Your Savings And Investments

Now that youve looked at your DTI and any debt you may have, think about your budget. How does a mortgage payment fit in? If you dont have a budget, keep track of your income and expenses for a couple of months. You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools.

In the mortgage process, its important to look at your budget and savings for a couple of reasons. One, you might need savings for a down payment, which well discuss in a later section. However, for now, lets go over something called reserves. These may be required, depending on the type of loan youre getting.

What Factors Affect Va Loan Affordability

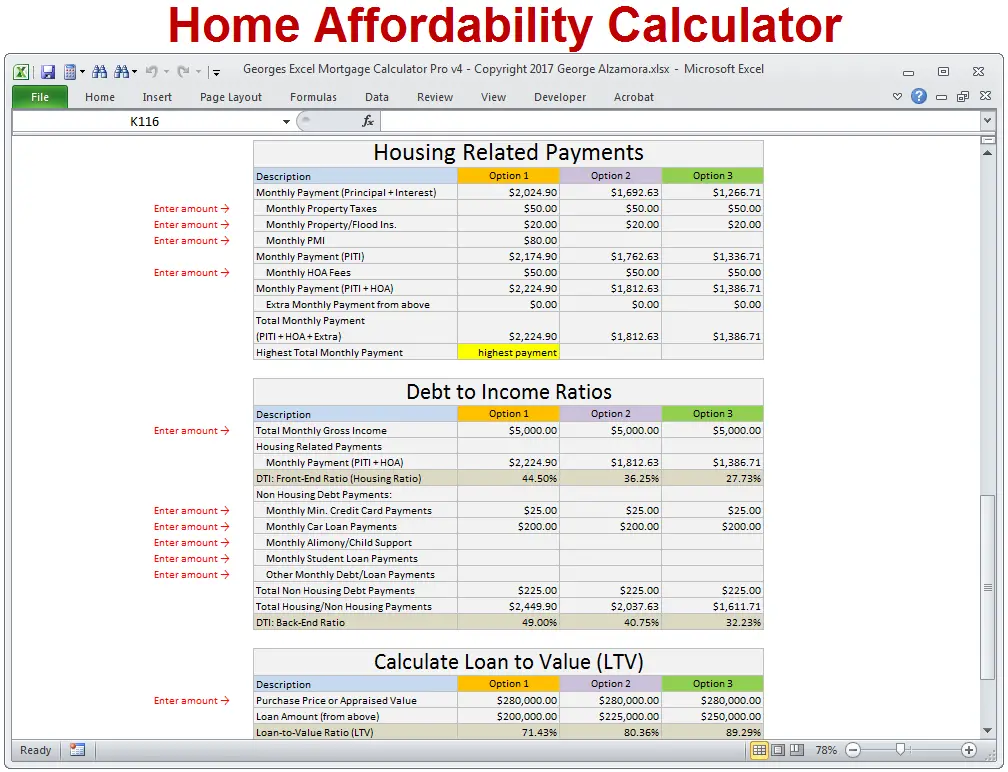

To calculate how much home you can afford with a VA loan, VA lenders will assess your debt-to-income ratio . DTI ratio reflects the relationship between your gross monthly income and major monthly debts. Our calculator uses the information you provide about your income and expenses to assess your DTI ratio.

There isnt a hard cap on DTI ratio for VA loans. Benchmarks can vary by lender and the borrowers specific circumstances. Buyers whose DTI ratio exceeds 41 percent will encounter additional financial scrutiny, but thats by no means a strict cutoff.

During the VA loan process, lenders gather debt information from credit reports, looking for big or recurring payments. Expenses like groceries, gas and other lifestyle needs typically do not factor into VA loan affordability calculations.

Do Va Lenders Require Mortgage Insurance

A big reason VA loans are so affordable is that they dont require mortgage insurance like other mortgage options. This benefit helps veterans and service members stretch their budgets and maximize affordability.

Conventional buyers often need to pay for private mortgage insurance unless they can make a 20 percent down payment.

Recommended Reading: How To Transfer Car Loan To Another Person

Budget For Mortgage Set

Mortgage set-up fees typically include the product arrangement fee and booking fee. To determine the mortgages annual interest calculation, lenders include valuation fees and redemption fees. The valuation fees are often referred to as the overall cost for comparison. When you apply for a mortgage, all your fees must be specified under the key facts illustration. This is a document prepared by the lender to outline the details of your mortgage and what they recommend during the early stages of application.

Take note of the following fees when you apply for a mortgage:

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers;and real estate agents;would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors;found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Read Also: How To Get Car Loan When Self Employed

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a;down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

Why An Auto Loan Calculator Is Important

If youre planning on financing your new vehicle purchase, the overall price of the vehicle isnt really the number you need to pay attention to. The most important number, for you, is the payment. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less youll pay each month, because youre spreading out the loan amount over a greater number of months. However, due to the interest youll be paying on your loan, youll actually end up spending more for your vehicle by the time your payments are over. Why? Because the more time you spend paying off your loan, the more times you will be charged interest.

Speaking of interest, the interest rate is the second most important number to consider when structuring a car loan. The interest rate is the percentage of your purchase that is added to the cost of your vehicle annually. So, if you buy a vehicle with 4.99% financing, then youre paying roughly 5% of your vehicles overall price in added interest every year.

Next, consider how much your vehicle is worth if youre trading it in. If youre trading in a vehicle thats worth $7000 and youre buying a vehicle thats worth $22,000, then you will only have to take an auto loan out for $15,000 .

Don’t Miss: Which Credit Union Is Best For Home Loan

How Much House Can I Afford With A Usda Loan

Low- to moderate-income homebuyers searching for houses in USDA-designated rural areas may qualify for no-down-payment financing. The minimum score is typically 640, and buyers pay an annual and upfront guarantee fee instead of mortgage insurance. Strict income limits may cap how much home you can buy with a USDA loan, even if you meet the standard 41% DTI ratio requirement.

How Much House Can I Afford

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

Read Also: What Kind Of Car Loan Interest Rate Can I Get

Home Affordability And The Covid

The coronavirus pandemic and the resulting economic downturn have shaken up the real estate market. As of June 2021, mortgage rates remain at historic lows, but there is no way to know whether they will fall even lower or start to move back up.

The fact remains that interest rates are lower right now than they have ever been. If you are in a good financial position to purchase a home at the moment meaning you have enough cash for a down payment, a good or great credit score, stable employment, and a low debt-to-income ratio it may make sense for you to take that step now rather than later.

- Categories

A Home Affordability Calculator Doesnt Tell You:

- Whether the lender will approve you for financing at the sales price shown

- What your final mortgage interest rate or closing costs will be

- How much your payment might vary based on your actual credit score

The bottom line: While the home affordability calculator gives you an idea of what you might qualify for, youre better off getting a mortgage preapproval if youre looking for a dollar amount based on your unique financial circumstances.

MORTGAGE CALCULATOR TIP

Our calculator is pre-set to a conservative 28% DTI ratio. You can slide the bar up to an aggressive 50% DTI ratio to see how much more home you can buy. However, be sure your budget can handle the extra debt lenders dont look at expenses like utilities, car insurance, phone bills, home maintenance or groceries when they qualify you for a home loan. Lenders may also require a higher credit score, or extra mortgage reserves to cover a few months worth of mortgage payments, if the high payment becomes unaffordable.

Read Also: How Much Business Loan Can I Get

How Are Joint Applications Treated

For joint applicants the limit is typically slightly lower with them either offering a full multiple on the first income and then adding in the second income, or lowering the multiplier across all incomes down to 3. Examples are shown in the table below.

| Income 1 | |

|---|---|

| 3X 1st + 2nd | £110,000 |

The reason why limits are lower for joint incomes is it is more likely someone will either get laid off or want to voluntarily quit to start a family or go back to school.

What Can I Afford Calculator

Includes mortgage default insurance premium of $

A maximum purchase price that is over $1,000,000 will use 20% minimum down payment for illustrative purposes, however a higher percentage may be required by your lender. Speak to your lender for exact amount.

Must be a valid email.

Must be a valid 10-digit phone number.

You May Like: What Is An Fda Loan

Should You Rent Or Buy A Home

Having the ability to buy something does not mean that one necessarily should. Owning a home is both a significant commitment and a serious lifestyle choice. Renting a home is a more flexible arrangement than buying. Here are some factors to consider beyond the above financial ratios.

Do you plan on living in the area for an extended period of time? Real estate transactions are typically large, leveraged, high-friction transactions. Between closing costs, real estate commissions & other related fees, many home buyers may spend about eight or nine percent of the home’s price between buying and selling it. If you live in a place for a significant period of time the home appreciation can more than offset any costs, but if you only live there a couple years before moving again it is likely to cost you as the first few years of a loan’s payments go primarily toward interest.

How secure is your source of income? If your job may require you to move then owning a home may harm your career flexibility. If you are in a field with high employee churn then renting may be a better option.

Will you be adding to your family in the near future? If you buy a house & quickly outgrow it, there’s no guarantee that it will be easy to simulaneously sell your current home and buy a larger one.

Best Usda Mortgage Lenders September 2021 Forbes

6 days ago Comparison shopping often leads to lower interest rates, so be sure to collect as much information as you can. You can use a loan estimate from;

USDA home loan logo This USDA mortgage and closing cost calculator will estimate the loan amount for eligible home buyers, including the USDA funding fee,;

Knowing USDA mortgage rates can help you better understand how much house you can afford with this loan option. Use our simple mortgage calculator with USDA;

The USDA loan calculator 2021 with funding fee has many options that you can Home Insurance how much insurance do you need to pay for the;

Read Also: Can You Refinance Your Car Loan With The Same Company

How Much House Can You Afford

| Monthly Pre-Tax Income | |

|---|---|

| $3,000 | $523,000 |

The table above used $600 as a benchmark for monthly debt payments, based on average $400 car payment and $200 in student loan or credit payments. The mortgage section assumes a 20% down payment on the home value. The payment reflects a 30-year fixed-rate mortgage for a home located in Kansas City, Missouri. Plug your specific numbers into the calculator above to find your results. Since interest rates vary over time, you may see different results.

In practice that means that for every pre-tax dollar you earn each month, you should dedicate no more than 36 cents to paying off your mortgage, student loans, credit card debt and so on. This percentage also known as your debt-to-income ratio, or DTI. You can find yours by dividing your total monthly debt by your monthly pre-tax income.

Assessing Your Mortgage Eligibility

After the 2008 UK financial crisis, lenders began employing strict measures before approving mortgages. By 2014, the Financial Conduct Authority required lenders to perform thorough affordability assessments before granting loans. The evaluation considers your personal and living expenses, as well as the level of monthly payments you can afford. It includes a stress test which simulates how consistently you can pay your mortgage under drastic financial changes. To determine the loan amount, lenders specifically consider your credit score and history, debt-to-income ratio , size of the deposit, and the price of the property you are buying.

Expect lenders to scrutinise your employment records, how long youve held your current job, and your present address. They also check the length and history of your bank accounts, together with other debt obligations you must fulfil. To do this, they review your also known as your credit report, which is used to determine your credit score. This gives insight into your ability to make mortgage payments. Ultimately, your records must prove youre a reliable debtor who always pays on time.

Mortgage Affordability Assessment Factors

To prepare for your mortgage application, be sure to gather the following documents:

If you are self-employed, expect lenders to ask for additional documentation. They require proof of income, such as a statement from your accountant covering 2 to 3 years of your accounts.

| Income |

|---|

| £211,600 | £306,600 |

Also Check: Should I Get An Unsubsidized Student Loan

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage.;Enter an income between;$1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.;

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.;

Selecting your;province;or territory helps us personalize your mortgage results.

Enter your total monthly;payments;towards any car loans, student loans or personal loans.

What Can I Afford

Thank you for taking the time to complete our calculator. Based on the information your entered, your results are illustrated in the table below.

For more information, visit us at www.scotiabank.com/mortgage to locate your nearest branch or Home Financing Advisor.

| You can afford a home with: |

|---|

| A maximum purchase price of: 256,192.54 |

| Based on… |

| A minimum down payment of: 250,075.56 |

| A monthly payment of:1,600.00 |

| A total mortgage amount of: 12,810.00 |

| Includes mortgage default insurance premium of $6,693.02 |

For the purposes of this tool, the default insurance premium figure is based on a premium rate of 4.0% of the mortgage amount, which is the rate applicable to a loan-to-value ratio of 90.01%;;95.00%. However, the insurance rate for your scenario may be higher or lower than this, which would normally result in a higher or lower insurance premium, respectively. Current premium rates may be found at https://www.cmhc-schl.gc.ca/en/co/moloin/moloin_005.cfm.

A maximum purchase price that is over $1,000,000 will use 20% minimum down payment for illustrative purposes, however a higher percentage may be required by your lender. Speak to your lender for exact amount.

You May Like: How Much Does My Loan Cost

Determine Your Fuel And Insurance Costs

Before you set out to buy or lease, find out what your fuel expenses will be and what it will cost to insure the vehicle. Both costs vary considerably based on your location, your driving history and the vehicle you’ve chosen. Even though it takes a little work to come up with these estimates, you shouldn’t overlook them. Knowing these costs can help you choose among multiple vehicles. Some may cost more to fuel up; others might have a higher cost to insure.

The EPA’s Fueleconomy.gov website has a detailed listing of fuel economy figures as well as annual fuel cost estimates for both new and used vehicles.

For insurance quotes, contact your agent or insurance company about the vehicle you’re interested in. You should be able to get an accurate estimate. Or go to the auto insurance website of your choice, and there should be an option to get an online quote. Do insurance and fuel costs add up to 7% or less of your monthly paycheck? Then you’re OK.