Which Is Better When

Before deciding whether to apply for a HELOC or a home equity loan, consider how much money you really need and how you plan to use it. Factor in interest rates, fees, monthly payments and tax advantages as you weigh your options.

Using the equity in your home before selling can be a powerful financial benefit. But remember, you’re using your home as collateral. One risk to avoid, whether you choose a home equity line of credit or a loan: Resist funding short-term needs with what may eventually amount to a long-term loan.

Is A Home Equity Line Or Loan Right For You

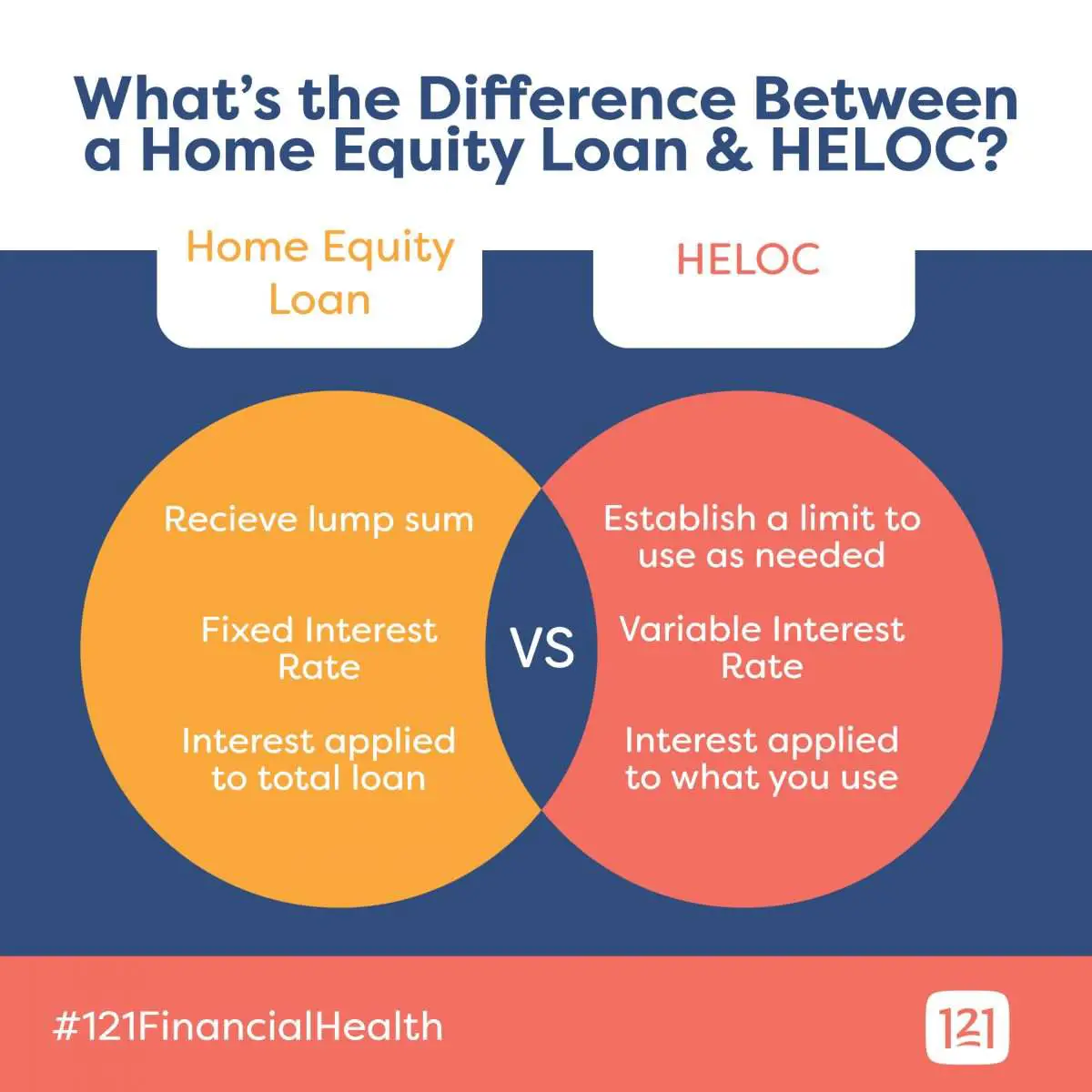

A HELOC gives you the flexibility of a financial backstop thats there when you need it. If your roof needs repair or a tuition bill comes due when youre short of cash, drawing on a home equity line of credit can be a convenient solution. You decide when to use the funds, and you pay interest only on the money you actually use. On the flip side, with a HELOAN, you get a lump sum of cash at loan closing, and know how much your monthly payments will be and how long it will take to pay off the loan.

With either, the amount you can borrow will depend on the value of your home and the amount of equity you have available. And with both, its important to remember that youre using your home as collateraland it could be at risk if its value drops or theres an interruption in your income.

But if you qualify and your financial situation is stable, a home equity line or a home equity loan could be a helpful, cost-effective tool for making the most of your homes value.

Ready to apply? Apply online now

Advantages And Disadvantages Of Home Equity Loans

Home equity loans can be a great solution for some borrowers and offer certain advantages over other types of loans:

- Home equity loans may offer lower interest rates and access to larger funds. A home equity loan often comes with a lower interest rate than other loans since your home is secured as collateral. This type of financing also typically offers more money all at once than personal loans or credit cards, which may be useful if you only need to make a one-time large purchase.

- There may be tax perks. If you’re using the loan to make home improvements, you may be able to deduct the interest if you itemize your income taxes.

- Home equity loans may offer a greater degree of flexibility than other loans. Home equity loans can be used for anything, from financing a car to going on vacation. This differs from some other loans that are earmarked for a specific purpose.

However, home equity loans aren’t right for everyone. It’s important to be aware of the risks associated with these types of loans as well:

Also Check: What Is Equity Reserves Fha Loan

Heloc Vs Home Equity Loan Vs Personal Loan

What’s the difference? And which one will work best for your needs, lifestyle and budget?

If you’re a homeowner interested in consolidating debt, starting that remodeling project or paying for unexpected expenses, you might be considering different borrowing options such as a home equity line of credit , a home equity loan, or a personal loan. But which one is best for you?

Heres a quick look at each option’s key differences and advantages, along with examples of how they can be used, giving you greater confidence in deciding the right loan for you:

Is A Home Equity Loan Better Than A Home Equity Line Of Credit

There are plenty of good reasons for either a home equity loan or a line of credit. This is especially true compared to a personal loan, where you definitely cant get a tax deduction on the interest you pay. But which option you choose really depends on how you plan to use the money, how youd prefer to pay it back, and if the money is tax-deductible.

A home equity loan is best if you have a specific need for a lump sum of money and youre comfortable taking on a second mortgage payment. Since this is a fixed-interest rate loan, you should also prefer predictable monthly payments.

If youre not necessarily sure what you want to do with the money but still want cash available , then a variable interest rate line of credit might be the better option for you. One of the best things about a HELOC is that you can borrow as much or as little as you need at any given time and are only required to pay interest on the money during the draw period.

Just remember that none of the HELOC or home equity loan interest is tax deductible unless you use the money to make significant improvements to the property. According to the IRS, this means the improvements must add to the value of your home, prolong your homes useful life, or adapt your home to new uses. For example, new furniture may improve the look of the home, but it does nothing for its value.

Read Also: Can My Girlfriend Be On My Va Loan

Still Cant Decide Get The Best Of Both

Knowing just the amount of the monthly payment or the interest rate is not enough. Pay close attention to fees including the loan processing fee, prepayment penalties, minimum draw requirements, appraisal, closing costs, document preparation, and recording fees or origination fees.

Our flexible 3-in-1 Advantage Plan puts you in control of a home equity plan that can change as often as your needs. This plan allows you to:

- Take advantage of a line of credit and a credit card.

- Take any portion of your line, convert it to a fixed-rate advance, and choose your repayment term…no application needed.

- Get up to three fixed-rate advances at a time.

- Each advance works like an installment loan with fixed payments for the term you choose.

- Fix your rate anytime without an application.

Having a credit line, fixed-rate advances, and a credit card all-in-one plan is an effective combination of features. If you want to learn more about home equity loans, HELOCs, or our 3-in-1 Advantage Plan, check out our Home Equity Loan options or download our free Equity Edge eGuide today.

How Does The Fed Rate Increase Impact Home Equity Products

Lenders often base home equity product rates on the prime rate, which is generally three percentage points higher than the fed funds rate. Consequently, the Federal Reserves recent rate hikes have led to more costly home equity loans and HELOCs.

If youre seeking a home equity loan, you do have some form of certainty regarding borrowing costs because interest rates on these products are generally fixed. This isnt the case with HELOCs, as they come with variable interest rates. Your monthly payments could continue to rise with subsequent Fed rate hikes.

You May Like: How To Apply For Home Equity Loan With Bad Credit

Can You Have A Heloc And A Home Equity Loan

Theoretically, there is no limit to the number of home equity loans or lines of credit you can hold simultaneously, but itll be harder to qualify with each new application because youll have less and less equity to tap with each loan.

For instance, if you have a home valued at $500,000 and two home equity loans totaling $425,000, youve already borrowed 85 percent of your homes value the cap for many home equity lenders.

A lender might also charge higher interest rates on additional loans or lines of credit, especially if you ask for a second loan from the same lender.

Pros Of A Home Equity Loan

- Youll get a fixed interest rate and predictable monthly payment.

- Youll get all of the loan proceeds at closing and can spend them however you see fit.

- Some lenders dont charge origination fees on home equity loans, whichll save you money at closing.

- The interest paid on the loan might be tax-deductible if the funds are used to upgrade your home.

Don’t Miss: What Bank Has The Best Car Loan Rates

When Is A Home Equity Loan Better Than A Home Equity Line Of Credit

A home equity loan is a better option than a home equity line of credit if:

- You know the exact amount that you need for a fixed expense.

- You want to consolidate debt but dont want to access a new credit line and risk creating more debt.

- You live on a fixed income and need a set monthly payment that doesnt fluctuate.

Common Uses Of A Heloc

Some of the most popular ways homeowners use HELOC funds include:

- Home improvements – Using your home equity to pay for home improvement projects that increase the value of your home can be a smart move.

- Medical expenses – A HELOC may be a good option if you have large or ongoing medical expenses and want to take advantage of lower interest rates.

- Large purchases – Because HELOCs have longer repayment periods than many loans, they may be an attractive choice for making large purchases.

- Tuition or education costs – HELOCs often have lower interest rates than student loans, though some lenders may place restrictions on how you can use the funds.

- Debt consolidation – A HELOC may be a good choice for consolidating credit card debt. However, be careful not to rack up even more debt during the HELOC’s draw period.

Also Check: How To Select Student Loan Repayment Plan

Home Equity Loan Vs Line Of Credit: Which Should You Choose

Whether youre trying to consolidate high-interest , finance a home improvement project, or borrow for any other reason, home equity loans and lines of credit can be a great way to borrow at a low interest rate. But which is best? This home equity loan vs. line of credit review guide will help you decide which is best for you.

Both options use the equity you have in your home as collateral, so you can get a better interest rate than if you were to use a personal loan. As such, its important to use one of these products only if you know for sure that you can make the payments. Otherwise, the lender might repossess your house.

So, whats the difference between a home equity loan and a home equity line of credit ? Which option is better? Lets find out right now.

Whats A Home Equity Line Of Credit

This type of financing, also known as a HELOC, is a revolving line of credit, much like a credit card except it is secured by your home. The lender approves you for a certain amount of credit. Generally, as long as you stay under that credit limit, you can borrow as much as you need, any time you need it, by writing a check or using a credit card connected to the account. Many HELOCs have an initial period of time a draw period when you can borrow from the account. After that, you might be able to renew the credit line but if not, you will probably have to start repaying the amount due either the entire outstanding balance or through payments over time. HELOCs generally have variable interest rates and payments so the rates and payments can go up or down over time.

Like home equity loans, you use your home as collateral for a HELOC. This can put your home at risk if you cant make your payments or theyre late. And, if you sell your home, most HELOCs make you pay off your credit line at the same time.

Recommended Reading: How To Get Cash Loan Same Day

How To Apply For A Heloc

With most HELOC lenders, you can generally get the application process started in just a few minutes online. Youll simply enter some personal and financial information, such as your name, address, salary, desired loan amount and estimated credit score.

To apply for a HELOC, start with these steps:

Which Gets Me Money Faster: A Heloc Or A Home Equity Loan

If you need money as quickly as possible, a HELOC will generally process slightly faster than a home equity loan. Multiple lenders advertise home equity loan processing time lines from two to six weeks, whereas some lenders advertise that their HELOCs can close in less than 10 days. The actual closing time will fluctuate based on the amount borrowed, property values, and creditworthiness of the borrower.

Recommended Reading: How To Apply For Fha Loan In Kentucky

What Does It Mean To Use My Home As Collateral

You use your home as collateral when you borrow money and secure the financing with the value of your home. This means if you dont repay the financing, the lender can take your home as payment for your debt.

Refinancing your home, getting a second mortgage, taking out a home equity loan, or getting a HELOC are common ways people use a home as collateral for home equity financing. But if you cant repay the financing, you could lose your home and any equity youve built up. Your equity is the difference between what you owe on your mortgage and how much money you could get for your home if you sold it. High interest rates, financing fees, and other closing costs and credit costs can also make it very expensive to borrow money, even if you use your home as collateral.

The Bottom Line With Installment Vs Revolving Credit Accounts

Installment loans are credit accounts repaid in equal payments, while revolving account payment requirements will change depending on usage. Installment accounts will work best if you know exactly how much money you need to borrow and want predictability with your payments. Revolving credit accounts work best if you are unsure how much money you need to borrow, want to build your credit, and dont mind a little bit of instability on your payments.

You May Like: How Do I Pay My Huntington Auto Loan

Reverse Mortgage Vs Home Equity Line Of Credit : Which Option Is Best For Tapping Into Your Equity

As the equity in your home increases, it opens up the opportunity to take advantage of that wealth you are growing. And there are several ways to do that without having to sell your home.

Two options to consider for turning that equity into cash are a reverse mortgage and a home equity line of credit .

But which one should you choose? In this article, we are going to learn the similarities and differences between a reverse mortgage and a HELOC, how they work, and what scenarios would make one a better option over the other.

Lets dive in.

How To Calculate Home Equity

To find the amount of equity you have in your home, you first need to determine the value of the home. You can do this through a home appraisal, which estimates the homeâs value based on a number of things, including recent sales of similar properties in your area. Once youâve determined the value of your home, you then subtract the total amount of debt secured by the property . The amount left represents your equity in your home.

Recommended Reading: Is There Any Loan For Buying Land

Are There Exceptions To The Three Day Cancellation Rule

Yes, the federal rule doesnt apply in all situations when you are using your home for collateral. Exceptions include when

- you apply for a loan to buy or to initially build your main residence

- you refinance your mortgage with the same lender who holds your loan and you dont borrow more funds

- a state agency is the lender for a loan

In these situations, you may have other cancellation rights under state or local law.

Big Banks Vs Small Banks

Its the eternal questionDavid or Goliath? When youre looking for low interest rates on a loan, theres no clear-cut answer to which is better. In broad comparisons, similar interest rates can be found at small or regional banks as at large national banks. But within each category, rates can vary widely.

While the small town bank may know your name, its rates may or may not be competitive. Still, if you already have an account at a local bank, its a good place to start your search for a home equity loan. It may have an extra incentive to offer you a lower rate or some reduced fees in hopes of keeping your business.

One thing to be aware of is that some banks stop issuing new home equity loans and home equity lines of credit in volatile markets. For example, as of June 2022, Citi and Wells Fargo arent offering home equity loans. U.S. Bank does offer home equity loans and Bank of America only provides home equity lines of credit with a variable interest rate.

Read Also: How To Combine Mortgage And Home Equity Loan