Thoroughness Of Property Appraisals

Property appraisals for FHA loans are extensive. Compared to conventional loan property assessments, inspectors will conduct a detailed analysis of the safety, structural integrity, design, HUD property guideline alignment and true value of your desired home, as well as compliance with local ordinances and standards.

The Right Loan For You

Although theres a lot to think about when considering conventional loans vs. FHA, remember that the goal is always to find the best loan type for your specific financial situation and homebuying experience.

Learning about FHA and conventional loans is helping you and your family make an informed decision about what fits you best when it comes to their eligibility requirements, terms, and flexibility.

Start with your goals and finances and get preapproved and youll find the right loan for you.

Fha Loans Are Hugely Popular With First

Chances are if youre a first-time home buyer, youll use an FHA loan over a conventional loan.

Just look at the chart above from the Urban Institute, which details the FTHB share of purchase mortgages by loan type.

As you can see, the FHA was dominated by FTHB with an 82.8% share in October 2018. Yes, nearly 83% of those who used an FHA loan for a home purchase were first-timers.

Meanwhile, only 47.8% share of purchase loans backed by the GSEs went to first-timers.

The reason this might be the case is due to the low credit score requirement coupled with the low down payment requirement.

Since first-timers are often short on down payment funds , FHA tends to be a good fit.

FHA borrowers also generally have higher DTI ratios, higher LTVs, smaller loan amounts, and lower credit scores relative to GSE borrowers.

However, if you have student loans, which a lot of first-timers probably do, the FHA can treat them a bit more favorably when qualifying you for a mortgage.

Recently, they made a change where just 0.5% of the outstanding loan balance is used as the monthly payment for DTI purposes, down from the former 1%.

Meanwhile, Fannie Mae may calculate your DTI using 1% of the outstanding student loan balance, which could make qualifying for an FHA loan easier.

So if you have student loan debt, pay close attention to this rule, and/or check out the more flexible guidelines offered by Freddie Mac.

Read Also: Mortgage Commitment Fee

Fha Fixed Rate Mortgages

- FHA 30 Year Fixed Rate Loan: A fixed rate loan that generally requires a small down payment. This loan may be obtained by buyers with low credit scores.

- FHA 15 Year Fixed Rate Loan: Similar to the 30 Year Fixed Rate Loan, it offers the benefits of a stable monthly mortgage payment, except that the interest you pay over the life of the loan is significantly less because the loan is expected to be paid in half the time.

- FHA 203k 30 Year Fixed Rate Loan: The 203k loan program provides borrowers special financing to buy a fixer-upper with enough extra money to complete necessary renovations.

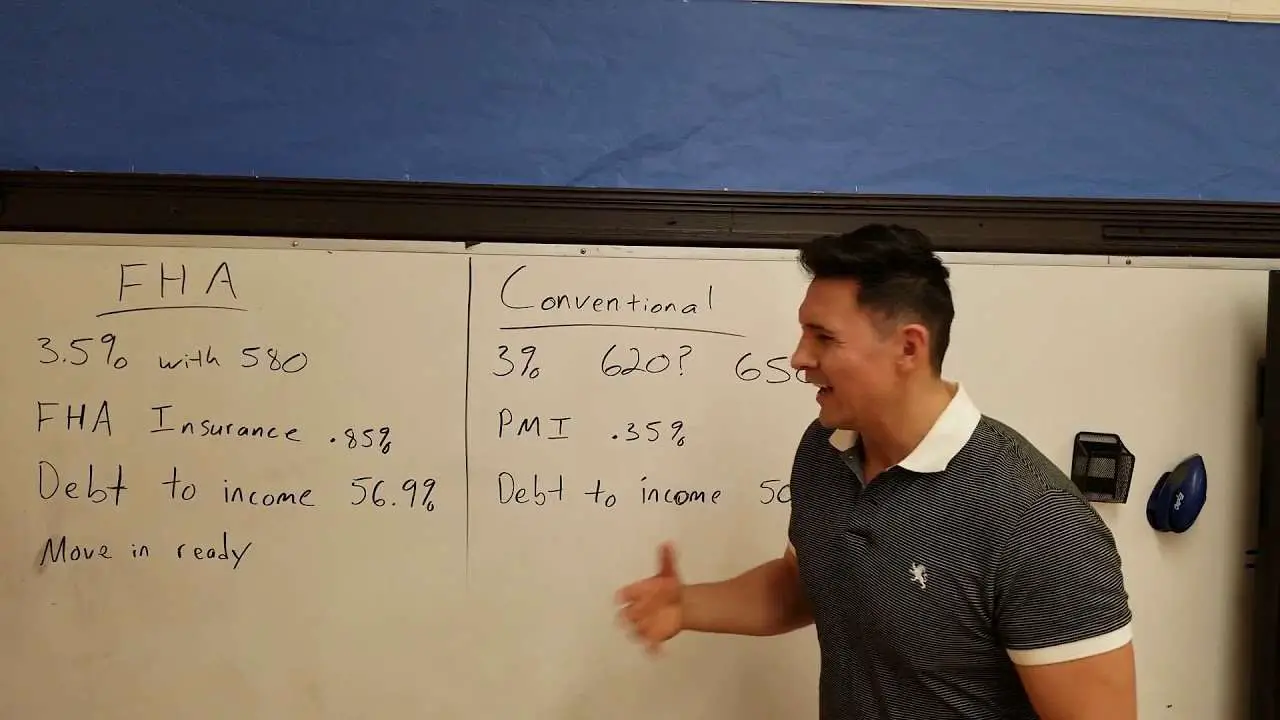

Conventional Loan Mortgage Insurance

If you dont put at least 20% down for a down payment, youre required to pay for private mortgage insurance , which can come in several forms:

- The most common is that you pay a monthly premium, which is an annual rate divided by 12.

- A single premium policy is another option, which involves an upfront payment.

- A split premium is an upfront payment as well as a monthly premium, and ideally, a seller will pay the upfront premium.

- Lender-paid PMI is also another option, in which the lender purchases the insurance and you pay it back at a higher interest rate. You cannot cancel lender-paid PMI.

You May Like: Does Va Loan Work For Manufactured Homes

How Do I Convert An Fha Loan To A Conventional Loan

4.3/5convertFHA loanconventionalloanFHAFHA

Also, can I switch from an FHA loan to a conventional loan?

To convert an FHA loan to a conventional home loan, you will need to refinance your current mortgage. The FHA must approve the refinance, even though you are moving to a non-FHA-insured lender. The process is remarkably similar to a traditional refinance, although there are some additional considerations.

Additionally, is a conventional loan better than FHA loan? In sum, an FHA loan is more flexible to obtain, but no matter how large your down payment, you will have to pay mortgage insurance. A Conventional loan requires a higher credit score and more money down, but does not have as many provisions.

In this way, how soon can you refinance an FHA loan to a conventional loan?

You must already have an FHA-backed mortgage. All of your mortgage payments must be up to date. You must wait 210 days, or have six months of on-time payments before applying. You cannot get a cash-out refinancing with the switch.

What is the difference between a FHA loan and a conventional loan?

The main difference between FHA and conventional loans is the government insurance backing. Federal Housing Administration home loans are insured by the government, while conventional mortgages are not.

What Is A Conventional 97 Loan

Most people have been told that they cant get a conventional mortgage with less than 10% or even 20% to use as a down payment, but thats not true.

The Conventional 97 mortgage program allows you to put down as little as 3% for a down payment and then borrow the remaining 97%. The 3% can be sourced from savings, grants, Community Seconds mortgages, and even from gift funds. The goal of the Conventional 97 loan program is to help people make their home ownership dreams come true, even if they dont have lots of cash on hand. Conventional 97 loans require Private Mortgage Insurance .

Recommended Reading: Loans Without Proof Of Income

Who Should Not Go With A Conventional Loan

Prospective homeowners with variable income or low debt-to-income ratios tend to have a harder time securing a conventional loan with favorable terms. Low debt-to-income ratios meaning your monthly debt payments eat a larger portion of your income make it particularly difficult to present as an attractive borrower to private lending institutions.

Reasons Why Fha Is Better Than Conventional

Somewhere along the line, FHA loan got a real unfair reputation as being a loan option that you should avoid.

Whats even worse, is that some real estate agents will have a bias against FHA financing, because of a bad experience they had many years ago.

Im not saying there is a right loan option, or a wrong loan option, I am just saying that there are usually multiple options, and you should not discount a FHA loan as a viable consideration.

One of the biggest knocks on FHA was mortgage insurance. If you have 20% down payment, or equity in the home, then it is less likely that FHA is high on the options list.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Conventional Vs Fha Mortgage Which Is Better For Me

Chances are that if you are reading this, youve either come far enough in the process of buying a home or are getting serious enough to do the research thats needed. After all, Mortgage isnt something one has to deal with very frequently. For some, its a once in a lifetime kind of an event. Since its perhaps the biggest purchase most ever do, due diligence is of utmost importance.

Once you get into the home buying process and get to the step of finding the right mortgage, you hear of so many new related terms and options. These are likely to overwhelm you since this is stuff youve never had to encounter in the past. Amongst the so many different questions that people ask us, the one that is a fairly common one is: What is the difference between a Conventional Mortgage and an FHA mortgage? And which is better for me? Here, we try to take a deeper dive and help you answer that question.

What Are Fha Loans

Federal Housing Administration loans are home mortgages insured by the federal government. Generally speaking, its a mortgage type allowing those with lower credit scores, smaller down payments and modest incomes to still qualify for loans. For this reason, FHA loans tend to be popular with first-time homebuyers.

The goal of FHA mortgages is to broaden access to homeownership for the American public. While FHA loans are insured by the federal agency with which it shares its name, you still work with an FHA-approved private lender to procure this mortgage type.

Recommended Reading: 20/4/10 Car Calculator

When A Conventional Loan Makes Sense

Each situation is flexible, but your qualifications or preferences should be close to these if you want to try for a conventional loan:

- Your credit score is at least 620.

- You have a down payment equal to at least 3%, or 20% if you want to avoid PMI.

- You have a low debt-to-income ratio, or DTI, which compares your monthly debt payments to your monthly gross income.

- You want flexible repayment terms.

What Is Mortgage Insurance And Do I Pay It With An Fha Loan

While there are many upsides to an FHA loan, a big downside to the FHA loan is the Upfront Mortgage Insurance Premium . This is collected at loan closing but may also be financed into the loan amount.

FHA loans also require payment of monthly mortgage insurance premium to protect the lender in case of default. In most cases MIP stays on for the life of the loan unless you put 10% down, then its a minimum of 11 years.

You can also get rid of your monthly mortgage insurance if you refinance your FHA to a conventional loan.

With an FHA mortgage, you will pay the same insurance premium regardless of your credit score. Conventional loans ask you to pay mortgage insurance each month if you put down less than 20%, but this premium may be less than with an FHA loan if you have a credit score over 720.

With an FHA loan, the borrower ends up paying more over the life of loan.

Recommended Reading: How Much To Loan Officers Make

Fha Vs Conventional Loans: What’s The Difference

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Fha Loan Mortgage Insurance

A mortgage insurance premium is a required payment for an FHA loan. FHA loan mortgage insurance is typically paid for the life of your loan, unless you make a down payment of 10% or more, in which case MIP comes off after 11 years. Youll pay an upfront mortgage premium , which normally amounts to 1.75% of your base loan amount.

You also pay MIP payments of approximately 0.45% 1.05% of the base loan amount, all based on the term of your mortgage, your loan-to-value ratio , your total mortgage amount and the size of your down payment.

Read Also: How To Transfer Car Loan To Another Person

What Is The Difference Between An Fha And Conventional Loan In Cost And Benefits

For home buyers with limited funds for a down payment, both FHA and conventional loans are available to help facilitate the purchase of a new dwelling.

FHA loans are insured by the U.S. Federal Housing Administration and are offered by FHA-approved lenders.

Conventional loans are not government insured and are available through many banks, credit unions and other mortgage lenders.

You may qualify for both, but there are real differences between them, so take the time to understand the advantages and disadvantages of each before making a decision.

About The Fha 35% Down Payment Program

The Federal Housing Administration is not a lender. Rather, its a loan insurer. The federal agency was established in 1934 and exists to support homeownership within communities.

Promising affordable and stable financing, the FHA established a program by which it would insure U.S. lenders against losses on a loan and provide more favorable loan terms for U.S. borrowers.

More than 80 years later, the FHA continues to fulfill its role.

Todays FHA homeowners get access to loans of up to 30 years minimum down payment requirements are as low as 3.5% and, FHA mortgage rates routinely beat the market average often by a quarter-percentage point or more.

In order to get the FHAs backing, banks must only verify that loans meet minimum FHA lending standards, a collection of rules which are more commonly known as the FHA mortgage guidelines.

FHA mortgage guidelines state that eligible home buyers must have documented, verifiable income, for example and require home buyers to live in the home being purchased.

The FHA also requires home buyers to pay mortgage insurance premiums as part of their monthly payments.

FHA MIP varies by loan type and downpayment, with the most common scenario being a home buyer using a 30-year fixed rate FHA loan with the minimum allowable 3.5% downpayment and paying 0.85 percent against the borrowed amount in mortgage insurance premiums annually, or $71 per month per $100,000 borrowed.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

The Hidden Benefit Of An Fha Loan

Whether youre purchasing a starter home or your dream home, smart buyers will look to the future and whether a property has resale value. Thats where FHA loans offer a hidden benefit not available with conventional loans: the ability for the next buyer to assume the existing FHA mortgage.

As long as a home buyer qualifies for the existing terms of an FHA mortgage, they are able to assume the existing loan and its original interest rate. That means that as interest rates increase, your FHA loan makes your home a much more attractive option. Conventional loans do not provide this benefit.

And if youre worried abotu FHA lifetime mortgage insurance, keep in mind that you can refinance out of FHA to cancel MI as long as mortgage rates stay at or near current levels. If rates rise too much, a refinance would increase your rate, negating your savings.

Kate: A Conventional Loan Is The Easy Choice

Kate has a very high credit score. She wants to buy a home and has saved enough to make a down payment of 20%. Kate has decided to settle in Beverly Hills, her dream home is a bit pricey so she will need a large loan. A Conventional loan is likely the right choice for Kate.

A conventional loan, or conventional mortgage, is not backed by any government body like the FHA, the US Department of Veterans Affairs , or the USDA Rural Housing Service.

Roughly two-thirds of US homeowners loans are conventional mortgages, while nearly three in four new home sales were secured by conventional loans in the first quarter of 2018, according to Investopedia.

Sometimes conventional loans are mistakenly referred to as conforming mortgages, which is a separate type of loan which meets the same criteria for funding from Fannie Mae and Freddie Mac, but although conforming loans are technically conventional loans, the reverse is not always true. For example, an $800,000 jumbo mortgage is a conventional mortgage, since it does not qualify as a conforming mortgage because it exceeds the maximum loan amount Fannie Mae and Freddie Mac guidelines will permit.

Read Also: Minimum Credit Score For Rv Loan

Fha Loans Are Good For Those With Poor Credit

- Theres not one clear winner across all loan scenarios

- Determining the cheaper option will depend largely on your credit score and LTV

- FHA loans tend to benefit those with low credit scores and high LTVs

- While conventional loans are often cheaper for those with better credit scores and larger down payments

The screenshots above from the Urban Institute detail when FHA wins out over conventional lending, and vice versa.

They show how each type of loan stacks up at 96.5%, 95%, 90%, and 85% loan-to-value , while also factoring in the borrowers FICO score.

You can use them to quickly determine what credit score and down payment combination favors which type of loan.

Of course, youll need to plug in your actual numbers into a mortgage calculator to see what works for you because they make a lot of assumptions.

Are Fannie Mae And Fha The Same Thing

People seem to confuse these two, maybe because they both start with the letter F.

So lets put it to rest. The answer is NO.

Fannie Mae is one of the two government-sponsored enterprises along with Freddie Mac that issues conforming mortgages.

The FHA stands for Federal Housing Administration, a government housing agency that insures residential mortgages.

They have a similar mission to promote homeownership and compete with one another, but they are two completely different entities.

Ultimately, Fannie Mae is a private sector company, while the FHA is a government agency that represents the public sector.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Fha Loans Are Subject To Costly Mortgage Insurance

- Mortgage insurance is unavoidable on an FHA loan, which is the big downside

- And it will often remain in force for the entire loan term

- Conventional loans allow you to drop MI at 80% LTV, which can be a huge advantage

- Fannie Mae and Freddie Mac also offer discounted mortgage insurance premiums for certain borrowers

Weve talked about some benefits of FHA loans, but there are drawbacks as well.

The major one is the mortgage insurance requirement. Those who opt for FHA loans are subject to both upfront and annual mortgage insurance premiums, often for the life of the loan.

The upfront mortgage insurance requirement is unavoidable, and nearly doubled from 1% to 1.75% back in 2012. And the annual premium can no longer be avoided.

Since 2013, many FHA loans now require mortgage insurance for life, making them a lot less attractive and expensive long-term! The never-ending FHA MIP could be the tipping point for some.

However, its possible to execute an FHA to conventional refinance to dump the MIP once you have the necessary home equity.

So it doesnt really need to stay in-force for life. And many FHA borrowers do in fact refinance out or sell their homes before paying MIP long-term.