How Do You Qualify For An Fha Loan

Because FHA loans are backed by a government agency, they’re usually easier to qualify for than conventional loans. The purpose of FHA loans is to make homeownership possible for people who would otherwise be denied loans.

You don’t need to be a first-time homebuyer to qualify for an FHA loan. Current homeowners and repeat buyers can also qualify.

The requirements necessary to get an FHA loan typically include:

- A credit score that meets the minimum requirement, which varies by lender

- Good payment history

- No history of bankruptcy in the last two years

- No history of foreclosure in the past three years

- A debt-to-income ratio of less than 43%

- The home must be your main place of residence

- Steady income and proof of employment

Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number that ranges from 300 850 and is used to indicate your creditworthiness.

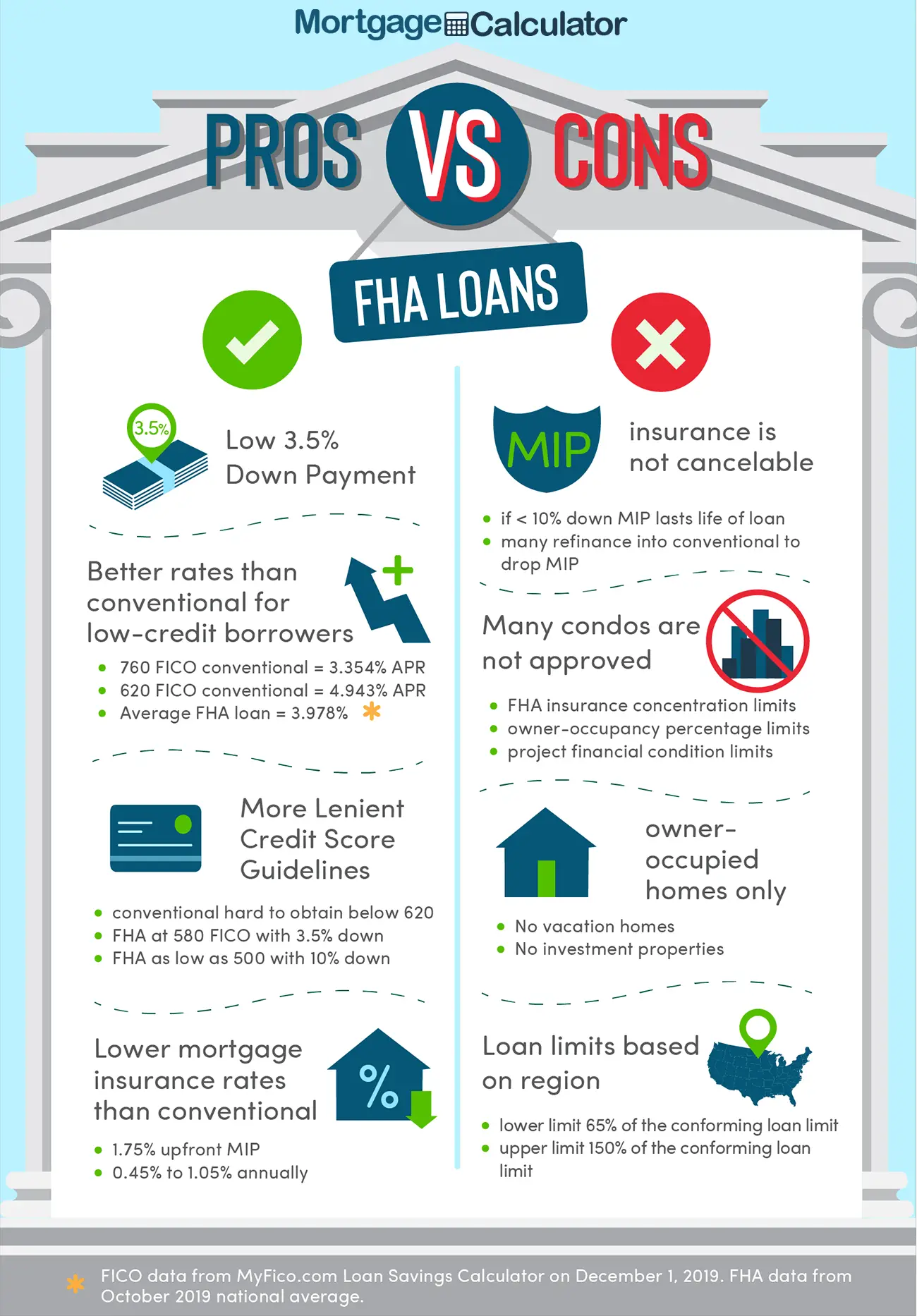

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

Our Fha Loan Approval Process

Assurance Financial understands you may have questions when you decide to buy a home. You may wonder where is there an FHA loan officer near me? or Is an FHA loan or another mortgage the right option for my situation?

Fortunately, Assurance Financial makes it easy to get answers. You can apply online for your mortgage with Abby, your virtual assistant, in just minutes. You can also contact a local loan officer to get more information. Once we look at your credit and application, we can give you a free quote and pre-qualification, so you can understand how much your home may cost. This process also allows you to understand whether you qualify for a home loan.

Once you are ready to apply and decide an FHA loan is right for you, Assurance Financial can walk you through the whole application process. You may need to submit documentation, and you will need to find a property to buy before completing this step. Once we have your application, we take care of processing in house. The processing stage involves underwriting, appraisal and approval.

Finally, we are able to move to funding once you have been approved. You will sign with a notary to close your loan, and we will fund your loan. At this point, you may be able to start getting ready to move in.

At every stage, Assurance Financial works to keep the process smooth and easy to understand. If you ever have questions, your mortgage expert is there to help.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Are Some Fha Loan Alternatives

If youre not sure if an FHA loan is right for you, there are a few other options to consider.

- Conventional loan A conventional loan means your mortgage isnt part of a government program. There are two main types of conventional loans: conforming and non-conforming. A conforming loan follows guidelines set by Fannie Mae and Freddie Mac such as maximum loan amounts. A non-conforming loan can have more variability on eligibility and other factors.

- USDA loan A USDA loan, also called a rural development loan, may be an option for people with low-to-moderate incomes who live in rural areas. They can be attractive because they offer zero down payments, but youll have to pay an upfront fee and mortgage insurance premiums.

- VA loanVA loans are made to eligible borrowers by private lenders but insured by the Department of Veteran Affairs. You may be able to make a low down payment . Youll probably have to pay an upfront fee at closing, but monthly mortgage insurance premiums arent required.

Fha Loan Vs Conventional Loan: Which Is Right For You

FHA loans are commonly compared to conventional home loans to determine which will best fit your situation.

When you meet with your Mortgage Coach at Dash Home Loans, well look at various types of loans available to you. Well help you compare FHA loans to conventional loans as well as others that are applicable in your situation. Our Mortgage Coaches are experienced and will provide in-depth information, but as youre researching loans yourself, here are a few differences to keep in mind:

- The minimum credit score for an FHA loan is 500. For a conventional loan, it is 620.

- Down payments for FHA loans are 3.5%, at least. For conventional loans, it is typically 3% to 20% depending on the lender.

- Loan terms for FHA loans are 15 or 30 years, while conventional loans offer 10, 15, 20, and 30 year loans.

- You have to purchase mortgage insurance with FHA loans, but not with most conventional loans.

- Conventional loans can be more restrictive with what is allowed to be used for gifts for down payment. One hundred percent of your down payment can be a gift with an FHA loan regardless of the down payment percentage. However, there are restrictions here too. If your credit score is below 620 and you get an FHA loan in NC, SC, or another state, you may need to pay at least 3.5% of the down payment yourself.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Fha Loans And Credit Score

There are a lot of factors that determine your , including:

- The type of credit you have

- Whether you pay your bills on time

- The amount you owe on your credit cards

- How much new and recent credit youve taken on

If you have a higher score, you might be able to qualify with a higher debt-to-income ratio, or DTI. DTI refers to the percentage of your monthly gross income that goes toward paying debts. Your DTI is your total monthly debt payments divided by your monthly gross income . This figure is expressed as a percentage.

To determine your own DTI ratio, divide your debts by your monthly gross income. For example, if your debts, which include your student loans and car loan, reach $2,000 per month and your income is $8,000 per month, your DTI is 25%.

The lower your DTI, the better off youll be. If you do happen to have a higher DTI, you could still qualify for an FHA loan if you have a higher credit score.

The FHA states that your monthly mortgage payment should be no more than 31% of your monthly gross income and that your DTI should not exceed 43% of monthly gross income in certain circumstances if your loan is being manually underwritten. As noted above, if you have a higher credit score, you may be able to qualify with a higher DTI.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Manufactured Home Fha Loans

The FHA offers fixed-rate loans for the purchase of manufactured homes. They typically have a term of 20 years, but theres a 15-year term limit for only purchasing a lot, and a 25-year term option for the purchase of a multisection manufactured home and a lot.

Borrowers can be lent up to $92,904 to finance a manufactured home and a lot. You dont need to own a lot for your manufactured home, but you must be able to show that youve secured a location to place it after the purchase.

How To Apply For An Fha Loan In 2021

Wondering how to buy a house with little money down? Taking time to apply for an FHA loan might just be your ticket.

Backed by the Federal Housing Administration , FHA loans make homeownership affordable through a 3.5% down payment requirement and flexible credit guidelines.

To sweeten the deal, FHA loan rates are often lower than youll find on conventional mortgages, thanks to the government backing.

Heres the lowdown on how to apply for an FHA loan.

Also Check: Usaa Auto Loan Refinance Rates

What Are The Requirements For An Fha Loan

Government backing and mortgage insurance mean FHA loans can have more relaxed borrowing criteria than conventional loans. Here are some of the requirements to keep in mind when preparing to apply for an FHA loan:

If you need assistance determining your eligibility for an FHA loan, find a HUD-approved housing counseling agency in your area. Their counselors can also help you navigate the application process.

What Is The Difference Between An Fha Loan And A Conventional Mortgage

- With an FHA insured loan it is possible to finance a purchase of up to 97.5% of the sales price.

- The FICO score requirement is lower for an FHA loan. Usually a conventional loan will require a 620 FICO score. FHA will allow you to have a FICO score as low as 500 but a larger down payment is required. Most lenders that we work with will allow a 3.5% downpayment with a score of 580 or higher.

- You can be two years out of bankruptcy or 3 years from a previous foreclosure.

- The down payment can come as a gift and the closing costs can be paid for by the seller or lender.

- You can use a cosigner to help you qualify.

- The loan can be assumed by a new buyer if you decide to sell your home at a later date.

- Some FHA loans allow you to borrow more than the purchase price to pay for repairs.

Many conventional lenders require at least a 680 700 FICO score if you want less than a 25% down payment. Most conventional loans now typically require anywhere from 10 to 30 percent down. Typically, conventional loans involve much stricter qualifying standards. Waiting times for bankruptcies and foreclosure are usually much longer with conventional loans.

The source of the down payment will usually be required to come from the borrowers own funds and usually the borrower must also have the funds to pay the closing costs. Often the borrower must have up to 6 months PITI in cash reserves after the close of escrow.

Recommended Reading: How To Get Loan Originator License

Down Payment Assistance Programs

First-time homebuyers may qualify for downpayment assistance or grants. You can search for down payment and closing cost assistance programs available in your state on the HUD website. To be eligible for down payment assistance, your household income should not exceed the maximum threshold based on the number of people in the home.

|

1 person household |

Zero Down Payment Fha Loan Options In Michigan

It is possible to get an FHA loan in Michigan with zero money down. Technically, the FHA loan itself will still require a down payment of 3.5% or more. But, an applicant can make the initial down payment without spending their own money. This way, the loan recipient doesnt need to save up the down payment sum themselves.

Gift Funds:

In every state, applicants can set up FHA gift funds. Relatives, employers, friends, non-profit groups, and credit unions can deposit money in a gift fund. Gift funds arent loans. The recipient must provide written documents proving they have no obligation to repay the funds. Then, they can use the gift funds towards the down payment.

DPA Grants:

In Michigan, residents can apply for down payment assistance grants through MSHDA. This program is exclusively for first-time homebuyers. For more on DPA programs in Michigan, read the FAQs.

Sellers Concession:

The FHA grants home sellers the option of a sellers concession. The sellers concession may be up to 6% of the market value of the homeenough to cover a 3.5% downpayment. In some cases, a seller will use their concession to cover the down payment and other closing costs. The seller will typically negotiate a higher asking price in return for the concession.

Read Also: How Do I Find Out My Auto Loan Account Number

Best Lenders For Fha Loans In September 2021

FHA loans offer several benefits including low rates and low down payments. Compare some of the best FHA lenders to find the right fit for your needs.

You might think all Federal Housing Administration lenders are the same. But even when youre looking for an FHA loan, its always smart to shop at least three lenders. Their mortgage rates, fees and other costs to borrow can vary substantially.

NerdWallet has picked some of the best FHA lenders in a variety of categories so you can quickly determine which one is right for you.

» MORE:Compare FHA mortgage rates

Due to the coronavirus pandemic, getting a mortgage may be a bit of a challenge. Lenders are dealing with high loan demand and staffing issues that may slow down the process. Also, some lenders have increased their fees, adjusted their minimum required credit scores or temporarily suspended certain loan products. If you cant pay your current home loan, refer to our mortgage assistance resource. For the latest information on how to cope with financial stress during this pandemic, see NerdWallets financial guide to COVID-19.

You might think all Federal Housing Administration lenders are the same. But even when youre looking for an FHA loan, its always smart to shop at least three lenders. Their mortgage rates, fees and other costs to borrow can vary substantially.

» MORE:Compare FHA mortgage rates

Where Can I Get An Fha Loan

Many lenders offering government-secured loans offer FHA loans. Assurance Financial offers a range of home loan products and is one place you can go if you have been wondering where to get an FHA loan. The FHA does not offer mortgages you still need to work with an approved lender to get this type of financing.

Also Check: How To Get A Loan Officer License In California

Benefits Of A Univest Fha Loan

- Available to first-time homebuyers and repeat borrowers

- As little as 3.5% down payment

- Available in a variety of fixed-rate and adjustable-rate loan options

- Flexible income, debt and credit requirements

- 100% gift or grant allowed for down payment and closing costs

- Non-occupying co-borrowers allowed

- Up to 6% seller paid closing costs

- FHA program is available for all income levels

You Find Out Where You Stand

A preapproval gives you an idea of how much you can borrow and whether youll qualify for a loan right now.

You might be approved with flying colors. Thats great. But if not, you want to know as soon as possible not after youve found a home you love.

Your applicationmay be turned down because you carry too much debt or your credit score is too low.

FHA lenders often require that your total mortgage payment and consumer debt payments arent much above 50% of your gross monthly income.

This is known as a back-end debt-to-income ratio . If a lender turns you down because of your DTI, youll know that you need to lower your overall debt or raise your income before you can buy a home. While that may seem disheartening at first, its empowering to know exactly what you need to do to get into your own home.

You May Like: Does Va Loan Work For Manufactured Homes

What Is An Fha

A Federal Housing Administration loan is a mortgage that is guaranteed by the Federal Housing Administration and given by an FHA-affirmed lender. FHA loans are intended for low-to-moderate-income borrowers they require a lower minimum down payment and lower credit scores than numerous typical mortgages. In 2020, you can acquire up to 96.5% of the worth of a home with a FHA loan.

This implies that you will have to make a down payment of 3.5%. You will require a credit score of in any event 580 to qualify. In the event that your credit score falls somewhere in the range of 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. With FHA loans, your down payment can emerge out of your savings, as a financial gift from a relative, or an award for down-payment help. On account of their numerous advantages, FHA loans are famous with first-time homebuyers.