Student Loan Interest Deduction Phase

The phase-out ranges for this tax credit depend on your filing status. As of tax year 2020, the return you would file in 2021, they were:

| Filing Status | |

| $70,000 | $85,000 |

These figures are adjusted for inflation, so they can change slightly year to year. The IRS typically announces inflation adjustments at the end of the tax year. These thresholds were accurate as of November 2020.

You can deduct up to $2,500 in student loan interest or the actual amount of interest you paid, whichever is less, if your MAGI is under the threshold where the phase-out begins. Your limit is prorated if your MAGI falls within the phase-out rangefor example, $70,000 to $85,000 if youre single.

Unfortunately, your student loan interest isnt deductible at all if your income is more than the ceiling where the phase-out ends.

Dont Miss: Avant Refinance Loan Application

Can You Claim Student Loan Interest Under $600

Paying interest on a student loan for yourself, your spouse or a dependent may make you eligible for the student loan interest deduction. 31 if youve paid at least $600 in interest on a qualifying student loan. If youre paying off multiple loans with more than one servicer, you may receive several 1098-E forms.

Dont Fear The Marriage Penalty

The marriage penalty is an industry name for a total tax bill being affected by a married couple filing their taxes jointly. Often, joint filing can result in a higher total tax bill than if the couple filed separately.

There arent any situations where being married and filing separately would be beneficial while deducting student loan interest on taxes. In fact, married couples filing separately are not eligible for the student loan interest deduction.

Also Check: How Long It Takes For Sba To Approve Loan

Find Out How Much Interest You Paid

To find out how much interest you paid on your student loans during the tax year, look for the Form 1098-E, Student Loan Interest Statement from your loan servicers. Any loan servicer that collected at least $600 in interest from you is required to send you a Form 1098-E by Jan. 31, either electronically or by mail.

If you paid at least $600 in interest during the tax year but made payments to multiple servicers, you can request a Form 1098-E from each servicer even if they collected less than $600 in interest from you. If you paid less than $600 in student loan interest, you can contact each of your servicers for the exact amount of interest paid during the tax year.

Do Student Loans Affect My Tax Returns

It depends. If you are still in school and receiving money from student loans, you should not consider that income, since you are obligated to pay it back.

If you have graduated and are making payments on your student loans, then your student loans may affect your tax returns. Depending on your income, type of loan and tax filing status, you may be able to deduct some of the student loan interest you pay.

Don’t Miss: Mortgage Loan Signing Agent

Can I Claim Interest Payments On Refinanced Student Loans

There is a common misconception that once you refinance student loans with a private lender, you can no longer claim student loan interest payments on your taxes. However, this isnt true you can deduct interest payments made toward any type of student loans, both federal and private.

Even though the IRS is a federal agency, private student loan interest payments are still eligible for tax deductions. As long as you meet the eligibility and income requirements as outlined above, you are good to go. If you are considering refinancing your federal student loans, dont fall into the trap of believing you wont be eligible for the deduction.

Do I Qualify For The Student Loan Interest Deduction

If you are a recent college grad struggling to pay down your student debt, it may feel like youll never catch a break. Fortunately, there is a tax deduction that could help offset a portion of your expenses. Learn more about the student loan interest deduction and how you can claim this write-off on your tax return. Then file with TaxSlayer Simply Free to claim this deduction for free.

Read Also: Apply For Second Upstart Loan

Are Student Loan Payments Deductible

When you repay student loans, you pay down the original balance and the interest that has accrued on that balance. You can deduct that interest on your taxes, but the entire student loan payment amount is not tax-deductible.

For example, say you have a $29,000 student loan with an interest rate of 5%. At the start of the standard 10-year repayment plan, you’d pay roughly $308 each month with about $121 of that payment going toward student loan interest.

Over your first year in repayment, you’d repay $3,691 overall: $2,293 in principal and $1,398 in interest. If you qualified for the student loan interest deduction, you could reduce your taxable income by the portion that went toward interest.

This includes not just newly accrued interest like that $1,398 but also any money that pays off interest that was capitalized, or added to your balance, when you entered repayment.

Will The Irs Take My Refund For Student Loans 2021

Will my federal student loan debt be collected if I’ve defaulted? Debt collection is suspended for borrowers who have defaulted on federal student loan debt through September 30, 2021. This means collectors will not take actions to collect payment, such as deducting from a tax refund or garnishing wages.

You May Like: Va Mpr Checklist

Who Qualifies For The Student Loan Interest Deduction

In order to qualify for the student loan interest deduction, there are a few criteria you need to meet.

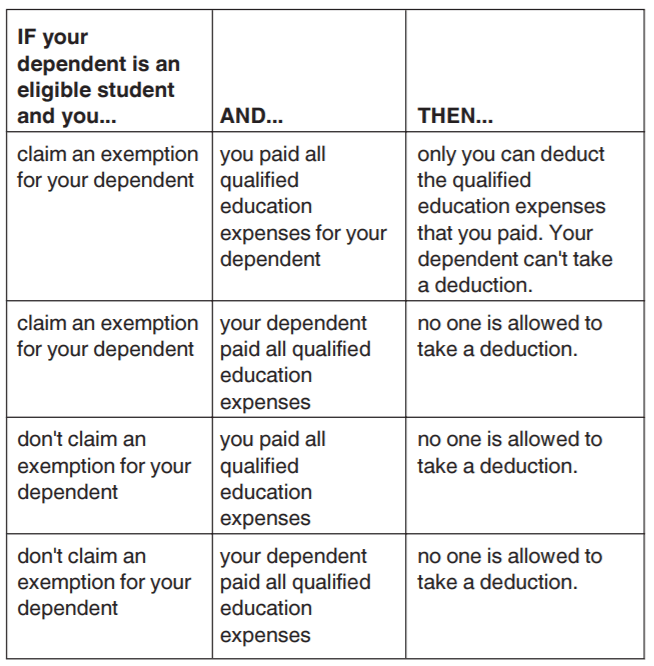

For starters, the loan youâre paying must have been for you, your spouse or a dependent. You cannot claim the deduction if someone else can claim you as their dependent, even if youâre the one who made the loan payments.

You can claim the deduction if your filing status is single, head of household, married filing jointly, or qualifying widow. You cannot claim the deduction if you are married but filing separately.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

How much of the deduction you can claim, if you can claim anything, also depends on your income.

Do Student Loans Count As Self Support

Student loans dont constitute income. However, the student loans are considered support to test if the person qualifies as your dependent. Usually, the cost of education is considered a form of support. If you, as the parent, take out a loan to pay for your childs education, you have provided the support.

Read Also: How To Calculate Va Loan Amount

Who Can Claim The Student Loan Interest Deduction

There are three criteria that taxpayers must meet in order to claim the credit: The taxpayer, their dependent, or another party pays for qualified higher education expenses. The taxpayer, their dependent, or another party pays the expenses for an eligible student enrolled at a qualified institution.

Claiming The Student Loan Interest Deduction

To claim the student loan deduction, enter the allowable amount on line 20 of the Schedule 1 for your 2019 Form 1040.

The student loan interest deduction is an above the line income adjustment on your tax return. That means you can claim it regardless of whether youre claiming the standard deduction or itemizing deductions.

If youre using tax preparation software like TaxAct, it will do much of the work for you. Heres what you need to know if you need help calculating the allowable amount to enter on line 20.

Tip:

Recommended Reading: How Much Of A Loan Can I Get For A Car

There Are Income Limits

The student loan interest deduction phases out at higher incomes, so youll be ineligible to claim the deduction if you make too much money.

- If you make more than $85,000 as a single filer, you cant get the student loan interest deduction.

- If you make more than $170,000 if married, filing jointly, you arent eligible for the student loan interest deduction.

Student Loan Interest Deduction Form

If you paid more than $600 in interest in 2020, you will automatically receive form 1098-E a student loan interest deduction form in the mail or by email.

You may have paid less than that amount because interest rates on federally held loans were frozen at 0% and payments were suspended for most of the year. But you can still deduct whatever you did pay if you otherwise qualify.

If you don’t receive a student loan interest deduction document, ask your student loan servicer to send it to you. A copy of the form, as well as details on how much interest you paid, may also be in your account on your servicer’s website.

Don’t Miss: Does Upstart Allow Co Signers

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Avoid Default At All Costs

Not only can defaulting on a student loan hurt your credit and cost you extra money, defaulting has other potential consequences. Your wages could be garnished and your tax refund withheld. Your tax refund is at risk if you default on your loans, but this wont happen if you take steps to set up a repayment plan or forgiveness program.

If you are struggling with student loan payments, consider calling your servicer to create a plan that will help you better manage the cost. You might be eligible for a hardship program, an income-based repayment plan or a settlement.

You May Like: Usaa Auto Refinance Rate

Not All Loans Are Eligible For The Student Loan Interest Deduction

The student loan interest deduction may be available to you if you meet certain key criteria. According to the IRS, student loan interest is tax deductible if:

- You took out the student loan for yourself, your spouse or any person who was a dependent at the time when you borrowed. The deduction is available for both federal loans and private loans.

- The loan was taken out to cover the costs of educational expenses during an academic year. You can only deduct interest if the student loan covered school-related expenses, including tuition or room and board. If you funded personal expenses not directly related to your education, like buying a car while in school, youre supposed to reduce your deduction.

- You were legally obligated to pay the interest on the student loan. If you pay on your childs student loan but arent obligated to pay the interest, you cant deduct it.

The Tuition And Fees Deduction

The deduction for tuition and fees expired on December 31, 2020. However, taxpayers who paid qualified tuition and fees in 2018, 2019 and 2020 could claim a maximum deduction of $4,000. The loss of this deduction highlights how useful a 529 college savings plan can be for saving money on college expenses.

You could get this tax break if you covered the cost of those qualified education expenses for a college student such as yourself, one of your dependents or your spouse. Qualified education expenses include tuition and other fees that students are obligated to pay in order to attend a particular institution. But you cant deduct expenses that you paid for with a scholarship or another tax-free award.

Youre ineligible for the tuition and fees deduction if you and your spouse are filing separate tax returns or you were a nonresident alien for part of the tax year. You cant claim the tax break if your income is higher than a certain threshold either. If your modified adjusted gross income is above $80,000 , you cant qualify for the deduction. Note also that this is an above-the-line deduction. That means you dont have to itemize deductions in order to take advantage of it.

Recommended Reading: Does Capital One Do Auto Refinancing

Tax Tips For College Students

- A financial advisor can help you manage the cost of college, set up college savings accounts and determine which deductions and credits you qualify for. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Start gathering financial documents early. Set a deadline for when youll have your W-2 forms, 1099 forms, investment income information, last years tax refund, student loan interest and the rest of the items listed on the IRS Tax Form checklist. By breaking the intimidating task of filing your taxes into smaller chunks, you have a better chance of avoiding a last-minute marathon session to meet the filing deadline.

- Educate yourself as soon as possible about what you can and cant deduct from your taxes. It pays to know everything you can about how taxes impact your situation in order to maximize your tax return.

Is H& r Block Expensive

You can pay as little as $0 or as much as $239.98 to prepare and file your own federal and state returns online. The more options you need to add on, including multiple streams of income and/or deductions and credits you qualify for, the more expensive it will be to prepare your return with H& R Block.

Don’t Miss: Capital One Pre Approved Auto Loan Program

What Is A Qualified Student Loan

First of all, your loan cannot be from one of your relatives or through an employer-provided educational assistance program.

Any public or private student loans can qualify as long as they go entirely toward qualified education expenses. A qualified expense is money you spend on the things that are required in order for you to enroll or attend an institution.

The following are qualified expenses:

-

Tuition and fees

-

Books and other class supplies

-

Other necessary expenses, like transportation

The institutions that qualify include most colleges, universities, and vocational schools. It doesnât matter if the institution is public, nonprofit, or private.

You just need to have been enrolled at least half time in a program that leads to a degree, certificate, or similar credential.

Can I Claim The Deduction For Interest Paid On Private Student Loans

Private student loans qualify for the student loan interest deduction as long as they were used to pay for qualified educational expenses at an eligible school approved to participate in a student aid program administered by the U.S. Department of Education. But loans provided by your relatives or employers dont qualify.

Recommended Reading: How To Get A Car Loan When Self Employed

Dependents Cannot Deduct Interest

If your parent can claim you as a dependent, you cannot deduct student loan interest from your overall tax bill. Your parent, however, might be eligible to claim the deduction if they are listed as a borrower on your student loan.

If someone is helping you pay your student loans and is not listing you as a dependent, you can still take advantage of the interest deduction.

Can I Deduct My Grandsons College Tuition

Yes, you can claim the education credit for your grandson college tuition if you meet the IRS requirements. Qualifications for claiming the American Opportunity Tax Credit are: You paid education expenses for eligible students. The eligible student is you, your spouse, or a dependent for whom you claim an exemption.

Also Check: Usaa Certified Dealers List

Student Loan Interest Deductions

Massachusetts allows 2 student loan interest deductions for interest paid on a “qualified education loan:”

- The federal deduction at I.R.C. § 221 for both graduate and undergraduate student loan interest paid

- The Massachusetts deduction for interest paid on a qualified undergraduate student loan

The same taxpayer may claim both deductions on the same return, provided the deductions are not taken for the same interest payments.

You Should Still Be Able To Deduct Student Loan Interest If You Refinance

If you choose to refinance your student loans, your student loan interest is likely still eligible for tax deductions. However, if you refinance for more than the original value of your student loans, and use the additional amount for any other purpose aside from qualified educational expenses, you wont be able to deduct any interest paid on the loan.

Recommended Reading: Is Loan Lease Payoff Worth It

Can I Claim The American Opportunity Credit If My Parents Paid My Tuition

If your parents paid your tuition, you may still be able to claim the American Opportunity Credit. However, you must meet the eligibility requirements for the AOTC and your parents cannot have claimed you as a dependent. If they claimed you as a dependent and paid your tuition, the tax credit could go to them.