How To Use The Pmt Function To Calculate Loan Payments In Excel

Let’s say you are shopping for a mortgage and want to know what your prospective monthly payment would be. To calculate, all you need are the three data points mentioned above:

-

Interest rate: 5.0%

-

Length of loan: 30 years

-

The amount borrowed: $250,000

Start by typing Monthly payment in a cell underneath your loan details. To use the PMT function, select the cell to the right of Monthly payment and type in “=PMT(” without the quotation marks. You will then be asked to enter the aforementioned data points:

An Auto Loan Calculator Reveals More Than Payments

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the auto loan payment calculator’s “total cost of car” result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

An auto loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

NerdWallet recommends that you shop for an auto loan before you visit dealerships you’ll give the dealer a rate to beat and won’t worry that you won’t be approved for loan.

Can I Get A Loan With A Credit Score Of 600

Recommended Reading: Becu Car Repossession

What Is My Loan Payment Formula

Now that you have identified the type of loan you have, the second step is plugging numbers into a loan payment formula based on your loan type.

If you have an amortized loan, calculating your loan payment can get a little hairy and potentially bring back not-so-fond memories of high school math, but stick with us and we’ll help you with the numbers.

Here’s an example: let’s say you get an auto loan for $10,000 at a 7.5% annual interest rate for 5 years after making a $1,000 down payment. To solve the equation, you’ll need to find the numbers for these values:

-

A = Payment amount per period

-

P = Initial principal or loan amount

-

r = Interest rate per period

-

n = Total number of payments or periods

The formula for calculating your monthly payment is:

A = P ^n) / ^n -1 )

When you plug in your numbers, it would shake out as this:

-

P = $10,000

-

r = 7.5% per year / 12 months = 0.625% per period

-

n = 5 years x 12 months = 60 total periods

So, when we follow through on the arithmetic you find your monthly payment:

10,000 / – 1)

10,000 /

10,000

10,000 = $200.38

In this case, your monthly payment for your cars loan term would be $200.38.

If you have an interest-only loan, calculating the monthly payment is exponentially easier . Here is the formula the lender uses to calculate your monthly payment:

loan payment = loan balance x

In this case, your monthly interest-only payment for the loan above would be $62.50.

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Recommended Reading: Usaa Credit Score For Auto Loan

What Is The Pmt Function In Excel

The PMT function calculates monthly loan payments based on constant payments and a constant interest rate. It requires three data points:

-

Rate: Interest rate of the loan

-

Nper : The number of loan payments

-

Pv : The principal or current value of the sum of future payments

While optional, there are two additional data points you can use for more specific calculations:

-

Fv : The balance you want to achieve after the last payment is made. If omitted, this value is assumed to be 0, meaning that the loan is paid off

-

Type: Use “0” or “1” to specify whether the payment is timed to occur at the beginning or end of the period

Where Can I Get An Auto Loan

Several types of lenders make auto loans, including car dealers, major national banks, community banks, credit unions and online lenders. You may get a particularly good deal from a lender you already have an account with, so check their rates first. Compare auto loan rates across multiple lenders to ensure you get the lowest APR possible.

Read Also: Used Car Loan Usaa

Can I Get An Auto Loan With Bad Credit

Bad credit auto loans are very common. In fact, there are lenders that specifically cater to borrowers with poor credit. Creditors can give bad credit auto loans to consumers with lower risk than bad credit personal loans because the car could just be repossessed if the borrower doesnt pay.

Unfortunately, many auto loan lenders charge unreasonably high interest rates and tack on additional fees for bad credit loans. Make sure the interest rate on your loan is fair and that the monthly payments are affordable or you risk losing the vehicle and further damaging your credit.

The Internet Has Changed Automotive Shopping

Research Before You Shop

After you have determined the car you want to buy, go to Edmunds.com to find the invoice price. Do not shop without this information in hand. It’s your leverage in the negotiating process. If you don’t have this piece of information, the dealer will work from the MSRP which is a much higher price. Consider MSRP as retail price and invoice price as dealer cost.

Never pay higher than invoice price. And don’t worry, the dealer still makes a profit. There is something called holdback which the manufacturer gives the dealer for each vehicle. It’s usually 2-3 % which they receive quarterly. At times the manufacturer also offers dealer incentives for specific models.

If you have looked ahead and planned your purchase, note that some times of the year are better than others to buy a car. Salesmen work on commission and have monthly, quarterly and yearly goals to meet. So buying at the end of one of these periods can save you money, especially if the salesman hasn’t hit his quota.

Get a Free Online Quote

If you have made a decision on the exact vehicle you want, visiting the dealership late in the day may work to your advantage because everyone is eager to go home. Aside from the information we provide here, you may want to read some personal stories of sale negotiations to better visualize and prepare yourself:

You May Like: Fha Loan Limits Fort Bend County

What To Do With Your Trade

Although it’s convenient to trade in your old vehicle to the dealer at the time of purchasing another, it’s not to your best advantage. You are likely to get the least value from the dealer, as they have to move it yet again and need to ensure a safe profit margin on selling it. They do not have to take your old automobile, and will offer you what will make them the highest profit. Some dealerships may offer artificially high trade in values, but only offer them in association with a higher price on the vehicle they sell you.

Selling Your Used Car Privately

The best option typically is to sell your vehicle privately. It seems even government agencies are freely giving out this advice from the Arizona Attorney General to the FTC. Don’t underestimate the value of your old car. Go to Kelly Blue Book online to do your valuation research. If you can sell it, even for a small amount, it’s extra bargaining power for your new vehicle.

Each year Americans buy roughly double as many used vehicles as new vehicles. You can put a”for sale” sign on your car parked out front if you live in a high traffic area. Sites like Craigslist or Auto Trader can also help send buyers your way.

Another option with your old automobile is to keep it. An old pick up truck used for heavy work can help protect the value of a new vehicle by minimizing wear and tear, along with depreciation. Automotive insurance companies typically offer multiple vehicle discounts.

Go Autos Car Loan Calculator

Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehiclelets say $8,000 to $10,000is more than most people can afford to pay with cash. Which means most people need to take out an auto loan in order to buy a car. But loans come with monthly payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term, the interest rate, the payment frequency, and the trade-in value. To be totally honest, its pretty confusing. But dont worry. Our car loan calculator can do all the hard work for you.

You May Like: Cars You Can Afford Based On Salary

Do Not Forget About Car Insurance

Some people forget about the cost of car insurance while budgeting for a new car. It is essential to work that cost into your monthly budget. All 50 states require drivers to have some kind of auto insurance, so this step isn’t optional.

Insurance costs vary by the car you drive. If you’re considering a new car, get a new insurance quote. This quote will help you more accurately budget for your new car.

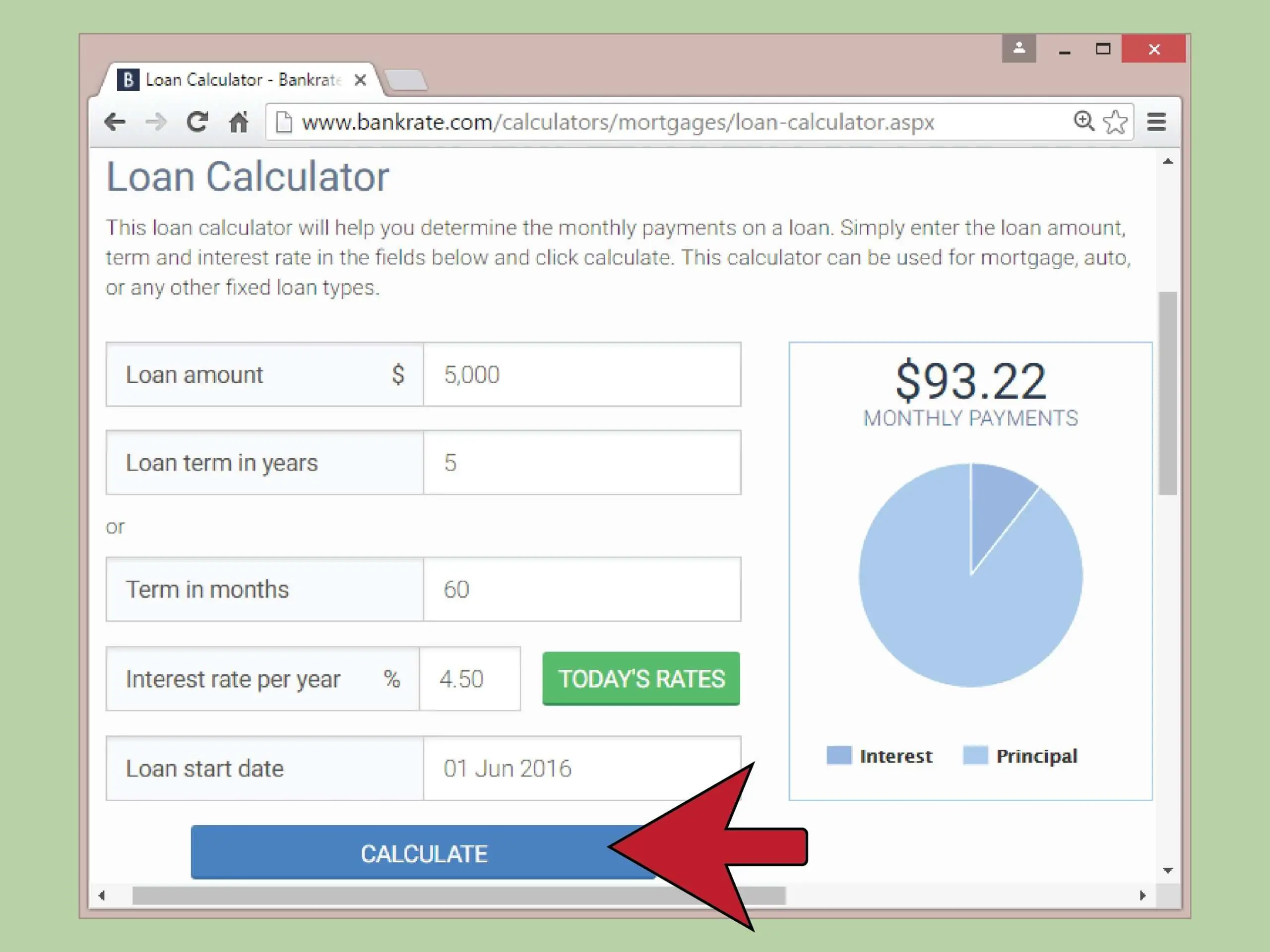

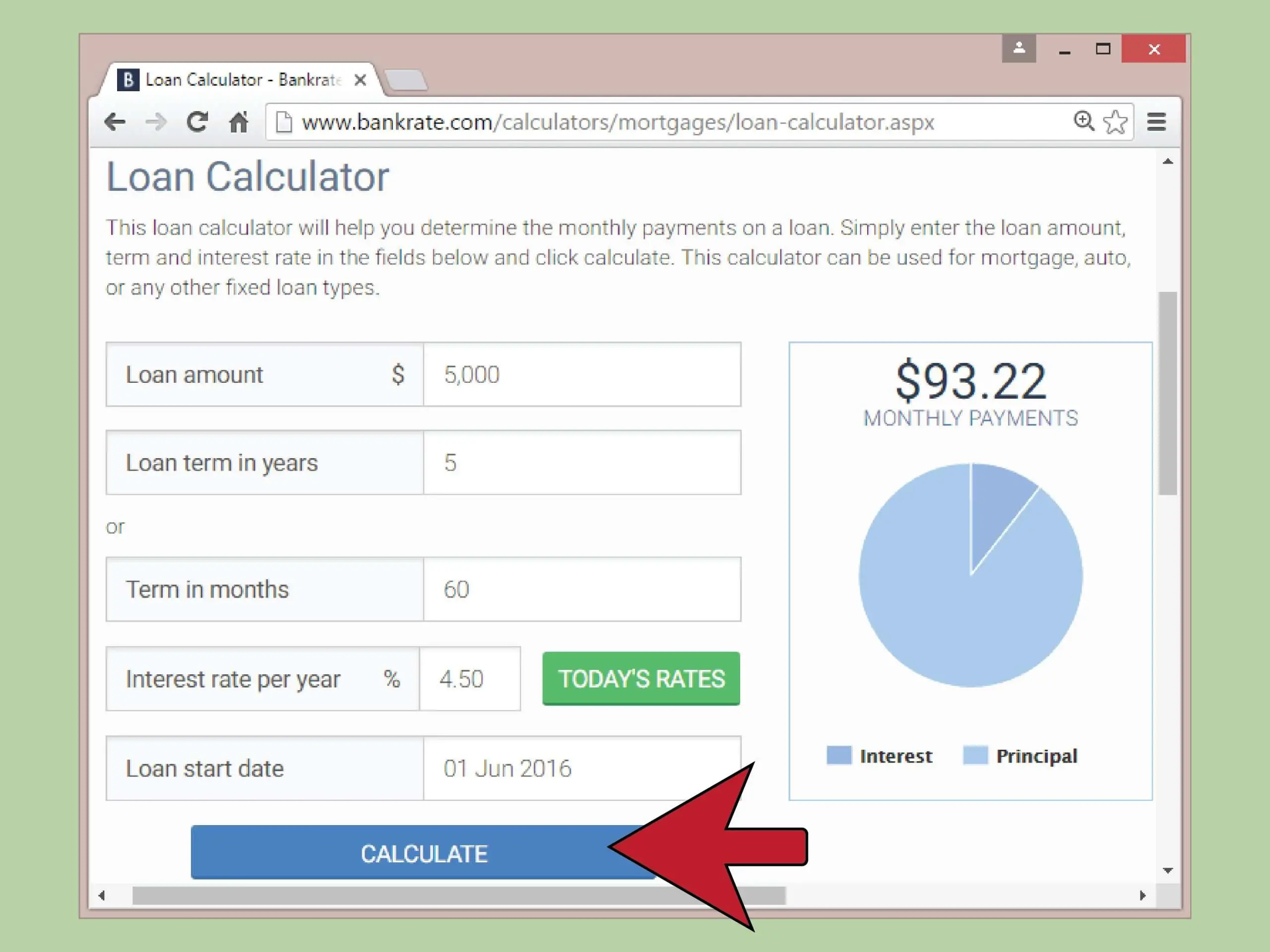

How To Calculate Auto Loan Payments

This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.There are 11 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 422,416 times.

Buying a new or used car, for most people, is not a purchase made by writing a check or handing over cash for the full amount. At least part of the amount is typically financed. If you do finance a car, it’s important that you understand exactly how much you’ll be paying every month, otherwise you could end up going over budget.

Also Check: Cap One Auto Loan

There’s More To A Loan Than A Monthly Payment

That same wise shopper will look not only at the interest rate but also the length of the loan. The longer you stretch out the payments, the more expensive the loan will be. Let’s take that same $20,000 loan above at 5% at 5 years and see how much we can save by paying it off in 3 years. So, $20,000 at 5% for 36 months will cost $21,579.05 saving you $1,066.43. Using the calculator above you will see that the monthly payment for the 5 year loan is $377.42 and the monthly payment for the 3 year loan is $599.42. If you can easily handle the higher payment the savings are well worth it.

If your credit drastically improves & your initial loan was at a higher interest rate, it may be worth looking into refinancing at a lower rate.

Things To Consider When Shopping For A Vehicle

When an individual buys a car, they are typically buying the transportation they will rely on for years to come. For most people this is a major investment, second only to the purchase of a home. Most drivers intend to own the car for a long while. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans.

| Borrower |

|---|

Read Also: Auto Refinance Usaa

How Is Interest Calculated On A Car Loan

An auto loan calculator shows the total amount of interest you’ll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you’ll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

The interest you pay each month is based on the loan’s then-current balance. So, in the early days of the loan, when the balance is higher, you pay more interest. As you pay down the balance over time, the interest portion of the monthly payments gets smaller.

You can use the car loan calculator to determine how much interest you owe, or you can do it yourself if you’re up for a little math. Here’s the standard formula to calculate your monthly car loan interest by hand:

Understanding 0% Financing Vs Factory Rebate

Many times dealerships will offer a choice of 0% financing or a factory rebate. How do you know which is better? Figure out the interest you would pay for the life of the loan if you financed with your bank. If the interest is more than the rebate, then take the 0% financing. For instance, using our loan calculator, if you buy a $20,000 vehicle at 5% APR for 60 months the monthly payment would be $377.42 and you would pay $2,645.48 in interest. If the rebate is $1,000 it would be to your advantage to take the 0% financing because the $1,000 rebate is less than the $2,645.48 you would save in interest. Be aware though, that unless you have a good credit rating, you may not qualify for the 0% financing and this option may only be offered on selected models. People with poor credit are a major source of profits because they can be charged far higher interest rates. Some “buy here, pay here” dealerships specifically focus on subprime borrowers.

Also Check: Interest Rate For Car Loan With 650 Credit Score

What It Means For Consumers

Calculating your monthly payments can help you figure out whether you can afford to use a loan or credit card to finance a purchase. It helps to take the time to consider how the loan payments and interest add to your monthly bills. Once you calculate your payments, add them to your monthly expenses and see whether it reduces your ability to pay necessary and living expenses.

If you need the loan to finance a necessary item, prioritize your debts to try and pay the ones that cost you the most as early as possible. As long as there’s no prepayment penalty, you can save money by paying extra each month or making large lump-sum payments.

It helps to talk to your lender before you begin making extra or lump-sum payments. Different lenders might increase or decrease your monthly payments if you change your payment amount. Knowing in advance can save you some headaches down the road.

Calculating Monthly Car Payments In Excel

Calculating a monthly car payment in Excel is similar to calculating a monthly mortgage payment. To start, youll need the interest rate, length of loan, and the amount borrowed.For this example, let’s say the car loan is for $32,000 over five years at a 3.9% interest rate:

-

Interest rate: 3.9%

-

Length of loan: 5 years

-

The amount borrowed: $32,000

Similar to the above example, youll enter this data into the PMT function to calculate your monthly payment. Since this loan is paid in monthly installments, the interest rate will need to be divided by 12 and the length of the loan will be multiplied by 12:

The formula now reads:

Again, the monthly payment amount will be negative because it is an outflow of money each month. In this case, the monthly car payment comes to $587.89:

You can also use to see how rates, terms, and loan amounts impact your car payment.

Read Also: Transfer Loan To Another Person