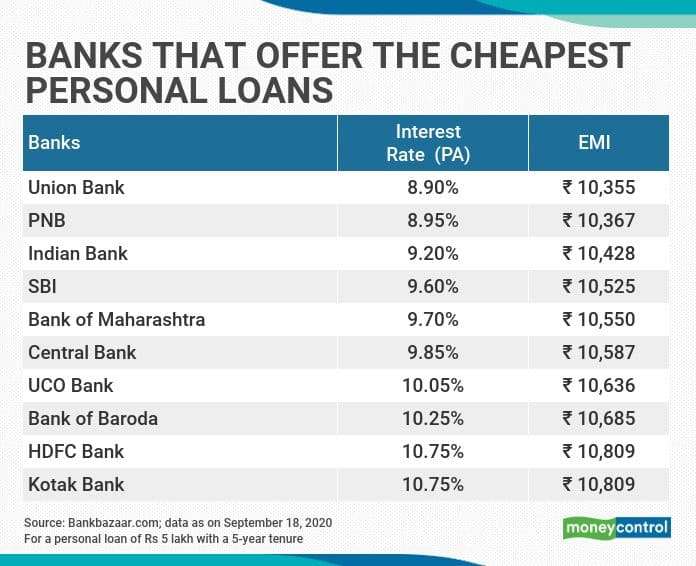

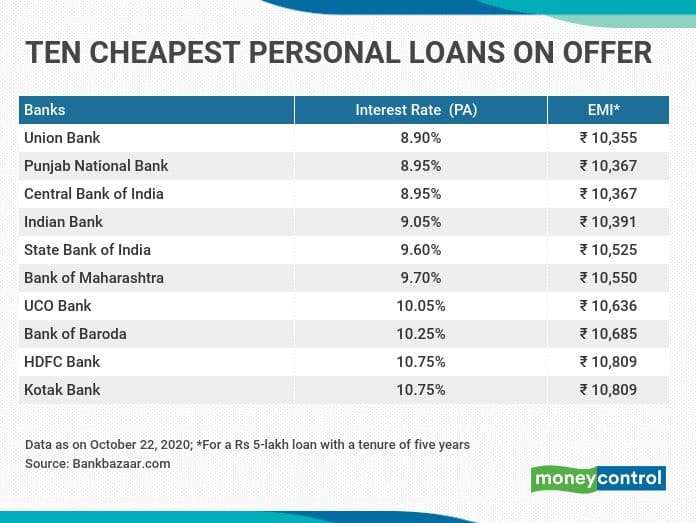

What Is A Good Interest Rate On A Personal Loan

Personal loan interest rates vary depending on your lender and credit score. If you have a high credit score, you could see interest rates as low as 2.49%, depending on where you get your loan. However, if you have poor credit scores, you may only qualify for loans that charge interest rates of 20% or more. Before you apply, improve your credit as much as possible to increase your odds of landing the best interest rate possible.

How Do I Choose The Best Personal Loan

Personal loans are available from traditional banks and credit unions as well as online lenders. Because of their streamlined application and qualification process, online lenders can often offer faster decisions and funding than traditional financial institutions. However, its still smart to compare as many lenders as possible to find the best personal loan for your needs.

Each lender has its own methods for evaluating borrowers, so be sure to consider not only interest rates but also repayment terms and any fees charged by the lender. This will help you determine which loan option best suits your current financial situation and your larger financial goals. In general, the most favorable personal loans will come with low, fixed rates and minimal fees.

Credible can help you easily compare your options you can see your prequalified rates from multiple lenders in just two minutes without affecting your credit score.

Here are Credible’s partner lenders that offer personal loans:

You May Like: Does Fha Loan On Manufactured Homes

What Else Makes A Personal Loan Cheap

While the interest rates and fees associated with personal loans are the most important, there are some further considerations to be made.

If you really want to find a cheap personal loan, youre going to have to find one that works best for your specific circumstances. When doing so, considering the following factors will help:

How much you can borrow: Always check how much youre allowed to borrow at the advertised interest rate. Rates may get higher or lower depending on whether you reach minimums or exceed maximums.

Whether you require a secured or unsecured loan: A secured loan will almost always have a lower interest rate than an unsecured personal loan. Keep this in mind when comparing loans and providers.

How your interest is calculated: Will your loan feature a fixed or variable interest rate? Choosing the right one could keep the total cost of your personal loan down.

The flexibility of repayments: If you plan on repaying your loan early, ensure you wont be penalised for doing so. Youre not going to plan on missing a repayment, but late fees are also worth knowing just in case.

Can I Get A Personal Loan With Bad Credit

Yes, there are several lenders that offer personal loans for bad credit for example, you might be able to geta personal loan with a 600 credit score or lower from certain lenders. However, keep in mind that these loans generally come with higher interest rates compared to good credit loans.

If you have bad credit and are struggling to get approved, consider applying with a cosigner. Not all personal loan lenders allow cosigners on personal loans, but some do. Having a cosigner could also help you qualify for a lower interest rate than youd get on your own.

Another option is working to improve your credit so you can qualify more easily in the future as well as get approved for more favorable rates and terms. A few potential ways to do this include:

Making on-time payments on all of your bills:

Paying down your credit card balances:

Your credit utilization ratio refers to how much you owe on revolving credit accounts like credit cards compared to your available credit limits. This ratio is also a big factor in your credit score, so if you can pay down your balances, you might see your score go up.

Taking out a credit-builder loan:

This type of loan is specifically designed to help borrowers build credit by building a positive payment history over a period of time. But unlike other loans, the payments you make on are put into a dedicated savings account, and the money is returned to you at the end of your repayment term minus any interest or fees.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What Are The Benefits Of Personal Loans

Personal loans offer several benefits, including:

Fixed interest rates:

Can be used to consolidate debt:

You can take out a personal loan to consolidate multiple kinds of debt, such as credit cards or other loans. Depending on your credit, you might get a lower interest rate than youve been currently paying, which could potentially help you pay off your debt faster.

Can cover large expenses:

If you need to pay for a large expense such as home improvements, medical bills, or a wedding a personal loan could be an option to get the cash you need.

Generally unsecured:

Most personal loans are unsecured, which means you dont have to worry about collateral. However, because unsecured loans present more of a risk to the lender, an unsecured personal loan could be harder to qualify for compared to a secured loan.

Why Trust Our Recommendations

Personal Finance Insider’s mission is to help smart people make the best decisions with their money. We understand that “best” is often subjective, so in addition to highlighting the clear benefits of a financial product, we outline the limitations, too. We spent hours comparing and contrasting the features and fine print of various products so you don’t have to.

Recommended Reading: Becu Auto Loan Payoff

Best Personal Loans In Canada 2021

Home \ Loans \ Best Personal Loans In Canada 2021

Join millions of Canadians who have already trusted Loans Canada

Personal loans are one of the most popular financial tools among Canadian consumers. They offer the opportunity to cover a wide variety of expenses, from unexpected travel to unfortunate car issues. While finding the best personal loan to meet your unique needs may seem like a difficult task, the good news is that more Canadian lenders are offering this product than ever. For everything you need to know about the best personal loan options in Canada and how to choose the best fit for your finances, keep reading.

Get Personal Loan Rates

However, it still may not be the best option for you, especially if you don’t have a cosigner. To find the best personal loan lender for your situation, do some comparison shopping before deciding to take out a personal loan.

Your personal loan interest rates will depend on your credit score and other financial history. Each lender is different with various types of loan offerings and ways to evaluate a potential borrower.

You May Like: How To Get An Aer Loan

What Are The Requirements To Apply For A Personal Loan

While eligibility criteria can vary by lender, here are a few personal loan requirements youll likely come across:

Good credit:

Verifiable income:

Lenders want to see that you can afford to repay your loan. Some lenders have a minimum required income while others dont but in either case, youll likely have to provide proof of income.

Low debt-to-income ratio:

Your debt-to-income ratio is the amount you owe in monthly debt payments compared to your income. To qualify for a personal loan, youll typically need a DTI ratio of 40% or less though some lenders might require a lower ratio than this.

How To Avoid Rejection Of Personal Loan Application

The approval of a personal loan application depends on a number of factors. When you apply for a loan, you should make sure that you are fulfilling all the factors to ensure the approval of your loan application. The eligibility criteria for personal loans may vary from lender to lender. However, there are number of common criteria which include the age of the applicant, his or her income, credit score, status of employment, and so on. Before you apply for a loan, make sure that all the eligibility criteria are being fulfilled. This will help you avoid rejection of your loan application. Although there are other options which you can resort to in case your loan application gets rejected, it is recommended to double check before applying to avoid the chances of rejection of application.

You May Like: How To Get An Aer Loan

What Is A Small Personal Loan

A small amount loan, fast loan or payday loan, is a loan of up to $2,000 that you have between 16 days to one year to pay back.

Lenders cant charge interest on small amount loans, but they can charge high fees. According to ASIC, most lenders charge an establishment fee of 20% of the loan amount and a monthly service fee of 4% of the loan amount.

Payday loans are typically more expensive than other types of loans, so its important to carefully consider the costs involved and make sure you will be able to afford the repayments.

Maybank Enable Personal Loan

- Monthly Add-On Interest Rate: 1.5%

- Loan amount: PHP 50,000 to PHP 1 million

- Loan terms: 12 to 36 months

- Processing duration: Five to 10 working days

- Loan fees:

- Processing fee of PHP 2,000 to PHP 3,000

- Documentary stamp of PHP 1.50 for every PHP 200 if loan amount is over PHP 250,000

One of the best low interest loans in the Philippines is Maybanks Enable Personal Loan, which offers a 1.5% fixed interest rate. You can also borrow up to PHP 1 million, depending on your salary and bank approval.

Read Also: Does Va Loan Work For Manufactured Homes

Personal Loan Credit Score Requirements By Lender

|

Lender |

- Professor of Management, Business & Economics Virginia Wesleyan UniversityRead More

- Cynthia VinesPh.D., CPA Director of the University of Kentucky’s Online Certificate in Financial Planning, Gatton College of Business and Economics University of KentuckyRead More

- Ph.D. Associate Professor of Finance, Pompea College of Business University of New HavenRead More

- Wee Meng Eric LeeAssociate Professor of Accounting, Accounting Alumni Faculty Fellow, College of Business Administration University of Northern IowaRead More

- Professor of Accountancy and Dean of the McIntire School of Commerce University of VirginiaRead More

- Sharon LassarPh.D., CPA John J. Gilbert Endowed Professor and Director, School of Accountancy, Daniels College of Business University of DenverRead More

Fixed And Variable Interest Rates

The type of interest rate on your personal loan may also have an effect on its cost.

A fixed interest rate is set by your lender at the start of your personal loan term, and remains the same for the duration of your loan. This keeps your repayments the same for the entire term of your personal loan, and if these are cheap enough for you to easily afford, then organising your monthly budget should stay nice and simple.

A variable interest rate, on the other hand, may be adjusted by your lender over the term of your personal loan, to better suit the current economic conditions. A rate cut could either lower your repayments, or allow you to pay off the loan faster, which can also make your loan cheaper in total as youll be charged less interest overall. However, interest rate rises could make your initially cheap personal loan repayments much more expensive, so be mindful of the risk of ending up in financial stress if your repayments were to rise.

Recommended Reading: How Long For Sba Loan Approval

Improving Your Credit In 2021

In short, improving your credit is one of the first steps you should take before you start applying for personal loans, no matter how much youre asking for. True, even if your credit score and rating are low, and your credit report is a bit worse for wear, there are subprime lenders out there who can grant you the personal loan you need. However, as we said, your interest rate can end up being extremely high, costing you hundreds, even thousands of dollars extra. So, if the present state of your creditworthiness is not where youd like it to be, you can try to improve it gradually by:

- Getting a free annual copy of your credit report.

- Review it for errors and dispute any you find.

- Pay your bills on time and in full, whenever possible.

- If you cant afford the full payment, at least make the minimum balance payment.

- Close any unused credit accounts.

- Pay off any other debts you may have, starting with the largest.

For more ways of improving your credit in 2021, read this.

How Much Can You Borrow With A Personal Loan

You can borrow as little as $1,000 and as much as $100,000 with a personal loan. Loan amounts will differ depending on the lender. And keep in mind the amount youre eligible to borrow will depend on your creditworthiness. If youre requesting $80,000 and have bad credit, you may not receive as large of a loan as you asked for.

Don’t Miss: What Happens If You Default On Sba Loan

Using A Personal Loan Calculator To Weigh Interest Rates

If youre ready to shop around for personal loan interest rates, its wise to keep a personal loan calculator handy. After all, your quoted APR determines your monthly payment. You can use a free online tool to estimate your monthly dues for each potential rate.

You can also employ personal loan calculators to determine your ideal loan repayment term. You might opt for a longer term at the expense of a slightly higher APR, for example, if it keeps your monthly payments in line with your cash flow.

In other words, personal loan rates are a key factor in determining which loan is best for you, but theyre far from the only factor to consider. Talk with lenders about repayment terms and protections as well as discounts and fees before choosing the best overall loan for your situation.