Best Way To Buy A Car

I had not so great credit wasnt getting approved for auto loans below 11% got pre approved and found the car I wanted. Called customer service before I went to the auto place to have everything solid. Went to buy the car, the dealer told me it was sopposed to be $71 more dollars than what capital one had said. I called cap 1 customer service back from the dealership and put them on speaker. Suddenly the dealership changed their mind and was ok with my price and payment. Dealers will always try to get money out of you. They will do it in finance. I ended up getting a loan for 6% thru capital one!

Capital One Quicksilver Student Cash Rewards Credit Card

Best overall for students

- This card is best for: Students who want to earn substantial cash back rewards right away without too much hassle.

- This card is not a great choice for: Students looking to take advantage of even higher cash back rewards in certain spending categories.

- What makes this card unique? The Capital One Quicksilver Student Cash Rewards card has one of the highest flat-rate cash back rewards rates for students. Students can earn unlimited 1.5 percent cash back on all purchases

- Is the Capital One Quicksilver Student Cash Rewards Credit Card worth it? Students who want to earn considerable cash rewards quickly will fare well with the Capital One Quicksilver Student Rewards card. Theres no annual fee or foreign transaction fees, so you dont have to worry too much about onerous charges.

Jump back to offer details.

Questions About Your Billing Statement Or Account

Capital One Auto Finance lists all current APRs and rates on the Current Rates for Auto Loans page. If you need more information on service charges, late payment fees and other fees appearing on your bill, the best contact number is 1-800-946-0332 if you already have an auto loan and 1-800-689-1789 if you are not currently a customer.

Don’t Miss: Parent Plus Loan Interest Deduction

Monoline Credit Card Company

On July 21, 1994, Richmond, Virginia-based Signet Financial Corp announced the corporate spin-off of its credit card division, OakStone Financial, naming Richard Fairbank as CEO. Signet renamed the subsidiary Capital One in October 1994.

At that time, Capital One was a monoline bank, meaning that all of its revenue came from a single product, in this case, credit cards. This strategy is risky in that it can lead to losses during bad times. Capital One attributed its relative success as a monoline to its use of data collection to build demographic profiles, allowing it to target personalized offers of credit directly to consumers.

Capital One began operations in Canada in 1996.

Exit From Mortgage Banking

In November 2017, President of Financial Services Sanjiv Yajnik announced that the mortgage market was too competitive in the low rate environment to make money in the business. The company exited the mortgage origination business on November 7, 2017, laying off 1,100 employees. This was the second closure the first occurred on August 20, 2007, when GreenPoint Mortgage unit was closed. GreenPoint had been acquired December 2006 when Capital One paid $13.2 billion to North Fork Bancorp Inc. The re-emergence into the mortgage industry came in 2011 with the purchase of online bank ING Direct USA.

Read Also: Usaa Vehicle Loan Calculator

Amendment To Terms Of Use To Allow Personal Visits

In 2014, Capital One amended its terms of use to allow it to “contact you in any manner we choose”, including a “personal visit . . . at your home and at your place of employment.” It also asserted its right to “modify or suppress caller ID and similar services and identify ourselves on these services in any manner we choose.” The company stated that it would not actually make personal visits to customers except “As a last resort, . . . if it becomes necessary to repossess sports vehicle”. Capital One also attributed its assertion of a right to “spoof” as necessary because “sometimes the number is ‘displayed differently’ by ‘some local phone exchanges,’ something that is ‘beyond our control'”.

More From Capital One

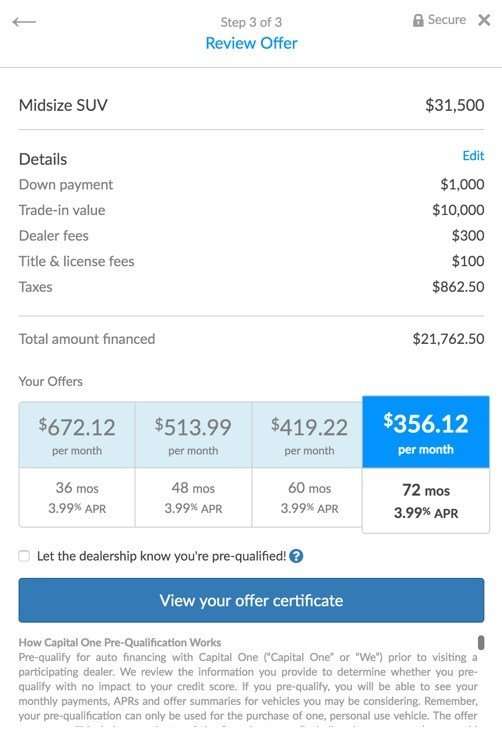

Capital One Auto Navigator works with over 12,000 participating dealerships. After you pre-qualify, youâll see personalized loan rates and can compare payments and save customized terms on the cars you like.

Keep in mind that the vehicle prices listed on participating dealer sites are the âaskingâ price and can probably be negotiated. Before you agree to a sale price, ask the dealer for an âout the doorâ price that lists all dealer fees. These fees are not set or controlled by Capital One. Typically, dealers will charge a documentation fee, sales tax and registration fees.

Capital Oneâs website includes details on its auto financing and refinancing products, a loan calculator and a blog featuring credit score and car-buying information. Capital One also offers a wide variety of , banking accounts and investing products.

Save on Your Car

Also Check: How Much Can I Qualify For A Car Loan

Positive Capital One Auto Loan Reviews

Customers that are happy with their Capital One auto loans mention positive customer service experiences and satisfaction with loan terms. Several customers with poor credit were also grateful to be able to secure loans with Capital One.

I recently was approved and now have a new car. That experience alone was the best I have ever had. My credit was literally beyond bad, and thanks to Capital One, I am on the right track and my credit score keeps going up.

– Susie Moore Young via Trustpilot

Apply At Capital One Auto Navigator

On the online form, you will need to supply:

- Personal information: Name, email, phone number and Social Security number.

- Residential information: Address, duration at current address, whether you rent or own and monthly house expenses.

- Employment information: Employer, length of employment and gross annual income.

You may be asked to upload proof of your residence or employment such as a copy of a utility bill or pay stubs.

Also Check: 600 Credit Score Auto Loan Interest Rate

Capital One Spark Cash Plus

Best for small businesses

- This card is best for: Small business owners looking to earn high cash back rewards without keeping track of spending categories.

- This card is not a great choice for: People who may not have the cash flow in their business to cover the annual fee.

- What makes this card unique? Small business owners can earn unlimited 2 percent cash back on all purchases, making it a bit easier to earn consistent rewards on business expenses. Theres also the opportunity to earn cash bonuses with certain terms and conditions.

- Is the Capital One Spark Cash Plus worth it? For small businesses with the cash flow to handle an $150 annual fee, the Capital One Spark Cash Plus is a great way to earn consistent and high cash back rewards on purchases. If youre looking to earn some of the cash bonuses but youre worried about the spending requirements, there may be other cards on the market that offer a different set of rewards that better fit your needs.

Jump back to offer details.

Is Capital One Trustworthy

Capital One is rated an A by the Better Business Bureau. The BBB, a non-profit organization focused on consumer protection and trust, determines its ratings by evaluating a business’ responses to consumer complaints, honesty in advertising, and clarity about business practices.

Keep in mind that a top-notch BBB score doesn’t ensure you’ll have a good relationship with a company.

Capital One does have one recent controversy. The US Treasury Department fined Capital One $80 million after the Office of the Comptroller of the Currency said the bank’s poor security around its cloud-based services helped to account for a 2019 data breach in which a hacker accessed over 140,000 social security numbers and 80,000 bank account numbers.

Also Check: Should I Get A Fixed Or Variable Student Loan

Things To Consider Before Refinancing

Benefits Of The Capital One Travel Rewards Program

The Capital One travel rewards program offers a decent amount of flexibility when it comes to earning miles. Capital One offers the Venture Rewards and VentureOne Rewards as travel card options. Seeing as they arent co-branded cards, or affiliated with certain hotels or airlines, you wont be limited to one brand. Plus, youll earn a flat rewards rate for every purchase no rotating bonus categories, no problem.

If you are interested in transferring your points, Capital One offers many miles transfer partners, and now most Capital One miles can be transferred to travel partners at a 1 to 1 ratio. Here is a list of some of the airline transfer partners:

- Aeromexico

- Singapore KrisFlyer

Here are a few other perks:

- You can redeem miles for travel, gift cards or as a statement credit for travel booked in the past 90 days on your Capital One card.

- Redemption also includes spending on Airbnb.

Lets break down Capital Ones travel cards, the Venture and the VentureOne using a few examples:

Recommended Reading: Loan Options Is Strongly Recommended For First-time Buyers

How To Pay Your Capital One Auto Loan

Pay capital one car loan with debit card. In addition to income from credit card account interest capital one makes a tidy sum from late fees. By transferring your auto loan s balance to a 0 apr credit card you could save hundreds in interest charges. It s important to note that this method transforms your auto loan from a secured loan into an unsecured loan as revolving credit.

Most lenders won t allow you to use a credit card to pay your loan directly but you know those convenience checks your credit card company sends in the mail encouraging you to transfer a balance you can use one of those in a pinch just be prepared to bite the bullet and pay whatever fee it entails. Set up one time and recurring payments in minutes. Checking or savings accounts.

The capital one mobile app ranked 2 in overall satisfaction in j d. Pros of paying a car loan with a credit card. Well yes technically you can.

The capital one mobile app has a 4 7 5 star customer rating on apple s app store and is in the top 10 in the finance app category as of 5 12 2020. The payment phone number to call at capital one is 1 800 946 0332. Not only that but you get to pay off your car faster too.

Capital one can help you find the right credit cards. And other banking services for you or your business. Power s most recent u s.

Pay capital one auto finance with a credit or debit card online using plastiq a secure online payment service.

Pin On Nigeria Website Design

Business One Credit Card

Capital One Venture X Rewards Credit Card

Best for premium travel benefits

- This card is best for: Anyone who wants a flat-rate travel rewards card that allows you to redeem miles to offset travel purchases and everyday expenses.

- This card is not a great choice for: Those who will not spend enough to receive the sign-up bonus or offset the $395 annual fee.

- What makes this card unique? While the $395 annual fee may feel steep, its actually significantly lower than the annual fee charged by comparable premium travel credit cards on the market namely, the Chase Sapphire Reserve®, which charges a $550 annual fee, and The Platinum Card® from American Express, which charges a $695 annual fee . Plus, theres an anniversary bonus .

- Is the Capital One Venture X Rewards Credit Card worth it? The annual fee might be eye-popping for some at first glance. However, the card itself can provide a ton of value, even for semi-frequent travelers, especially when you consider you can recoup a large chunk of that charge by just using the up to $300 back in annual statement credits for bookings through Capital One Travel.

Jump back to offer details.

Read Also: Usaa Auto Loans Rates

Capital One Auto Navigator

Rather than speculate on whether you could be approved for an auto loan, you could prequalify online with the Capital One Auto Navigator program. You could also apply for a Capital One auto loan at one of its participating 12,000 dealership partners search the directory here.

No matter how you apply, you will need to meet the following criteria:

- Be 18 years or older.

- Have a valid address in 48 states, excluding Alaska and Hawaii.

- Earn a minimum monthly income of $1,500 to $1,800, depending on your credit qualifications.

Exactly Just How Can Easily I Pay My Capital One Auto Lending Bill

Certainly, there certainly are actually several methods towards pay your Capital One auto lending bill:

Register for on the internet financial to earn on the internet or even mobile phone resettlements utilizing your account info. . These could be arranged as single or even repeating resettlements.Contact 1-800-946-0332 as well as create a single payment or even establish a repeating payment strategy over the telephone.Email a cashier%s inspect, cash purchase or even individual inspect, together with the payment discount voucher in your regular month-to-month declaration towards:Capital One Auto Finance, P.O. Package 60511, Urban area of Market, CA 91716.

Exactly just what towards Perform When You Can not Pay Your Capital One Auto Finance BillCapital One Auto Finance is actually a worldwide auto funding business maintenance countless customers in the Unified Conditions, the UK, as well as Canada. Along with a dedication towards the client, Capital One Auto Finance provides a number of choices for customers that can not pay their expenses.

Don’t Miss: Credit Score For Usaa Auto Loan

Choose Your Vehicle Or Dealership

The first step to getting a Capital One auto loan is to browse the Auto Navigator site for vehicles and dealers in your area. If you narrow your choices down to a single vehicle, you can get prequalified right on that page for an auto loan. You can also simply view dealership inventory in your area and find out which dealers work with Capital One.

Capital One Quicksilver Secured Cash Rewards Credit Card

Best secured card for flat-rate rewards

- This card is best for: People with bad, thin or fair credit who cant qualify for non-secured rewards credit cards.

- This card is not a great choice for: People with good-to-excellent credit who can qualify for one of the non-secured versions of this card or another standout rewards credit card on the market.

- What makes this card unique? The combination of a $0 annual fee and 1.5 percent cash back on all purchases is a true rarity as far as secured credit cards go. The card also features other hallmarks of a standout credit card for people with bad, thin or fair credit. Namely, it offers the opportunity for a credit limit increase after six months of demonstrated responsible use and touts a relatively low $200 minimum for refundable security deposits.

- Is the Quicksilver Secured Cash Rewards Credit Card worth it? The consumer-friendly terms alone make the card a good fit for people with bad, thin or fair credit. The rewards program makes it a top pick among people looking to earn cash back who cant yet qualify for an unsecured credit card.

Jump back to offer details.

Recommended Reading: Usaa Mortgage Credit Score Requirements

Capital One Auto Finance: 2021 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Auto loan reviews

-

New auto purchase loan

The bottom line:

Capital One Auto Finance is a good fit if you want to check rates without affecting your credit score and plan to shop within its large dealership network. It also refinances existing loans.

I Cant Make A Payment

When we spoke to the customer service representative at Capital One Auto Finance, they informed us that they provide options for customers who cannot pay their bill. The options available include payment arrangements and changing the due date of your payment.

- Payment arrangements call customer service at 1-800-946-0332 to arrange payment arrangements. Customers must call prior to the established due date.

- Change payment dateCapital One Auto Finance allows customers in financial hardships to change their due date. The payment can be moved up to 15 days past the original due date. Fees and charges may apply.

Also Check: Marcus Goldman Sachs Loan Reviews

Capital One Review Details

Capital One is a well-known lender that works with an established network of car dealerships. You can pre-qualify to refinance with Capital One, which has no effect on your credit score.

Pre-qualification decisions are typically returned within 24 hours your loan offer will show a new rate, term and monthly payment. If you select the offer, youâll submit a complete credit application. At that point, a hard credit inquiry is required and your final terms could change.

Capital One does not offer cash-out refinancing or lease buyouts.

- Not available in every state.

- Only available at participating dealerships.

Best for borrowers who plan to buy from a dealership in Capital One’s network.