When Should I Lock My Mortgage Rate

Its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, ask your lender for a float down. With this option, you get the lower of the two rates. Pay attention to the fine print, though. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

How Do I Find Current 15

NerdWallets mortgage rate tool can help you find competitive 15-year fixed mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

» MORE: Pros and cons of a 15-year fixed mortgage

Do Fha Loans Have Lower Interest Rates

An FHA loan is a mortgage the Federal Housing Administration insures. FHA loans have relaxed lending standards to help borrowers who dont qualify for a conventional mortgage, but they do not typically have lower interest rates. has a bigger impact on mortgage rates than loan type. If you have a high credit score, your FHA loan rate will probably be lower than that of someone with a low credit score.

» MORE: Compare FHA loans and conventional mortgages

Read Also: How To Be The Best Loan Officer

What Is The Forecast For Mortgage Rates In Canada In 2022

Between January 2022 to June 2022 alone, fixed mortgage rates in Canada have gone up just over 85%. In the same time period, variable mortgages rates in Canada have increased by an average of over 300%.

The current consensus among economists is that mortgage rates will continue to rise in Canada in 2022 and possibly 2023 as well.

Refinancing Into A 15

If you have a 30-year mortgage and are more than halfway through your loan term, refinancing into a 15-year loan with a lower rate can save you thousands in interest. In general, 15-year mortgages have higher monthly payments due to the shorter term but, depending on how much lower you can cut your rate and the balance of your current loan, your monthly payment might not increase as much as you think it will, or at all.

Whichever type of refinance you pursue, be sure to shop around for rates and compare offers, including lender fees.

> > Read more about how to refinance your mortgage.

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

Recommended Reading: What Is The Ppp Loan Forgiveness

Hfcs And Banks Have Revised Home Loan Interest Rates After Repo Hike

The Governor of the Reserve Bank of India on Wednesday announced a hike in repo rate by 40 basis point. This will affect all floating rate home loans. The public sector bank Bank of Baroda hav increased its interest rate on home loan from 6.5% to 6.9%. Bank of India, on the other hand has also increased its home loan interest rates from 6.5% to 6.9%.Indias largest mortgage lender, HDFC has increased its prime lending rate by 30 basis points. Federal Banks home loan interest rate has gone up from 7.65% to 8.05%.

13 May 2022

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Theres income on your application that cant be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its wise to get it in writing as well.

Don’t Miss: What Are Assets For Home Loan

Are Refinance Rates The Same As Mortgage Rates

Rates for a home purchase and mortgage refinance are often similar.

However, some lenders will charge more for a refinance under certain circumstances.

Typically when rates fall, homeowners rush to refinance. They see an opportunity to lock in a lower rate and payment for the rest of their loan.

This creates a tidal wave of new work for mortgage lenders.

Unfortunately, some lenders dont have the capacity or manpower to process a large number of refinance loan applications.

In this case, a lender might raise its rates to deter new business and give loan officers time to process loans currently in the pipeline.

Also, cashing out equity can result in a higher rate when refinancing.

Cash-out refinances pose a greater risk for mortgage lenders, so theyre often priced higher than new home purchases and rate-term refinances.

Since rates can vary, always shop around when buying a house or refinancing a mortgage.

Comparison shopping can potentially save thousands, even tens of thousands of dollars over the life of your loan.

Here are a few tips to keep in mind:

1. Get multiple quotes

Many borrowers make the mistake of accepting the first mortgage or refinance offer they receive.

Some simply go with the bank they use for checking and savings since that can seem easiest.

However, your bank might not offer the best mortgage deal for you. And if youre refinancing, your financial situation may have changed enough that your current lender is no longer your best bet.

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

Don’t Miss: Can I Refinance An Upside Down Car Loan

How Do I Compare Current 30

The more lenders you check out when shopping for mortgage rates, the more likely you are to get a lower interest rate. Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

With NerdWallets easy-to-use mortgage rate tool, you can compare current 30-year home loan interest rates whether youre a first-time home buyer looking at 30-year fixed mortgage rates or a longtime homeowner comparing refinance mortgage rates.

Canada Vs Usa Mortgage Terms

Canadaâs mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners donât need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

Don’t Miss: How To Apply For Second Home Loan

How To Compare 30

If you compare loan offers from mortgage lenders, youll have a better chance of securing a competitive rate. Heres how to compare:

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

Read Also: Does Spouse Have To Be On Va Loan

Where Mortgage Rates Are Headed

Mortgage rates plunged early in the pandemic and scraped record lows below 3 percent at the start of 2021. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and rates rose past 5 percent in 2022.

Low interest rates were the medicine for economic recovery following the financial crisis, but it was a slow recovery so rates never went up very far, says Greg McBride, CFA, Bankrate chief financial analyst. The rebound in the economy, and especially inflation, in the late pandemic stages has been very pronounced, and we now have a backdrop of mortgage rates rising at the fastest pace in decades.

What The Forecast Means For You

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnt include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

Don’t Miss: Does Va Home Loan Cover Closing Costs

Renting Vs Buying A Home

Deciding whether it makes sense to rent or buy is about more than just comparing your monthly rent to a potential mortgage payment. How long you plan on staying in that area should also factor into the decision. Buying a home requires you to pay thousands of dollars in upfront fees. If you sell the house in the next two or three years, then you may not have enough equity built up in the home to offset the fees you wouldnt have paid if you were renting. You also need to factor in maintenance and upkeep costs with owning a home.

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Its important to understand that buying points does not help you build equity in a propertyyou simply save money on interest.

Also Check: What Debt To Income Ratio For Car Loan

The Ontario Housing Market: Things To Know

- Homes in Ontario typically cost above $675 000, which is higher than the national average.

- Residential property prices are expected to see steady gains, in part due to a growing demand for homes in Toronto and the greater Toronto region.

- The federal government has taken steps to make homeownership more affordable for certain first-time buyers whether in Ontario or nationally by introducing the First-Time Home Buyer Incentive.

- Before you start searching for your home, its important to consider how much debt you can take on. Enter your details to find out how much you might be able to borrow.

How Do You Lock In Your Va Loan Interest Rate

Buyers have to be under contract in order to be eligible for a rate lock. Once thats in hand, the timeline can vary depending on a host of factors, including the type of loan, the overall economic environment and more.

If you’re ready to see where rates are right now, or if you have more questions, contact a home loan specialist at 1-800-884-5560 or start your VA Home Loan quote online.

There’s no obligation, and you’ll be one step closer to owning your brand new home.

You May Like: What Is The Average Personal Loan Amount

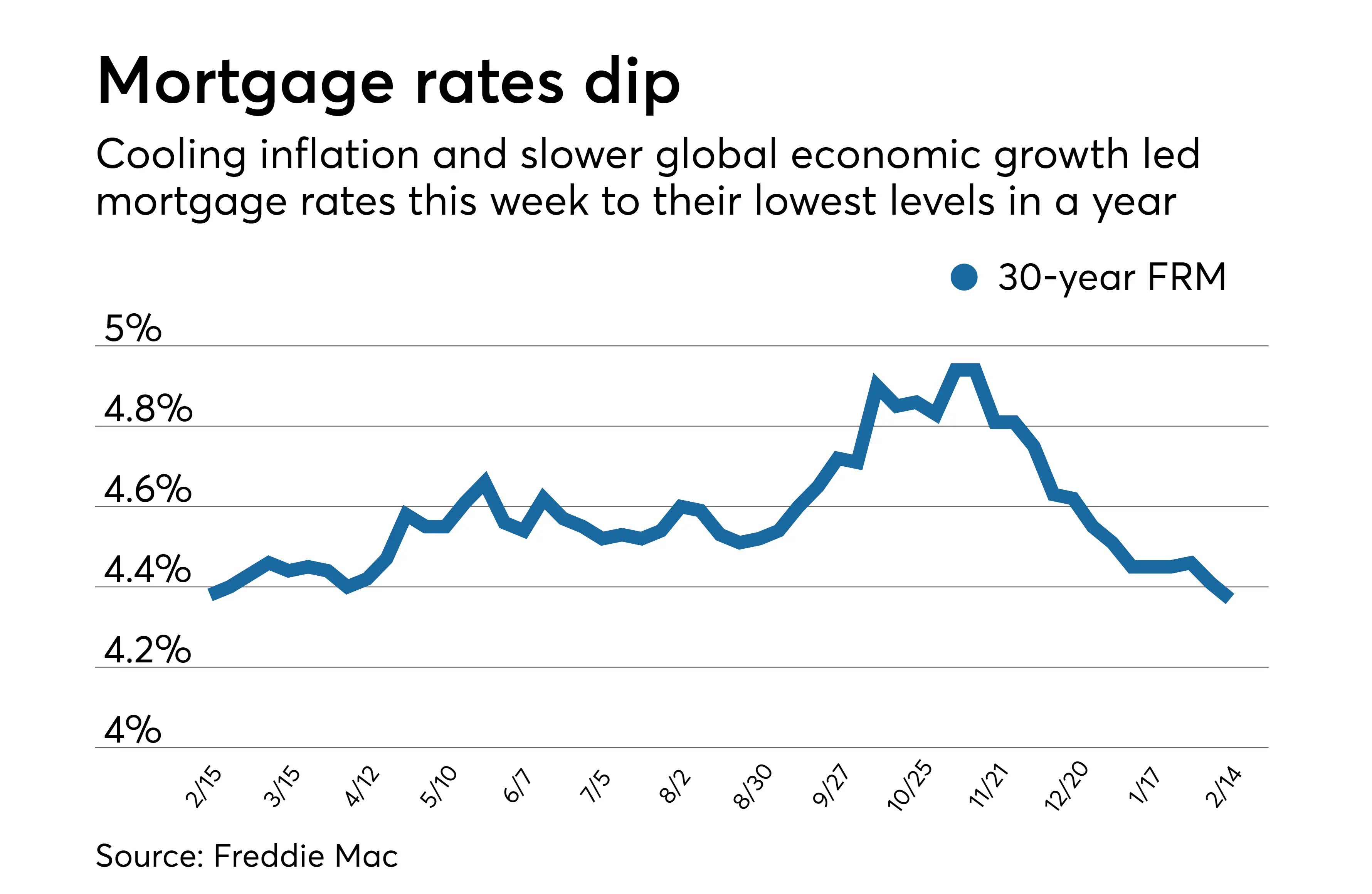

After Steep Rise Mortgage Rates Appear To Be Stabilizing

With inflation still running hot and the Federal Reserve responding aggressively, the average rate on 30-year mortgages has climbed significantly.

The bump comes as the Fed has moved to raise rates in 2022. The central bank is ramping up efforts to fight inflation, which has remained high after a bout of pandemic stimulus. In May, annual price increases clocked in at 8.6 percent.

Inflation is out of control and until it peaks, neither will mortgage rates, says Greg McBride, chief financial analyst for Bankrate.

While the central bank directly moves interest rates on some mortgage products, namely adjustable-rate mortgages and home equity loans. Fed policy has fewer ramifications for fixed mortgage rates, which more closely follow the 10-year Treasury yield. The 10-year Treasury does react to inflation, however, and also to investor sentiment, with the benchmark yield recently trending upward.

For borrowers, the spike marks an end to the historically low rates that characterized the period following the global financial crash of 2008 and 2009. Rates were as low as 3 percent in August 2021. In June 2022, they approached 6 percent. However, there are signs that the rate is leveling off and may even fall amid signs inflation is easing a bit.

How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thatâs because with bi-weekly payments, youâll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgageâs total cost of interest for a 25-year amortization at a 2% mortgage rate.

You May Like: What Is Escrow In Mortgage Loan

How Do I Qualify For A Mortgage

While itâs important to think about qualifying for the best rates, you should also give some thought to the basics that youâll need to qualify and get approved for your mortgage. To qualify for a mortgage, here are some of the most important things that prospective lenders will want to see.

A good credit score – You should have a credit score of 680 or higher to qualify for the best mortgage rates, but to qualify for a mortgage at all, youâll need a credit score of at least 560. In addition to looking at your credit score, prospective lenders will also consider any derogatory information from your credit report, such as any missed payments . If you have bad credit, generally defined as a credit score of less than 660, you are unlikely to qualify for the best mortgage rates, and instead youâll need to use a sub-prime mortgage lender like Equitable Bank or Home Trust. If your credit score is even less than 600, you will most probably need to use a private lender like WealthBridge. Sub-prime mortgage lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates. It’s a good idea to have a detailed understanding of how your affects your ability to obtain a mortgage.