See How Much You’ll Pay

Calculate monthly and overall costs

| Your loan |

|---|

| 4.8 out of 5 stars, based on 43,445 customer reviews | |

| Customer reviews verified as of | 04 August 2022 |

|---|

OneMain Financial gets high marks on the Trustpilot website from thousands of reviewers, with the vast majority of customers giving it an “excellent” or “great” rating. Positive reviews mention excellent customer service and fast turnaround. Negative reviews include problems with OneMain Financial not releasing vehicle titles in a timely fashion after the loan has been paid and issues with incorrect marks on credit reports.

The company has been registered with the BBB since 2015 and has an A+ business rating for how it has handled several hundred complaints over the past three years. However, only gets a fair customer rating on the BBB site, with many recent negative reviews. Some unhappy customers mention not getting final loan approval after being prequalified, while satisfied customers report smooth processing and good customer service.

Is There A Onemain Near You

Although OneMain is available in most states and provides an online application, you do need to go to a physical branch location to verify your personal and financial details.

Most online lenders dont require this extra step, but it might feel good to talk to a real-life person who can help clarify any questions you have about your loan terms.

As long as it doesnt feel like a huge trek or burden to make the appointment, it may be in your best interest to have that additional layer of customer service before you agree to sign on the loan.

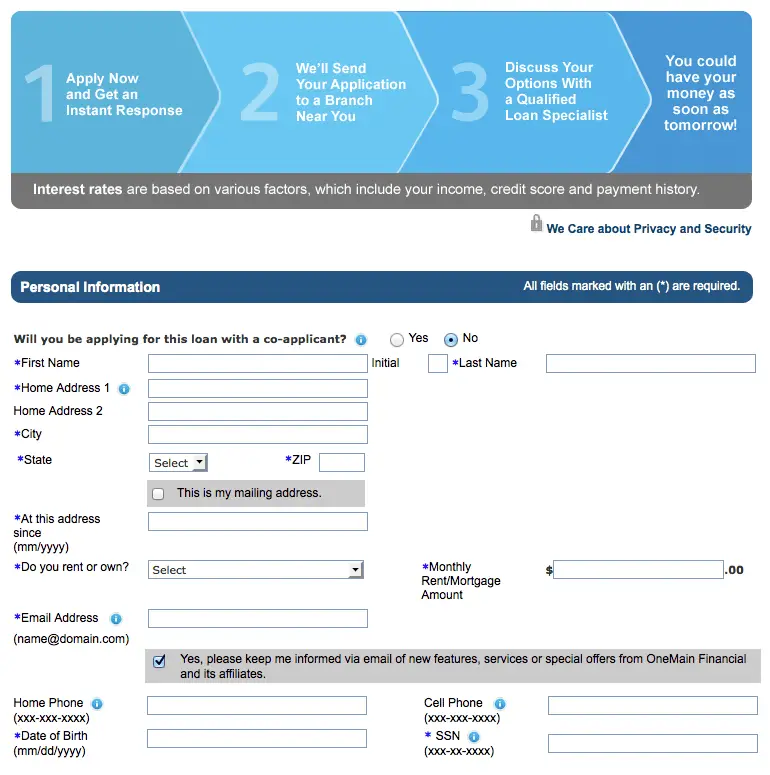

Onemain Financials Loan Application Process

OneMain Financial takes a unique approach to lending, offering a blend of technology and a personal touch that fewer banks offer today.

Step 1: Through the OneMain Financial website, you can first get pre-approved for your loan by answering some quick questions about yourself. You wont be asked about the purpose of your loan at this time. This process took me about two minutes to complete, and it has no impact on your credit.

Unlike many online loan preapprovals, however, the results arent very comprehensive. While youll be able to see the secured and unsecured loan amounts for which you qualify, you wont see any interest rate, monthly payments, or other loan terms until you officially apply. This can make it difficult to gauge whether a OneMain Financial personal loan is the right product for you without formally applying and taking a hit on your credit report.

What you can see, though, are the fees associated with your new loan if you choose to move forward. These include:

- Origination fees ranging from $25-$400 or 1-10% of the loan amount, depending on your state

- Late payment fees of $5-$30 or 1.5%-15% of the late amount

- Non-sufficient funds fees of $10-$50 per returned payment

You can also check out OneMain Financials online loan calculator to get an idea of what your monthly payments would be based on your loan amount, desired terms, and interest rates for which you might qualify.

Read Also: How To Get Loan Officer License

How To Get A Loan With Onemain Financial

OneMain Financial offers an easy, straightforward application process. Heres what youll need to do:

If youre denied for a personal loan with OneMain Financial because of your credit score, consider these strategies to boost your odds of approval.

The Lady I Delt With Was Very Good

The lady I delt with was very good ! Always nice and very informative ! But I do wish I would have waited on financing I had way better offers as far as internet rate ! And payment ! The day after I signed !!! Thank you for your time !! And I’m not sure on date of experience !!!

Date of experience:September 14, 2022

Read Also: How Much Can I Borrow For Home Improvement Loan

Onemain Financial: Top Loan Features

OneMain Financial has two unique features. They are the only online lender that accepts applications online but requires you to come to an office to get the money. They also offer secured and unsecured loans and report to the major credit bureaus.

Loan limits: OneMain offers loans from $1,500 to $20,000 repayable between 2 and 5 years.

High rates: Interest rates range from 18% to 35.99%. The high rates reflect OneMain accepting borrowers with bad credit.

Expensive fees: The most significant fee is your origination fee, which is deducted from the loan upfront. OneMain says, Depending on the state where you open your loan, the origination fee may be either a flat amount or a percentage of your loan amount. Flat fee amounts vary by state, ranging from $25 to $400. Percentage-based fees vary by state ranging from 1% to 10% of your loan amount subject to certain state limits on the fee amount.” OneMain also charges late fees and a fee for having a payment not go through due to insufficient funds.

Secured and Unsecured: If you own a car outright and use it as collateral., you will be able to borrow more and get a better rate than taking an unsecured loan.

Fast Funding: Though you have to come into a branch location to finalize your loan, online applications approved by noon can be funded the same day.

44 States: You can get a OneMain Financial loan in every state and Washington DC except for Arizona, Arkansas, Connecticut, Massachusetts, Rhode Island, and Vermont.

What Sets It Apart

OneMain Financial is one of the few providers that offers the convenience of an online lender with the support of physical branches in most states. Speaking with a loan officer can be especially important if you have bad credit or are new to credit.

It gives you the chance to ask questions, explain negative marks on your report and make sure a loan is the right solution. But its probably faster to apply and manage a loan online than one from a local bank.

You May Like: Do You Have To Repay Ppp Loan

What To Do If You Are Rejected From Onemain Financial

Your personal loan application may be declined by OneMain Financial if you do not meet one or more of their requirements. This should not cause concern because most rating factors can be improved upon over time to enhance your creditworthiness.

If your application is declined, ask OneMain Financial for the exact reason you were declined. This will help you figure out if you need to seek an alternative loan or work on improving some attributes before reapplying. Some of the reasons you may be declined include not having a steady source of income or lack of suitable collateral, high debt to income ratio or other reasons.

It is recommended to avoid reapplying immediately after being declined as this may impact your credit score negatively. However, you may find that there are other financing options available to you, but this will depend on why you were declined. For instance, applying with a co-applicant may help to boost your creditworthiness and increase your chances of approval.

What To Know Before Getting A Personal Loan

Personal loans can be appealing when you have a financial emergency, need to fund a big expense, or want to consolidate your debt. Depending on the lender, personal loans can be either secured or unsecured. Secured personal loans require you to use your property, such as a car or other vehicle, as collateral to secure the loan. Unsecured loans do not require any collateral.

When taking out a personal loan, only apply for the minimum amount you need to cover your goal. Depending on your creditworthiness and the lender you choose, personal loans can have relatively high fees and interest rates, so you may end up paying a substantial amount of money on top of the loan principal. In the case of secured loans, you also risk losing your property if you fall behind on your payments, so its essential that you only borrow what you need and have a plan in place to repay the loan on time.

Before submitting your loan application, its wise to shop around and compare quotes from different lenders to find the best personal loan rates.

Recommended Reading: Which Bank Has The Best Personal Loan Rates

Onemain Financial Vs Upgrade

Both OneMain Financial and Upgrade offer personal loans. However, there are some key differences to keep in mind:

- While OneMain Financials maximum loan amount is $20,000, Upgrade allows borrowers to take out as much as $50,000.

- The longest loan term OneMain Financial offers is 60 months. By contrast, Upgrade has loan terms as long as 84 months.

- OneMain Financial focuses on non-prime consumers. While Upgrade doesnt specify a minimum credit score, the weighted average for its customers’ scores is 715, higher than the score of a typical OneMain Financial customer.

Todd Was The Customer Service Loan Rep

Todd was the Customer Service Loan Rep who prepared the Loan contract & walked me through the final processes by telephone call & online Loan service. He was fabulous. I am extremely pleased with One Main Financial as my choice of Loan Institutions & every customer service rep I have dealt with there has been equally as outstanding as Todd. Im very happy with the service & equally as happy with the Loan proceeds I received. Adequate for my needs at this time. Thankyou.

Date of experience:September 29, 2022

Read Also: How To Estimate Car Loan Payments

Onemain Financial Personal Loan Review : A Unique Take On Same

Last updated Aug. 25, 2022| By Stephanie Colestock

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Ifyoure thinking about taking out a personal loan, there are plenty of options on the market today to choose from. Learning more about how to get a loan and shopping around to find the best option for you is important, though. This ensures you get the funding you need from a trusted lender while saving money and frustration along the way.

To that end, we bring you our OneMain Financial personal loan review. OneMain Financial is an innovative personal loan provider that aims to change the way consumers borrow money. Well discuss what makes this lender stand out and why they might be on your short list if a quick loan is ever necessary for you to reach your financial goals.

What Can A Onemain Financial Personal Loan Be Used For

OneMain Financial loans are personal loans, which means theyre not tied to any particular purpose. This gives you the freedom to use them for pretty much anything you need.

You can borrow money for emergency car repairs or to renovate your home. You can pay off medical debt or high-interest credit card debt. You can even spend the money for fun if you want to.

That said, there are a handful of restrictions on what you can use your loan money for. Among other things, you cant use it for business or to pay for college or gambling.

Amusingly, OneMain also makes sure to let potential borrowers know that theyre not allowed to borrow money for illegal activities.

You May Like: Can You Buy Any Home With An Fha Loan

Re: Do Not Get A Loan From One Main Financial

One Main is the old Citifinancial rebranded . I got personal loans from them twice, in 1997 and 2008, and ended up regretting it both times. They’re a bit dressier than bottom-of-the-barrel payday and title loan joints but they work on the same basic principle, and I’m never going back to them again if I can avoid it. If you need a personal loan, go to a reputable credit union.

Implementing With Onemain Economic: Financing Criteria

To help you be eligible for your own financing, you will need to verify your term and you will satisfy specific earnings conditions. OneMain Monetary necessitates the adopting the data accomplish and you can app:

Even though name confirmation is essential, individuals factors pertaining to your earnings is always determine your eligibility for a financial loan having OneMain Economic. An especially lowest credit rating or highest loans-to-income ratio, such as for example, could possibly get disqualify you from financing. Sometimes, collateral may be required to track down recognized for a financial loan.

OneMain Monetary minimum credit score: Theres no mention of the a specific credit history youll need for an effective OneMain Monetary unsecured loan for the bank webpages. not, theres a prequalification means to your institutions website. Filling out this type makes it possible to find out if would certainly be attending qualify for financing, and for exactly what terms.

Really does OneMain Economic Undertake Less than perfect credit? Sure, OneMain Economic exists to incorporate money to those that have less than perfect credit just who fund. To pay on the additional chance it requires with the, OneMain Monetary charges highest APRs towards those individuals financing. Whereas a knowledgeable personal bank loan rates are located in new mid-solitary digits, OneMain Financials lower newest speed is 18%.

Recommended Reading: Apply Online For Personal Loans

Why Get A Personal Loan From Onemain Financial

Personal loans are with fixed interest rates that you can use for a variety of reasons.2 If approved, youll borrow a set amount of money and pay it off with monthly payments over a scheduled period of time. Personal loans can offer an alternative to credit cards by giving you a predictable and fixed repayment plan. They can even be a tool for if you make your payments on time.

At OneMain, weve been a trusted loan company for over 100 years. You can apply for our simple and convenient personal loans online, or talk to one of our loan specialists over the phone or at your local branch.

Who Should Not Choose Onemain Financial

In comparison to other lenders in the market, OneMain Financial interest rates are relatively high. Borrowers with good credit who can get personal loans from other lenders should consider other alternatives.

OneMain Financial also has high fees, and borrowers will incur high origination and late fees, making the loans cost even higher. This lender is not ideal if you require high loan limits since the maximum loan limit in most states is $20,000.

Also Check: How To Apply For Fema Loan

Where Onemain Personal Loans Stand Out

Secured and joint loan options: OneMain lets borrowers use a vehicle to secure a loan or add a co-applicant to an application. Either option can help improve a borrower’s chance of qualifying and getting a lower rate than they would on their own. With a secured loan, the lender will appraise the vehicle and require it to be insured.

Choose and change your payment date: A borrower can pick their payment date when they sign a loan agreement, as long as its within 45 days of the day they accept the offer. After that, they can change the payment date twice during the life of the loan.

Fast funding: The lender is one of few that says it can fund a loan the same day a borrower submits an application. With other lenders, the time from application to funding can be one or two days.

Branch access: OneMain operates branches in each of the 44 states where it offers personal loans. Though a borrower can get a loan without visiting a branch, those who are more comfortable interacting with a loan officer in person can do so at a OneMain branch.

Seven-day cancellation policy: Borrowers have seven days to change their mind and cancel the loan without having to make payments. Few lenders offer this feature.

» MORE: Personal loans for fair credit

Payoff Vs Onemain Financial

Payoff is a targeted lending service that does what its name implies it helps people pay off credit card debt.

In addition to their loans, Payoff also provides their customers with a service called Happy Money. This is an all-around money management program thats designed to help with all your finances.

> > More: Payoff Personal Loans Review

Also Check: How To Make Personal Loan Agreement

Onemain Financial Personal Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Personal loan rating: 4/5

- Loan terms: 24 to 60 months

- Loan amount: $1,500 $20,000

Our verdict:

OneMain Financial is a lender that offers personal loans ranging from 18.00% to 35.99% at fixed rates. Unlike some online lenders, OneMain Financial has branches located across 44 states and may be a good fit for consumers who want a face-to-face experience during the loan process.

On this page

|

Charges an origination fee High interest rates Small loan amounts Larger loan amounts require collateral |

One of the great things about this lender is the short amount of time it takes to receive your loan funds. According to OneMain Financials website, the process takes as little as one day from start to finish. This lender doesnt charge a prepayment fee, and consumers who dont meet OneMain Financials credit requirements can instead apply for a secured loan.

Unfortunately, if you take out a loan with OneMain Financial, youll have to budget for an origination fee, which will be taken out of your total loan balance. OneMain Financial also has much higher interest rates than some competitors and may not be a good fit if youre looking for a large loan.