Determining The Amount To Finance

Calculate Your Personal Loan Payments

You can estimate your monthly payment and how much youll pay in interest once you know your personal loan interest rate, term and amount.

For example, lets say you have a personal loan with a $5,000 loan amount, 11.25% fixed interest rate and a term of 36 months. The Forbes Advisor personal loan calculator shows your monthly payment would be roughly $164 and youd pay around $914 in interest over the life of the loan. Overall, you would owe $5,914, which includes both principal and interest.

Interest Is What You Pay To Borrow Money From A Lender When You Finance The Purchase Of A Vehicle

Interest charges are included in your monthly loan payment and can add thousands of dollars to the amount you have to repay. Thats why its important to understand how car loan interest is calculated, what factors can affect your rate and how to minimize interest charges.

Also Check: How To Get Mortgage License In California

Whats The Average Interest Rate On A Car Loan

According to the Federal Reserve, in the first quarter of 2021, the average auto loan rate on a 48-month new-car loan was 5.21%, and the average rate on a 60-month new-car loan was 4.96%.

A range of factors can affect what interest rates you might be offered, including your credit scores, the size of your down payment and the length of your loan term. Your rate may be higher or lower than average depending on your financial situation.

Which Auto Loan Calculator Should You Use

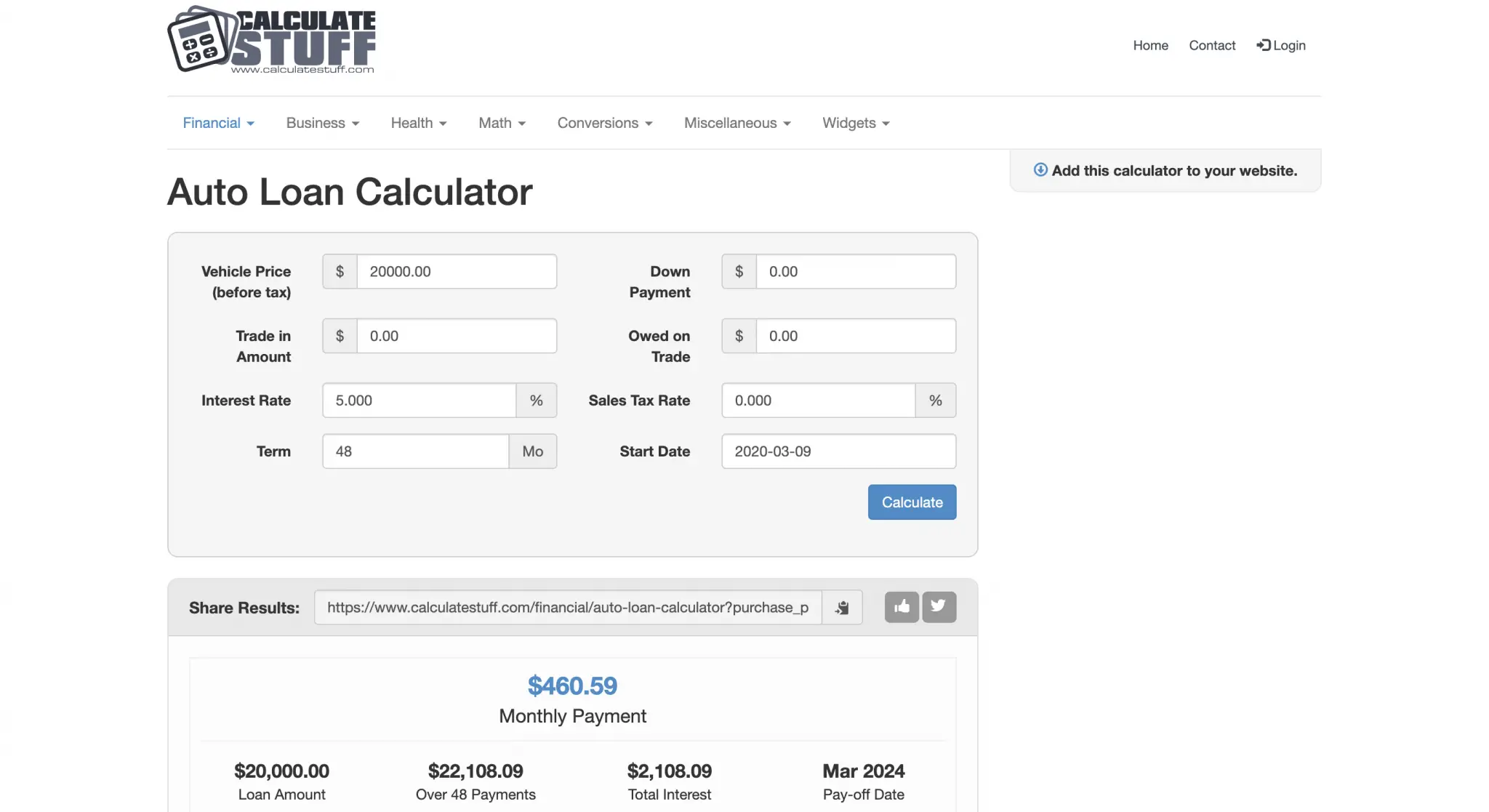

Use the auto loan payment calculator if you know what you expect to spend.

For example, perhaps you think you can afford a $20,000 loan on a new car. A 48-month loan for the most creditworthy borrowers would be 3% or less. At that rate, you’d pay about $440 a month and $1,250 in interest over the life of the loan. A subprime rate might be 11%, making the payments about $515 and you’d pay more than $4,500 in interest.

Many people reduce payments by lengthening the term of the loan. If you change the term to 60 months, payments on that $20,000 loan at 11% fall from $515 to $435. However, you would pay nearly $6,100 in interest, or an additional $1,600, for doing so.

Use the reverse auto loan calculator if you have a specific monthly payment in mind. Say you have decided that you can afford to spend $350 a month on car. Depending on the interest rate and length of loan you choose, a $350 car payment could repay a $15,600 car loan at 3.66% in 48 months or a $19,100 loan at 60 months.

Don’t Miss: Usaa Personal Loan Credit Score

How To Calculate Auto Loan Payments

This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.There are 11 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 422,416 times.

Buying a new or used car, for most people, is not a purchase made by writing a check or handing over cash for the full amount. At least part of the amount is typically financed. If you do finance a car, it’s important that you understand exactly how much you’ll be paying every month, otherwise you could end up going over budget.

Why Do Banks Charge Different Interest Rates

While the cash rate is one of the main things banks will consider when setting commercial interest rates, itâs not the only one. Banks will also be keeping an eye on overhead costs, as well as maintaining a healthy margin between the loan and deposit rates theyâre offering.

Generally speaking, online banks tend to offer cheaper home loan rates and more generous savings account rates than their larger counterparts, as they have fewer overhead costs to worry about. The flipside to this is that larger banks tend to offer more when it comes to physical branches and face-to-face services.

Recommended Reading: Usaa Car Loan Number

Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

Auto Loan Payment Calculator Results Explained

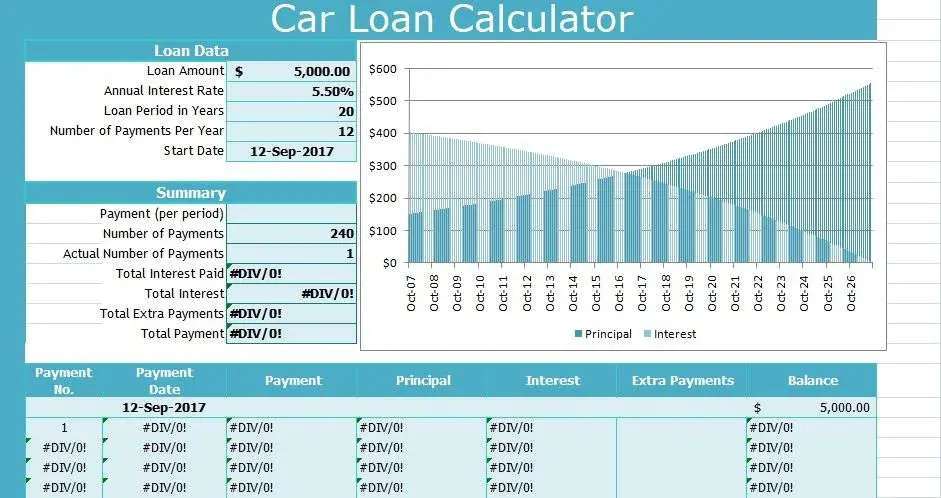

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

Recommended Reading: Current Usaa Car Loan Rates

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 345,921 times.

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

Why Is The Interest Rate For Used Car Loans Higher Than The Rates For New Car Loans

It is important to note that financing for used cars carries a higher risk for the lender compared to financing new cars. This is because the risk for a breakdown is higher for used cars, which in turn affects its resale value and pay off. Additionally, used cars are typically financed by buyers who have a lower credit score and who are in a relatively riskier financial position.

Recommended Reading: Should I Choose Fixed Or Variable Student Loan

Calculating Interest On A Car Personal Or Home Loan

These loans are called amortizing loans. The mathematical whizzes at your bank have worked them out so you pay a set amount each month and at the end of your loan term, youâll have paid off both interest and principal.

You can use an interest calculator to work out how much interest youâre paying all up, or, if youâd rather do it by hand, follow these steps:

1. Divide your interest rate by the number of payments youâll make in the year . So, for example, if youâre making monthly payments, divide by 12.

2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

This gives you the amount of interest you pay the first month.

So for example, on a personal loan of $30,000 over a period of 6 years at 8.40% p.a. and making monthly repayments:

Because youâve now begun to pay off your principal, to work out the interest you pay in the following months, you need to first calculate your new balance. So:

1. Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal.

2. Take this amount away from the original principal to find the new balance of your loan.

To work out ongoing interest payments, the easiest way is to break it up into a table. So using the above example, your calculations might look like this:

An Auto Loan Calculator Reveals More Than Payments

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the auto loan payment calculator’s “total cost of car” result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

An auto loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

NerdWallet recommends that you shop for an auto loan before you visit dealerships you’ll give the dealer a rate to beat and won’t worry that you won’t be approved for loan.

Also Check: Usaa New Auto Loan Rates

Car Loan Calculator: Benefits And Features

The benefits of IDFC FIRST Banks Car Loan Calculator India are:

- It helps you plan your monthly budget by providing the amount of EMI you will have to pay in the future. If you want to buy a car of your choice, you can check whether it is affordable to you by choosing different tenures on a car loan EMI calculator.

- The car loan EMI calculator gives you an accurate EMI amount payable. With manual calculation, you tend to make a mistake.

- You can have a comprehensive view of your car loan repayment through the iconographic like a table or chart the car loan interest rate calculator offers.

How To Use The Cleartax Car Loan Calculator

- Use the slider and select the loan amount.

- You then select the loan tenure in months.

- Move the slider and select the interest rate.

- The calculator would show you the EMI payable, total interest and the total payable amount.

- Recalculate your EMI anytime by changing the input sliders.

- EMI will be calculated instantly when you move the sliders.

Also Check: Usaa Used Auto Loan

Defining Car Loan Terms

Calculate Compound Interest On A Loan Using Fv Function

You can also calculate compound interest on a loan in Excel usingthe FV function.

Introduction to FV Function

Function Objective:

Calculates the future value of an investment based on a constant interest rate. You can use FV with either periodic, constant payments, or a single lump-sum payment.

Syntax:

| The total number of payment periods in an annuity. | ||

| Pmt | Required | The payment that is to be made per period. It is fixed or constant over the life of the loan or mortgage. Typically, pmt contains only the principal and interest but no fees or taxes. If pmt is omitted, you must include the pv argument. |

| Pv | Optional | The present value, or the total amount that a series of future payments is worth now. Also known as the principal. |

| Type | Required | The number 0 or 1. It indicates the time when the payments are due. If the type is omitted, it is assumed to be 0. |

Return Parameter:

Future value.

Step 1:

- First, we will select cell C10 and write down the formula below for compound interest for the first month.

=FV

Formula Breakdown:

- C4 = Rate = Annual Interest Rate = 4%

As we are calculating on monthly basis, we have divided it by the number of months in a year, 12.

- C7 = Npr = Total number of payments = 60

We have 5 years to pay back the loan. 5 years have a total of = 60 months

- 0 = Pmt = The payment made each period.

- -C8 = Pv = The present value.

Step 2:

Read more:How to Calculate Home Loan Interest in Excel

You May Like: What Happens If You Default On An Sba Loan

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Don’t Miss: Can I Refinance A Fha Loan