Historical Auto Loan Rates

Auto loan rates are at historically low levels as a result of an overall low interest rate environment. Over the last decade, the average interest rate on a 48 month auto loan from a commercial bank has fallen by over 40%. This is largely a result of the 2009 financial crisis, after which interest rates were lowered to incentivize consumers to stimulate the economy by spending on items like cars rather than saving.

Loans from auto finance companies have historically carried lower rates than loans from commercial banks. The large car manufacturers have “captive finance” arms that exclusively provide loans for consumers purchasing the parent companys cars this enables automakers to provide lower rates, as the car purchase, rather than the interest, is the manufacturers primary revenue stream.

*The Federal Reserve stopped reporting data on auto finance company interest rates after 2011.

What Is The Difference Between Apr And Interest Rate

The difference between APR vs. interest rate is that APR includes interest plus other loan or credit card fees. As noted above, theres more to a loan than the interest rate. The APR factors in those costs to show you what borrowing will cost you over a year. Thats why youll notice that the APR is usually higher than the interest rate percentage.

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

You May Like: How To Get An Aer Loan

What Is A 0% Apr Financing Deal

0% APR interest car deals mean you wont be charged interest on your car loan. Your monthly payment goes entirely to your principal, potentially saving you thousands of dollars over the life of your loan. Traditional auto financing includes principle and interest payments each month. But, with 0% APR car deals, you wont have to pay the interest portion. This can lower your monthly payment over the same loan term or allow you to afford a nicer vehicle or trim package.

Amortizing Your Prepaid Finance Charges

You pay your prepaid finance charges at the beginning of your loan, hence the term prepaid. Still, you pay back the principal on your loan with your monthly payments, so you can think of your prepaid finance charges as another type of interest charge. Because of how car loan interest works, you pay more interest at the beginning of your loan than near the end as your loan balance decreases, a process known as amortization. So, under APR you pay your prepaid finance charges via amortization as well.

In our example, the $200 of prepaid finance charges are paid down via amortization as the graph below depicts .

The orange portion of the lines depict the portion of the finance charge for each monthly payment that is made up of the prepaid finance charges. As you can see, both the blue interest charges and the orange prepaid finance charges decrease over the course of the loan as you pay down your loan balance. If you add up all the interest charges and prepaid finance charges, you will find that the total finance charge is $2,631, making the total of payments for this loan $17,631 .

Recommended Reading: Genisys Credit Union Auto Loan Calculator

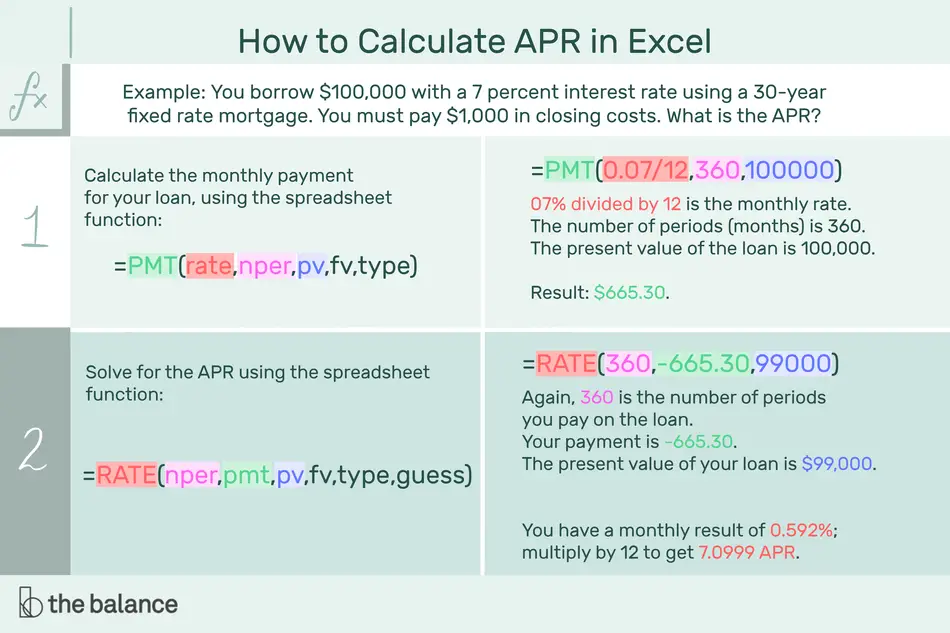

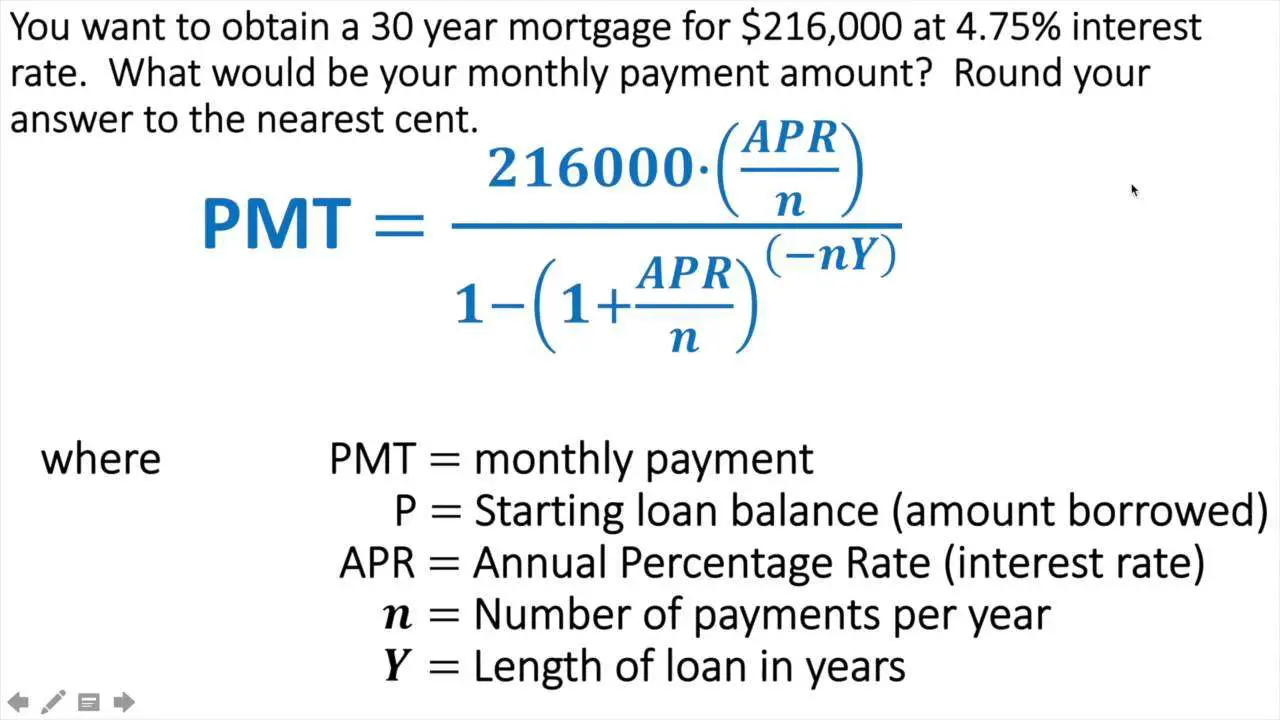

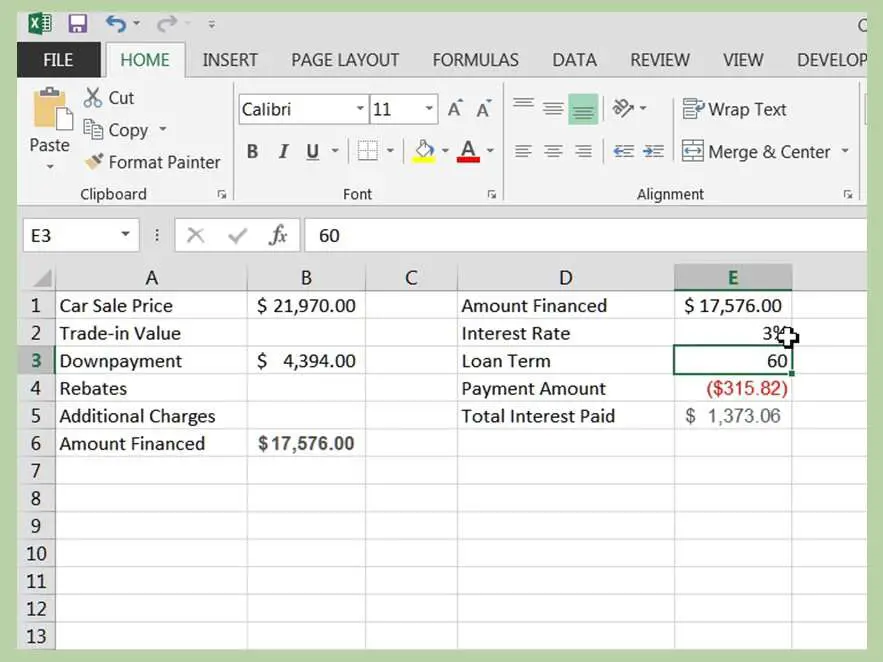

How To Calculate Apr On A Car Loan

Heres how to calculate APR for a car loan in four steps:

For example: To calculate APR on a $16,000 vehicle loan for five years with a $400 per month payment:

What Is The Average Apr Range For A Car Loan

TheAPR for a new car loan for someone with excellent credit can be substantially lower than for someone who has poor credit. Moreover, extra fees from your lender or dealership can increase your APR significantly. If you choose to finance these charges as part of your car loan, theyll cost you even more in the long run. Since rates and fees can vary widely, its essential to understand interest rates and APR.

Also Check: How Long For Sba Loan Approval

What Factors Influence Auto Loan Interest Rates

Your auto loan’s interest rate will be determined by a few factors:

- Your credit score and history. The better your credit score, the less interest you’ll pay. Auto loans are one borrowing situation where it can make a big difference according to Experian data from the fourth quarter of 2020, the average borrower with a credit score below 500 will pay 11.5 percentage points more than a buyer with a credit score above 780.

- Whether you’re buying a new or used car. Thanks to manufacturer incentives and higher resale value, new car purchases are less expensive to finance than used cars. The exact rate depends on credit scores, but used car financing is on average between 1.15 to 6.1 percentage points more expensive than new car financing, according to Experian data.

- Your loan’s length in months. Longer loan terms often have higher interest rates, since they’re considered higher risk.

- The make, model, and year of the car you’re buying. Some cars have better resale values than others, and that will play a part.

- Your down payment. Making a down payment on your vehicle purchase will influence your car’s loan-to-value ratio, calculated by dividing the amount you owe on the loan by the car’s value after depreciation.

How Average Interest Rates Vary For Loans For New And Used Vehicles

The average interest rates on auto loans for used cars are generally higher than for loans on new models. Higher rates for used cars reflect the higher risk of lending money for an older, potentially less reliable vehicle. Many banks wont finance loans for used cars over a certain age, like 8 or 10 years, and loans for the older models that are allowed often carry much higher APRs. One leading bank offers customers with good credit interest rates as low as 2.99% for purchasing a new model, but the minimum interest rate for the same loan on an older model from a private seller rises to 5.99%.

The typical auto loan drawn for a used car is substantially less than for a new model, with consumers borrowing an average of $20,446 for used cars and $32,480 for new. However, terms longer than 48 or 60 months are generally not allowed for older model used cars, as the potential risk for car failure grows with age.

You May Like: How To Transfer Car Loan To Another Person

Need Additional Help Consult With Bmw Of Murrieta

We understand if youre feeling a bit overwhelmed! If you have lingering questions surrounding how to calculate interest rate on a car, the friendly finance team at BMW of Murrieta is here to assist. When you visit our dealership near Ontario, our finance specialists will walk you through the process, step-by-step. You may also find our monthly payment calculator to be of help, and if youd like, we invite you to apply for BMW financing online.

What Is Apr Isn’t That The Same As My Interest Rate

When you buy a car, you hear a lot of percentages being thrown around. The first of these is your interest rate for your new loan. This percentage is usually a bit lower and is simply the cost of borrowing money from the financing institution. This number includes none of the fees that are charged for your loan.

The APR or Annual Percentage Rate, however, is also figured a percentage, but this number will include all the fees for the loan itself. The percentage rate is usually presented as the higher of the two numbers, but it’s necessary to remember that they’re not the same thing at all. All lenders are required to provide you with the APR, so you’re better able to understand what you’ll be paying with each payment.

Read Also: How To Find Your Student Loan Number

A Few Additional Tips About Using The Car Loan Calculator

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the calculator’s total amount paid result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

The car loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

How To Calculate Apr On A Credit Card

Calculating APR on credit card is different than the method for other loan products. Credit card APRs change as the interest rates and prime rate set by the banks change. A bank or credit card issuer isnt legally obligated to notify you, so its important to monitor for changes.

To find a credit cards APR, add the current U.S. bank prime loan rate and the interest rate the credit card issuer charges. For example, the U.S. prime rate is currently 5%. If the card providers interest rate is 4%, the consumer credit card rate will be 9% APR 5% prime rate + 4% card interest rate = 9% APR.

Read Also: How To Get An Aer Loan

What Is A 0% Apr Car Loan

When you take out a car loan, the lender will usually charge you interest in exchange for financing the purchase. The interest rate will vary depending on the term, type of car, loan amount and your credit score. Most lenders also charge fees on top of interest. The APR reflects both the fees and interest assessed on the loan.

A 0% APR deal typically means the lender is not charging interest or fees on the loan.That means all your monthly payments will go toward the loan principal.

The 0% APR loan deals are mostly available for new cars or in rare cases, certified pre-owned cars.

Unfortunately, most lenders do not offer 0% APR. In fact, these discounts are usually found through a car manufacturer, and will be limited to select vehicles.

Dealerships offer 0% APR because theyre making more money off the car purchase. And borrowers may be willing to buy a more expensive vehicle if they can get 0% APR financing.

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Also Check: Does Va Loan Work For Manufactured Homes

What Factors Determine The Total Cost Of A Car

When youre choosing a loan, the length of the loan term and the APR you receive will determine how much you pay in total. So will the down payment you make, and any money you receive for trading in your previous car. Youll also need to pay for state taxes, title fees and potentially dealer-specific fees upon purchase, plus ongoing driving expenses.

Understanding 0% Financing Vs Factory Rebate

Many times dealerships will offer a choice of 0% financing or a factory rebate. How do you know which is better? Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some “buy here, pay here” dealerships specifically focus on subprime borrowers.

Read Also: Bayview Loan Servicing Class Action Lawsuit

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

How Do I Qualify For A 0% Apr

Borrowers need an excellent credit score to qualify for a 0% APR deal, usually 740 or higher. You can check your credit score for free by visiting the sites of the three major credit bureaus or through your bank or . If your score is below 700, you may find it difficult to be approved for a 0% deal.

Dealers also often require a down payment for a 0% APR loan, which can be several thousand dollars or more. If you dont have the down payment in cash, you wont be approved for the loan.

In rare cases, you may be able to find a 0% APR deal with no down payment required. Again, these deals will likely require an excellent credit score and stable income.

Recommended Reading: How To Get Loan Originator License

What Affects An Apr For Car Loans

It’s important to know and understand your credit score before researching car loans. , according to NerdWallet.com, in the lender’s determination of your interest rate, or APR. Simply put, bad credit equals a higher APR and good credit equals a lower APR. Some lenders won’t even offer a loan at all to someone with bad credit. The type of car you are interested in also affects the APR for a car loan. Generally, new cars offer lower APR loans while used cars offer a bit higher.

The basic scale for credit scores is:

- Bad: 300-629

- Good: 690-719

- Excellent: 720-850

People with bad credit scores, typically anything below 630, will likely face difficulty being approved for a loan and high interest rates if they are approved. This is because lenders see these borrowers as risky or more likely to default on their loans than those with better credit. When a borrower defaults on a car loan, the lender repossesses the vehicle and then sells it. However, they may lose money in the sale. Because of this risk, the financing of the loan costs more.

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

You May Like: How To Get Loan Officer License In California

What Is The Average Apr For A Car Loan

When you search “average APR for car loan” you’ll be met with some statistics, but they mean nothing without an understanding of your own financial situation and how car loans work.

When you search “average APR for car loan” you’ll be met with some statistics, but they mean nothing without an understanding of your own financial situation and how car loans work. The average APR for a car loan for a new car for someone with excellent credit is 4.96 percent. The average APR for a car loan for a new car for someone with bad credit is 18.21 percent. So, there’s certainly a wide range of APR for car loans and it’s important to know where you’ll fit before starting the car buying process.