Power Of Attorney Purchases

Military members must often travel or deploy. Some military families may try to purchase a home at their next duty station while still living at their current duty station.

Service members who cant purchase a home in person may use a power of attorney to close their VA loan. Closing a sale with a power of attorney shouldnt pose any additional issues for the seller, as long as sellers know that someone besides the buyer might be present at the closing.

Best Va Loan Lenders Of September 2022

Fernando García DelgadoClaudia Rodríguez HamiltonFernando García Delgado27 min read

Offering a wide range of VA Loans for active-duty service members, veterans, or their family

Offering a wide range of VA Loans for active-duty service members, veterans, or their family

- Free credit consulting service

- The minimum credit score required is 620

- Loan terms: 15 and 30 years

- Minimum down payment required: 0% for qualifying buyers

- Provides extensive customer service hours

- The minimum credit score required is 620

- Loan terms: 15, 25, and 30 years

- Minimum down payment required: 0%

- Discloses the latest rates online with daily updates

- The minimum credit score required is 580

- Loan terms: 30 years

- Minimum down payment required: 3%

- Waives origination fees on all VA home loans

- The minimum credit score required is 680

- Loan terms: information unavailable

- Minimum down payment required: 0%

- Easier qualification compared to conventional loans

- Rates as low as 2.750% APR

- Quick, easy application process

- Get the best rates by letting banks compete for your business

- Calculate what you can afford with VA Loan Calculator

- Free personalized mortgage rates in minutes

- 100+ years serving military members

- $0 down VA loan options

- USAA Bank is an Equal Housing Lender

- Membership not required for a loan inquiry, but is for a preapproval or application

See our VA loan guide to learn more about the type of loans available and the Veterans Affairs s service requirements.

How To Apply For A Va Loan

If you think you’re eligible, you first need to apply for a Certificate of Eligibility, either through your private lender or the VA’s eBenefits online portal. Veterans and former National Guard or Reserve members who have been activated must provide discharge or separation papers . Current service members, as well as National Guard or Reserve members, will need to show a statement of service that’s signed by their commander, adjutant or personnel officer.

The following information must be included in your statement of service:

- Date you entered the service

Recommended Reading: How To Trade In Car With Existing Loan

What Is A Va Renovation Loan

A VA renovation loan, sometimes called a VA rehab loan, is a home loan that allows borrowers to include the cost of certain repairs or improvements in their loan amount.

This makes it possible for VA loan borrowers to purchase a home in need of repairs or upgrades without having to get a separate loan rather, the repair costs and purchase price are rolled into a single loan with one monthly payment. These loans can also be used to refinance an existing loan.

Other Va Loan Lenders We Considered

While there are many mortgage lenders with outstanding products and features, they dont necessarily have everything that could make them one of our top picks.

We reviewed the following lenders, and while they meet some of our criteria for top VA loan lenders , they ultimately didnt make the cut.

Veterans First

Thanks to its fully online mortgage process, Veterans First is a great choice for military members deployed overseas. Its focus on VA loans also means that the company is better prepared to attend to the specific needs of military members and veterans during the mortgage process.

On the other hand, Veterans Firsts specialization in VA loans means that it offers no other types of loans, which makes it less than ideal for anyone who doesnt qualify for these products. Its higher than average credit score requirement was also a deciding factor in keeping it out of our top list.

North American Savings Bank

North American Savings Bank is dedicated to servicing customers in the Kansas City, MO area, but it extends its mortgage services to individuals all over the U.S. In addition to standard VA loan products , it offers many mortgage options for individuals who are unable to provide traditional credit and income data.

- 12 branch locations limited to Missouri

- VA mortgage rates are higher than average

Recommended Reading: Who Can Refinance My Car Loan

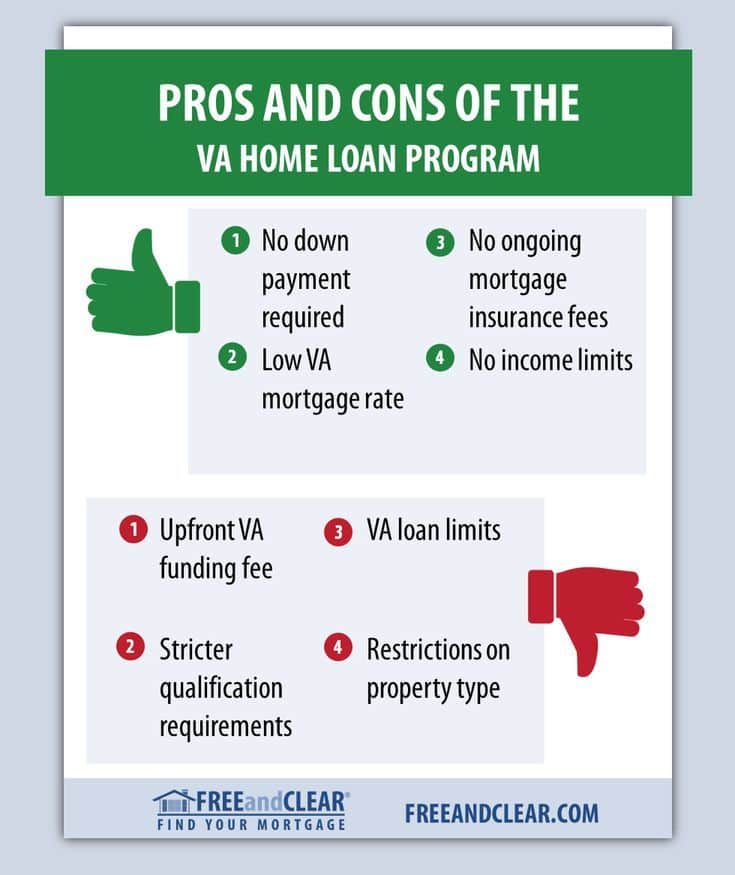

Advantages Of A Va Home Loan

First, some of the advantages of a VA mortgage. The government guarantees at least one-quarter of the loan amount on a VA mortgage, which is why you don’t need to put up a down payment. Its also why you don’t have to buy mortgage insurance, which is required on FHA loans and conventional mortgages with less than 20 percent down.

Closing costs are also limited on VA loans, with the lenders fees limited to 1 percent of the loan amount and restrictions on the types of fees that can be the buyers responsibility. On the other hand, the seller may pay all closing costs plus an additional 4 percent in concessions, which effectively reduces the purchase price of the home.

In addition, the maximum you can borrow is typically greater than what you can get in an FHA or even conventional Fannie Mae or Freddie Mac loan. Although the standard loan limit is only $647,200, in reality you can borrow far more, up to $1,000,000 in certain high-priced markets. By comparison, the maximum you can get on an FHA or Fannie/Freddie loan in even the most expensive areas is $970,800.

Finally, if you eventually run into financial difficulty, its usually easier to obtain forbearance on a VA mortgage than on other types of home loans.

Risk Of Borrower Being Deployed

With active military members, there is always the potential of deployment. As a result, it is possible for service members using a VA loan to close on the home via power of attorney . The use of this legal instrument can catch sellers by surprise. It could even be regarded as a downside from the seller’s point of view, as they want to know who they’re selling to. The seller might prefer a buyer they can get to know and connect with over one that is nameless and requires a POA.

Keep in mind that this might not be an issue for most sellers. But others prefer to meet a buyer and get to know them before accepting their offer.

Read Also: What Is The Best Online Loan

Do Sellers Prefer Va Loans Or Conventional Loans

One big challenge for veteran home buyers is that sellers tend to favor conventional loans over VA loans.

In todays market, with multiple offers for sellers to review, sellers may prefer contracts with conventional financing over VA financing. Typically, the appraisal with conventional financing will list the property as-is, while a VA appraisal will often have additional requirements, which can sour the deal in the eyes of sellers, Crist cautions.

Still, VA loans typically offer better deals for buyers than conventional loans. So its worth working with your real estate agent and the sellers agent to see if you can get the offer accepted as-is.

Make sure the seller and their agent understand how VA loans really work, and that they arent acting under any misconceptions about the VA mortgage program. This could help in getting your offer accepted.

Can I Use A Va Streamline To Refinance Another Type Of Loan

No. VA streamlines are intended for VA-to-VA refinances only. If you have a conventional, FHA, USDA, or other type of loan, you could possibly use a VA cash-out refinance. You would need an appraisal, plus income, asset, and credit documentation to qualify. And, of course, youd need to be a service member or veteran to qualify.

Also Check: How To Lower Interest Rate On Car Loan

Latest News On Va Loans

To learn more about mortgage loans, we recommend you start with our guide on 9 Types of Morgage Loans. Our guide includes in-depth information on loan types, terms and interest rates.

If youre looking to purchase your first home, you can also read our first-time homebuyer guide about the different programs that can help you achieve your homeownership goals.

Although the VA loan program offers favorable terms like no down payment and no private mortgage insurance to those who qualify, private institutions still issue the loans just like any other mortgage. To make sure you save money and make the most out of your VA loan benefit, weve put together an article on the 5 Tips for Getting the Best VA Loan Rate.

Finally, VA loans don’t require a down payment because the government guarantees the loan. However, putting money down can cut your costs in the long run. Read our latest article to learn more about the advantages of making a down payment on a VA loan.

Potential Disadvantages Of A Va Loan

Advertiser Disclosure: Opinions, reviews, analyses & recommendations are the authors alone. This article may contain links from our advertisers. For more information, please see our .

A VA loan may be one of the best deals in the mortgage industry. But despite benefits including no down payment, relaxed credit guidelines and less restrictive income requirements, there are disadvantages of a VA loan.

These disadvantages are worth being aware of before applying for a loan, and in some cases you may need to apply for a different type of financing.

You May Like: How Much Home Loan Can I Get Calculator

What Is A Va Home Loan And Who Qualifies

If you’re a veteran, this type of mortgage can eliminate your down payment and help you save you in interest.

Amanda Push

Amanda Push is a writer based in Colorado who covers personal finance, technology, safety and security, moving, and more. Her writing has also been featured at TheSimpleDollar.com, Interest.com, MyMove.com, and Safety.com.

Alix Langone

Reporter

Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry. She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine. She has written for various publications, such as Fortune, InStyle and Travel + Leisure, and she also worked in social media and digital production at NBC Nightly News with Lester Holt and NY1. She graduated from the Craig Newmark Graduate School of Journalism at CUNY and Villanova University. When not checking Twitter, Alix likes to hike, play tennis and watch her neighbors’ dogs. Now based out of Los Angeles, Alix doesn’t miss the New York City subway one bit.

Coming up with the down payment on a home can feel like an insurmountable hurdle, especially when you factor in all the other upfront costs. That’s why a VA-backed home loan — which requires no down payment and allows for lower credit scores — could be your ticket to home ownership. To qualify for a VA loan, you or your spouse must be a current or former member of the US military.

When Is A Va Loan Better

If you qualify for a VA home loan, chances are that its going to offer a better financing deal for you than a conventional loan. Thats because you dont have to put any money down, pay any PMI, or worry about exceeding a maximum loan amount.

Say you are a veteran who wants to purchase a $300,000 home as a first-time buyer, says Davis. Assume you only have $6,000 in savings, which is not enough money to purchase a home using a conventional loan or an FHA loan. You can utilize your VA benefit to purchase the home with zero dollars down and structure the loan either with a lender credit or seller credit to help pay closing costs.

In other words, a VA loan is a better bargain here, especially if you dont have sufficient funds for a down payment.

Another example where a VA loan is a better option would be if a borrower has a credit score below 620 as well as no money for a down payment. A VA loan is the optimal choice in this situation, says Atapour.

Also Check: Credit Union Private Party Auto Loan

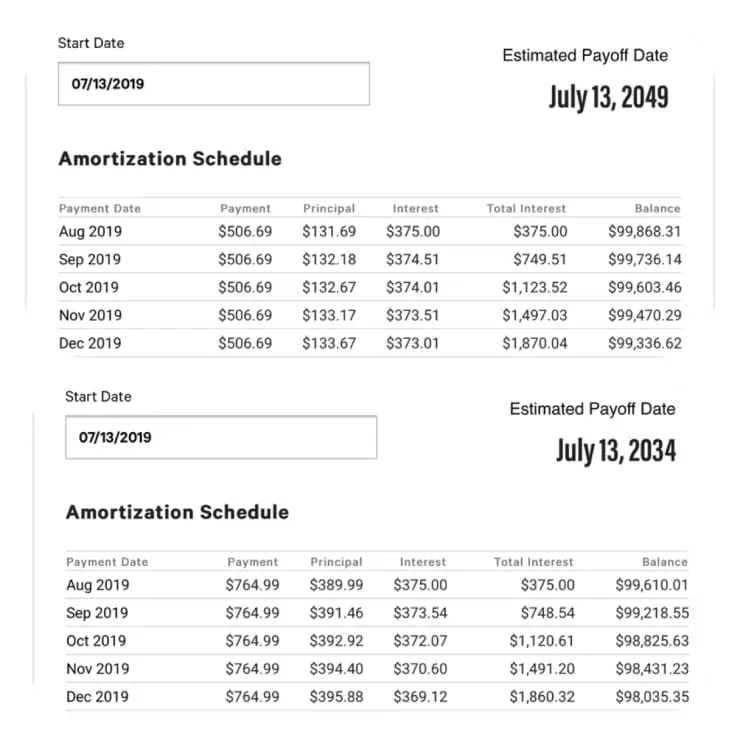

Lower Interest Rates And Closing Costs

Of all the loan types on the market, VA loans are one of the cheapest when it comes to closing costs and interest rates. Interest rates on any government-backed loans tend to be lower when compared to conventional mortgages. By choosing a VA loan, you could significantly reduce your potential monthly mortgage payments.

Closing costs on a VA loan are another expense that can make mortgages much more expensive than they first appear. These costs can be as much as 3% to 5% of the price of the home, and can vary by lender. VA loans differ in that they give borrowers the option to limit what they have to pay.

How We Chose The Best Va Loan Lender

Given that many mortgage lenders offer similar products across the board, we narrowed our search criteria to three factors: rates, experience and customer service.

- Rates – We chose VA loan lenders that offered the lowest rates to ensure your mortgage payments fall in line with your budget.

- Experience in VA Loans – We prioritized VA mortgage lenders that process many VA loans. Having a VA mortgage lender who is familiar with this process ensures that every step is taken care of on time.

- Customer Service – We highlighted VA mortgage lenders that excel in customer satisfaction and provide first-time homeowners step-by-step guidance throughout the pre-approval, application and loan closing.

We also made sure that our picks are registered with the Nationwide Multistate Licensing System and Registry and meet the minimum certification requirements for mortgage lending.

Also Check: How Much Can I Get Approved For Usda Loan

Va Streamline Refinance Funding Fee

VA loans do not require ongoing mortgage insurance like most other mortgage types, but they do require an upfront VA funding fee.

For the VA IRRRL, the funding fee is usually 0.50% of the new loan amount. This is much less than the 2.3% to 3.6% first-time borrowers or cash-out refi applicants pay upfront.

The funding fee can be waived for veterans who are disabled because of service-related lenders.

Do Va Loans Vary By Lender

The two main ways a VA loan can vary slightly from lender to lender are the rate and the minimum credit score. The VA does not underwrite the loan it provides a guarantee to the lenders who offer the loan program. The lenders determine the rates they will offer, as well as the other underwriting guidelines they will adhere to, such as your credit history and debt-to-income ratio.

The benefits of a VA loan are the same no matter which lender you choose. The key benefits of the program are no down payment requirement, no PMI requirement, and no prepayment penalties, with a VA funding fee taking the place of the PMI.

Also Check: How To Pay Off Student Loan

Summary: When To Consider Va Versus Conventional

In the vast majority of cases, veterans get the best deal buy taking advantage of their VA benefit. Later in life, if youve owned a home for several years and have built up equity, there may be instances when other loan products are better than VA programs. First, for folks that are 62 years or older, VA doesnt offer their version of a reverse mortgage. Your loan officer can always run different scenarios to find the best deal given your unique circumstances.

When Is A Conventional Loan Better

Despite all the perks of a VA loan, a conventional loan may be a better option under certain circumstances.

Imagine you want to purchase that same $300,000 home as a first-time buyer. But in this scenario, you have $60,000 to put down and there are 15 other offers on the house you want to purchase, Davis explains.

Here, a VA offer is unlikely to get accepted over a conventional offer because there is a greater perceived risk of issues with appraisal. But since you have 20% to put down, you can purchase the home with no mortgage insurance.

Davis adds, If your main priority is to get the house, a conventional loan might be the way to go even if you qualify for both a conventional loan and a VA loan.

You May Like: Can I Pay Off My Child’s Student Loan

Pros And Cons Of Conventional Loans

When it comes to conventional loans, they typically close faster than VA loans.

Conventional loans also can receive appraisal waivers, reducing your closing costs and increasing certainty of closure for a real estate purchase, says Davis. And there is no funding fee for a conventional loan.

As mentioned before, primary, second, or investment properties can all be purchased with a conventional loan. And home sellers often look more favorably on a conventional loan than a VA loan.

Conventional mortgages, however, require you to purchase private mortgage insurance if you are paying less than 20% down. And unlike VA loans, they usually require a down payment of 3% or more, notes Nik Shah, CEO of Home.LLC.

Furthermore, unlike VA loans, conventional loans have maximum loan limits. These are set by each county in most counties, the max loan amount you can borrow is $ for a single-family home.

The Va Loan Pros And Cons Every Veteran Should Know

As a veteran-owned-and-operated business, we know the importance of doing right by those who have served our country. We know that few things are as life-changing as buying a home, so were going over the VA loan pros and cons every veteran should know.

If youre a veteran, active duty service member, or a widowed military spouse, you may qualify for a VA home loan. You may also qualify if youve served for more than six years in the Selected Reserve or National Guard.

In this blog, well explore what a VA home loan is and how it can empower our nations bravest to attain homeownership. Keep reading to learn more about this unique mortgage product and how it can help you become a homeowner.

What is a VA home loan?

Simply put, a VA home loan is a mortgage administered by a private lender and is backed by the United States Department of Veteran Affairs. Because of this federal guarantee, these mortgages operate somewhat differently than the traditional mortgages available to the general public.

If youre unable to fulfill your loans terms, the federal government will pay the remaining balance of what you owe. This is why lenders appreciate VA home loans as much as the borrowers who use them. Its a win-win for all involvedveterans have an easier time attaining financing, and lenders get peace of mind.

The list of VA loan pros and cons has a lot working in its favor. Lets explore other advantages of this dynamic product.

Here are some of the advantages

You May Like: Can I Use 529 To Pay Student Loans