Amount Interest Rate And Other Costs

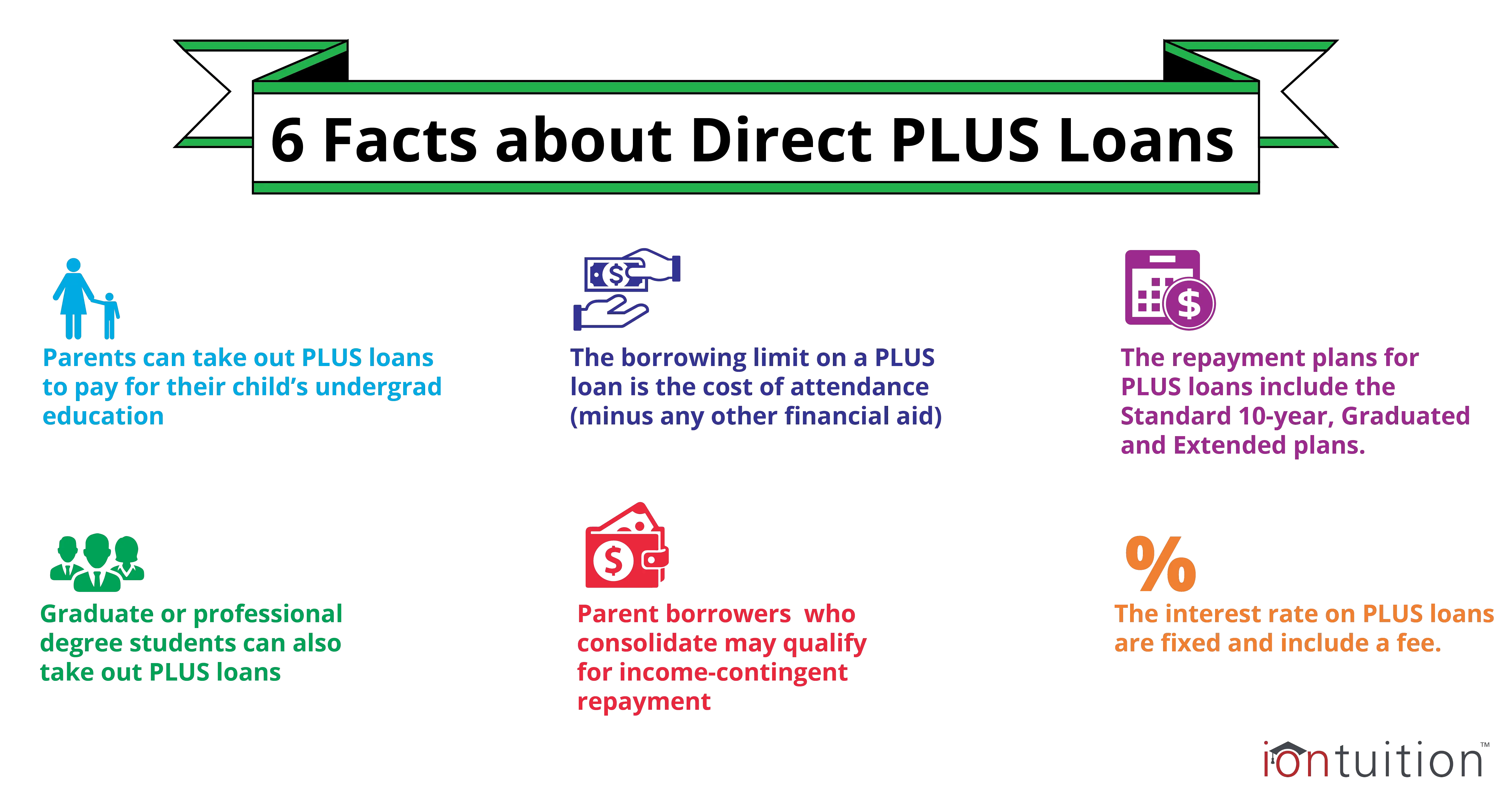

What is the max amount for a Parent PLUS Loan? The max amount for a Parent PLUS Loan is up to the full cost of attendance as determined by the school, but you can borrow anything less than that as well. That gives some room to work within as you determine how much you need.

Keep in mind, for the 2021-2022 academic year, Parent PLUS Loans carry a 6.28% fixed interest rate â nearly double the average interest rate on a typical student loan.

Right now, Parent PLUS Loans also take 4.228% out of each loan disbursement. That percentage changes depending on the date of the first disbursement. Many call this an origination fee, but studentaid.gov refers to this as simply âloan fees.â

What Is Parent Plus Loan Forgiveness

Like other types of student loan forgiveness, parent PLUS loan forgiveness cuts short your repayment obligations. If you meet certain requirements, you can stop repaying your debt and have the remaining balance wiped away.

Parents who take out PLUS loans must qualify for loan forgiveness based on their own circumstances, not those of the child for whom they borrowed loans. For instance, the Public Service Loan Forgiveness program provides loan forgiveness after a certain time to borrowers who work in government and nonprofit jobs. To get parent PLUS loans forgiven under this program, the parentnot the studentmust work in a qualifying job.

Forgiveness for parent PLUS loans also often requires actively confirming your eligibility and submitting an application. In certain instances, though, the government may contact you to explain that youre eligible for a forgiveness program.

Who Is Eligible For A Direct Plus Loan

To receive a Direct PLUS Loan, you must

- be a graduate student enrolled at least half-time at an eligible school in a program leading to a degree or certificate, or be the parent of a dependent undergraduate student enrolled at least half-time at a participating school

- not have an adverse credit history and

- . If you are borrowing on behalf of your child, your child must also meet these requirements.

Recommended Reading: Gustan Cho Mortgage Reviews

Parent Plus Loan Interest Rate

The interest rates on Parent PLUS Loans are fixed and do not change over the life of the loan. The interest rate for the 2020-2021 academic year is 5.30%.

Every year on July 1, interest rates are reset based on current market rates.

The interest on a Parent PLUS Loan starts to add up from the date the loan is first disbursed. If the borrower does not pay the interest as it accrues, it will be capitalized , increasing the size of the loan.

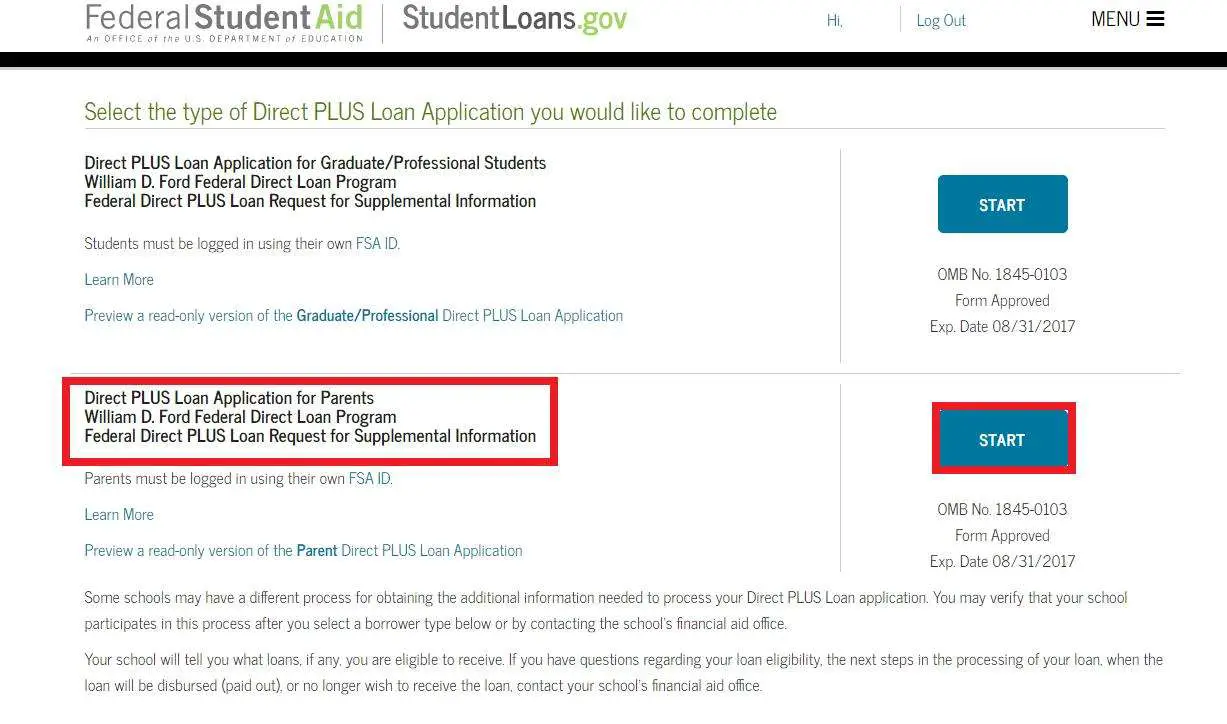

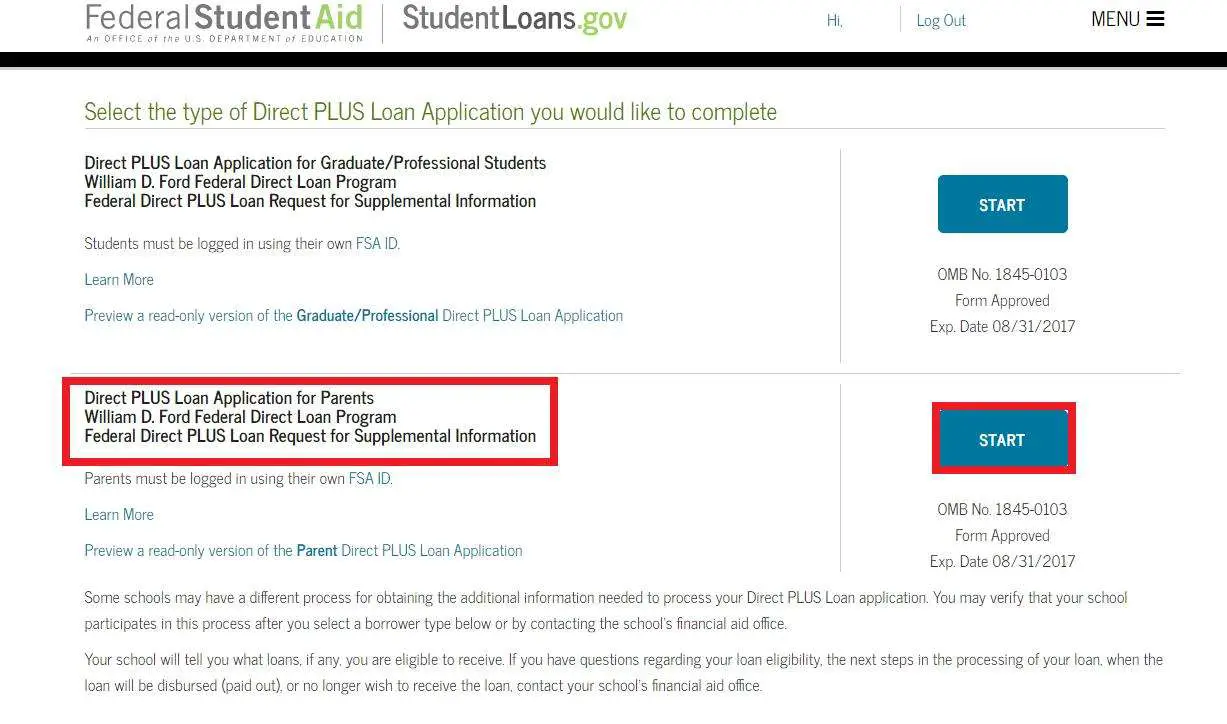

Applying For A Parent Plus Loan

The first step to apply for a Parent PLUS Loan is to complete the FAFSA® form with the student. Then, parents can log in at StudentLoans.gov, choose the Parent Borrowers tab, and the Apply for a PLUS Loan link.

Most schools require you to apply for Direct PLUS Loans online, however, some may have different application processes that you must follow. Studentaid.gov provides a list of schools that allow you to apply online. If your school is not on this list, check with the schools financial aid office to verify the application process you must follow.

Those who qualify for a Parent PLUS loan, will have to sign a Direct PLUS Loan Master Promissory Note . This document verifies that the borrower agrees to the terms of the loan. Each school may have a different process, double check with the financial aid office to ensure you understand the specific process for your students school of choice.

Keep in mind, those borrowing more than one parent PLUS loan for separate children, will need to sign multiple MPNs.

Don’t Miss: Car Loan Amortization Formula

What Happens If You Dont Pay A Parent Plus Loan

A Parent PLUS Loan will enter default after 270 days of nonpayment. At that point, you could be facing wage garnishment, or having Social Security payments or tax refunds withheld to cover the debt.

The best way to avoid those troubles is to steer clear of debt completely. The next best approach is to pay it all off as fast as possible.

Paying Back Federal Plus Loans

Unlike federal loans for students, you must start making payments on your Parent PLUS loans right after they are fully disbursed, with the first payment being due no more than 60 days after disbursement .

If you are having trouble paying back your PLUS loan, there are options to lower your monthly payment amounts. You may also request deferment if you or your child is enrolled in school at least half-time, and up to six months after your child graduates or drops below half-time status. This allows you to forgo making payments on the loan until your child graduates or drops below half-time status. However, you are responsible for paying any interest that accrues during the time your payments are postponed. If you do not pay this interest during deferment, it will be capitalized at the end of your deferment.

If you have questions about PLUS Loans, please contact us! Were here to help.

Also Check: Usaa Auto Loan Rates

What If I Am Denied For A Direct Plus Loan

Dependent undergraduate students, if your parent is unable to secure a PLUS loan, you may be eligible for additional unsubsidized loans to help pay for your education. You would need to provide the PLUS Loan Application and the denial letter from the Department of Education. The additional Unsubsidized Loan your are eligible for would be offered on your Student Center after processing.

How To Apply For A Parent Plus Loan In 6 Easy Steps

Lots of parents get parent PLUS loans to help their college students pay for college. Brookings data showed that at least 3.4 million parent PLUS borrowers owe $87 billion.

The average parent PLUS loan balance is $25,600. Theres been a rise in parent borrowers over time due to:

- Increased tuition

Interesting, huh? Now, heres how to apply for a parent PLUS loan.

Recommended Reading: How Do Lenders Verify Bank Statements

I Cant Pay My Parent Plus Loan What Now

Life happens, and no one plans on not being able to pay their student loans â but it happens. If you can’t pay your Parent PLUS Loan, here are 8 options to consider:

The federal government doesn’t offer a loan program that would allow you to move the liability for a Parent PLUS Loan to a spouse or to the student. However, some private lenders will allow a parent to transfer a Parent PLUS Loan to a child through refinancing.

Parent PLUS Loans are not eligible for IBR, PAYE, or REPAYE forgiveness programs. But they are eligible for ICR.

Parent PLUS Loans can be forgiven if the parent borrower suffers a total disability that renders them unable to repay the loan.

If possible, you should always avoid going into default. Federal student loans can garnish your wages or tax refund to get the repayment theyâre owed.

For weekly student loan tips and tricks, life-changing info, and great resources, . Iâll only send you stuff that you should know as a borrower.

Parent Plus Loan Rates And Terms

Parent PLUS loan interest rates are currently fixed at 7%. They are tied to the rate of the ten-year Treasury note, with a cap of 10.5%.

The PLUS loan is given for one academic year at a time. As a result, parents must qualify for the loan each year. In other words, the credit check at year one does not make parents eligible for four years worth of Parent PLUS Loans. The loan enters repayment once it is fully disbursed, and there are a variety of repayment options available to parents, including deferment.

Read Also: How To Transfer Car Loan To Another Bank

What To Do Before You Take A Plus Loan

Many times, a school will present the student’s financial aid package with a Direct PLUS Loan added in. The school might say that it wants to make families aware of all of their available funding options, but including the Direct PLUS Loan in the package can make the true cost of college confusing. When considering the costs of college, ask for a financial aid package breakdown without the PLUS loan.

Instead of a Direct PLUS Loan, you might have your child opt for a private student loan for any leftover costs that grants, work-study, federal student loans, scholarships, and other aid do not cover. If you want to help your child financially, you can make payments on the private loan while they are still in school. This allows you to subsidize your childs college costs but doesn’t hold you solely accountable for the debt.

You may be able to refinance your PLUS loan to lower your interest rate or spread payments over a longer period.

Is A Parent Plus Loan A Good Option

Absolutely not! Hopefully youve seen for yourself that debt doesnt pay. Instead, you and your child should be pouring all your effort into finding ways to cash flow college with scholarships, grants and your own savings. Want an amazing resource from an expert on making college affordable? Of course you do. Its called Debt-Free Degreeand its packed with tips and solutions to all of your questions about covering college without loans.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

You May Like: When To Refinance Fha Mortgage

Parent Plus Loan Deferment

Repayment on a Parent PLUS Loan normally begins no later than 60 days after the loan is fully disbursed. However, borrowers can defer repayment of a Parent PLUS Loan while the student is in school and during a six-month grace period after the student graduates or drops below half-time enrollment status. Parent PLUS Loans can also be deferred while the parent borrower is enrolled on at least a half-time basis in an eligible program. However, interest continues to accrue during these deferment periods.

How Do I Pay Back My Loan

When you receive your Direct PLUS Loan, you will be contacted by your loan servicer. Your loan servicer will provide regular updates on the status of your Direct PLUS Loan and will provide you with information on how and when to repay your loan. Youll make payments to your loan servicer using one of several repayment plans available to PLUS loan borrowers.

You can learn more about repayment options here.

Read Also: Sss Loan Requirements

Tips For Parent Plus Loans

- Calculate the total cost and consider options that may be needed to cover any remaining cost. Options can include the Tuition Payment Plan, a Parent PLUS loan and Alternative loans. Review your options to determine what is best for your family.

- The Parent PLUS Loan is borrowed only by a parent for their student’s educational expenses.

- A Parent PLUS Loan is not listed on the award offer for the student to accept.

- Parents wishing to borrow the Parent PLUS Loan must be U.S. citizens, and may be the biological, adoptive, or stepparent of the dependent student.

- The Parent PLUS loan borrower does not have to be the same parent used on the FAFSA.

What Does Parent Plus Loan Repayment Look Like

This is the part they dont tell you about on campus visits or in glossy college catalogsyou have to pay back whatever you borrow, and then some! Millions of people every year go to college, forgetting theres a high price to pay since there are no immediate bills coming in.

And while students with private loans can live in that bubble as long as theyre in school, the same doesnt hold for people with Parent PLUS Loans. The repayment schedule begins as soon as the college receives the money. Its as punctual as a credit card bill.

As with any debt, you should pay off a Parent PLUS Loan as fast as you can. And the best way to do that is to put it on a list with all of your other debts, and focus all extra money on the smallest amount firsteven if thats not your PLUS Loan. Everything else gets the monthly minimum until youve eliminated that first debt. Then you roll what youd been paying on that one to the next smallest.

Here are the options for PLUS payback:

If youre already in a Parent PLUS Loan, there is one solid approach we would recommend for some people, and thats refinancing. But its only a good option if your loans are delaying other goals . Refinancing will help you pay off your student loans faster by getting you into a shorter term, with a better fixed-interest rate. That means you can focus on becoming debt-free and attacking your next financial goals.

You May Like: Can I Get A Car With A 600 Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Sign The Master Promissory Note

Before you receive your loan, you will be required to sign the Master Promissory Note. This is a legal document. When you sign it, you agree to all of the loans terms.

Though you will have to apply for a new parent PLUS loan each year, its possible to receive more than one loan under the Master Promissory Note you sign. In some cases, they are good for up to 10 years.

Read Also: How Much Car Payment Can I Afford Based On Salary

Pros And Cons Of Parent Plus Loans

From a students perspective, a Parent PLUS Loan can be a great way to help get their education funded without taking on more debt.

From a schools perspective, this helps students pay for their education costs, so its a win for them. From a fill-the-gap perspective, these loans allow you to apply for whatever amount is needed to pay the school-certified cost of attendance not already covered by other means.

These loans are pretty straightforward to get, because debt-to-income ratios are not a factor, and a parents ability to get one is not limited by income. Credit history is factored in, and an adverse credit history can affect approval .

Adverse credit history in this case can include foreclosures, bankruptcy discharges, repossessions, defaults, wage garnishments, current delinquencies, and more. If you believe your credit circumstances qualify as adverse, you may still be able to be approved for funds, especially if you get an endorser who doesnt have these credit challenges.

Parent PLUS loans also may be eligible for loan forgiveness programs , income-driven repayment plans and other repayment benefits associated with federal student loan programs, including deferment and forbearance options.

Challenges with Parent PLUS loans include the fact that, because there isnt a limit on the amount that can be borrowed as long as it doesnt exceed college attendance costs, it can be easy to take on significant amounts of debt .

Now, back to the idea of transferring the loan.

Apply For The Loan Through The Department Of Education Website

Applications for parent PLUS loans can be completed online at the Department of Educations website. The information you enter will be sent to your childs school, and the school will determine if you qualify for a parent PLUS loan. The application process typically takes about 20 minutes to complete.

Before you begin the online parent PLUS application process, have this information available:

- Your verified FSA ID.

- Your employers information.

Read Also: Usaa Car Loan Application

What Are Federal Parent Plus

Federal Parent PLUS Loans are loans taken out by parents of dependent undergraduate students, enrolled at least half-time, to help pay for their childs college expenses. Parents are responsible for repaying Parent PLUS loans.

PLUS loans are in addition to the loans taken out by your child, and your PLUS loan will cover the entire cost of tuition, room and board, and other school-related expenses that your childs financial aid doesnt cover. These PLUS loans also have a fixed interest rate .

Note: Parents cannot borrow more than the cost of the childs education minus other financial aid receivedyour childs school will determine the actual amount parents can borrow.

Parent Plus Loan Master Promissory

The Master Promissory Note is the official loan agreement that describes the terms and conditions for repaying the loan. The same parent who completes the PLUS Loan Request must sign the MPN before the loan funds can be sent to the school. The MPN is also available on your StudentAid.gov account.

Note that an MPN is good for 10 years, so you may only need to sign this on the first application. However, in subsequent years, each request for a Parent PLUS Loan will start a new credit check.

If two different parents would like to apply for Parent PLUS Loans, each must complete this application process separately. If requesting funds in the same year for the same student, the total combined amount may not be higher than the schools Cost of Attendance.

Guidelines for requesting a Parent PLUS Loan:

- Same parent who will complete and sign the Master Promissory Note should request the loan.

- Parent, not the student, must request the loan.

- A parent must sign into the StudentAid.gov with their FSA ID. If you don’t already have one, you will need to create your own FSA ID.

Also Check: Usaa Auto Lease Calculator