What If Im Offered A Poor Interest Rate On My Auto Loan Because Of My Score

High interest rates dont have to keep you from taking on a loan. You might be able to consider refinancing your auto loan after a year or so of consistent, on-time payments. Refinancing pays off the balance on your original loan with a new loan, ideally leaving you with lower payments or a shorter repayment term.

With responsible repayments, you might see an increase in your credit score, which can mean stronger terms on a new loan. If youre quoted refinancing at similar rates or terms to your original loan, consider waiting to refinance until your credit score improves further.

Case study: Roberta uses a secured card to save time and money on her car loan.

Roberta didnt have the best credit score when she initially took on her auto loan, and she isnt happy with carrying its high interest rate to the end of the loans term. But she knows she needs a stronger credit score before she can refinance at a lower rate.

On-time loan payments contribute to an overall improvement of her score. To speed along the process, she also signs up for a secured credit card. She uses the card minimally to keep her credit utilization rate down, paying down each of her monthly statements on time and in full.

How To Check Your Credit Score

When it comes to checking your credit score its best to start with a soft search credit check. This gives brokers an idea of your financial history without leaving a permanent mark on your credit score. Too many hard searches can suggest youre continually on the search for new lines of credit a major red flag for lenders.

Whether you have an excellent credit score or youre not quite where you want to be, we can help secure you the best car finance deals from our panel of lenders. Were available to discuss your options and help you learn more about what credit score is needed for car finance UK. Get in touch at or give us a call on to chat with a car finance expert.

Consider Your Loan Term

While you might reduce your monthly payment by lengthening the term of your auto loan, it will cost more over time. Interest rates are typically lower for shorter terms .

Long-term loans come with the risk of negative equity, which is when you owe more on your loan than the car is worth. This can happen if you have an accident or other damage to your vehicle early in the life of your loan.

You May Like: Usaa Bad Credit Auto Loans

Which Credit Score Is Used For Car Loans

Credit-scoring models from FICO and VantageScore are most commonly used for auto loans, but lenders may also use the industry-specific FICO® Auto Scores.

With the FICO Auto Scores, FICO first calculates your base scores your traditional FICO scores then adjusts the calculation based on specific auto risks. These scores help lenders determine the likelihood youll make your auto loan payments on time. FICO Auto Scores range from 250 to 900 points.

What Credit Score Do You Need To Get Approved For A Car Loan

Lets face it, owning a car makes life a whole lot easier. Whether youre single and need a way to get to work or you have a wife and four kids, owning a car will save you both time and stress. Unfortunately, many Canadians believe that their subpar credit score will stop them from getting approved for a car loan. The truth is, most Canadians with a monthly income of at least $2000 will be able to obtain a car loan despite their credit score.

While having a great credit score certainly helps to obtain better financing terms, its not a requirement to get car financing. In this article, well talk about the minimum credit score required to get approved for financing, how better credit can get you a better loan, things to consider when evaluating lenders and give you some tips on how to improve your credit.

You May Like: When Can You Refinance An Fha Loan

Reasons Why There Is No Minimum Credit Score: Because There Are Other Solutions

Finally, if a lender is truly interested in lending to you, they will find a way to make it work.

This is our approach as well. Sometimes, we realise that it would be reckless and dangerous to extend credit to a potential customer. This is because any more debt they take on could get them in trouble. In that case, well suggest the customer first improve their finances and then come back for a second application.

But if we can see youre committed to paying back the loan and have taken positive steps towards better financial health recently, then we will do everything in our power to get you behind the wheel again.

How Can You Improve Your Credit Scores

- Correct credit report errors. Take a look at your credit report from each of the reporting bureaus. Make sure the information is right, and contact the bureaus if anything needs to be corrected.

- Make payments on time. Consider automating your payments to ensure you never miss one.

- Pay off debts. You may want to target high interest credit card debt first. As you pay off high interest debts, youll have more money to direct toward becoming debt free.

Dont Miss: Voluntary Repossession Drivetime

Read Also: Mountain America Mortgage Rates

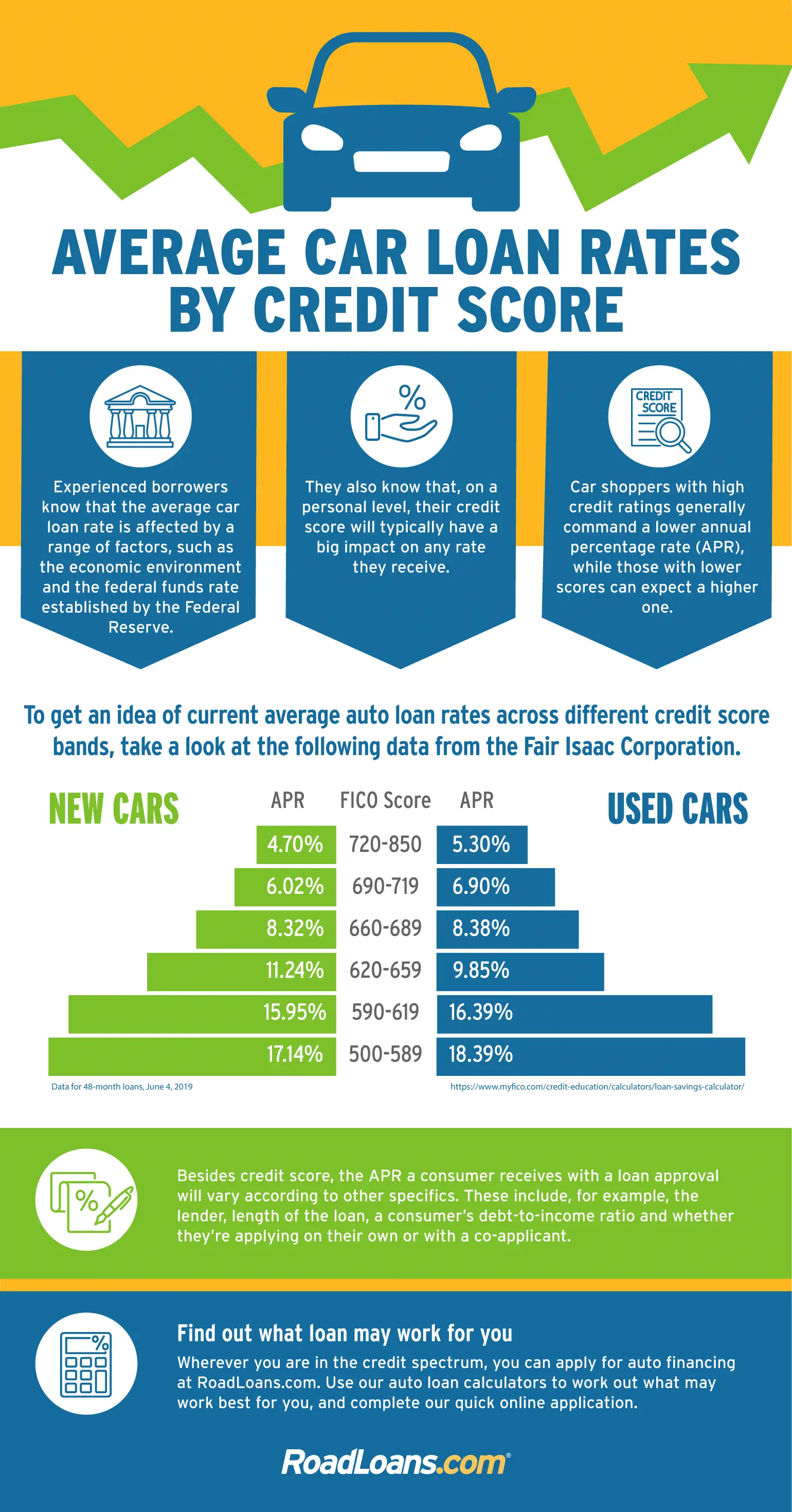

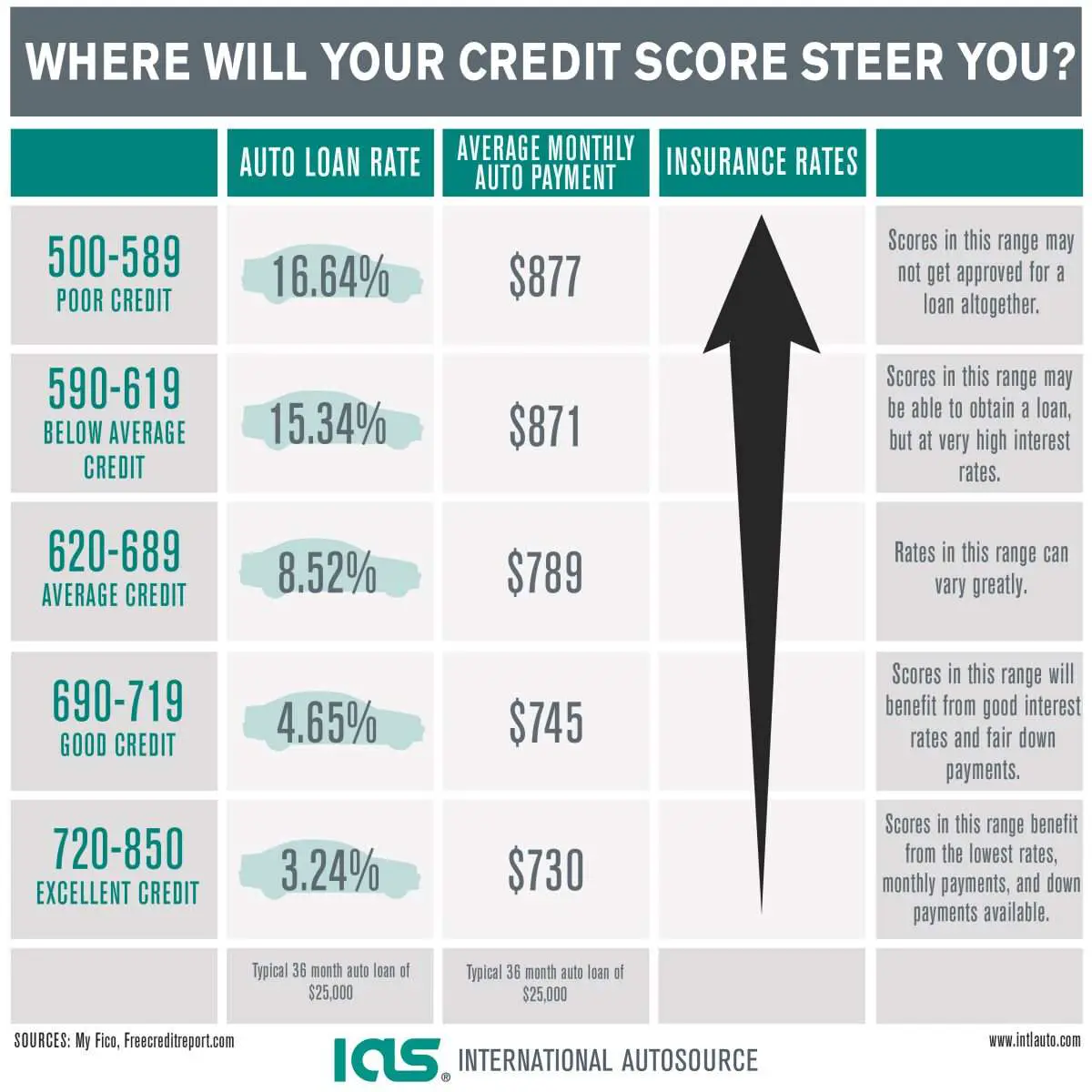

How Credit Scores Affect Car Loan Rates

Your credit score affects your car loan rates in a couple ways:

- Your eligibility: While there isnt a universal minimum credit score to secure an auto loan, many lenders have minimum credit score requirements. If your score falls below the minimum, you likely wont be approved for a loan.

- The rates youre offered: Typically, borrowers with higher credit scores have access to lower rates for financing. Those rates tend to go up as a borrowers credit score goes down.

Minimum Credit Score Required To Get A Car Loan

Lenders see every borrower as a financial risk, this is why people with bad credit end up getting loans with higher interest rates. The high-interest rates make the level of risk worth it for the lender. Typically, lenders want to see their applicants have a credit score of around 600 for them to be willing to approve a car loan. Lenders are increasingly happy when the applicant has a credit score of 650 or higher, resulting in lower interest rates. Essentially, the better your credit score, the better financing terms youll qualify for.

There are some lenders however that prefer to only deal with applicants with good credit scores. Not to worry because there are plenty of alternative lenders and even car dealerships that work with Canadians with all types of credit.

You May Like: Usaa Rv Loan Rates Calculator

What Is The Minimum Credit Score To Buy A Car

There may not necessarily be a minimum credit score required to buy a car. Consumers with deep subprime credit scores from 300 to 500 have obtained financing for new and used vehicles in the second quarter of 2021, according to the credit bureau Experians State of the Automotive Finance Market report for that period. Although the percentage of borrowers in this category is very low, this indicates that even those with the lowest credit scores still may have access to auto financing.

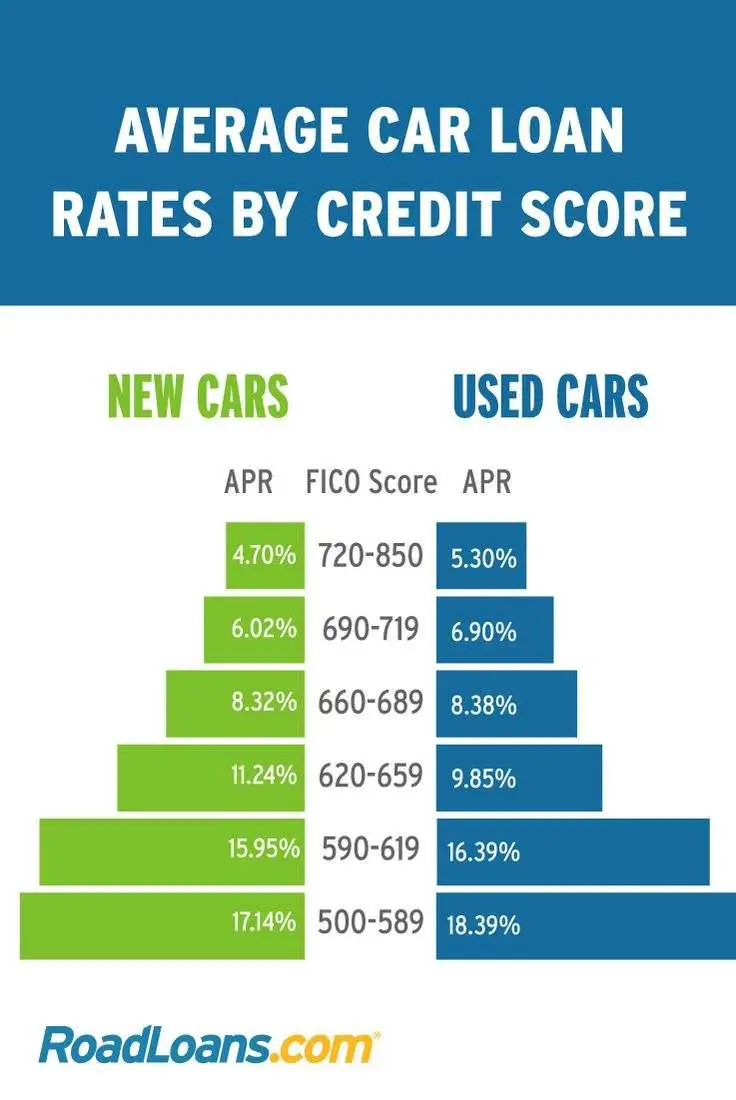

Car Loan Rates By Credit Score

The table below shows the average auto loan rate for new- and used-car loans based on credit scores, according to Experian data from the second quarter of 2020.

| 6.05% | 4.08% |

As you can see, having a good credit score will give you a lower interest rate on your loan than an average or lower credit score. And having poor credit means youll pay high interest rates.

A few extra percentage points may not seem like a big deal but when that percentage is applied to the thousands of dollars that car loans typically amount to, it adds up quickly.

Heres how this plays out in reality. Lets say two borrowers one a prime borrower and the other subprime want to finance $10,000 for a used car. They both have a 60-month loan term. The subprime borrower is offered a 17.78% rate the average for borrowers in this range in the second quarter of 2020, according to Experian. The prime borrower is offered the average 6.05% rate.

Over time, the subprime borrower will pay back $15,164, or $5,164 in interest. The prime borrower will pay about $1,614 in interest, for a total cost of $11,614. Thats a difference of $3,550 in interest paid and in this case, it all came down to credit scores.

Taking steps to improve your credit could increase your chances of getting approved for a loan with better terms, keeping more money in your pocket in the long run.

You May Like: How Much Car Loan Can I Afford Based On Income

What Are Some Ways To Finance A Car In The Uk

Weve covered this in full in our article on how car finance works in the UK, but heres a quick summary of the most popular types of car finance:

- Personal loan: probably the simplest option. Borrow an agreed amount and use it to purchase the car. Make monthly repayments until youve paid off the total amount, plus interest. You own the car outright from day one, so you can drive it as much as you like and sell it whenever you feel like it.

- Hire purchase: pay a deposit, and then monthly payments for an agreed period. You can use the car from day one, but until you make the final payment, you dont legally own the car.

- Personal contract purchase : pay a deposit, and then monthly payments . At the end of the agreement, you have a choice: make a final payment and own the car outright, or walk away . As with HP, you dont own the car until the final payment is made, and you will face mileage restrictions. Related post: PCP Versus Bank Loan: Whats The Best Way To Finance A Car?

All three of these finance options are available from car dealers as well as independent finance providers and banks and are available for used cars as well as new ones. And each of these finance agreements are regulated by the Financial Conduct Authority.

Build Your Credit Score Before Applying For Car Loans

If you just arenââ¬â¢t getting car loan interest rates that work for you, it may be best to delay buying your new car and work on building your first. Here are a few things you can do for that:

Lower your credit utilisation ratio: The idea is to keep your credit balance low as compared to the credit limit available to you. Ideally, you shouldnââ¬â¢t use more than 60-70% of the credit limit available. This will help show the lenders that you can manage your finances well and you arenââ¬â¢t overextending yourself.

Avoid applying for other credit products: When you are applying for a car loan, refrain from applying for other types of credit in the same span of time. Ideally, you should avoid applying for new credit products for the next 4-6 months.

Build payment history: For all your existing credit products, you should make sure to pay your bills on time and in full. Donââ¬â¢t miss any payments or it can affect your credit score even more. Itââ¬â¢s also a good idea to setup automatic payments so you donââ¬â¢t forget.

Recommended Reading: Usaa Personal Loan Calculator

Consider Getting A Cosigner

Depending on your situation, getting a cosigner might be your best option to get a loan at a reasonable interest rate. Consider looking for a cosigner if:

- Your income is lower than the minimum requirement for a car loan

- You have bad credit

- Your debt-to-income ratio is too high to qualify for a loan

- You have a variable income

Your cosigner is responsible for making your monthly payment if you cant fulfill your loan obligations, so only take this approach if you are confident you can make your payments in full and on time. Using a cosigner lets you leverage that persons credit score to get a better interest rate or loan terms.

Read Also: Notify Credit Bureau Of Death

Why Is Your Credit Score Important For A Car Loan

When buying a car, having a high credit score will help you in many ways. When it comes to the best auto loan rates, they are generally reserved for those who have a good credit score.

Before heading to a car dealership, you must be prepared. Make sure you check your credit report first, so you know exactly what to expect. This way, if your credit score is low, you can give yourself more time to decide on whether youd like to buy a car now, or with a better credit score. In time, you can then benefit from better rates and get the best deal on your new purchase.

Recommended Reading: Upstart Loan Calculator

How To Monitor And Keep Track Of Credit Scores

There are a number of ways you can check your credit score, including through your credit company or another financial institution where you have an account, as well as through a credit service or credit scoring website. Contrary to what you may expect, your credit report does not include your credit score, though it does provide valuable information about your credit history and debts, which is why it can still be helpful to read over your credit report before making a major purchase like a car.

Credit scores can fluctuate over time depending upon financial circumstances, and occur at least every 45 days. Thats why its important to take a look at where your score stands right before you begin the process of car shopping.

Also keep in mind that its common for credit inquiries to occur when youre shopping around to see what auto loan terms you qualify for. While soft inquiries dont affect your credit score, hard inquiries, such as those that happen when youre comparing rates for an auto loan, can ding your score. However, most major credit scores will count multiple car loan inquiries made within a certain period of time typically 14 days as one inquiry.

Apply For A Loan With A Cosigner

If your score is in the nonprime to deep subprime range, you might consider applying for a car loan with a cosigner. A cosigner is someone, such as a family member, who is willing to apply for a loan with you and, ideally, has good to excellent credit. A cosigner shares responsibility for the loan, reducing the lenders risk. Youre more likely to qualify for a loan and get a lower interest rate than if you applied on your own. But if you’re unable to make the loan payments, your cosigner will be stuck with the bill.

Don’t Miss: Should I Get A Fixed Or Variable Student Loan

How Do You Check Your Credit Score

Even if youre not buying a car right now, its wise to keep track of your credit score. Federal law allows consumers to obtain one free report each year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Many banks and credit card companies also provide free credit scores to their customers, so take advantage of that if you can. Checking your credit report regularly will not adversely impact your score.

Reduce The Amount You Want To Borrow

Lenders are much more willing to lend you a small amount than a large amount. That stands to reason: would you feel more comfortable lending your neighbour £10 or £10,000?

The differences dont need to be that huge though – for example, finding a car for £7,000 rather than £8,000 could make a real difference, and will almost certainly reduce the amount of interest you pay too.

Of course, saving money on a car is easier said than done – Motoring Research has a detailed guide with some great insider tips.

You May Like: Texas Fha Loan Limits

What Credit Score Is Needed For A Car Loan

The reality is that almost anyone, including those with bad credit scores, can get a car loan. The problem is that buyers with poor credit will be paying substantially more in monthly payments because of their low credit scores. Even further, the difference in credit scores will limit the amount that someone could pay for a car.

Suppose you have an annual income of $65,000 with a net monthly income of $4,300. If we follow the guideline of not exceeding 10 percent of net monthly income for a car payment, then a buyer with a deep subprime credit score would be limited to financing $20,000 at an interest rate of 14.39 percent.

A deep subprime buyer who wanted to purchase a car costing $30,000 would have to make a down payment of $10,000 to stay within these monthly payment guidelines.

On the other hand, a buyer with super prime credit and the same income would be able to get an auto loan up to $27,000 at an interest rate of 3.65 percent due to her good credit score. This buyer would only have to make a down payment of $3,000 to purchase that same $30,000 car.

What Else Is Considered

Ultimately, a credit rating only really gives a lender an idea of how youve conducted your finances in the past. While that helps companies decide whether or not theyd be willing to lend to you its not the full story and a good credit rating doesnt necessarily mean youll be a suitable candidate for car finance.

Lets consider an example:

Imagine you decide youd like to apply for finance on a Lamborghini Huracan. Youve got an excellent credit rating so you should have no problem right?

Well, that might be the case but with a monthly HP payment thats likely to well exceed £3,000, affordability might be a problem. So, if you earn £2,000 per month, you simply will not be able to get the finance, regardless of your credit rating.

This works the other way around too:

Lets say you earn £1,600 each month and youre looking to buy a new Ford Ka on a PCP deal. Youre in a position to put a large deposit down so your monthly payment comes down to around £100 per month. The finance company would consider the risk here to be very small, so youre likely to get the finance, even if your credit score could use a little work.

With those two examples, you can see how someone with an excellent credit rating can be refused finance and someone with a less than average credit rating can potentially get finance fairly easily.

Read Also: How Does Pmi Work On Fha Loan