Livestock And Poultry By Contract Producers

USDA is providing up to $1 billion for payments to contract producers of eligible livestock and poultry of up to 80 percent of their revenue losses from January 1, 2020, through December 27, 2020. These funds were made available through the Consolidated Appropriations Act, 2021.

Contract producers of broilers, pullets, layers, chicken eggs, turkeys, and hogs and pigs may be eligible for CFAP 2. Ducks, geese, pheasants, and quail produced under contract are also eligible commodities, as well as breeding stock of eligible livestock and eggs of all eligible poultry types raised by contract producers.

Payments for contract producers are based on a comparison of eligible revenue for the periods of January 1, 2019, through December 27, 2019, and January 1, 2020, through December 27, 2020. Contract growers may elect to use eligible revenue from the period of January 1, 2018, through December 27, 2018, instead of that date range in 2019 as a more representative comparison to 2020. This is intended to provide flexibility and make CFAP 2 more equitable for contract producers who had reduced revenue in 2019 compared to a normal year for their operation. The difference in revenue is then multiplied by 80 percent to determine a final payment, as shown in the following equation:

Expected CFAP 2 Payment for Contract Producers = x 0.80)

Payments to contract producers may be factored if total calculated payments exceed the available funding.

How Do I Become An Approved Legal Representative

When you log into RDApply, you will be taken to the Home Page. At the top of the screen will be a button called Legal Representative Request. Selecting it will generate a form where you can send a request to Rural Utilities Services Staff, asking for your eAuth to be linked to a Tax Identification Number.

After you send in your Legal Representative Request, Rural Utilities Services Staff will review it. Once its been approved, you will be able to login to RDApply and create an application.

Do You Know How To Improve Your Profile For College Applications

See how your profile ranks among thousands of other students using CollegeVine. Calculate your chances at your dream schools and learn what areas you need to improve right now it only takes 3 minutes and it’s 100% free.

Its no secret that college is expensive. Thankfully, grants, scholarships, and financial aid packages can help you drastically reduce the cost of college and minimize the number of student loans youll need to repay in the future.

The Free Application for Student Aid, more popularly known as the FAFSA, is one of the most popular methods for obtaining financial assistance for college. The FAFSA is an application that high school seniors can fill out to receive federal financial aid to help pay tuition.

If youre a high school senior, chances are, you have a lot on your plate. College application essays, university tours, schoolwork, and extracurricular activities are likely to keep your schedule extremely busy.

Instead of making your life more complicated with another time-consuming application process, here are some tips to quickly fill out your FAFSA this year!

Read Also: Rv Loan Calculator Usaa

Usda Announces Funding Available To Organizations To Assist Socially Disadvantaged Farmers And Ranchers Under Pandemic Assistance For Producers Initiative

The U.S. Department of Agriculture Farm Service Agency announced the availability of $2 million to establish partnerships with organizations to provide outreach and technical assistance to socially disadvantaged farmers and ranchers. The funding was made possible by USDAs new Pandemic Assistance for Producers initiative, an effort to distribute resources more broadly and to put greater emphasis on outreach to small and socially disadvantaged producers impacted by the pandemic.

FSAs Coronavirus Food Assistance Program 2 signup reopened April 5, 2021, as part of the Pandemic Assistance for Producers initiative. Farmers and ranchers will have at least 60 days to apply or make modifications to existing CFAP 2 applications.

Cooperative Agreements The cooperative agreements will support participation in programs offered by FSA, including those that are part of USDAs Pandemic Assistance for Producers initiative. Interested organizations must submit proposals by May 5, 2021.

Outreach and technical assistance cooperative agreements support projects that:

- Increase access and participation of socially disadvantaged applicants in FSA programs and services.

- Improve technical assistance for socially disadvantaged applicants related to county committees focused on urban agriculture as well as FSA programs, including loan, disaster assistance, conservation and safety-net programs.

Additional CFAP Actions

Why Do I Need To Fill Out The Fafsa

Many students and parents dont fill out the FAFSA because they think federal grants are only available to families earning less than $50,000. The truth? You could qualify for other financial despite your income or your familys income. Why should you fill out a FAFSA? To maximize your chances to receive grants, scholarships and avoid student loan debt, and much more!

To qualify for grants, financial aid, and scholarships, you must fill out a FAFSA form. If you dont meet the requirements for need-based scholarships, the college could award a merit-based scholarship instead.

When some schools have tuition over $65,000, need-based financial aid is even available to students from middle and upper-middle class income brackets.

Once you fill out a FAFSA form, you automatically qualify for low-interest and forgivable federal student loans, which are the best kind of student loans. The FAFSA form is also required to qualify a parent for a federal parent PLUS loan.

How can completing a FAFSA form improve your chances of getting into a particular school? If a student fails to submit a FAFSA form to an institution, they are less likely to enroll. Aside from qualifying for grants, scholarships, and other forms of financial aid, filling out a FAFSA form indicates that you are interested in that institution, making it more likely that the institution will try to entice you to attend by offering financial aid.

Recommended Reading: How To Get Loan Officer License In California

Emergency Loans Available In Montana Disaster Areas

FSAs Emergency Loan Program is available for agricultural producers in counties designated as primary or contiguous natural disaster areas. See map below of current Disaster Designations in Montana. Contact your local FSA office for specific designations in your area and time frames to apply. Eligible producers have eight months from the date of the disaster designation to apply for low-interest emergency loans to 1.) restore or replace essential property 2.) pay all or part of production costs associated with the disaster year 3.) pay essential family living expenses or 4.) refinance certain debts, excluding real estate. Producers interested in applying for an emergency loan, or other FLP loans, should contact their local FSA office to set up an appointment with the Farm Loan Program staff serving your area.

Livestock Forage Disaster Program Triggered In Seven Montana Counties

Livestock producers in Big Horn, Carter, Custer, Roosevelt, Rosebud, Sheridan & Powder River counties eligible for 2020 LFP

Producers in Big Horn, Carter, Custer, Roosevelt, Rosebud, Sheridan & Powder River counties are now eligible to apply for 2020 Livestock Forage Disaster Program benefits on small grain, native pasture, and/or improved pasture.

LFP provides compensation if you suffer grazing losses for covered livestock due to drought on privately owned or leased land or fire on federally managed land.

County committees can only accept LFP applications after notification is received by the National Office of qualifying drought or if a federal agency prohibits producers from grazing normal permitted livestock on federally managed lands due to qualifying fire. At this time, Big Horn, Carter, Custer, Powder River, Rosebud, Roosevelt and Sheridan counties are the only Montana counties that has met the drought criteria for LFP eligibility. You must complete a CCC-853 and submit the required supporting documentation no later than , for 2020 losses.

For additional information about LFP, including eligible livestock, contact their local county office and visit fsa.usda.gov/mt.

Read Also: Defaulting On Sba Loan

Fill Out The Application With Your Student

Your student will need to know if they are a dependent or independent student for purposes of applying for federal student aid. If they are a dependent student, they will have to report parent information, as well as their own information.

For these reasons, its important that you work together in order to avoid any inaccuracies.

To Diversify Or Not To Diversify

Some farmers will focus on one or two crops, and try to expand to fill the niche throughout their region. Basil is at the top of the list for first time farmers, and many growers are finding success replacing out of state basil imports.

Herbs in general are among the most profitable crops, and if you havent explored this niche, we often recommend that you begin looking at grocery store shelves and speaking with restaurants about their herb supply.

In particular, you will want to know if there is competition from local producers, or if all the herbs are trucked in from out of state.

The benefits of this approach are that you are able to focus on a few crops with similar growing requirements, and avoid the confusion of managing multiple crops and multiple customer categories.

The downside is that your volume may be limited while you find your niche and scale up.

Other farmers will explore crop diversification strategies to expand their offerings. They may be looking at root crops like garlic or carrots vine crops like tomatoes or cucumbers, and a full line of leafy greens and herbs.

The benefits are that you may have a larger crop mix to offer each customer, and may be able to reach a higher volume of sales.

The downside is that you will have more moving parts to manage, and the learning curve for each crop can be steep.

The bottom line:

Also Check: Becu Used Car Loan

Information Youll Need To Fill Out The Fafsa:

- Your FSA ID, which you can create on fsaid.ed.gov. Note that students and parents will need to create their own FSA ID and keep it private.

- Your social security number and drivers license, and/or alien registration number if you are not a U.S. citizen.

- Your federal income tax returns, W-2s, and other records of money earned.

- Your parents income tax returns, W-2 forms and 1040 forms if youre a dependent.

- Bank statements and records of investments .

- Records of untaxed income .

- Title IV Institution Codes for each school youre applying to, which you can find from the FAFSA federal school code search.

Learn how to answer each question

How To Fill Out Your Loan Modification Forms For Approval

A loan modification can really help homeowners in financial hardship. What a loan modification does is change the terms of the loan to make your monthly mortgage payments more affordable. In order to get a loan modification approved you must submit a loan modification application. This application includes several forms for you to fill out and return to your lender. It is crucial that you know how to fill out the loan modification forms properly in order to enhance your chances for approval.

Here are the various loan modification forms you will need to fill out.

The Borrowers Statement:This statement includes your basic personal information such as your name, social security number, address, place of employment and other basic information. This form should be easy for you to fill out. Just double check to make sure everything is accurate.

The Hardship Letter:A hardship letter is where you make your case for why you need a loan modification. You will want to write a brief but convincing letter explaining your financial hardship. You also need to show your willingness to correct your financial situation and demonstrate your ability to make lower mortgage payments on time.

Cover Sheet:On the cover sheet submission form you will request new loan terms and a lower mortgage payment amount. If you figure out what you can afford to pay ahead of time you will be in a much better position to negotiate with your lender if necessary.

Read Also: Usaa Credit Score Range

Select The Schools To Receive Your Fafsa Information

Add every school you are considering in the School Selection section. You can add up to 10 schools at a time. You can also remove schools at any time to make room for new schools.

If you dont apply to or get accepted to an institution, they can disregard your FAFSA. Keep in mind that the schools you list will use your FAFSA information to determine the type and amounts of aid available for you.

Some schools suggest that students list schools in a particular order, where you list state schools first. Check if your state has a requirement for the order to list schools on your FAFSA form.

The Fafsa Will Always Be Your First Stop

While its great that 84% of parents have indicated they plan to fill out the FAFSA, ideally that number would be 100%. Its largely considered to be the gateway to all forms of financial aid since many scholarship applications require that you fill out the FAFSA before youre even considered for other offers. The college application process can be fraught with other considerations and complications, but thankfully the FAFSA doesnt have to be one of them. A little advanced prep the best place for students and parents to start to ensure smooth sailing when submission time comes.

Don’t Miss: Can I Refinance My Sofi Personal Loan

Remember Financial Planning Should Happen Before Funding

Want information on starting a commercial farm? It can be tough to find. Thats why were walking aspiring farmers through the planning process in our Feasibility Workshop. In the online workshop, well go through the process of creating your own in-depth feasibility study to help you make the business case for your future farm.

Freaked Out About Funding

So youve decided to start a farm. Youre buzzing with excitement and anxiety about getting started, and maybe youve hit a few hitches in the planning process. Youre worried about getting the funding you need, and the world of financing can be overwhelming.

If this is you, then dont worry! From grants and crowdfunding to bootstrapping and loans, you have multiple options to fund your farm. One of those options is the USDA Microloan, a loan built specifically for unique startup farmers like yourself.

In this post, were going to explore how to apply for the USDA Microloan as an Upstart Farmer, including:

- why a microloan is a good option for small startup farmers

- what the process looks like

- tips on applying

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Determine Your Reason For The Loan

The first step is to figure out why you need the loan. FSA loans are only for specific uses. Does your reason fall under any of the following?

- Purchase farmland

- Purchasefarm equipment or livestock

- Expand an existing farm

- Refinance existing farm debt

Farm loans cannot be used for personal use or to pay for any non-farm related business.

State Executive Director Comments

Spring has arrived, field work is in progress, and we anticipate a successful and bountiful 2021 crop season. Our county office staff is busy creating acreage reporting maps, wrapping up WHIP+ and QLA applications, accepting CFAP 2 applications under the extended signup period, accepting CRP enrollment offers, and processing farm loan applications. The agency is developing policy and regulation as preparations are made for implementation of the American Rescue Plan. I encourage you to read the articles included in the April newsletter to determine if there are other FSA programs that may be of interest and fit your farming operation.

As of April 12th, most Minnesota Service Centers will be allowed to have limited visitors, by appointment only. Appointments will be limited to situations that are deemed critical and where producers cannot be served through phone, email, or other online tools. Staff continues to promote our electronic options for sharing and signing FSA forms. Visitors will be required to complete a COVID screening questionnaire prior to their appointment. Visitors will be required to wear a mask while in the service center and practice social distancing. Currently, service centers are allowed fifty percent of their staff in the office. We continue to focus on the safety of our staff and customers as our number one priority.

Respectfully,

Michelle Page, Acting State Executive Director

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Tips On Filling Out The Fafsa Form

At StudentAid.gov/fillingout, we’ve set out many tips for students as they prepare to apply for aid. Here, we wanted to give you some additional information that might help you as you advise your students.

Meanwhile, you can find out how to host or find a FAFSA completion workshop for your students.

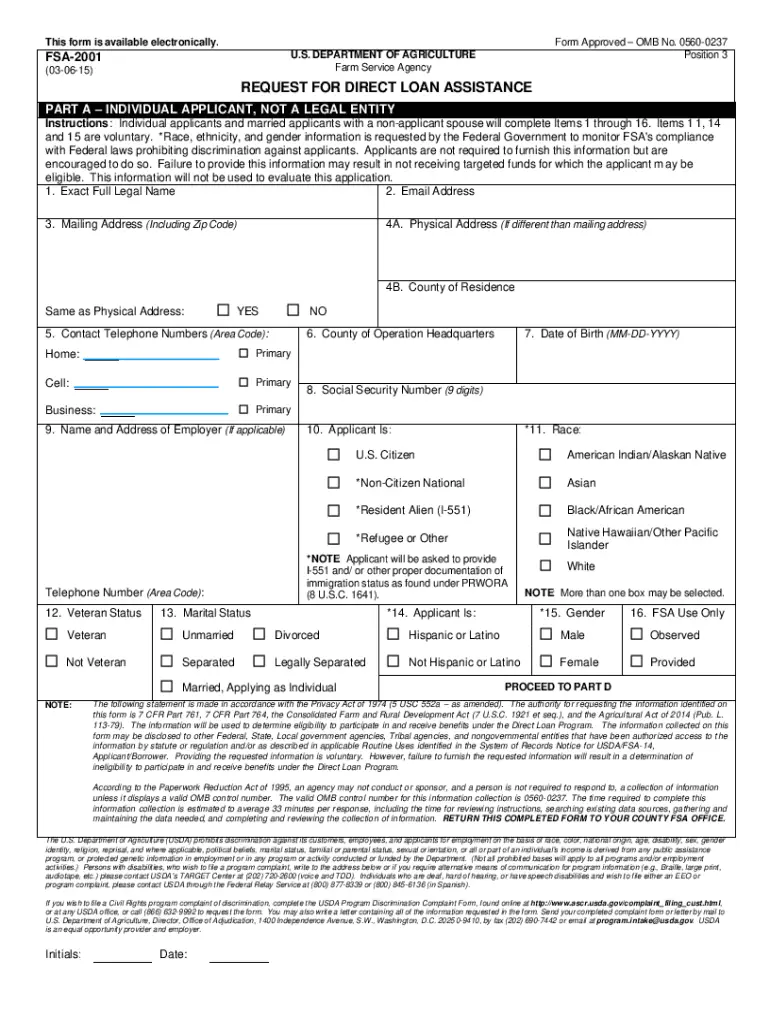

How Do I Qualify For A Usda Farm Loan

The requirements to qualify for a USDA farm loan will depend on which program youâre applying to. However, for the direct loan programs, there are some basic eligibility criteria you will need to meet:

- Farm must be an eligible operation

- No federal or state convictions for planting, cultivating, growing, producing, harvesting, storing, trafficking, or possession of controlled substances

- Have the legal ability to accept responsibility for the loan

- Have acceptable credit history

- Be a U.S. citizen, non-citizen national or legal resident alien

- Have no previous debt forgiveness by the Farm Service Agency

- Must be unable to obtain sufficient credit elsewhere, with or without FSA loan guarantee

- Not delinquent on any federal debt at time of loan closing

- Not be ineligible due to Federal Crop Insurance violations

- Have sufficient farm management experience

- May need to be owner-operator of farm after loan closing

While the Farm Service Agency states that applicants need to have acceptable credit history, your credit score is not a primary factor in the loan decision process. The agency states that loan applicants arenât automatically denied if they have isolated incidents of slow payments, no credit history or recent temporary credit problems beyond their control.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan