Sign A Purchase Contract

Your agents job is to help you craft a strong offer and formulate a sound negotiation strategy. This can include sellers paying for some or all of the VA closing costs.

Dont forget to ask about contingencies that youll want included in a contract. This can include how long you have to secure financing, the amount of earnest money youll need and the right to have a home inspection.

Though not required by the VA, getting a home inspection is a good idea. Youll be able to get to know your property better and back out if you cant get the seller to agree to make certain repairs before closing.

Is A Va Loan Right For You

A VA loan is an important benefit earned by our military. If you qualify, you can get a great interest rate with no money down, and even past credit problems.

If you feel like youre ready, apply for a VA loan with Rocket Mortgage® today!

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Pay For Moving And Other Expenses

You’ll need some cash for moving, home maintenance, furniture and other expenses that come with homeownership. “A new home purchase is stressful for a buyer, and financial stress will just add to an overwhelming feeling,” Powell says. “Having cash savings will lessen the stress and make the home buying experience easier.”

Also Check: Does Va Loan Work For Manufactured Homes

Sign The Final Paperwork

Youll likely go to the escrow agents office to sign all the final paperwork. Review all the documents carefully. Compare your most recent loan estimate with the closing disclosure. , according to the CFPB.)

If there are discrepancies between your closing disclosure and your last loan estimate, your lender must justify them. While some costs can increase at closing, others legally cant. Call your lender immediately if something doesnt look right.

If you need to pay any closing costs, youll pay those at this time too. Bring a cashiers check or other certified funds to the escrow office when you sign your documents your escrow company provides the total amount needed.

Who Is Liable After A Va Loan Is Assumed

If a veteran home buyer wants to purchase your house and assume a VA loan, it is possible to swap your entitlements. Basically, the veteran homebuyer will use their VA entitlement and in so doing, your VA entitlement will be restored. When this happens, the VA who will assume your mortgage will be liable in the event of a default.

On the other hand, if a civilian wants to purchase your home and assume a VA loan, they dont have a VA entitlement to substitute for yours. This means, your entitlement will remain tied up to the original mortgage. If the non-veteran home buyer who assumed the VA loan defaults on the loan, you can still be held liable. Aside from that, the civilian who assumed your house and mortgage may sell the property to someone else, and you will still be held liable for any losses related to the mortgage.

The buyer must sign a release of liability so the seller will no longer responsible for the mortgage once its been assumed.

Read Also: Becu Autosmart

Is A Va Loan Worth It

If you stack up a VA loan against a conventional mortgage, youll see that despite the benefits, when it comes to the cold hard cash, youre best going with a conventional loan!

Youd have a better interest rate at around 3.6%, and you would also have no PMI.8 And youd really see the savings when you looked at the interest paid over the life of the loan.

So, what if you decided to save up a 20% down payment on a $200,000 home and went with a 15-year fixed-rate conventional mortgage instead?

Lets compare the numbers. Well use a current interest rate on a 15-year VA loan of around the 4% mark.9

| DESCRIPTION |

| $208,156 |

With a 15-year fixed-rate conventional loan, your total interest paid is $48,156thats almost $20,000less than what you would pay in the VA loan example!

When you factor in the loan amount, the funding fee, and the total interest paid, the entire cost of the VA loan is $272,013. So youre paying more over the course of the 15-year term compared to a conventional mortgage. Think of what you could do with all the money youd save!

The bottom line is this: VA loans are usually one of the most expensive ways to buy a home. If you have to take out a loan in order to buy a home, go with a 15-year fixed-rate conventional mortgage with a 20% down payment to avoid paying PMI. Outside of buying your home with cash, its the best way to go.

About the author

Ramsey Solutions

What Are Va Loan Requirements

In order to get this loan when you’re looking to buy a home, military personnel have to meet the VAs specific service requirements.

Generally, youre eligible if you fall into one of these three categories:

- Youre an active duty service member or an honorably discharged veteran who has 90 consecutive days of active service during wartime or 181 days of active service during peacetime.

- You have served more than six years in the National Guard or the Selected Reserve.

- Youre the spouse of a service member who died in the line of duty.3

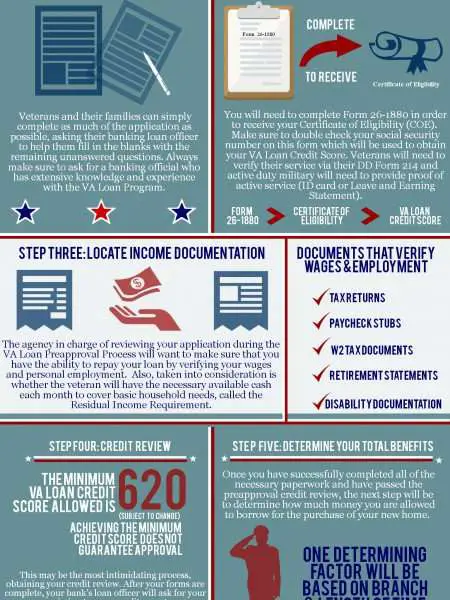

If you were to go through the application process, you would need a Certificate of Eligibility to show mortgage lenders that you qualify for a VA loan.4 You can apply for a COE through the VA website, by mail, or through your lender.

Recommended Reading: How Does Paypal Business Loan Work

What Are The Eligibility Requirements For A Va Loan

There are a few different qualifications for a VA loan, but the main one is you must be a current or former member of the military or a surviving spouse of someone who served. Active duty members can qualify for a VA loan after 90 days. Conditions for former military personnel depend on the years you were on active duty wartime veterans generally have shorter minimum service requirements. If youre unsure whether you qualify, you can refer to the VA home loan eligibility list.

While the VA does not publish official credit score guidelines and leaves these requirements up to each lender, the consensus among experts is that its easier to get approved for VA loans compared to a traditional mortgage. Credit score requirements can vary by lender and other factors, but the minimum score veterans need for a VA loan is often lower than conventional benchmarks, says Birk. VA loans also allow veterans to bounce back faster after derogatory credit events like a bankruptcy or foreclosure.

All things considered, VA home loan eligibility has remained relatively stable as mortgage availability plummeted in 2020 in response to the pandemic. Credit score minimums went up slightly, but they still remained a very flexible option for individuals who might not qualify for conventional loans, says Crooks, Jr. The VA also helped facilitate transactions in several ways, including allowing exterior-only appraisals and waiving termite inspections in moderate to heavy areas.

What Happens When Someone Dies With A Va Loan

What happens to the VA loan if the borrower dies before paying off the debt in full? Assuming a VA loan after death means the surviving spouse will be responsible for the debt. If the borrower is single but has a co-borrower, then they will take over the debt. If the deceased borrower has neither, the borrowers estate will handle the debt. The VA loan could also be assumed by an eligible buyer who could be a veteran, non-veteran, or even the children of the deceased owner of the original loan.

Read Also: Usaa Auto Refinance

How Long Does It Take For Underwriters To Approve A Va Loan

The underwriting process usually takes at least a few weeks. If your loan needs to be manually underwritten, it will typically take a bit longer due to the extra work required.

According to the latest data from ICE Mortgage Technology, it takes about 61 days for a VA loan to close. This includes the underwriting stage, which is typically the longest step in the process.

Meet Your Lenders Underwriting Conditions

Once it has all the required documentation, your lender submits your application to its underwriting department. This is the final step to officially approve your mortgage loan. Its not uncommon for underwriters to request more information called conditions at this stage. Usually, additional documentation is all that is needed.

After the underwriter gives final loan approval, your lender sends your final loan documents to an escrow company.

Also Check: How To Find Your Student Loan Number

Complete The Closing Process

The closing step is where youll sign documents that you understand and agree to the terms of your loan. Before your scheduled loan closing, youll receive a document called a closing disclosure where youll be able to see a breakdown of your final closing costs.

Typical costs may include a funding fee, which varies from 1.25 percent to 3.3 percent of the loan amount. Usually, the higher your down payment, the lower the fee. There are also exceptions such as ones related to disabilities or death.

You can also do a final walkthrough of the property. Once you sign all closing documents, youll receive the keys to your new house.

Buy A Home One Step At A Time

If youre just getting starteIf youre just getting started, then consider the VA loan program. VA loans can save you a lot of money and make your homeownership dreams come true.

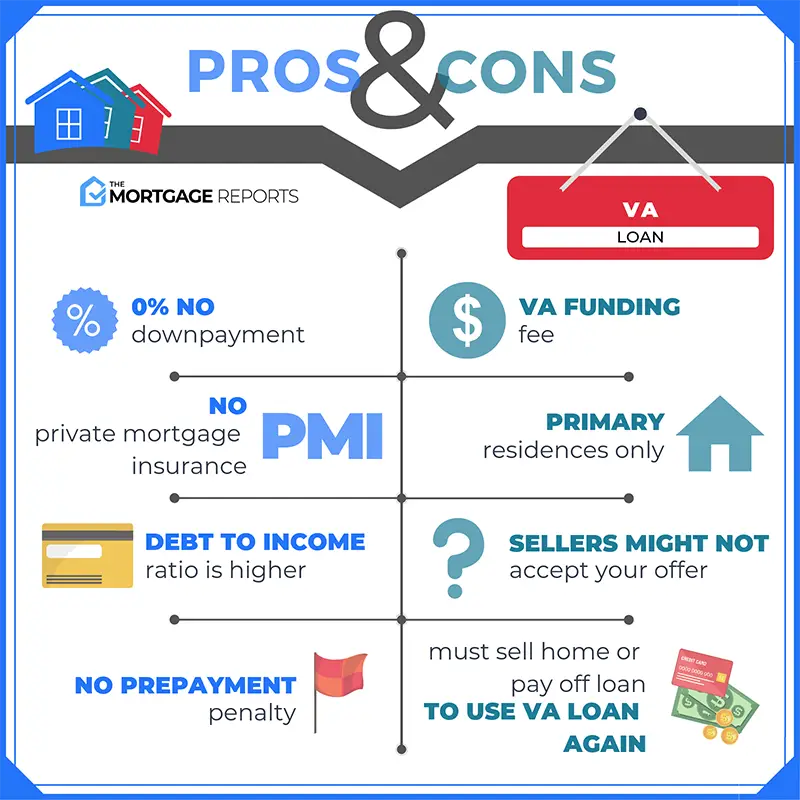

VA loans typically come with lower interest rates than most other mortgages. The ICE Origination Insight Report shows theyre consistently lower than FHA and conventional loan interest rates. VA home loans also require zero money down and no continuing private mortgage insurance.

Please contact our support if you are suspicious of any fraudulent activities or have any questions. If you would like to find more information about your benefits, please visit the Official US Government website for theDepartment of Veteran Affairs or the US Department of Housing and Urban Development.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791

Full Beaker, Inc. is not licensed to make residential mortgage loans in New York State. Mortgage loans are arranged with third-party providers. In New York State it is licensed by the Department of Financial Services.Cookie Settings.Do Not Sell My Personal Information.

You May Like: How Much Do Mortgage Officers Make

Our Top Picks For Best Va Loan Lenders

- Quicken Loans by Rocket Mortgage – Best Online Loan Lender

- USAA – Best for Low Fees

- Veterans First Mortgage – Best for Online Loan Accessibility

- Lending Tree – Best for Comparing VA Loan Rates

- Freedom Mortgage – Best for Streamline Refinancing

- Fixed and adjustable-rate mortgages, FHA loans, USDA loans, jumbo loans, refinance loans, and cash-out loans

- Online pre-qualification and application process

- Education resources for veterans with the collaboration of former senior enlisted military leaders

- Free credit counseling services for homebuyers through Lighthouse program

- Access to over 6,000 real estate agents specialized in VA home purchases through Veterans United Realty

- No home equity loans or HELOCs

Veterans United offers every mortgage loan product available under the VA loan program except home equity loans or HELOCs. We liked the lenders focus on customer experience, with a robust education section on their website, user-friendly online approvals, and 24/7 help over the phone.

Veterans United has slightly higher rates and fees than other lenders on our list, and only offers in-person service in 18 states. However, in the JD Power 2020 Primary Mortgage Origination Satisfaction Survey, this lender would have had a high rating had it been able to qualify.

- No home equity loans and home equity lines of credit

Nonetheless, it has been the highest-ranked lender in the J.D. Power U.S. Primary Mortgage Origination Satisfaction Study for eleven years running.

What Is A Certificate Of Eligibility

A COE is a document that shows your mortgage lender that youre eligible for a VA loan. To get a COE, you need to demonstrate proof of service. The proof you need to submit varies based on whether youre an active-duty military member, a veteran, a surviving spouse, etc.

If youre eligible, Rocket Mortgage® can help you secure your COE.

Also Check: Genisys Loan Calculator

Cover The Earnest Money Deposit

You’ll need some cash for earnest money when making an offer on a house. Earnest money is a deposit that shows the seller you’re serious about buying the property. The money is applied toward the purchase, returned to you at closing, or forfeited if you back out of the deal without a valid reason. The earnest money is usually about 1% to 3% of the loan amount, but can vary widely depending on the market.

What Are The Drawbacks Of A Va Loan

This all sounds great so far, right? But if you dig a little deeper, youll find some serious problems with this type of loan.

The zero down payment leaves you vulnerable. A small shift in the housing market might leave you owing more on your home than its market value! That means you could get stuck with the home until the market recovers or take a financial loss if you have to sell the house in a hurry.

Youre required to pay a VA loan funding fee between 1.25% and 3.3% of the loan amount.7 On a $300,000 loan, that fee can be anywhere from $3,750 to $9,900. And the fee is usually included in the loan, so it increases your monthly payment and adds to the interest you pay over the life of the loan. Plus, you might need to factor in origination fees from the lender. Yikes!

The lower interest rates on VA loans are deceptive. While interest rates for 30-year VA loans are usually equal to or slightly lower than 30-year conventional fixed-rate loans, neither loan is a good option. Both will end up costing you much more in interest over the life of the loan than their 15-year counterparts. Plus, youre more likely to get a lower interest rate on a 15-year fixed-rate conventional loan than on a 15-year VA loan. We can prove it.

A VA loan can only be used to buy or build a primary residence or to refinance an existing loan. So you can forget trying to buy an investment property or vacation home with one.

Read Also: Does Va Loan Work For Manufactured Homes

What Is A Va Loan

A VA loan is a low or zero-down payment mortgage option offered to eligible veterans and active duty service members and their families. VA loans are partially backed by the Department of Veterans Affairs and are issued by private lenders. Capital Bank Home Loans has been a VA lender since 2011, has closed thousands of VA loans and has some of the top ranking VA Mortgage Bankers in the business.

What If I Want To Purchase A Condo With A Va Loan

The Department of Veterans Affairs has a condo database of approved developments. If your dream condo is not on the VAs list, your lender can ask the VA to approve this development. Keep in mind that the VAs process for adding a new condo development to their approved list can take months and is not guaranteed to be approved once the process is over.

Recommended Reading: Is Bayview Loan Servicing Legitimate

Keeping Your Mortgage Documents Safe

The last piece is considering what to do with these documents as you’re collecting them.

Many new homeowners often overlook the importance of keeping important mortgage documents. From the deed to the purchase contract, closing disclosure and home inspection report, keeping your home loan paperwork in a safe place will protect you from unforeseen problems arising after you close on your mortgage such as an IRS audit.

You should keep some mortgage documents indefinitely and store them in safe spots like a fireproof box or in the cloud using password-protected folders. And, you should never send any of your mortgage documents to anyone who wasn’t part of your mortgage qualification process.

Since mortgages require so much paperwork, it is smart to get your documentation house in order. Being a prepared homebuyer can prevent costly delays and get you to closing quicker.

Our LenderVeterans United Home Loans is a VA approved lender Mortgage Research Center, LLC NMLS #1907 . Not affiliated with the Dept. of Veterans Affairs or any government agency. Not available in NV. 1400 Veterans United Dr., Columbia, MO 65203. Equal Housing Lender

What To Expect On Closing Day

Be ready to sign your final paperwork. Your title company will walk you through each section of the closing documentation theyve prepared on your and the sellers behalf. When the documents are in order, you will pay the down payment balance, if any, and your share of the closing costs.

After the closing, the closer will record the deed and mortgage or deed of trust in the local property records. When recorded, the deed will be mailed to you as grantee and the security instrument to the lender. The security instrument remains on record as a lien against the home until your loan is paid off.

The last and more important step to the VA loan process? Get the keys to your new home its time to celebrate!

Recommended Reading: Www Chfainfo Com Homebuyer

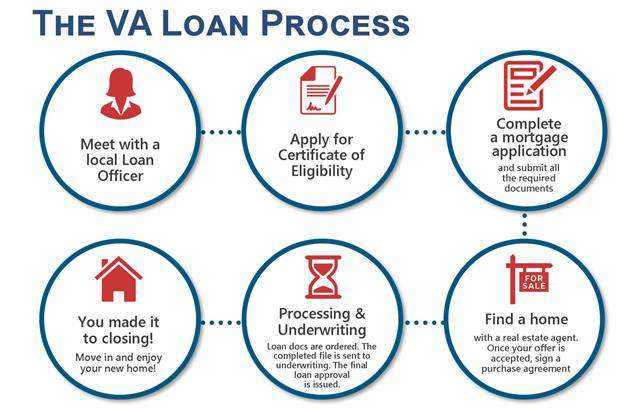

Secure A Certificate Of Eligibility

Youll need this to be eligible for your VA loan. Youll need to provide proof of your military service based on your status.

Rocket Mortgage® can help you verify your eligibility and get your certificate. VA-approved lenders, like Rocket Mortgage®, can help you get your certificate quickly with proof of service.

Tell your lender you need your certificate of eligibility early in the process so they can help you get it.