Loans Under 60 Months Have Lower Interest Rates

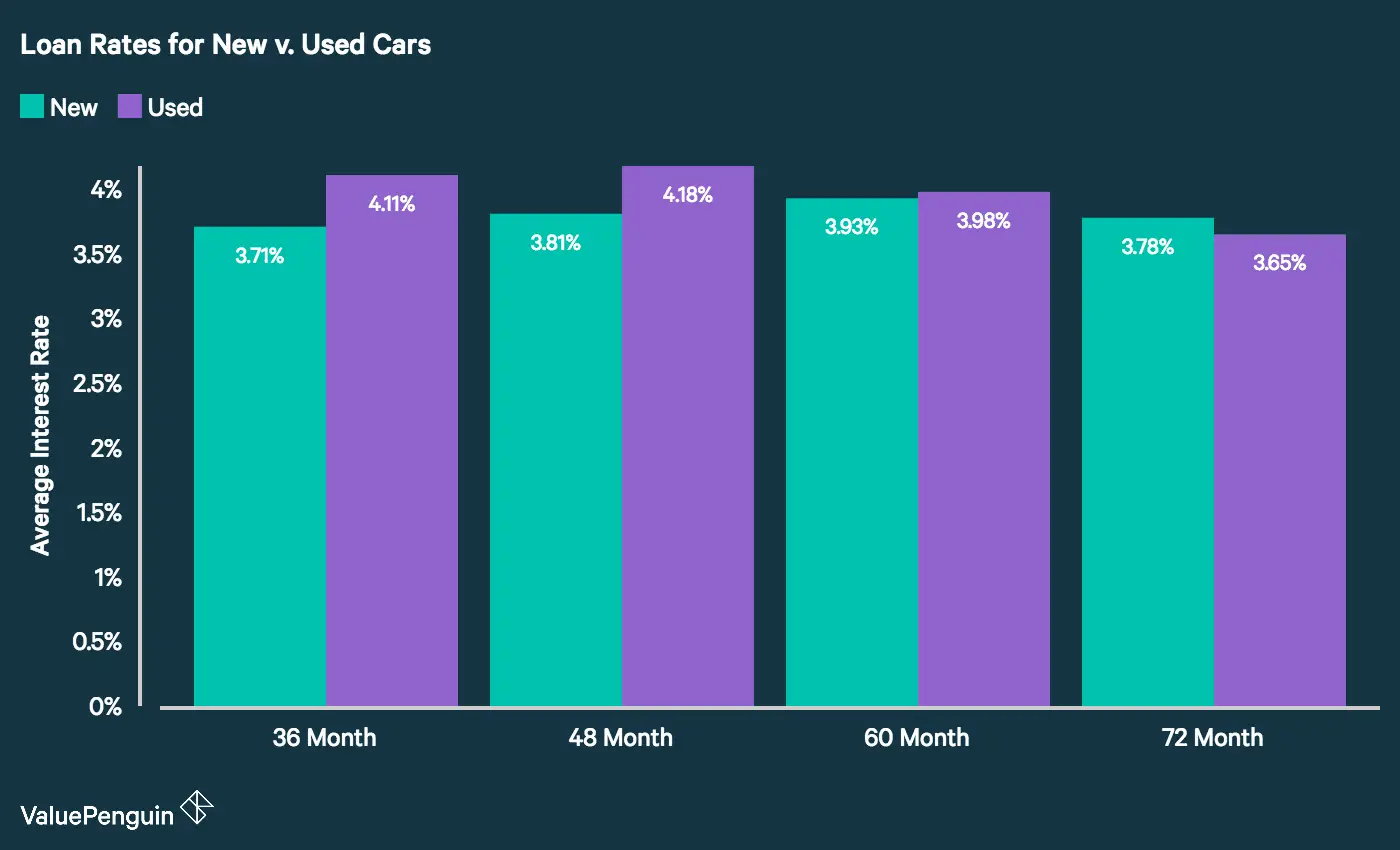

Loan terms can have some effect on your interest rate. In general, the longer you pay, the higher your interest rate is.

After 60 months, your loan is considered higher risk, and there are even bigger spikes in the amount you’ll pay to borrow. The average 72-month auto loan rate is almost 0.3% higher than the typical 36-month loan’s interest rate. That’s because there is a correlation between longer loan terms and nonpayment lenders worry that borrowers with a long loan term ultimately won’t pay them back in full. Over the 60-month mark, interest rates jump with each year added to the loan.

Data from S& P Global for new car purchases with a $25,000 loan shows how much the average interest rate changes:

| Loan term | |

| 72-month new car loan | 3.96% APR |

It’s best to keep your auto loan at 60 months or fewer, not only to save on interest, but also to keep your loan from becoming worth more than your car, also called being underwater. As cars get older, they lose value. It’s not only a risk to you, but also to your lender, and that risk is reflected in your interest rate.

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

Average Car Loan Interest Rate By Credit Score

Though a vehicle might seem to fit within your budget, it helps to know how much interest you’ll owe on an auto loan first.

The five categories of credit ratings have corresponding average APR on auto loans. Each type is defined by a range of values, so knowing which corresponds to you arms you with important information as you go through the application process.

The credit score grades used by lenders, from highest to lowest, are super-prime, prime, on-prime, subprime, and deep-subprime. Respectively, each category covers the spectrum of values from 781â850, 661â780, 601â660, 501â600, and 300â500.

Consequently, the average APR on a used car loan varies from 3.66 percent for a super-prime score to 20.58 percent for a deep-subprime score. The rest fall somewhere in between.

When you’re looking for a quality used vehicle, where can you turn? You may be searching for anything from a Camaro to a Sprinter van, and you need good resources to locate a solid example. Shift makes it easy with their vast selection of vehicles on their easy-to-use website. Want to try before you buy? In certain service areas, a Shift concierge will drive to your door, so you can take a test drive before you sign the papers.

Don’t Miss: Mortgage Originator License California

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

How Do Lenders Come Up With Car Loan Interest Rates

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

You May Like: How Do Loan Originators Get Paid

Bmw Launches The X3 M Suv In India

German automaker BMW has recently launched the BMW X3 M SUV in India. The price tag that the car comes with is Rs.99.90 lakh .

This is the first time that the automaker has brought a high performance M version of the SUV in the country. The company claims that the BWM X3 M comes with the most powerful straight-six engine ever which has been put under the hood of a BMW M series car. The car comes with a host of features and safety fitments such as adaptive LED headlamps, rain sensing wipers, parking assistant, powered tail gate, head-up display, tyre pressure monitor, vehicle immobiliser, ABS with brake assist, EBD, and so on. The engine powering the car is a Twin Power Turbo, 3.0-litre, inline six cylinder engine that churns out 480 hp of max power and 600 Nm of peak torque. It is capable of clocking 0 to 100 kmph in 4.2 seconds and can hit a top speed of 250 kmph.

3 November 2020

Is 19 Apr On A Car Good

While there may be lower interest rates available, 1.9% can be a good deal under some circumstances. In terms of cost, an interest rate of 1.9% APR may not add much to your overall car purchase. On a $30,000 SUV, we estimate that a 5-year loan at 1.9% APR would equate to $1,471 in money spent on interest alone.

Recommended Reading: Should I Get A Fixed Or Variable Student Loan

What Affects Loan Interest Rates

The rates above are average APRs based on information reported to the NCUA. You may find different rates based on a number of factors, including:

- A low score will require a higher interest rate, and vice versa. Credit score is perhaps the single most important factor lenders use to determine rates.

- Loan term: Shorter terms have lower interest rates. Consider making higher monthly payments to get a shorter-term loan with a lower overall cost.

- Lenders look at your entire credit report, so two people with the exact same score can find different rates based on how their score is calculated.

- Income: Lenders can have minimum income requirements for borrowers to qualify and also to secure the best auto loan rates.

- Down payment: A higher down payment not only reduces the total amount of the loan, but it shows that you are committed to purchasing the vehicle, and this can also reduce your interest rate.

- Interview process: If you impress a loan officer with professionalism and supporting documentation in discussing your financial situation, you may have a better chance of getting the best auto loan rates for your situation.

- Negotiation: If you get multiple pre-qualification offers, you can use those when negotiating interest rates from lenders.

- Autopay: Many lenders offer discounts for making automatic payments. Credit unions can also offer a discount if you pay for the loan with an account at that same credit union.

How Do Lenders Decide My Auto Loan Interest Rate

Answered by Jim Manelis is a car enthusiast and Chase Auto Executive.

Buying and financing a vehicle can seem like a daunting transaction, but you can accelerate the process by being prepared with the right information. One of the most common questions people ask is how lenders decide on what their auto loan interest rate will be.

Also Check: Penfed Credit Score Requirement Auto Loan

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

Increase Your Likelihood Of Approval

Knowing your credit score will help you plan a realistic approach toward financing your next vehicle. While you can still get approved for a loan with a lower credit score, you may have a higher interest rate.

If this is the case, or if your credit score is too low for approval, consider signing with a co-applicant. A co-applicant is an individual who enters the loan with you and may maintain part ownership of the vehicle under that loan.

Buying a vehicle is an exciting experience, but it can also be overwhelming with so many variables to consider. Here are some helpful tips to make your buying experience a little easier:

- Think about how you plan to use your vehicle, considering things like interior space, car size, maintenance, and gas mileage.

- Do your research, and test drive all of the cars you’re interested in. Consulting a reference guide for general specifications and fair market values is always a good idea.

Considerations when buying a new vehicle:

Considerations when buying a used vehicle:

Read Also: Usaa Refinance Auto

What Is Hero Financing

Category: Loans 1. Home Energy Renovation Opportunity Loan The Home Energy Renovation Opportunity program is an energy-efficient financing program for homeowners in approved communities. It covers energy- The name HERO stands for Home Energy Renovation Opportunity. The HERO Program is a Property Assessed Clean Energy Program, which

What Is The Average Car Loan Interest Rate In Canada

Home \ Auto \ What is The Average Car Loan Interest Rate in Canada?

Join millions of Canadians who have already trusted Loans Canada

Want To Lower Your Car Payments?

Speak with a Loans Canada representative today and learn how you can refinance your car loan and save. Call us today at:

Note: Program is currently not offered in Quebec.

If youre in the market for a new or used car, its likely that youll need to secure some financing for your purchase. When applying for a loan, youll find that the interest rate is an important factor in determining exactly how much the loan will cost you. The interest rate identifies how much extra money you will be paying back in addition to the principal. Interest rates vary, and to get a competitive rate, you will need to have a strong financial status capital, income, and credit rating. Lets take a look at car loan interest rates in Canada.

You May Like: Usaa Loan Refinance

How Your Credit Score Affects Car Loan Interest Rates

The biggest factor in determining your interest rate is your credit score. However, the credit score used by banks and credit unions for an auto loan can be different from the one you see from a third-party credit score provider. In addition, it can vary per lender, and lenders can score you differently depending on the financial product or service you require.

Typical credit scores usually fall between a range of 300 to 850. The higher the number, the better your credit. You can purchase your FICO scores directly from FICO.

Is 7 Percent Interest Good For A Car

Asked by: Abe Nikolaus

According to Middletown Honda, depending on your credit score, good car loan interest rates can range anywhere from 3 percent to almost 14 percent. However, most three-year car loans for someone with an average to above-average credit score come with a roughly 3 percent to 4.5 percent interest rate.

Read Also: Defaulting On Sba Loan

What Factors Influence Car Loan Rates

There are several things lenders look at when deciding car loan interest rates:

- Your credit score and credit history

- Your income and where it comes from

- Employment history

- Loan term length

- Down payment amount

These factors all have the potential to affect your interest rate. So does The Bank of Canadas interest rate policyif interest rates are rising, you could expect to pay a higher rate for a car loan. Conversely, when rates are lowered, car loan rates may drop as well.

Getting out of debt takes time and dedication. You can learn more about managing your debt problems with our 9 steps.

How Do Lenders Determine Your Auto Loan Rate

Much like insurance companies, lenders determine auto loan rates based on information about you and your vehicle. Here are some of the factors that can affect your car loan rate:

- :By far the biggest influence on your rate is your credit score. People with the highest credit scores get the best auto loan rates.

- Loan term:Generally, the longer your loan term, the higher your interest rate will be.

- Vehicle age:Banks and other lenders often charge higher interest rates on older cars.

- New or used vehicle: Most lenders save their lowest interest rates for new car loans. If you want a used car loan, you might pay a higher interest rate.

- Down payment:Some lenders will adjust interest rates based on what percentage of a vehicles cost you put down when you buy it.

Be sure to compare auto loan quotes from lenders before making a decision. Some lenders may weigh factors such as your credit score differently than others. Do the math and look at the total cost of your loan over its lifetime, and not just the APR.

Recommended Reading: Usaa Student Loan Rates

How Interest Rates Impact Your Car Loan

If your car loan is variable, it will change with theBank of Canada Ratethroughout your term. This means an increase in the overnight rate will increase your loan rate and your monthly payment by the same amount.

Usually, your lender will have a fixed profit margin on top of their prime rate. For example, RBC adds a 2.9% to 11.9% premium on top of their prime rate. The premium you receive is dependent on your creditworthiness. For example, someone with a high credit score, low debt service ratio, and reliable car model would receive a premium closer to 2.9%. Whereas someone who is not creditworthy is seen as riskier, so they must pay a higher premium.

Your variable interest rate will match the prime rate plus your premium. An increase in the prime rate will also increase your payments. A decreasing rate will lower your monthly payments. Your payments won’t change throughout your term if you have a fixed rate.

Profession And Employment History

It is another crucial element that plays an integral role when lenders decide auto interest rates. The best auto refinances companies give extra importance to professional and employment details because it can tell you how stable the borrower is on the financial front. For instance, an auto loan applicant with patchy and bumpy employment history with too many gaps is not a good sign for lenders.

Auto financing companies avoid working with those showing employment inconsistencies. After all, they have to get into a 5-7 year partnership with the borrower and thus need to make sure that they can pay the repayment installments on time. In many cases, they may ask you to furnish pay stubs and other proof of income for finalizing the interest rate.

If they are not satisfied with your employment track record, they might put a higher interest rate on loans to take the edge off the nonpayment risks. Some lenders also give you an option to get your interest lowered by making a hefty down payment.

Besides employment history, some lenders also factor in what type of profession you are in. Whether it is blue-collar or white-collar and how much job security the profession providesââ¬â all these insights also help them devise interest rates that remain good for borrowers and themselves.

Read Also: Does Usaa Refinance Auto Loans

Securing The Best Auto Loan Rates

When you’re ready to buy, you’ll want to shop around before committing to a specific financial institution. Each one has different ways of determining if you’re approved and, if so, the rate of interest. Also, each lender has particular interest rates they set individually, so searching around could get you a better APR.

Although your credit report affects interest rates, it also influences other aspects of an auto loan. If you have excellent credit, you may qualify for a greater amount and be eligible for additional loan options.

As you shop around for the lowest rate, it’s beneficial to speak to lenders who offer pre-approval. This way, before filling out a loan application, you can determine if you qualify for specific rates. Another plus of pre-approval is it doesn’t affect your credit score.

As you look around for the best rates, it all comes down to lenders lowering their risk. You can benefit from an assortment of advantages if you convince a lender you’re a safe candidate, including low rates and repayment options.

Even when you consider APR and interest rate, you should also take into account your monthly payment. No matter the interest rate you secure, extending your loan and lowering your monthly payments have benefits of their own.

With the extra money you save every month, you’ll have available funds for investments or unforeseen expenses. And a lower monthly payment lets you stretch your budget when you’d like to drive away in something more expensive.