How Much House Can I Afford

One of the key metrics lenders look at to determine how much house you can afford is your debt-to-income ratio the percentage of your gross monthly income that goes toward paying your monthly debt payments. A low DTI demonstrates that you have a good balance between debt and income, while a high DTI signals that your debt may be too high for your income.

In general, 43% is the highest DTI you can have and still qualify for a mortgage. Most lenders, however, prefer DTIs that are no higher than 36%, with housing expenses representing no more than 28% of that debt .

Another factor that determines how much house you can afford is the amount of money you have available to make a down payment and cover closing costs. Though a larger down payment might mean a bigger mortgage , make sure youll have money left over to furnish the home and live in it.

Of course, just because a lender approves you for a loan doesnt mean you have to borrow the entire amount. A smaller loan payment provides some wiggle room each month, which might come in handy in an emergency or if something unexpected comes up . A lower payment also makes it easier to save for other goals and work on your retirement nest egg.

Add Up Your Minimum Monthly Payments

The only monthly payments you should include in your DTI calculation are those that are regular, required, and recurring. Remember to use your minimum payments not the account balance or the amount you typically pay.For example, if you have a $10,000 student loan with a minimum monthly payment of $200, you should only include the $200 minimum payment when you calculate your DTI.Here are some examples of debts that are typically included in DTI:

- Your rent or monthly mortgage payment

- Your homeowners insurance premium

- Student loan minimum payment: $125

- $100

- Auto loan minimum payment: $175

In this case, youd add $500, $125, $100 and $175 for a total of $900 in minimum monthly payments.

Why Your Dti Is So Important

First of all, it’s desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors . It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

Don’t Miss: Typical Motorcycle Loan

Is An Fha Mortgage Right For You

An FHA mortgage is a great option for borrowers who may not qualify for a conventional home loan. Here are five important questions to ask yourself before deciding:

If you answered yes to all of these questions, an FHA loan may be a good fit for you. There are many factors you should consider before you apply for any type of loan. One of the best things you can do is talk to an experienced Home Lending Advisor about the options available to you.

Got Student Loan Debt An Fha Loan May Be Your Best Mortgage Option

If youre among the nearly 45 million people in the U.S. who owes some of the more than $1.71 trillion of student loan debt, you may feel that homeownership is out of reach.

But lenders can work with you to review your individual circumstances and possibly qualify you for a mortgage. Loan programs address student loan debt in different ways, so its important to work with a lender who can analyze a variety of financing options and someone who stays up to date on the latest changes to loan requirements.

Loans that are guaranteed by the Federal Housing Administration have always been designed as a vehicle for homeownership for first-time buyers and those who lack cash for a large down payment, who have low-to-moderate incomes and who have credit challenges. In exchange, and to fund the program, borrowers pay mortgage insurance for the life of the loan.

Recently the FHA adjusted its student loan rules about how to calculate monthly student loan payments, which may make it easier for those with education debt to qualify for a mortgage.

Previously, the FHA assumed borrowers with student loan debt were paying one percent of their loan balance every month, Hope Morgan, a Mortgage Network branch manager in Salisbury, Md., wrote in an email. The new FHA policy assumes they are paying 0.5 percent, which more closely reflects what borrowers actually pay each month.

Morgan provided the following example of the potential impact of the new FHA loans:

Also Check: Va Second Tier Entitlement Calculator 2020

If Your Dti Is Between 36% And 50%

A DTI between 36% and 50% is still considered OK for the most part you can likely still qualify for a loan fairly easily with a DTI ratio in this range. If your DTI is closer to 50%, however, it may require taking action to reduce debt if you plan on applying for a mortgage soon and hope to get a favorable rate.

If you can afford to do so, you should practice strategies like the snowball method to attempt to pay down some of your debts before applying. While you may have no issues getting a loan, getting rid of some of your debts might help you achieve a lower interest rate going forward.

Dti Limits For Different Types Of Mortgages

The following chart shows specified DTI limits for different types of mortgages. It includes conventional mortgages and government-backed loans such as FHA loans, VA loans, and USDA loans.

| Loan Type | ||

|---|---|---|

| 41% | 41% | Loans that cater to borrowers in rural markets with incomes below 115% of the local median income. See more details here. |

The soft back-end limits may allow approval using automated underwriting software. Meanwhile, the hard limits usually require manual approval and other compensating factors, such as a high credit score or perhaps a co-signer for mortgage approval. Government-backed mortgages also tend to have lenient DTI limits compared to conventional loans. If you have low income and considerable debts, obtaining a government loan might be a good fit for you.

To increase income and improve DTI ratio, borrowers apply for a mortgage together with their spouse. When the lender evaluates your DTI ratio, it combines your spouses monthly income and debt obligations.

If Your Spouse Has Unsatisfactory Credit

Recommended Reading: How Long Does Sba Take To Approve

When Can Dti Be Higher Than 36%

Some mortgages such as those offered by the FHA, have certain, more stable features that make it more likely youll be able to afford your loan, according to the CFPB. Current FHA loan requirements allow for a total DTI ratio of up to 50% or less.

Both small lenders and large banks may offer loan options at higher DTI percentages. Be sure to compare mortgage loans from several lenders to find the best option for your financial needs.

Max Dti Ratio For Fha Loans

- General guideline is max ratios of 31/43

- Though it can potentially be much higher

- Based on the findings from an automated underwrite

- Potentially as high as 55%

The max DTI for FHA loans depends on both the lender and if its automatically or manually underwritten. Some lenders will allow whatever the AUS allows, though some lenders have overlays that limit the DTI to a certain number, say 55%.

These limits can also be reduced if your credit score is below a certain threshold, such as below 620, a key credit score cutoff.

For manually underwritten loans, the max debt ratios are 31/43. However, for borrowers who qualify under the FHAs Energy Efficient Homes , stretch ratios of 33/45 are used.

These limits can be even higher if the borrower has compensating factors, such as a large down payment, accumulated savings, solid credit history, potential for increased earnings, a minimal housing expense increase , and so on. Yet another reason to build credit and save up money before applying for a mortgage!

To sum it up, if you can prove to the lender that youre a stronger borrower than your high DTI ratio lets on, you might be able to get away with it. Just note that this risk appetite will vary by mortgage lender.

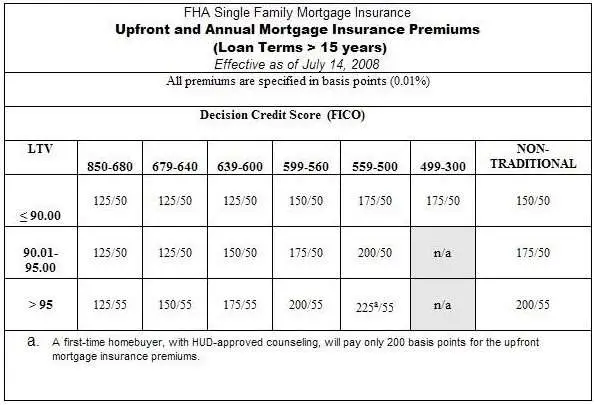

Also note that mortgage insurance premiums are included in these figures.

You May Like: Usaa Auto Loan Refinance Calculator

How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johns income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

Estimating Your Dti Ratio With Your Spouse

Using the above calculator, you can determine your DTI ratios before you apply for a mortgage with your spouse. For example, lets say your gross monthly income is $6,500 while your spouses monthly income is $4,500 after taxes. The following table details your housing expenses and other debt payments, as well as your estimated front-end and back-end DTI ratios.

| DTI Ratio Details | |

|---|---|

| Back-end DTI ratio | 34.17% |

In this example, if you apply for a mortgage with your spouse, your front-end DTI ratio will be 20.53%, and your back-end DTI ratio will be 34.17%. If your lenders DTI limit is 28% for front-end DTI, and 36% for back-end DTI, you have a good chance of qualifying for a mortgage. And since your DTI is low, youre entitled to a more favorable rate.

Getting a Co-signer

Don’t Miss: Usaa Refinance Auto

Figure Out Where You Spend Your Money

Track your spending for a week or two. In addition to making you more mindful of your spending, expense tracking will help you identify all the splurges that accumulate too much outflow.

Identify places where you can cut back , because youll need the extra money to reduce your existing debt payments.

Lender Standards For Debt

Lenders want to know how well you’re making ends meet and how much home you can actually afford. The lower your DTI, the less debt you owe and the more able you are to make monthly loan payments.

Lenders consider both your front-end ratio, which is the percentage of mortgage you pay relative to your income, and your back-end ratio, which measures your total debts, including mortgage expenses, against your income. It can be helpful to know how your spending and savings can impact your future homeowning goals, too.

| Mortgage Industry Term | |

|---|---|

| Total Fixed Payment Expense Debt-to-Income Ratio | .43 |

You May Like: Va Loan For Modular Home

How To Calculate Your Dti Ratio

total monthly debt payments divided by monthly income = debt-to-income ratio

1. Take your annual income and divide it by 12 to get your monthly income.

2. Add up your reoccurring monthly expenses such as:

- Minimum monthly payments on credit cards

- Auto loans

Note: To find your back-end DTI ratio add your monthly mortgage payment

3. Divide your monthly debt obligations by your monthly income to get your DTI ratio

For example: If your yearly income is $60,000 and your total monthly debt payments come to $1,000

$60,000 divided by 12 = $5,000

$1,000 divided by $5,000 = .2

= 20% debt-to-income ratio

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Read Also: Usaa Auto Loan Credit Score Requirements

And Why Is That Of Interest To A Lender

If your concern is that the borrower may not be able to pay the monthly interest and the principal, youll look for those who are more likely to pay back than not.

One good way is to see what an individuals income is.

For example, say someone makes $10,000 a month. If their monthly mortgage payment is $2,000 and thats the only debt they have, their DTI ratio will be 2000/10000 = 20%

On the other hand, if their debt payment is $8,000 with the same income, their DTI ratio will be 80%.

Which one of these is more likely to make their payments? The former, I would guess.

Why? Because someone whose debt payment is low compared to their income, has more cushion to work with. They have more disposable income and savings very likely. Hence, they will be more likely to make the payment. Theyll also possibly have more savings.

On the other hand, someone who spends 80% of their income towards debt payments likely has less in savings because most of their income was being used up to make those debt payments.

Total Debt To Income Ratio Calculation :

Total housing payment, HOA dues, and other debts / calculated income / $5000 income = 40% total ratio

Once calculated, your numbers are run through an automated underwriting system. However, if you arent approved right away, it doesnt mean youre denied a loan. The FHA also allows for manual underwriting, but you still must meet their guidelines.

Have Questions about FHA Loans?

Contact our dedicated team online or via email to get personalized answers to your questions.

Read Also: Usaa Credit Score For Auto Loan

Guide To Understanding Conforming Conventional Loans

Having a place of your own takes a while for most people. We dream of what type of house to buy, all while building enough savings to secure it in time. But apart from gathering ample funds, purchasing a home means understanding different financing options that might work for you.

For first-time homebuyers, this process may really be a struggle, especially if you haven’t sorted out your finances. However, once you’re more informed about your options, you’ll have a better idea of how you can make the most of your housing investment.

To help get you started, we’ll talk about one of the most common mortgage types in the country: conforming conventional home loans.

In this article, we’ll define what conforming conventional mortgages are and how these loans are typically structured. We’ll also discuss how it diverges from jumbo mortgages, as well as other government-sponsored mortgages such as FHA loans, USDA loans, and VA loans. Then, we’ll include requirements you need to know about the application process.

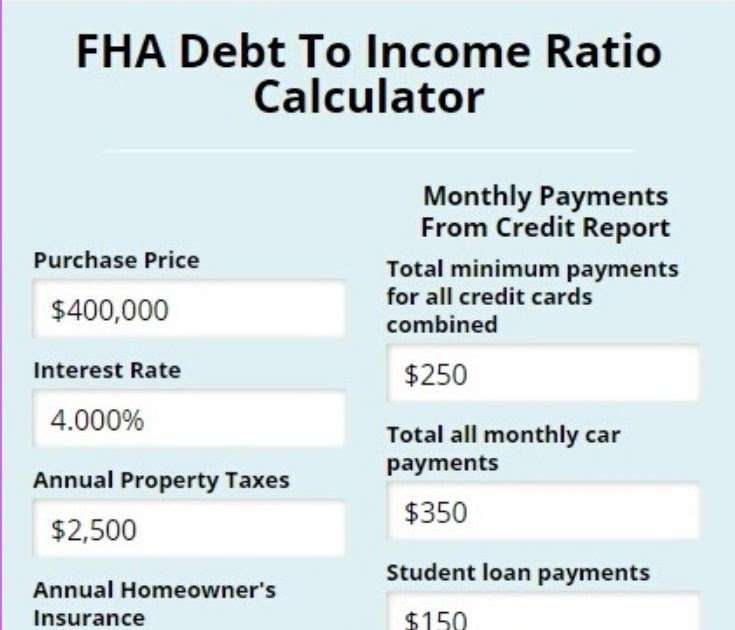

How Do I Calculate My Debt To Income Ratio

Calculating your DTI is simple and not very time consuming. To calculate your debt to income ratio, add up all of your monthly debt payment obligations including your mortgage, car loans, student loans, and minimum monthly payments on credit cards. Do not include expenses such as groceries, utility and gas. Then, calculate how much you earn each month. Finally, divide your monthly debt obligations by your gross monthly income to get your DTI.

For example if you and your spouse earn $6,916 per month, your mortgage payment is $1,350, your car loan is $365, your minimum credit card payment is $250, and your student loans are $300, then your recurring debt is $2,265. Divide the $2,265 by $6,916 and you will find your DTI is 32.75 percent.

- The FHA Loan is For:First time buyers, repeat home buyers, families and qualified permanent residents

- The FHA Program Can Be Used To:Buy HomeRefinance

- $0 Down

- Low Closing Costs

- As low as 5% Down

- Low Closing Costs

Don’t Miss: How To Pay Upstart Loan

This Weeks Question: I Have The Ability To Pay For My Debts And Im Wondering If A Zero Dti Is Good Im Looking At Buying A House Next July

A 0% debt-to-income ratio means that you dont have any debts or expenses, which does not necessarily mean that you are financially ready to apply for a mortgage. In addition to your DTI, lenders will review your credit score to assess the risk of lending you money. The specific requirements vary from lender to lender. But, most lenders look for a 35% or lower DTI and a minimum credit score above 620 to qualify for a conventional loan. On the other hand, FHA loans have more flexible requirements.

How to calculate your DTI

Your DTI determines the percentage of your gross income used to pay for your debts and certain recurring expenses. There are two types of ratios, the front-end and the back-end DTI, which is what lenders focus on the most when applying for a mortgage. To calculate your front-end DTI, add your home-related expenses such as mortgage payments, property taxes, insurance, and homeowners association fees. Then, divide them by your monthly gross income, and multiply it by 100. Most lenders look for a 28% front-end DTI.

Monitor your credit score