The Equity In Your Home

Find out how much you may be able to borrow

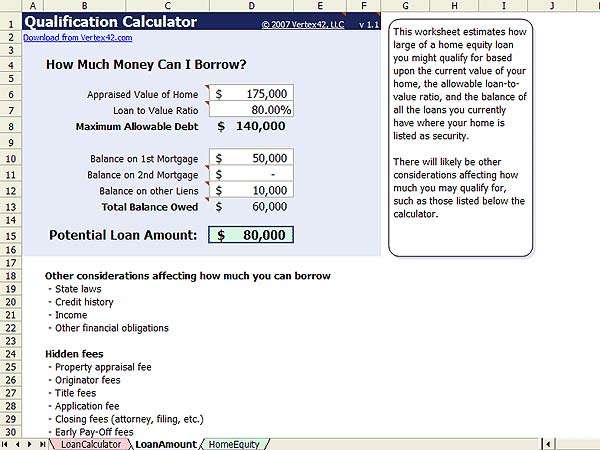

The loan-to-value ratio of your home and the ratio requirements of the lender determine how much equity is available for a home equity line of credit or home equity loan. The loan-to-value ratio is calculated by taking total mortgage debt and dividing it by the current, appraised value of the home. Higher loan-to-value allowances can result in larger home equity loans or lines of credit. Calculate your available equity based on the LTV.

The Heloc Stress Test

Although you could potentially qualify for a credit limit of up to 65% of your home’s value, your real limit may be subject to a stress test similar to themortgage stress test. Banks and other federally regulated lenders will use the higher of either:

- theBank of Canada five-year benchmark rate, currently set to 5.25%, and

- your negotiated interest rate plus 2%.

Helocs Vs Home Equity Loans Vs Cash Out Refinancing

Cash-out Refinance

A cash-out refinance, is really a refinancing of your existing mortgage with an additional lump sum added in, to be spent as you see fit. This can be viewed most simply as one loan replacing another.

Home Equity Loan

A home equity loan, is a lump sum payment as well, but it does not include your mortgage payment â it is in addition to your mortgage, so is sometimes referred to as a second mortgage. The first mortgage has a senior position in the capital structure, but if you default on either loan you could still lose the house.

Home Equity Line of Credit

A HELOC is similar to a home equity loan in terms of working alongside your existing first mortgage, but it acts more like a credit card, with a draw period, and a repayment period and is one of the more popular options with todayâs homeowners.

Read Also: How Much Commission Do Loan Officers Make

How Much Equity Do I Have In My House

Use our mortgage equity calculator to work out how much equity you have in your home. You can then check if you can get a cheaper mortgage, or whether you can release equity from your home.

How to use our mortgage equity calculator:

-

Enter how much your property is worth. If you’re not sure, get a free valuation from Zoopla or an estate agent like Yopa.

-

Enter how much is left on your mortgage balance. You can check your balance by asking your lender, checking your last statement or by signing in to your account on your lender’s website.

-

Enter how much you owe on secured loans, if you have taken any out.

Use our equity release calculator no personal details needed. You can also use the tool as an equity release calculator .

You can also get help working out your mortgage balance and how much your house is worth here.

Understand Your Home Equity Loan Payments

Our home equity loan calculator doesnt calculate monthly payments youll see the monthly payment information on the loan estimates you collect while youre comparing offers.

There are three factors that will affect your monthly home equity loan payments:

Recommended Reading: Does Va Loan Work For Manufactured Homes

How Much Can You Borrow With A Home Equity Loan

A home equity loan generally allows you to borrow around 80% to 85% of your homes value, minus what you owe on your mortgage. You can do some simple math to estimate how much you might be able to borrow.

For example, say your home is worth $350,000, your mortgage balance is $200,000 and your lender will allow you to borrow up to 85% of your homes value. Multiply your home’s value by the percentage you can borrow . That gives you a maximum of $297,500 in value that could be borrowed. Subtract the amount remaining on your mortgage , and you’ll get the approximate sum you can borrow as a home equity loan in this case, $97,500.

Alternately, you can ditch the math and use our home equity loan calculator.

What Is Home Equity And How Do You Calculate It

Home equity is the stake you have in your property, as opposed to the lender’s stake. To calculate your home equity, subtract your current mortgage balance from the appraised value of your home. Over time, you build up equity in your home as you make payments on your mortgage. Home equity is one way to measure your personal wealth, since you can borrow from your home equity in the form of loans or lines of credit.

Youll need a substantial amount of equity in your home to qualify for a home equity loan. A home equity calculator can help you figure out how much you can borrow.

Don’t Miss: Sofi Vs Drb

Tax Benefits Of Homeownership

Before the 2018 tax bill passed homeowners could deduct the interest expenses on up to $100,000 of debt from home equity loans & HELOCs, but interest on these loans is no longer tax deductible unless it is obtained to build or substantially improve the homeowner’s dwelling.

If you are planning on taking a large amount of equity out of your home it may make more sense to refinance your first mortgage, as first mortgages & mortgage refinance loans still qualify for the interest deduction on up to $750,000 of mortgage debt.

Homeowners who had up to $1 million in mortgage debt before the new tax law was passed will still retain the old limit even if they refinance their homes.

How Much Money Could You Save By Refinancing at Today’s Low Rates?

Our home refinance calculator shows how much you can save locking in lower rates.

Should I Use Heloc Or A Credit Card +

Like credit cards, home equity lines of credit are a revolving line of credit. The idea is to take a loan based on the value of your home but to take only small portions of that loan as the need arises, instead of taking one lump sum. HELOC interest rates are never fixed, but they are generally lower than what you tend to get with credit card loans.

Don’t Miss: Usaa Car Loan Apr

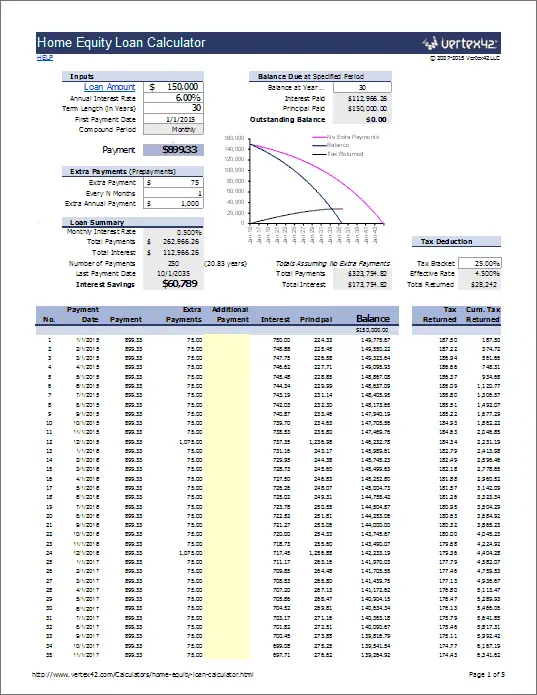

How Home Equity Loan Payments Are Calculated

The calculator on this page tells you how much you may be able to borrow, but it’s not a home equity loan payment calculator that figures monthly payments on a loan.

A home equity loan has equal payments every month. The monthly payments depend on three factors:

-

Loan amount.

-

Loan term. The term is the number of years it will take to pay off the loan. For a given amount and interest rate, a longer term will have lower monthly payments, but will charge more total interest over the life of the loan.

-

Interest rate. Usually, a longer loan term has a higher interest rate.

Heloc & Home Equity Loan Qualification

The three primary things banks look at when assessing qualification for a home equity loan are:

- Available equity in the home: as mentioned above, banks typically allow a max LTV of 70% to 85%

- People with an excellent credit score of above 760 will get the best rates. Those with good credit of 700 to 759 will still be able to access credit, though typically not at the best rate. People with a fair credit score of 621 to 699 will typically be able to obtain credit, though at higher rates. People with poor credit scores may not be able to obtain credit.

- Debt to income ratio: lenders generally like borrowers to spend less than 36% of their pre-tax income on monthly mortgage & debt payments, though some banks may allow borrowers to obtain funding with DTI ratios as high as 43%

Read Also: Usaa Credit Score Range

How Is Heloc Interest Calculated +

The balance of a home equity line of credit payment could change from day to day, depending on the draw length and repayments. Because of this fact, HELOC interests are calculated daily instead of monthly.

For example, a 7% HELOC has its interest for one day as 0.000192, which is obtained by dividing 0.07 with 365 . To get the daily interest for that loan, you multiply 0.0001192 by the loans average daily balance. Assume that the average balance is $150,000, the daily interest becomes $28.77.

Is A Heloc A Good Idea

Our HELOC calculator will tell you whether you might qualify and how much you could be able to borrow through a home equity line of credit. But no calculator can tell you whether tapping into that money is a good idea.

Getting a HELOC can make sense for projects that may increase your homes value, such as major repairs or remodeling. But drawing from home equity is risky for other uses, such as covering vacation expenses, paying off credit card debt or buying a car. No matter the reason, your home is the collateral for the HELOC, so failure to make payments could lead to foreclosure.

You May Like: How Do I Refinance An Auto Loan

How Long Is The Draw Period

The draw period will range in time based on the lender and offer, but typical draw periods are set at ten years. During the draw period you do not have to spend all the credit you are extended, and you only pay on the money you spend.

Draw periods may range from 5 years to 20, but the average tends to fall in the middle. The payments you make during the draw period can revolve and restore your credit. So, if your line is for $40,000 and you use $20,000 and pay back $15,000, youd then have $35,000 left to draw from.

Note that if you choose a draw period with principal + interest payments, your payments are likely to remain steady. Payments typically increase when your draw period payments are interest-only. You can usually also pay extra principal if you have interest-only payments.

It is important to understand how long your draw period will be and what terms will apply to it. If you need money in a shorter time-frame for a known cost, maybe a HELOC is more than you need, and a home equity loan might be a smarter move for a lower overall cost.

If you are looking at needing smaller amounts spread out over time, the HELOC and its draw period can help you to save money by only using what you need, as needed. Making interest-only payments during this time can also free-up cash flow crucial to some situations.

Inactive Account Fees

How To Use Our Home Equity Loan Calculator

Our home equity loan calculator can help you determine how much available equity you might qualify to borrow with a home equity loan or home equity line of credit.

Heres the information youll need to use the calculator:

- Your homes most recent appraised value

- Your outstanding mortgage balance

- Your credit score range

If you need help determining your homes value, reach out to your real estate agent to request a competitive market analysis. Another option is to use LendingTrees home value estimator.

Find out how much you owe on your mortgage by taking a look at your most recent mortgage statement. And if you dont already know your credit score, you can get a free credit score online.

Once youve input this information, the calculator provides the estimated home equity loan amount you might qualify for.

HOME EQUITY LOAN SHOPPING TIP

Once the home equity loan calculator generates a number for you, use it to gather quotes from multiple home equity lenders to find the best deal. Compare the interest rates and costs on each loan estimate you receive, and make sure you gather your quotes on the same day .

Also Check: Va Manufactured Home Requirements

Is It The Best Option

Depending on what you need the money for, and how much you need, a HELOC may or may not be a great option for you. It’s generally a better idea than borrowing with a credit card, as the low HELOC interest rates offered by lenders could easily mean thousands in savings. A possible exception would be if your credit card has a 0% APR introductory period and you anticipate paying off the balance quickly.

However, there are some circumstances where a HELOC may not be the best option. To name one example, if you know you need a large sum of money right away let’s say to finance home renovations — then you might be better off with a traditional home equity loan. On the other hand, if you want the financial flexibility to borrow but don’t have an immediate need for a large amount of money, then a HELOC could indeed be the way to go.

The bottom line is that a HELOC is only one type of borrowing. Before you decide, it’s important to evaluate all of your options and their pros and cons for your personal situation.

How Home Equity Loans And Helocs Differ

Both a home equity loan and a HELOC are ways to cash in on your homes equity, but they work differently.

A home equity loan gives you all the money at once with a fixed interest rate. HELOCs act more like credit cards you can borrow what you need as you need it, up to a certain limit. HELOCs have adjustable or variable interest rates, meaning your monthly payment can change, but you only pay interest on the amount you draw.

You May Like: Usaa Apply For Auto Loan

The Bankrate Guide To Home Equity Loans

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure our content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

When shopping for a home equity loan, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. Loan details presented here are current as of the publication date. Check the lenders websites for more current information. The top lenders listed below are selected based on factors such as APR, loan amounts, fees, credit requirements and broad availability.

What Are The Minimum Requirements

Many lenders have fixed LTV ratio requirements for their home equity loans, meaning you’ll need to have a certain amount of equity in your home to qualify. Lenders will also factor in your credit score and income when determining your rate and eligibility.

Minimum requirements generally include a credit score of 620 or higher, a maximum loan-to-value ratio of 80 percent or 85 percent and a documented source of income.

Also Check: What Do Loan Officers Do

Why Is Home Equity Important

Home equity can be a long-term strategy for building wealth.

Mortgage payments reduce what you owe while your home gains value, so paying on a house has been called a forced savings account.

Home equity can be a long-term strategy for building wealth.

This is unlike virtually every other asset purchased with a loan, such as vehicles, which lose value while you pay them off.

A growing number of U.S. homeowners are amassing impressive stockpiles of home equity wealth, according to Daren Blomquist, senior vice president at Attom Data Solutions.

At the end of the second quarter of 2017, over 14 million U.S. properties were considered equity rich meaning the debt on the property was 50% or less of the homes current market value.

Thats about 24% of all owner-occupied homes with a mortgage.

How Much Do You Owe On Your Home Including Your Mortgage Balance And Any Other Secured Debt

As you pay down your mortgage balance, the amount of your home equity usually increases.

Your mortgage balance is the principal amount you still owe to your lender. It doesn’t include future interest payments. Secured debt is additional debt secured by your home that could include a second mortgage, a line of credit or a loan.

$0$1,700,000

You may qualify for a:

Personal loan or line of credit

$ increase on your mortgage*.

Personal loan or line of credit

$line of credit*.

Personal loan or line of credit

Based on your information, you may be able to access up to $ of your home equity*.

“Gauge chart illustrates your home’s appraised value, estimated equity and balance owing on your mortgage and any other secured debts.”

- Mortgage balance and other secured debt

- Estimated equity you may qualify to borrow

Lump sum

CIBC Home Power® Mortgage

Take advantage of your home equity. Borrow more money by refinancing your mortgage with the CIBC Home Power Mortgage:

- Consolidate expenses into one monthly payment

- Access up to 80% of your homes appraised value1

Take out a personal loan, starting at $3,000:

- Choose fixed or variable interest rates, payment frequency and term

- Pay off all or part of the loan at any time without penalty

- Apply online for faster approval

Ongoing access

CIBC Home Power Plan Line of Credit2

Enjoy convenient and constant access to your money with a CIBC Home Power Plan Line of Credit, secured against your home:

Ongoing access

CIBC Personal Line of Credit

Recommended Reading: Need To Refinance My Car With Bad Credit

What Will Your Home Equity Loan Payment Amount Be

Repayment of a home equity loan requires that the borrower makes a monthly payment to the lender. That monthly payment includes both repayment of the loan principal, plus monthly interest on the outstanding balance. Loan payments are amortized so that the monthly payment remains the same throughout the repayment period, but during that time, the percentage of the amount that goes towards principal will increase as the outstanding mortgage balance decreases. Use this First Merchants home equity loan payment calculator to help you to estimate the monthly payment amount of a home equity loan to the lender.